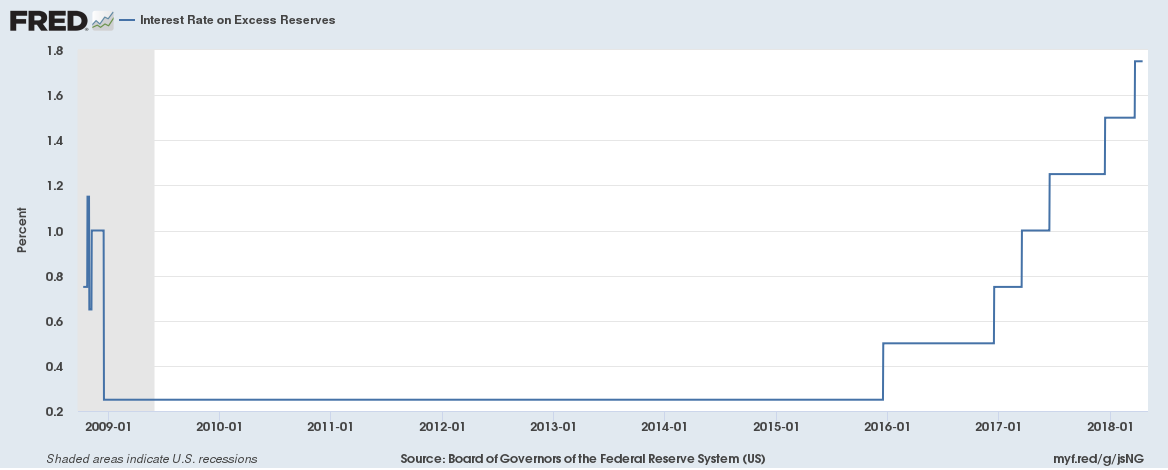

Banks in the US can hold excess reserves with the Federal Reserve. In 2008, as part of the Emergency Economic Stabilization Act of 2008 it was mandated that interest would be paid on reserve balances held with the Federal Reserve. What is of significance is the interest rate on excess reserves.

Since 2015, the Federal Reserve has set the interest rate on excess reserves equal to the top of the target range for the federal funds rate. Why is this important? Look at the graphs below.

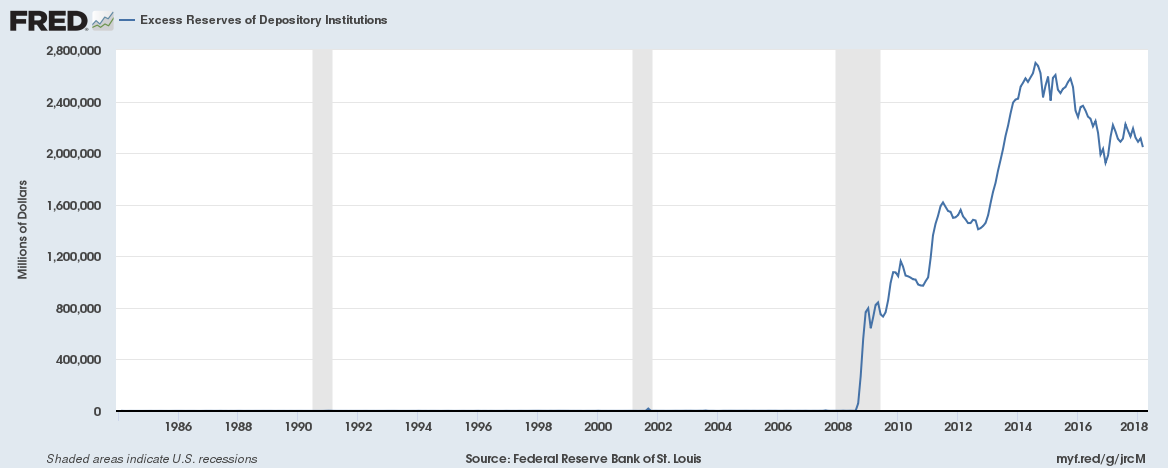

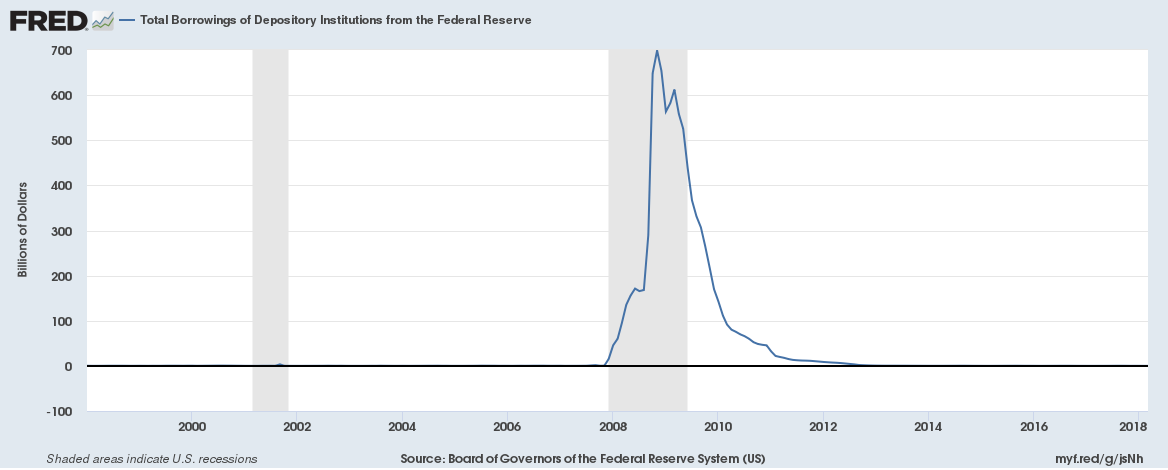

Excess reserves cash funds held by banks over and above the required reserves have grown significantly since the financial crisis. During the crisis banks borrowed money from the Federal Reserve but that has reversed. Banks currently hold over $2 trillion in excess reserves with the Federal Reserve.

Holding excess reserves is a risk-free way to earn a great return. In 2017, the Federal Reserve paid over $25 billion as interest to banks in the US on reserves. Given that interest rates are expected to rise several times this year that number could very well double. Obviously, the Federal Reserve is expected to slowing wind down QE and in principle excess reserves could shrink but that is likely to be a very slow process. In the meanwhile, banks in the US should enjoy a windfall in the form of risk-free return.