The European Central Bank (ECB) announced on Wednesday that it will halve its bond buys to 15 billion Euros (from the current 30 billion Euros) a month from October then shut the programme at the end of the year.

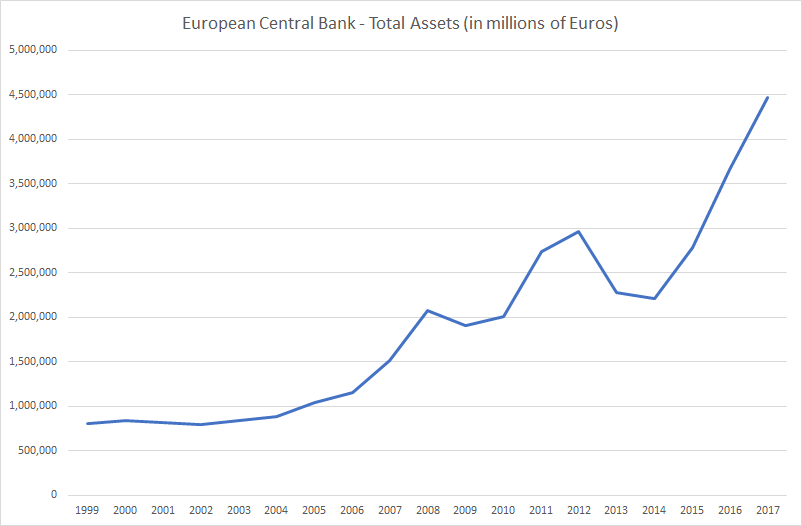

ECB’s balance sheet has increased by 2 trillion Euros since 2015 when it announced its bond buying programme. 2-year yields for most of the Eurozone countries are currently negative and 10-year yields in most cases are lower than that of the United States. The European Central Bank (ECB) is by far the biggest holder of European bonds and the biggest (almost 90%) buyer of the weaker Eurozone (Italy, Spain, Portugal and Greece) countries debt since 2015. The ECB balance sheet is now over 4.5 trillion Euros, some 45% of Eurozone GDP.

Who is likely to buy Eurozone bonds if the ECB doesn’t?

The simple answer to that is asset managers and pension funds. Pension fund inflows in Europe alone are some 60 billion Euros a month. One could argue that not all of it flows into bond funds which is true, but a significant proportion does.

There is likely to be some flow of money from equity funds to bond funds if equity markets become riskier or fall significantly. A potential impact of the end of QE could be a fall in equities.

Some money is also likely to flow out of Emerging Market bonds into European bonds as yields rise. This would result in increase in yields for Emerging Markets.

Irrespective of who buys new bond issuances, European bond yields are only going up. Eurozone countries have enjoyed a falling budgetary deficit (and Germany and Netherlands a budgetary surplus) mainly down to lower interest costs. Rising yields will likely reverse that.