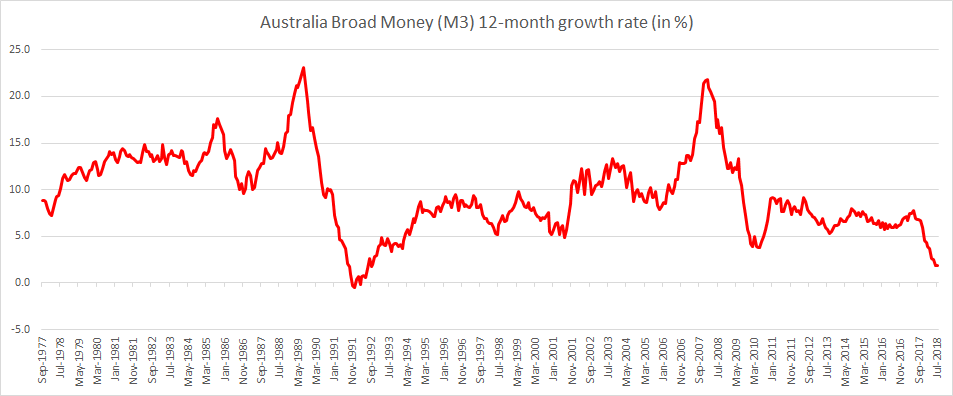

Australian credit growth is slowing but outstanding debt remains at historically high levels. Housing credit growth, personal credit growth, investor housing credit growth and business credit growth are all slowing. But the rather surprising thing is broad money (M3) supply growing at a 12-month rate of just 1.9%, the slowest since 1992 when Australia faced eight consecutive quarters of declining economic growth.

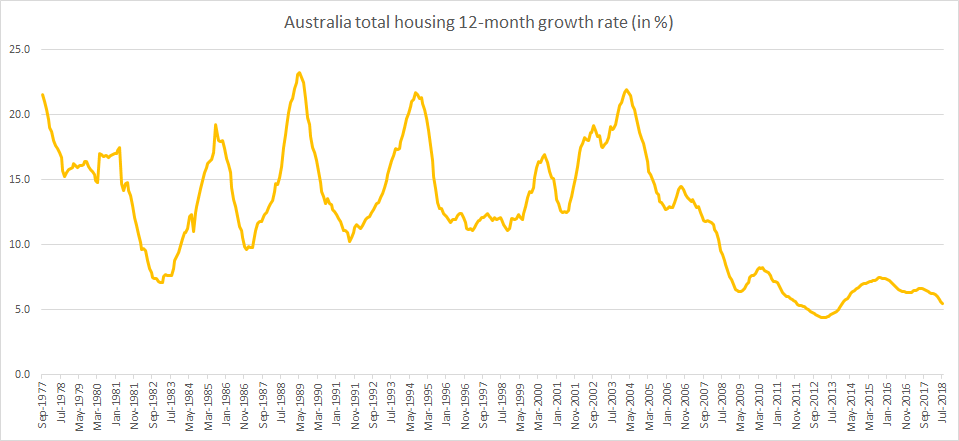

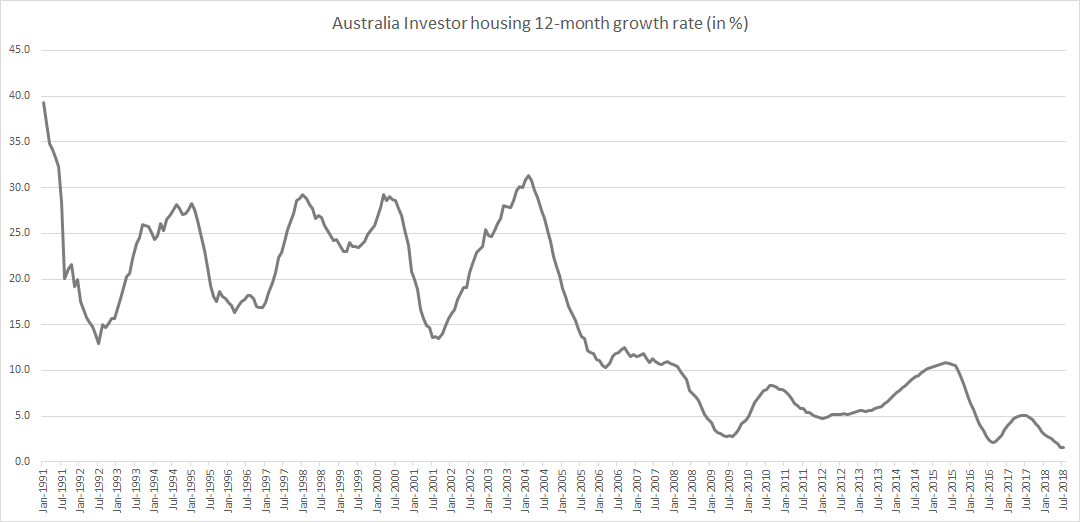

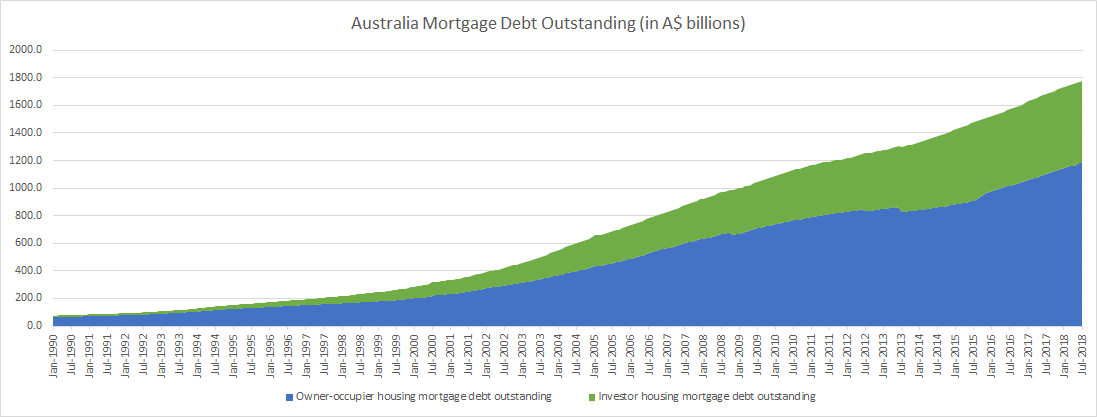

Total housing 12-month credit growth at a rate of 5.5% is the slowest since December 2013. Total Investor housing 12-month credit growth at 1.5% is the slowest ever. Total Mortgage debt outstanding stands at A$1.78 trillion, about 100% of GDP.

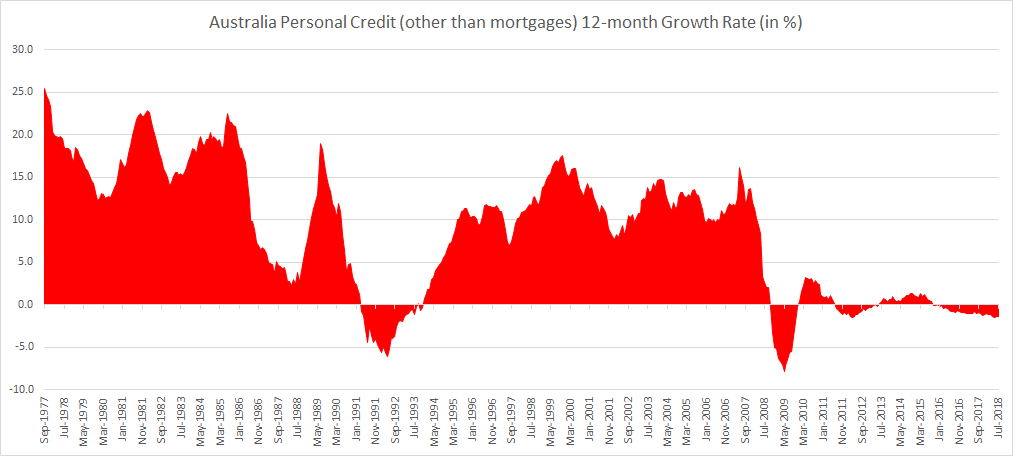

Total 12-month personal credit (other than mortgages) growth stands at negative 1.4%. This includes personal loans, overdrafts and credit cards.

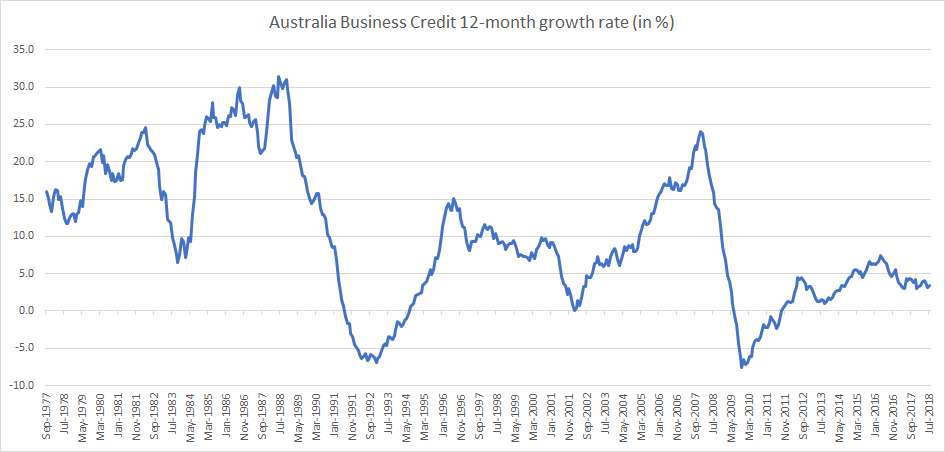

Business credit growth is slowing too despite fairly robust economic expansion.

Related:

Here’s how much money supply has grown for major economies in the past decade (2008 to 2018)