2019 was a historic year for many reasons. Record returns on stocks, bonds and other assets. 2019 – this time it was different. And 2020? This time it will again be different, very different.

Equities were the star

Equities were the star of 2019. U.S. equities led the world with gains of 31%, closely followed by Europe at 27%. The MSCI World Index was up a staggering 28% in 2019.

Earnings were flattish

Global corporate earnings barely grew in 2019 (only results until Q3 were in). Global Corporate Earnings Recession? In Progress. Global Economic Recession? Coming up, in 2020 or 2021.

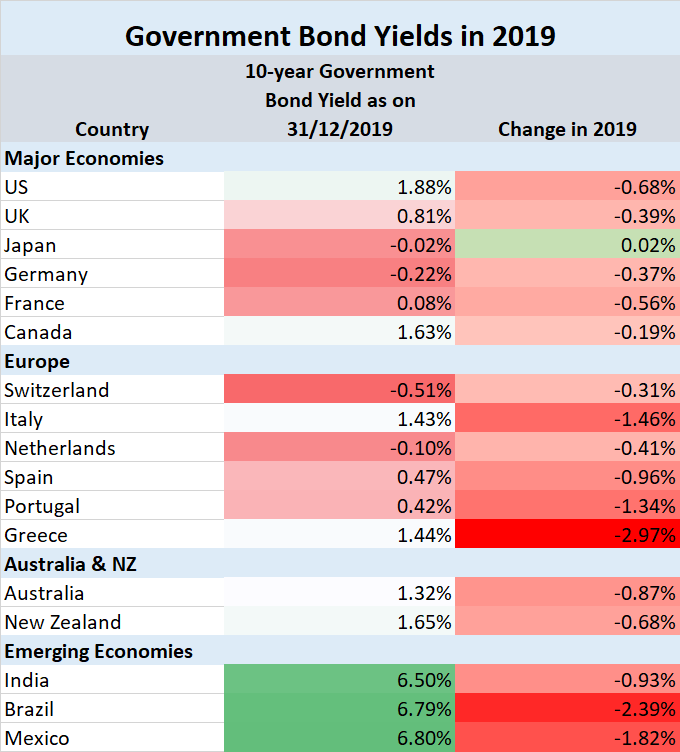

Bonds delivered fantastic returns

Bond yields tracked weaker economic data. (Equities didn’t get the message!). Yields fell everywhere.

Government Bond Fund Returns

Italy 10.6%

Spain 8.3%

UK 7.1%

US 6.9%

Global 5.6%

Japan 1.7%

Interest Rates began falling

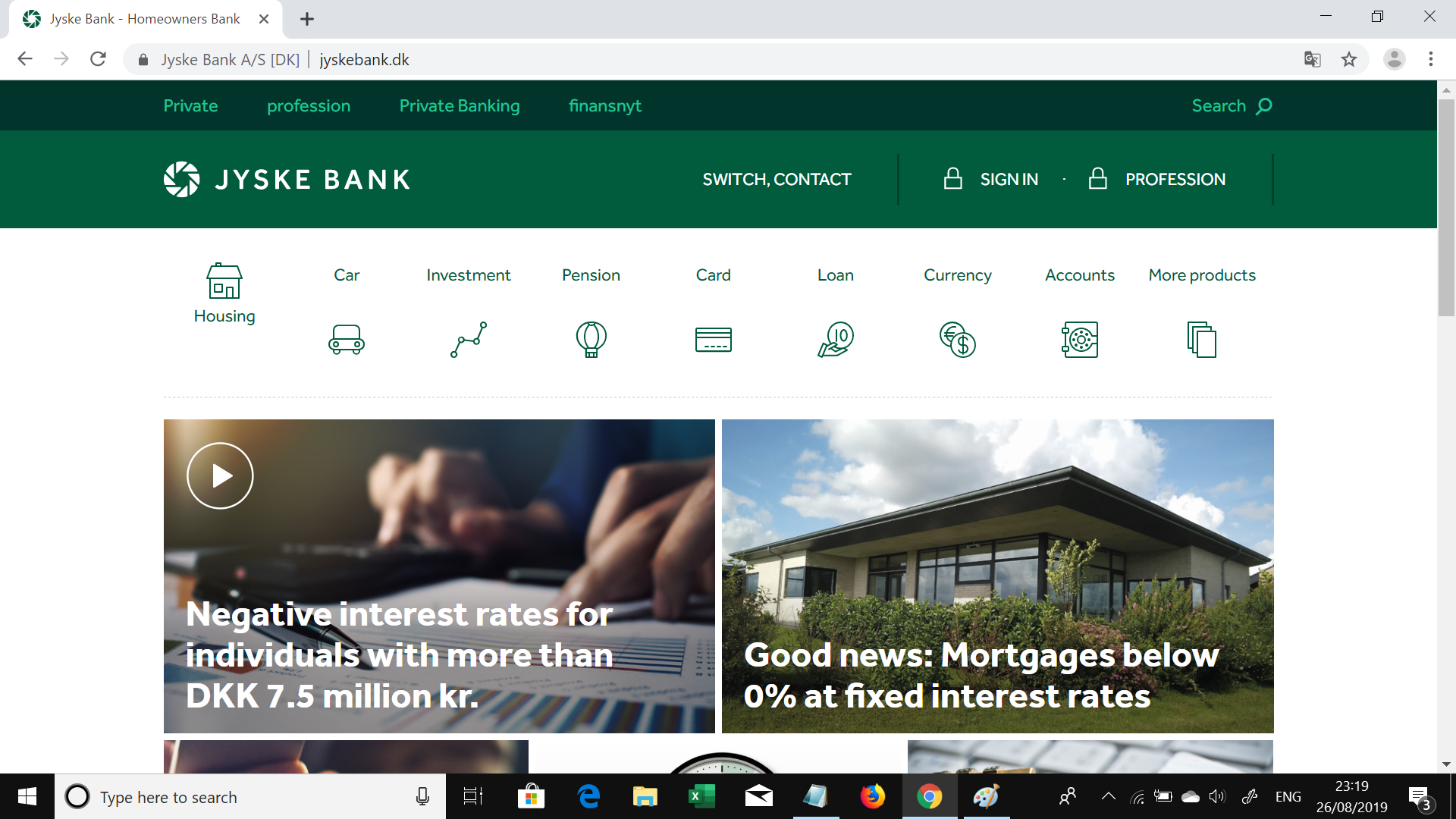

At the end of 2019, the Federal Reserve and the European Central Bank started to expand their balance sheets again. Interest rates globally started getting cut. Negative interest rates in the U.S.? Might come in 2020 or 2021.

Meanwhile, in Nordic countries, customers started getting get paid to hold mortgages.

Asset Returns in 2019

Developed Market equities 28.4%

MSCI Emerging Market equities 18.9%

U.S. Equities 31.5%

MSCI Europe ex UK 27.5%

Japan Equities 18.1%

U.S. Treasurys 6.9%

Euro Government Bonds 6.8%

Commodities 7.7%

Global REIT 24.4%

Global Investment Grade Bonds 11.5%

Our 2020 Predictions

- Lower, possibly negative central bank interest rates

- Equities lower

- Government Bond yields will continue to fall

- Far lower global economic growth

- Trade wars will make the news fewer times

2020 – this year will really be different