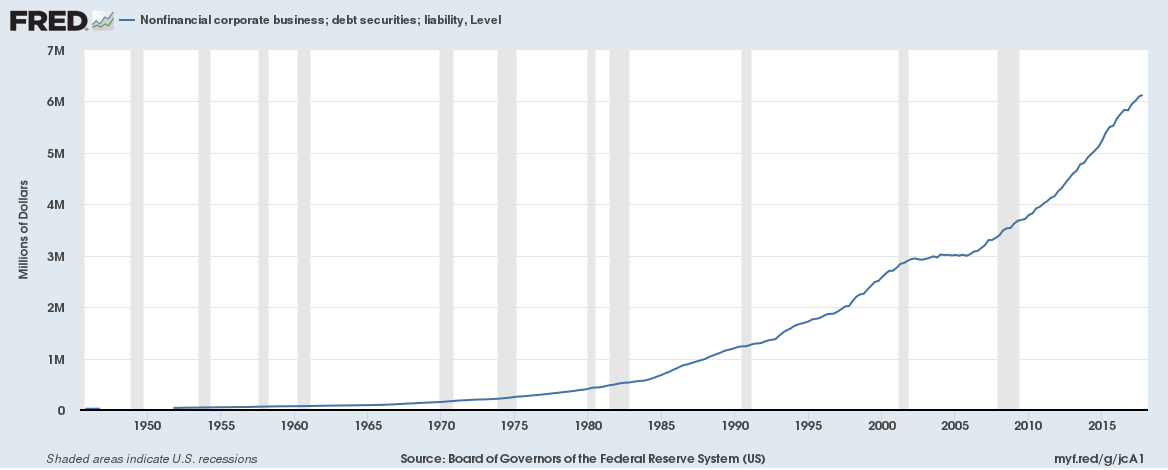

Corporations (non-financial) in the United States have $6.2 trillion in debt and debt has doubled in the past decade,

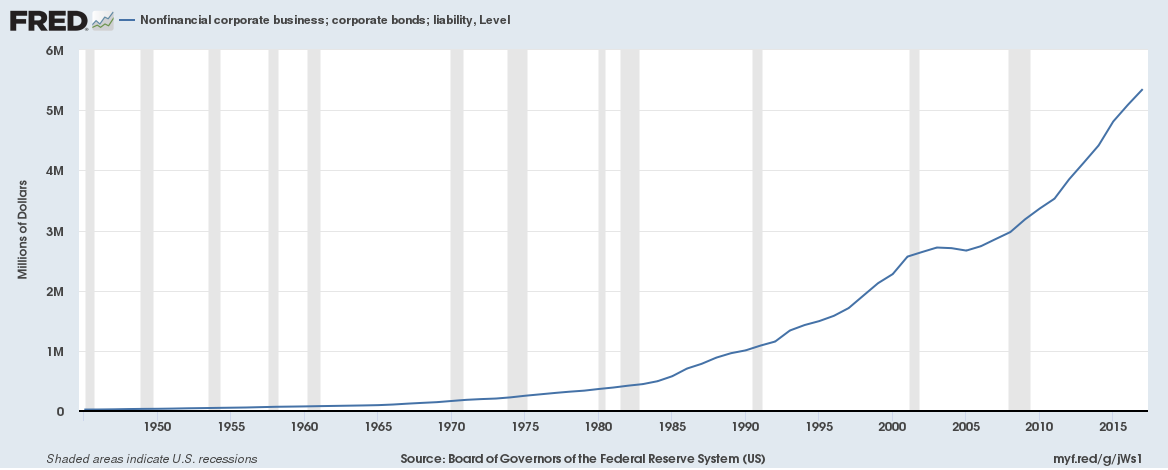

And corporate bond outstanding is up from $3 trillion in 2008 to $5.4 trillion currently,

Average yields are currently 4.05% on Aaa (Moody’s) rated corporate bonds and 4.67% on Bbb (Moody’s) rated corporate bonds. Corporations in the U.S. are expected to pay some $250 billion in interest payments this year.

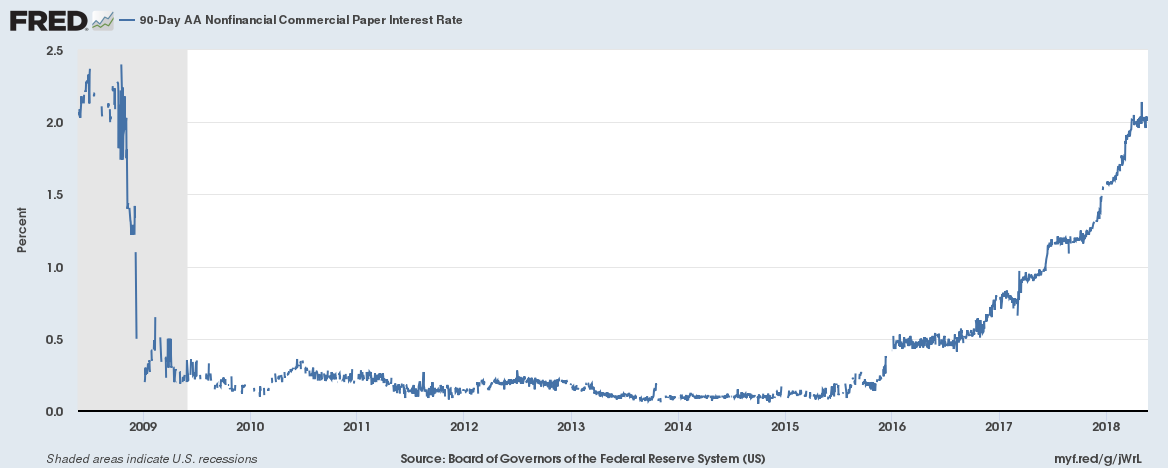

Even commercial paper funding (short term borrowing from the market) is at an all time high at $320 billion,

And interest rates on commercial paper is close to the highest in a decade,

Why are corporations borrowing? The main reason is buying back their stock. U.S. Corporations are expected to spend some $600 billion on stock buybacks this year. Spend on business expansion and Research & Development has fallen over the past decade even as companies continue to buy back their own stock in a soaring stock market.