Does a balance of payment (or trade) surplus equate higher growth? Not necessarily, Australia which has had deficits for over forty years has grown faster than Germany which has had over forty years of surpluses. Does a current account surplus (i.e. exports greater than imports) mean a nation is doing better than other nations with current account deficits? The answer is no, what really matters is why the deficits exist.

Almost every nation had capital and exchange controls until about the late 1960’s which meant that investment was almost entirely funded by domestic investors. When these controls were eased investors and savers started seeking better returns overseas.

International flow of money meant fewer trade barriers. Countries like Germany and Japan started investing overseas seeking better returns to support ageing populations. China started investing in foreign exchange reserves to protect itself in case there was a repeat of the Asian currency crisis.

Analysis of both developed and emerging economies with both current account deficits and surpluses shows no evidence that surplus nations outperform deficit nations. Deficits do become problematic but only when there is a sudden deterioration in the current account position like Thailand during the Asian Crisis in the 1990s or Spain just before financial crisis of 2008.

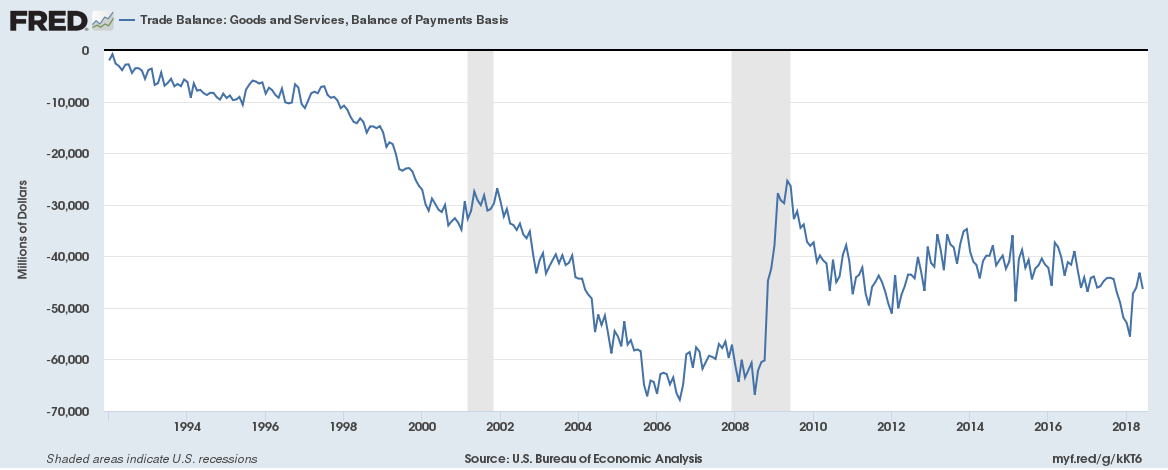

The exception has been the United States which didn’t see any adverse impact when the deficit suddenly widened in the 1990s. The dollar’s reserve currency status means the United States can tap into the savings of the world via capital inflows. The trade deficit hasn’t been too bad economically for the United States, but a lower deficit would absolutely mean higher manufacturing output and more jobs.

The bigger problem for the United States is a growing fiscal deficit (Related: The impact of U.S. tax cuts on Federal finances so far).The U.S. requires the dollar to hold its reserve currency status (Related: A brief history of global trade or reserve currencies) otherwise other nations might start buying up real U.S. assets instead of buying Treasurys or U.S. government bonds.

Related:

All you wanted to know about US trade in 2017 and why China matters so much

14 must know things about U.S. trade and trade tariffs

Average import tariffs or custom duties per country