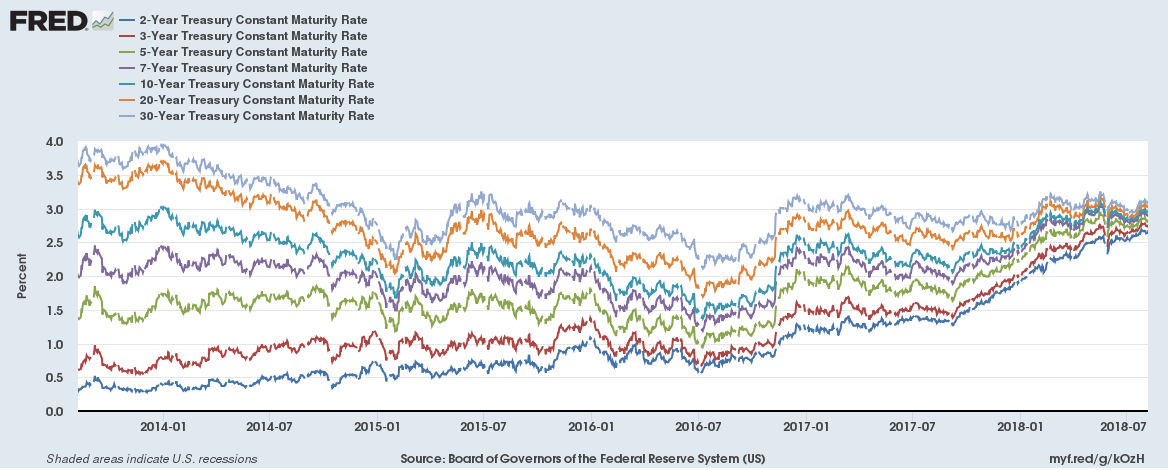

U.S. 2-year, 3-year, 5-year, 7-year, 10-year, 20-year and 30-year yields are all converging. Looks like a beautiful chart, just one thing …

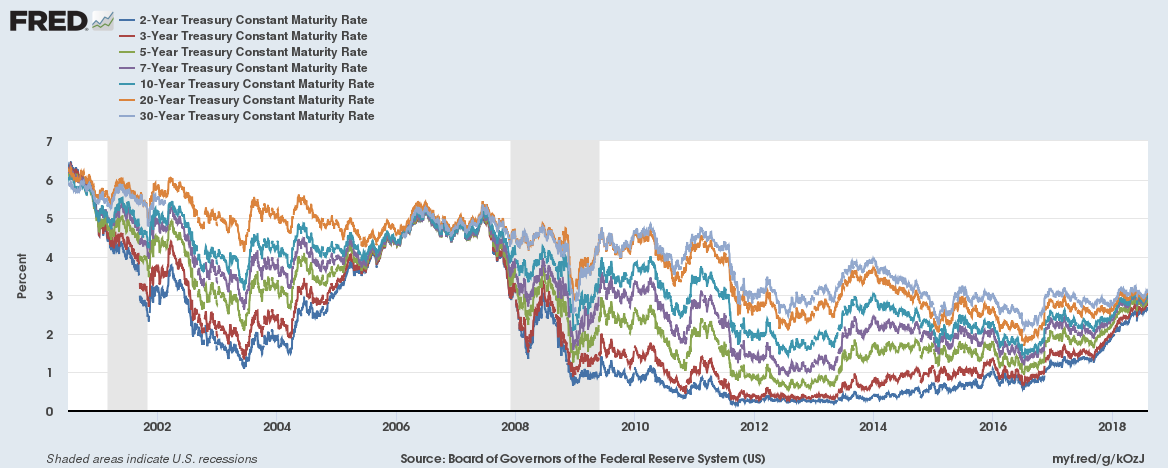

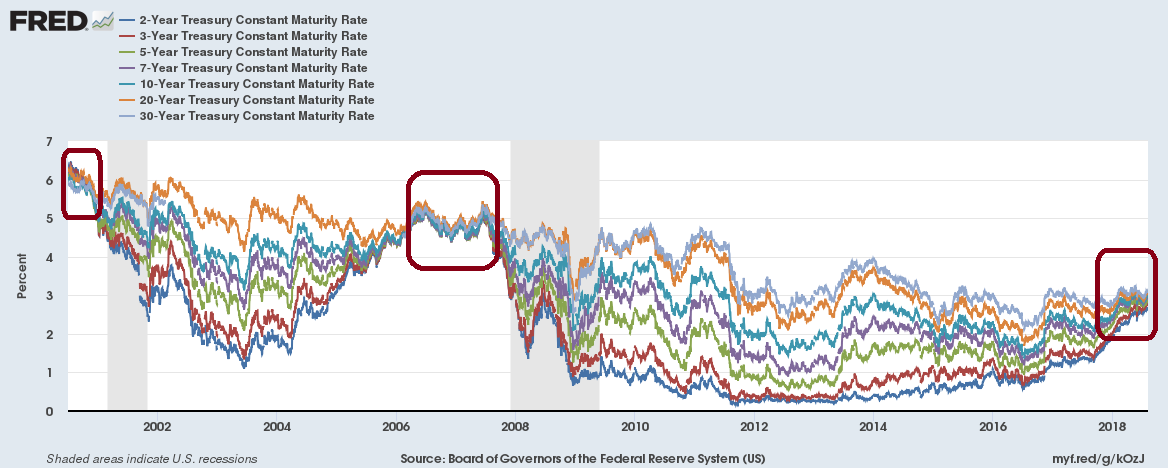

These Treasury yields have almost converged three to six months before each of the past five recessions. This isn’t a good sign, but perhaps this time it is different. Another thing – this is a sign that interest rate increase expectations are falling.

Here are yields as of August 8, 2018

2-year: 2.68%

3-year: 2.76%

5-year: 2.84%

7-year: 2.92%

10-year: 2.98%

20-year: 3.06%

30-year: 3.12%

Related:

Those three U.S. recession indicators – how near or far are those from being invoked?