So, longer-term U.S. government bonds are now yielding lower than short-term bonds. Is this really a big economic warning?

Poor economic growth ahead?

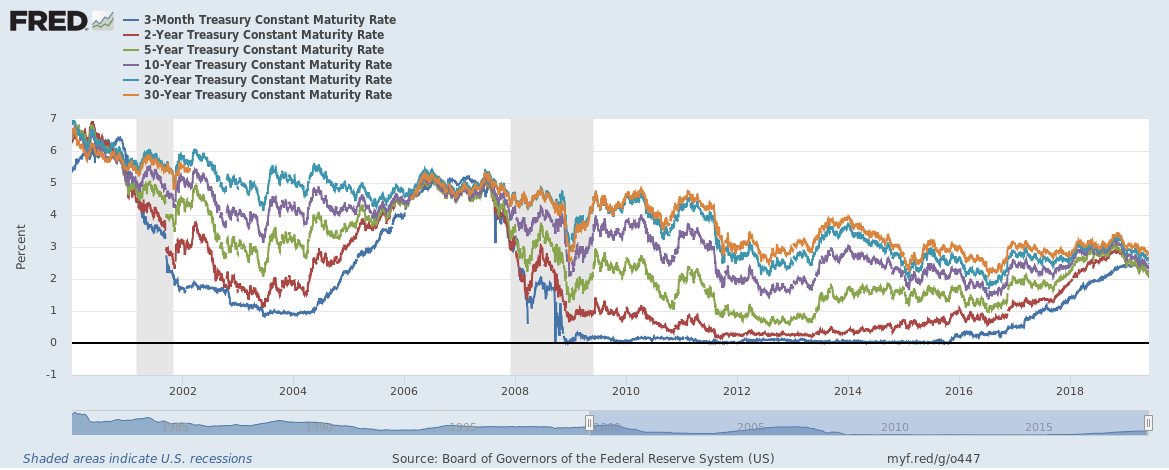

In “normal” market conditions, longer term U.S. government debt yields are much higher than yields for shorter term maturities. Why? Because longer term economic growth is expected to accelerate which brings with it higher interest rates.

When shorter term bonds start yielding higher than longer term bonds it means economic growth has peaked for the current cycle. Growth peaking doesn’t directly mean that a recession is near. It just means that growth is slowing, the economy can and will still expand albeit at a slower rate.

Yield curve inversion happens when the spread between long-term and short-term bonds turns negative.

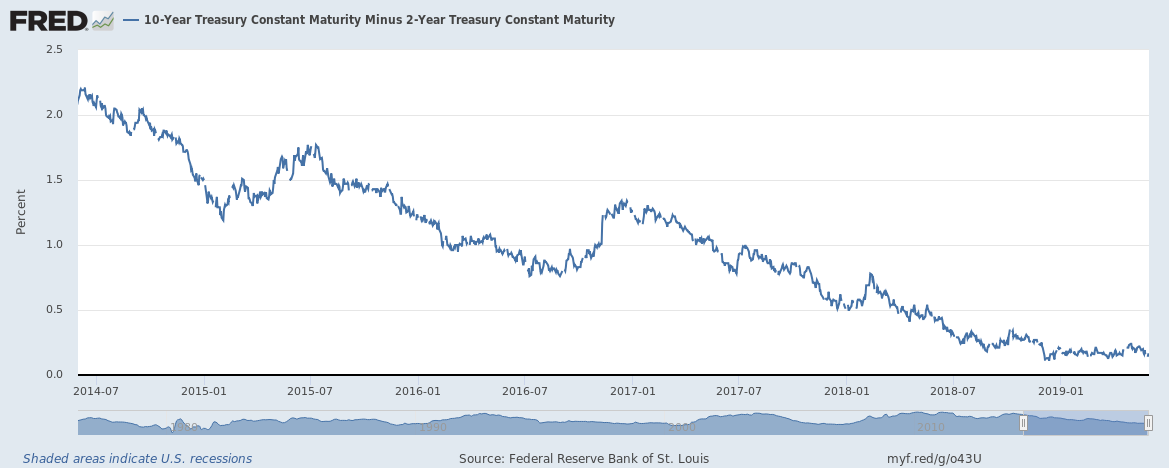

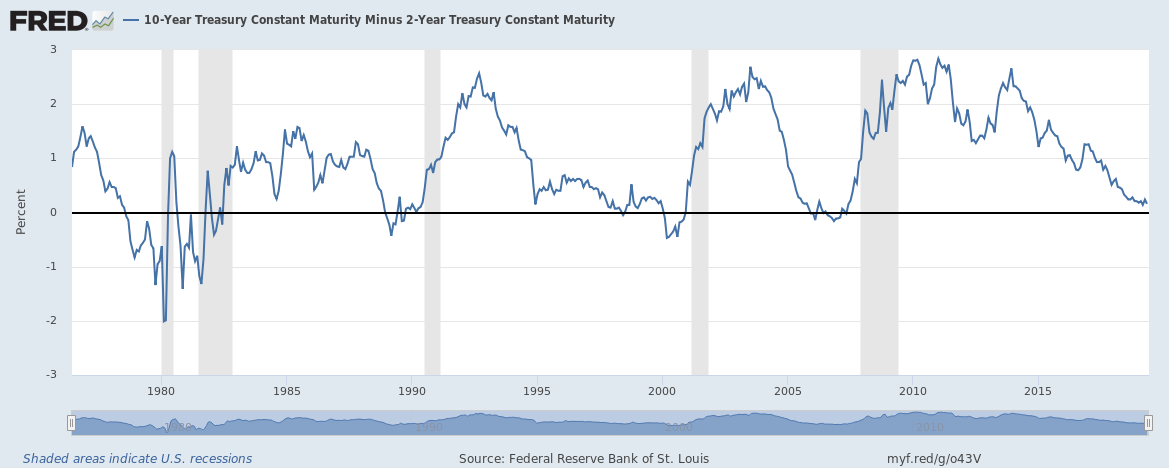

The interesting part: The U.S. 10-year Treasury constant maturity yield minus the 2-year Treasury constant maturity yield spread has been a good indicator of past recessions.

The 10-year and 2-year yield curve inversion (i.e. 2-year yielding higher than 10-year) has preceded the last seven straight recessions. The difference is currently 21 bps.

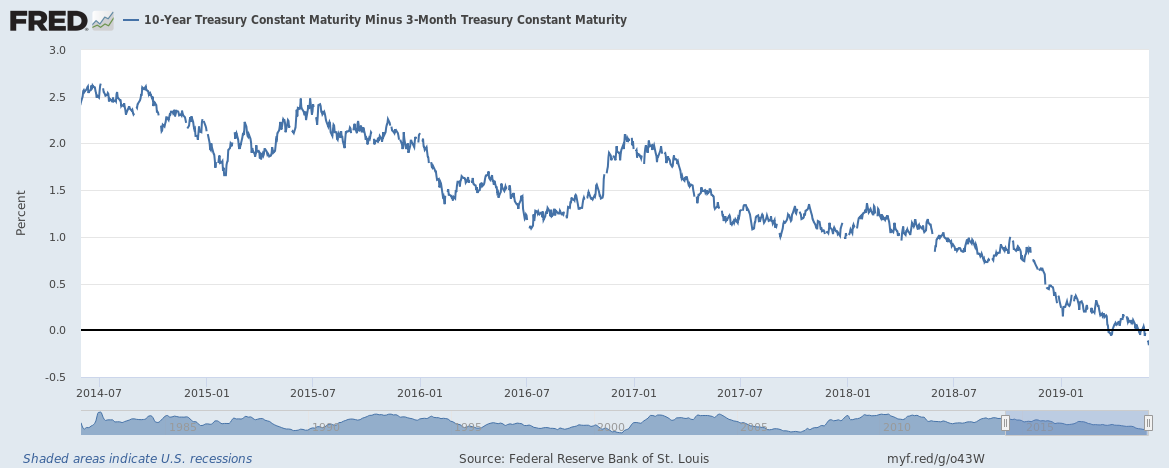

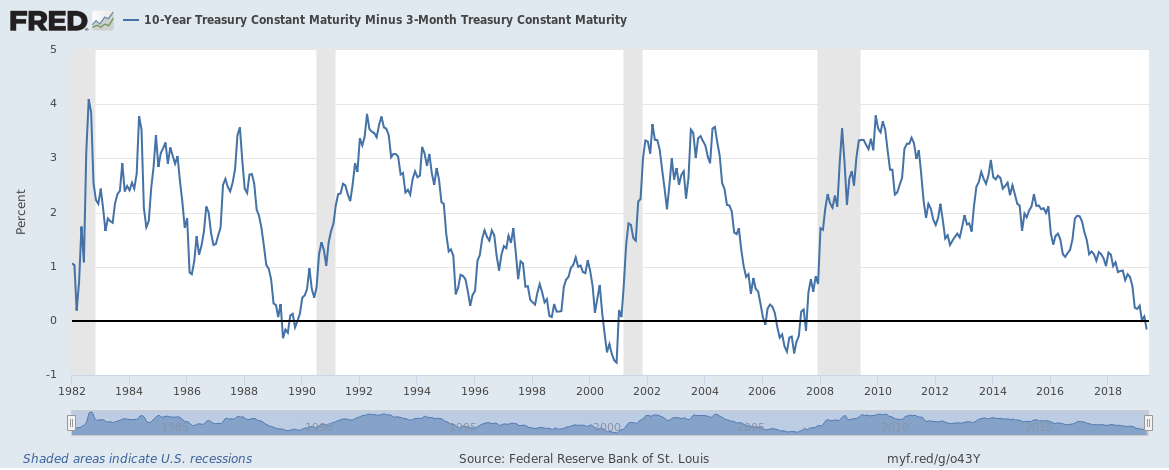

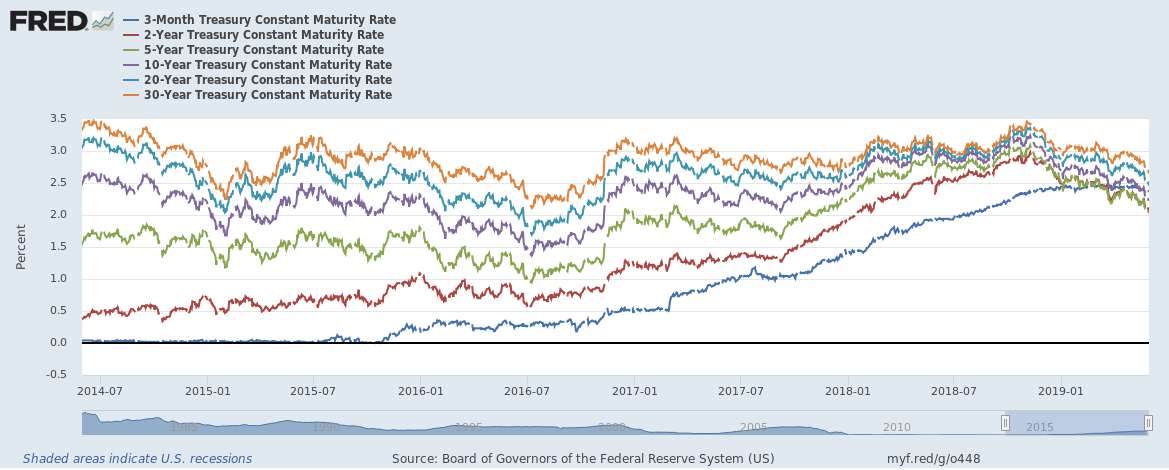

The 10-year and 3-month yield curve inversion (i.e. 3-month yielding higher than 10-year) has preceded the last four straight recessions. This yield curve for this is currently inverted. The 3-month yield is 20 bps higher than the 10-year yield.

Most U.S. yields are falling, a clear indicator that the market now expects interest rates to fall. We wrote in January that 2019 will be a year that will be different with interest rate hikes slowing or interest rates even reversing. We again wrote in March that interest rates are headed downwards as global bond yields are falling quickly again. We are almost 100% certain that interest rates globally are only headed downwards for 2019 and well into 2020.

What do you think the chances are of the fed lowering interest rates?

GDP growth over the last 10 years hasn’t been organic, but a result of QE. Fed hasn’t essentially paid 3-5x per point of GDP.

Now that this expansion is ending, will the FED resort to ever more market manipulation to pump a bleeding economy?

We see a good chance that the Federal Reserve will lower interest rates over the next 12-18 months unless economic growth accelerates (which is unlikely to happen).

Another factor to watch is bank profitability. Banks lend on interest rates based on longer-term yields and pay interest on deposits based on shorter-term yields. A bigger yield spread between long-term and short-term yields means greater profits. When the yield curve falls so do profits which generally lowers economic growth in the broad economy.