The Stock Markets made big swings in August thanks to trade tensions heating (and then cooling) between the U.S. and China and the yield curve inverting.

Trade Tensions and the Stock Markets

On the trade side, August kicked off with a threat from the U.S. of an additional 10% tariff on $300 billion of Chinese imports starting September 1st. China responded with new tariffs on $75 billion worth of U.S. products. By the end of August, tensions began to cool when both nations said they will start talking.

There were major swings both ways in the market, but major markets ended just a bit down. The S&P 500 just lost 2% over the month.

Bonds and Yield Curve Inversion

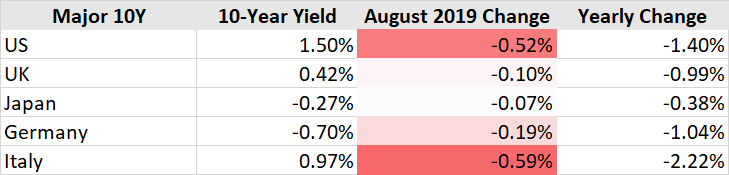

Fall Bond Yields were the big story with yields on 10-year bonds collapsing during the month.

The Yield Curve inverted mid-August. The U.S. 10-year Treasury constant maturity yield minus the 2-year Treasury constant maturity yield spread has been a good indicator of past recessions. Yield curve inversion which happens when the spread turns negative and has preceded the last seven straight recessions. Recession soon? No chance, we expect yields to rise again by the end of 2019.