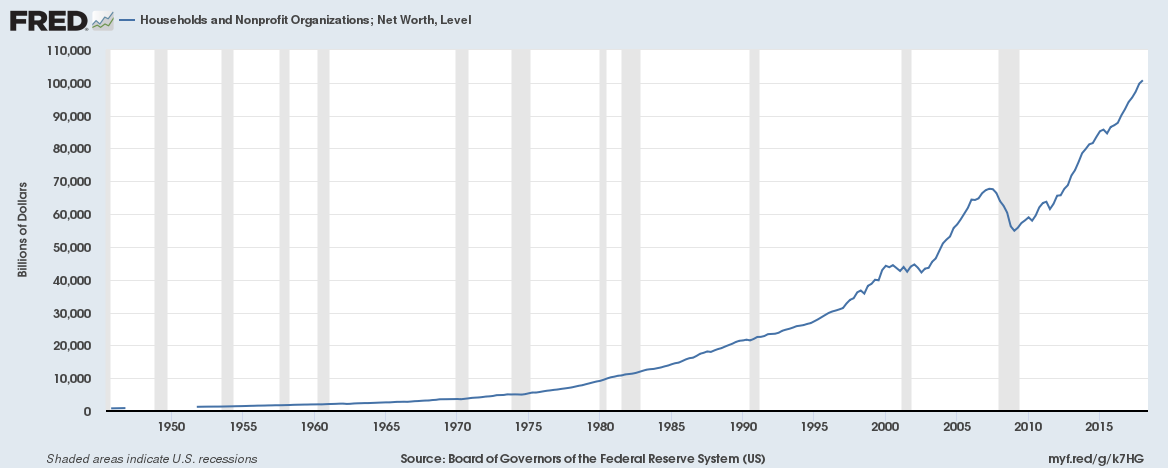

Households in the United States have a total net worth (or wealth in other words) of $100.77 trillion at the end of Q1 2018. The number is up from $56.27 trillion at the end of Q4 2008.

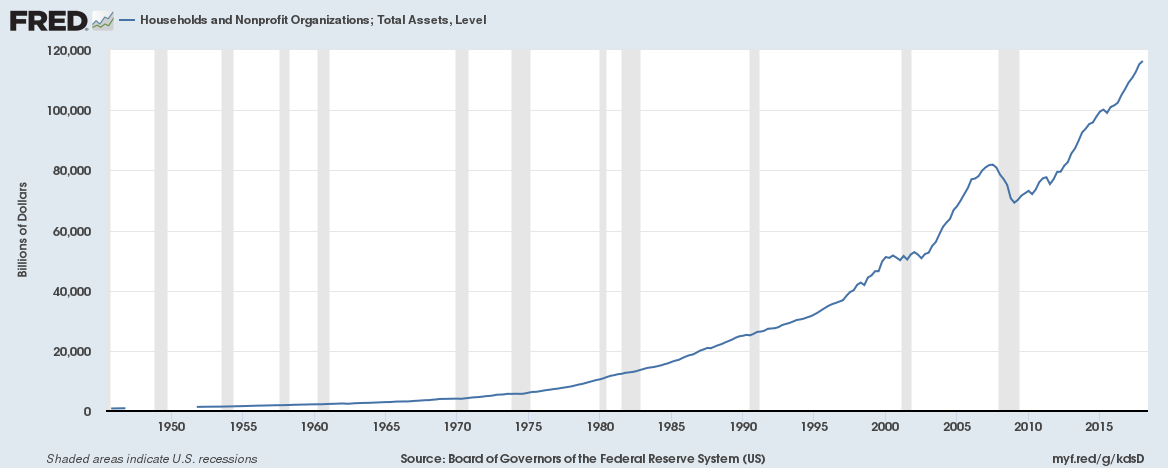

Total Household Assets are $116 trillion (up from $77 trillion at the end of 2008)

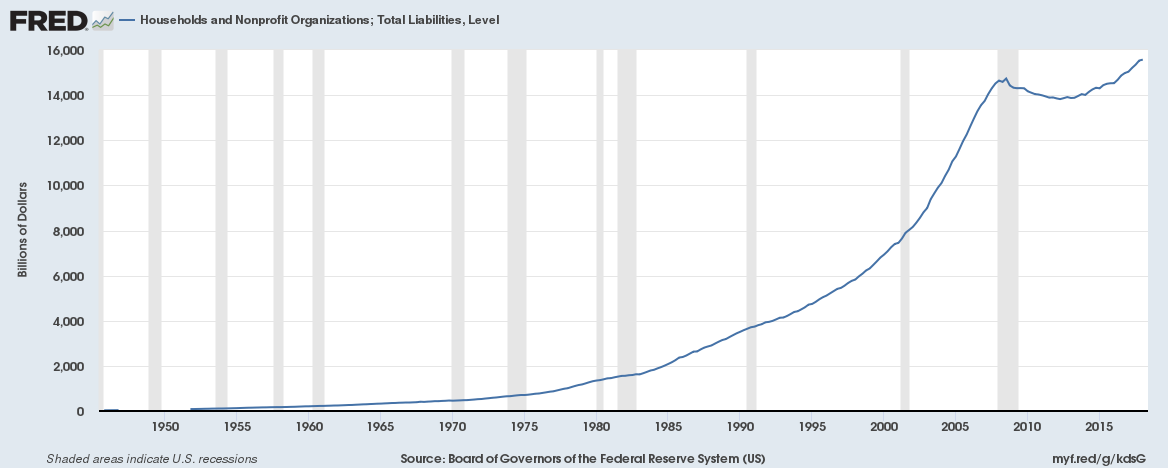

Total liabilities are $15.57 trillion (up from $14.43 trillion at the end of 2008)

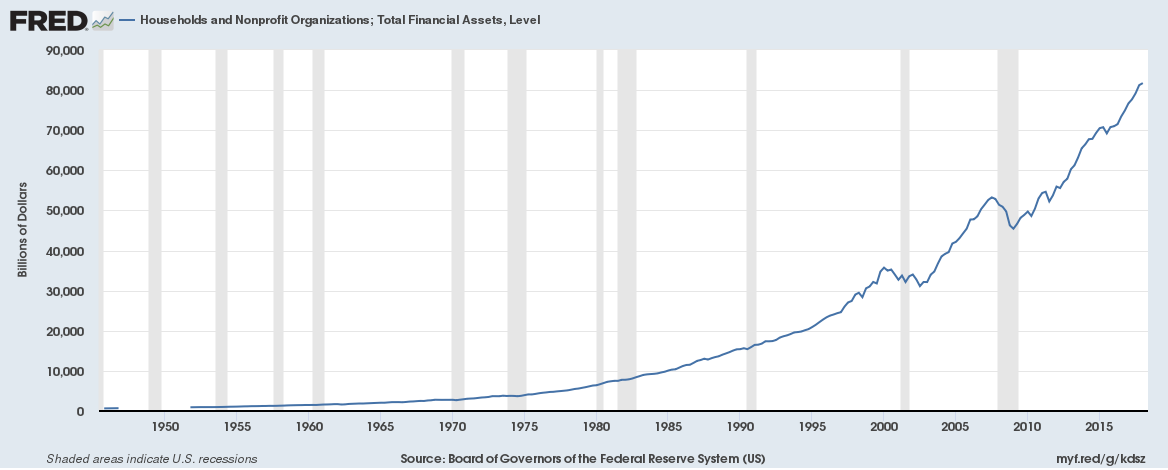

Total Financial Assets are $81.74 trillion (up from $46.28 trillion at the end of 2008)

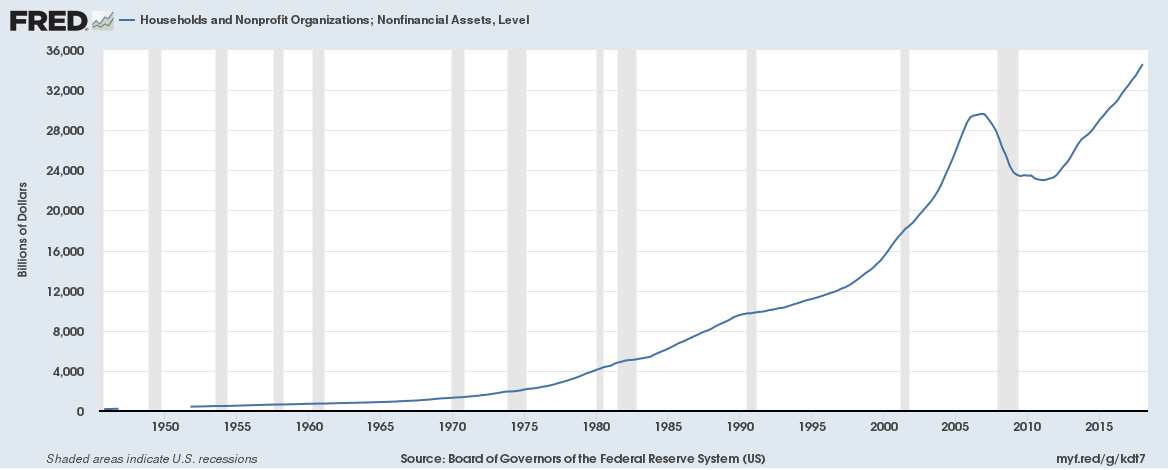

Non-Financial Assets are $23.22 trillion (up from $14.09 trillion at the end of 2008)

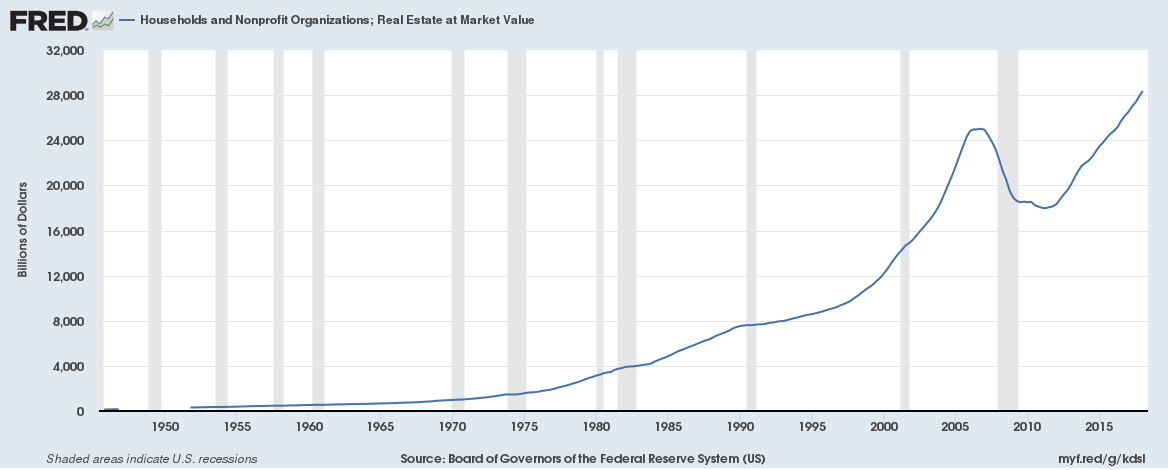

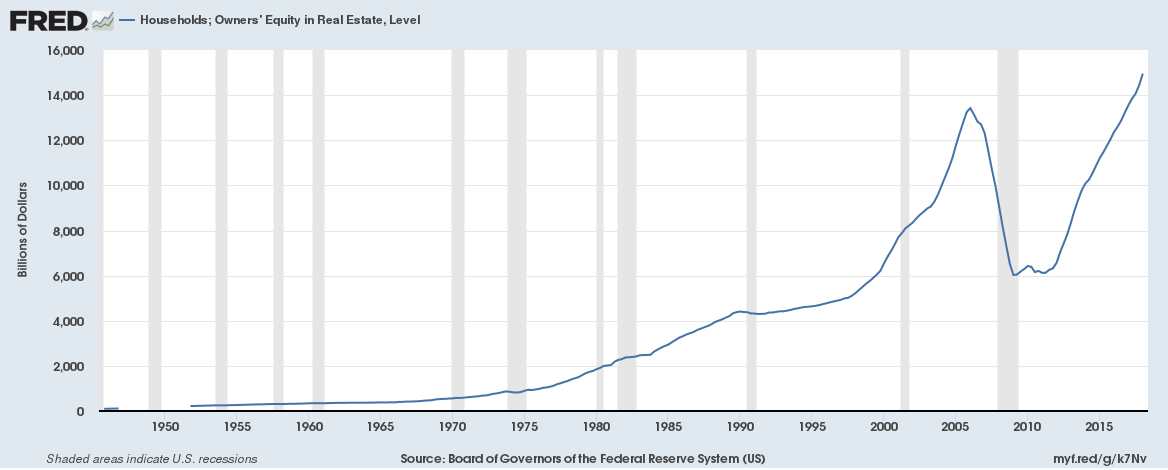

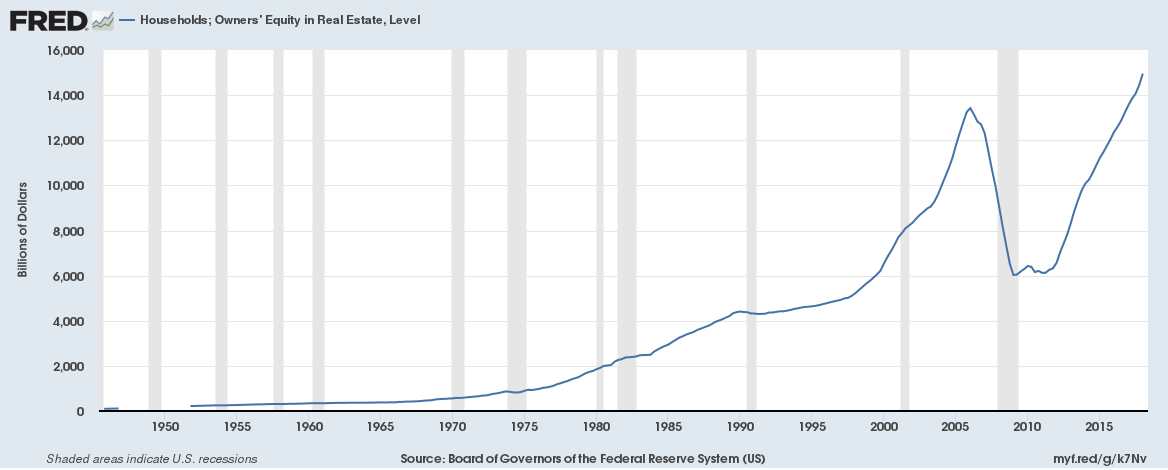

Real Estate at Market Value is worth $28.37 trillion (up from $19.49 trillion at the end of 2008)

Direct Equity Investments are valued at $17.63 trillion (up from $5.6 trillion at the end of 2008)

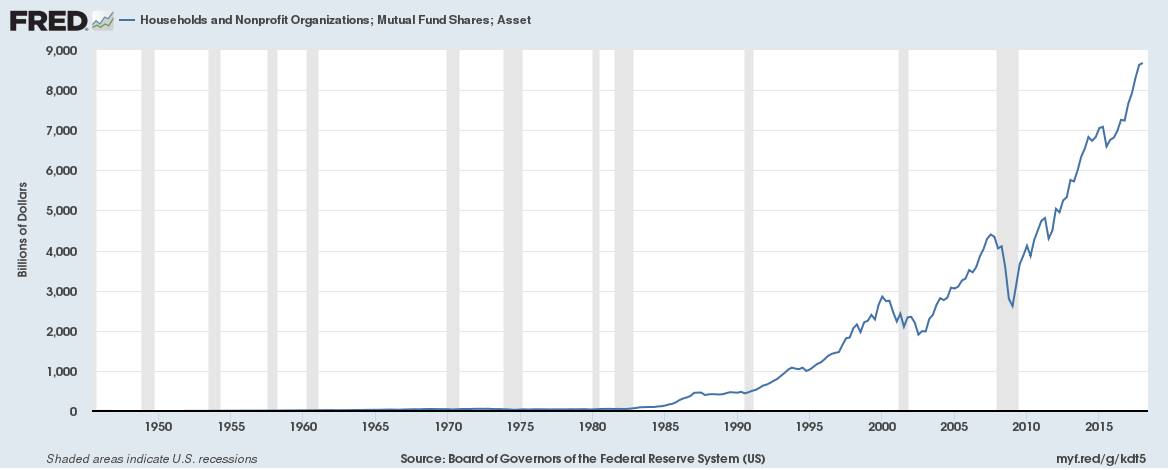

Mutual Fund Investments are worth $8.67 trillion (up from $2.79 trillion at the end of 2008)

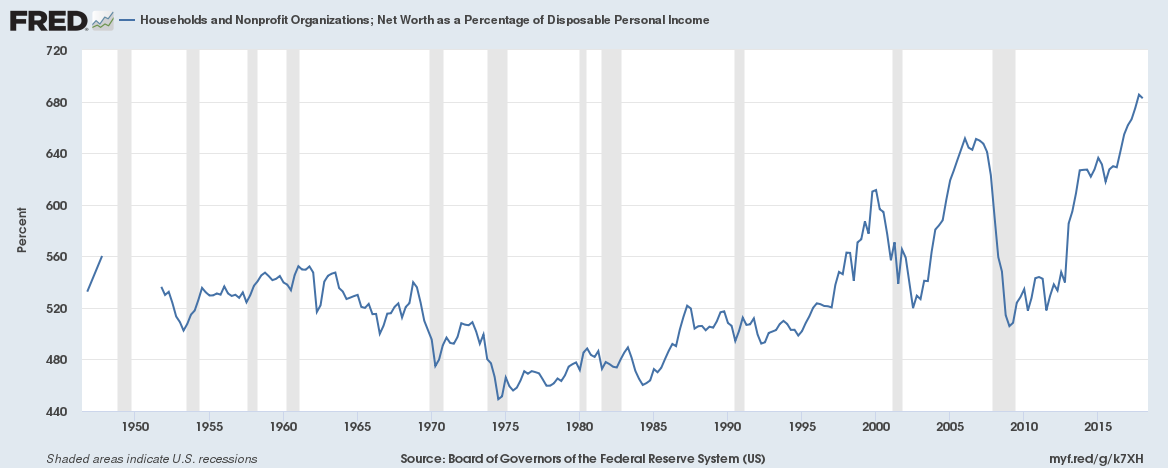

Household Net worth is currently 6.8 times disposable income, up from 6.5 times at the end of 2007