We haven’t written about government bond yields recently but there has been a lot of action in the bond market. Government bond yields have been falling globally which are an indicator that markets are expecting stagnant or falling interest rates. 10-year government bonds are the most tracked and traded and yields have mostly fallen compared to a year ago.

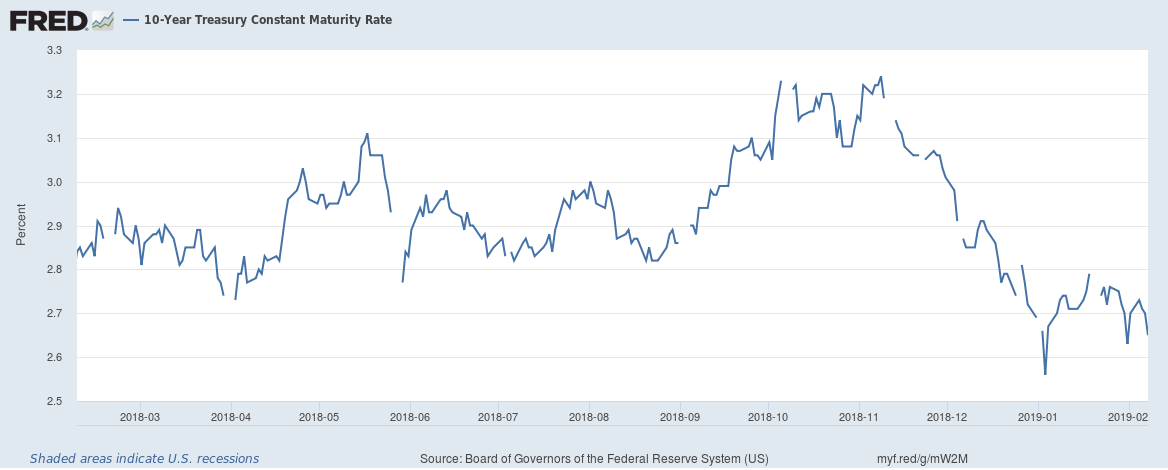

The U.S. 10-year Treasury bond yield is now at 2.65%, down 19 bps from a year ago.

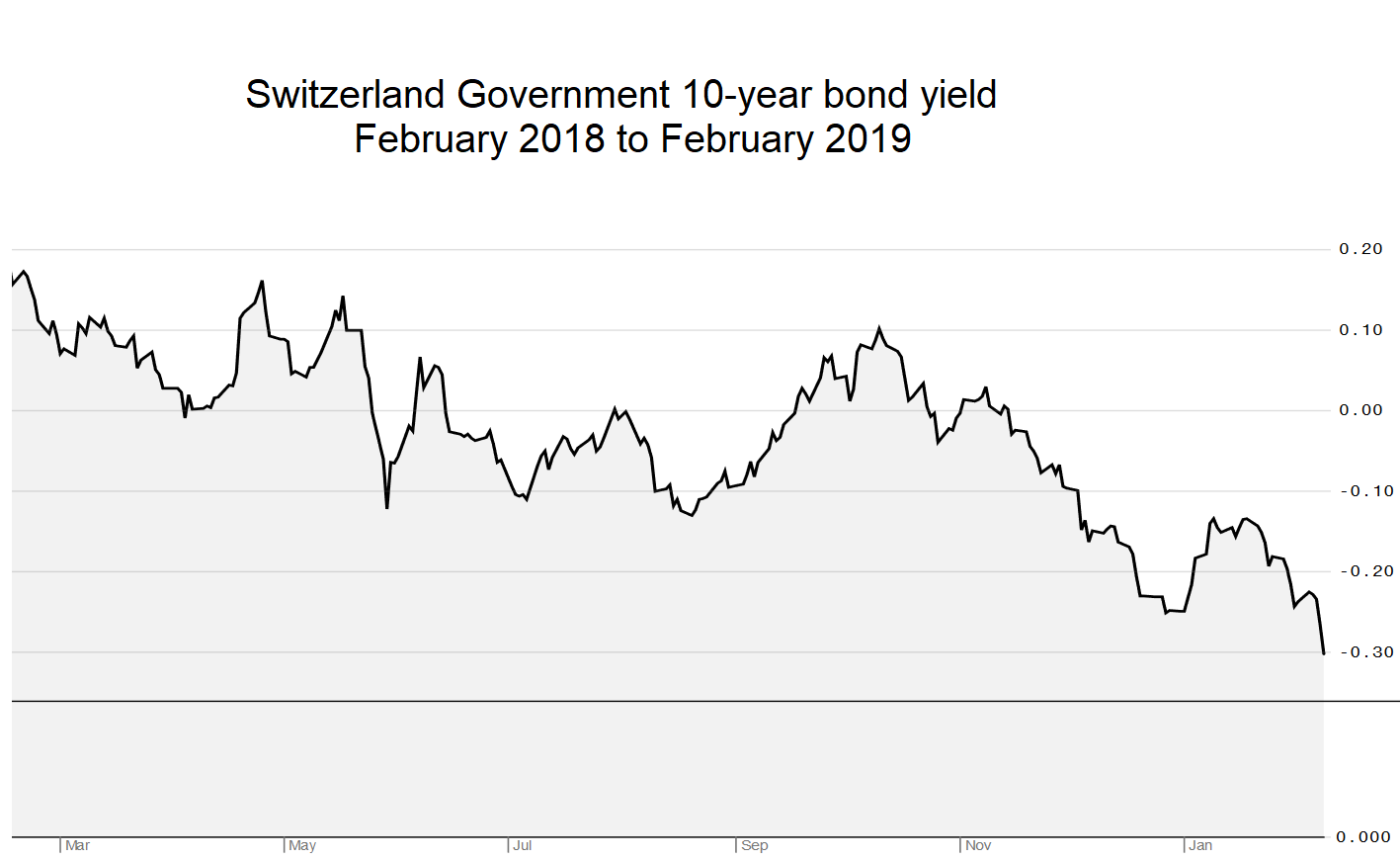

For Switzerland, the 10-year government bond yield is now at -0.30% (yes, that is negative), down 49 bps from a year ago.

Other bond yields,

UK 10-year: 1.16% (down 46 bps from a year ago)

Japan 10-year: -0.03% (down 10 bps from a year ago)

Germany 10-year: 0.09% (down 67 bps from a year ago)

France 10-year: 0.54% (down 45 bps from a year ago)

Italy 10-year: 2.98% (up 96 bps from a year ago)

Spain 10-year: 1.35% (down 24 bps from a year ago)

Greece 10-year: 4.52% (down 77 bps from a year ago)

Canada 10-year: 1.85% (down 49 bps from a year ago)

Australia 10-year: 2.08% (down 80 bps from a year ago)

India 10-year: 7.5% (up 1 bp from a year ago)

Brazil 10-year: 9.02% (down 96 bps from a year ago)