Where is the biggest property bubble?

Here’s how much the total residential mortgage debt outstanding has grown since 2008 for Australia, Canada, the UK and the US,

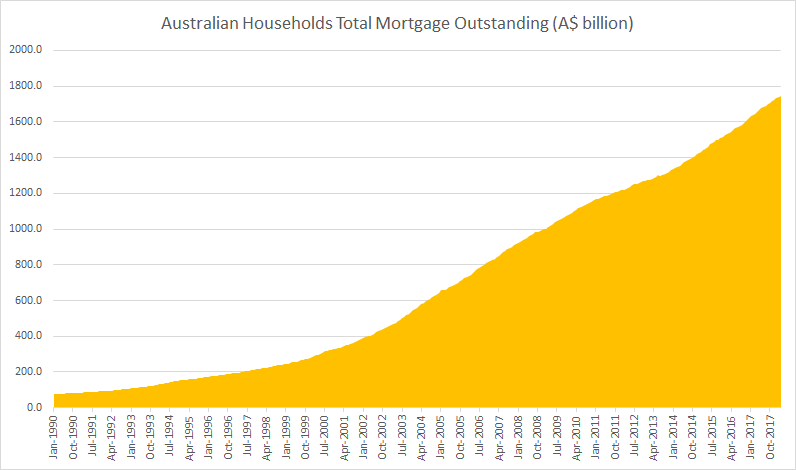

Australia

Total Residential Mortgage Debt Outstanding: A$1.75 trillion (Up 67% since September 2008), 96% of GDP (2017), Population: 24.64 million (2017)

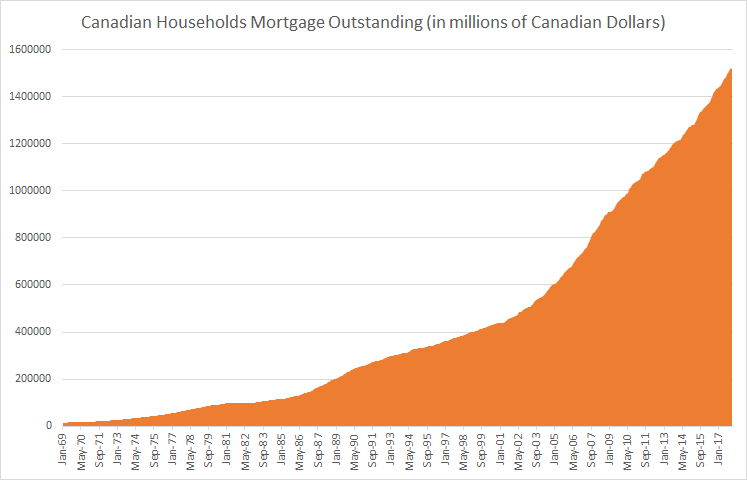

Canada

Total Residential Mortgage Debt Outstanding: C$1.53 trillion (Up 70% since September 2008), 102% of GDP (2017), Population: 36.29 million (2016)

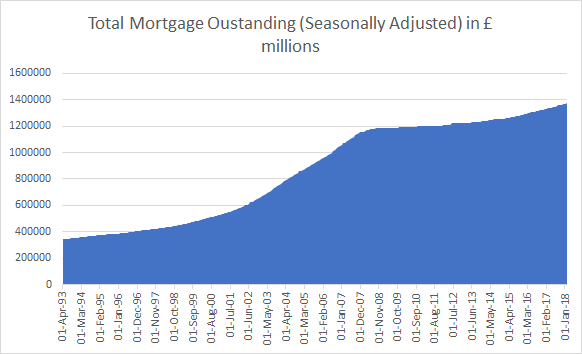

United Kingdom

Total Residential Mortgage Debt Outstanding: £1.38 trillion (Up 11% since September 2008), 76% of GDP (2017), Population: 65.64 million (2016)

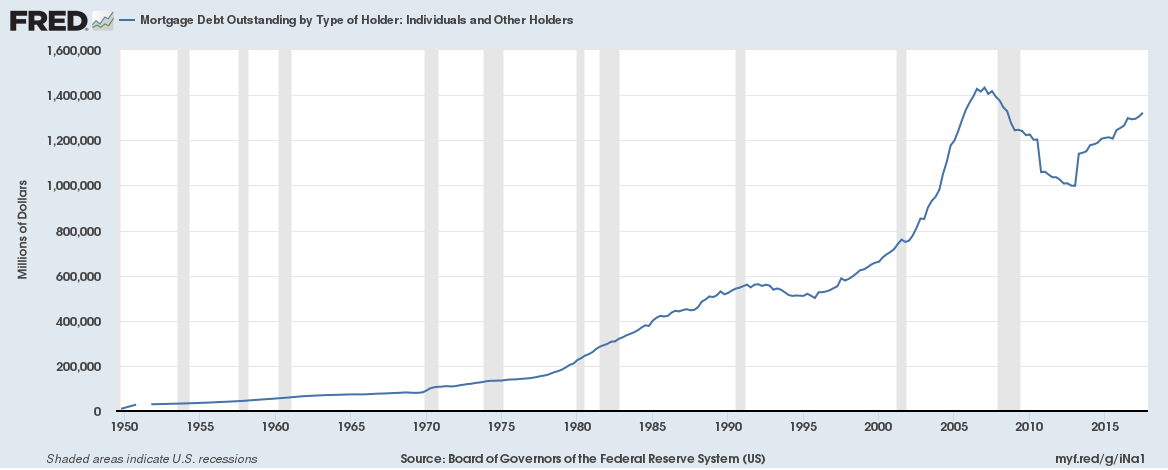

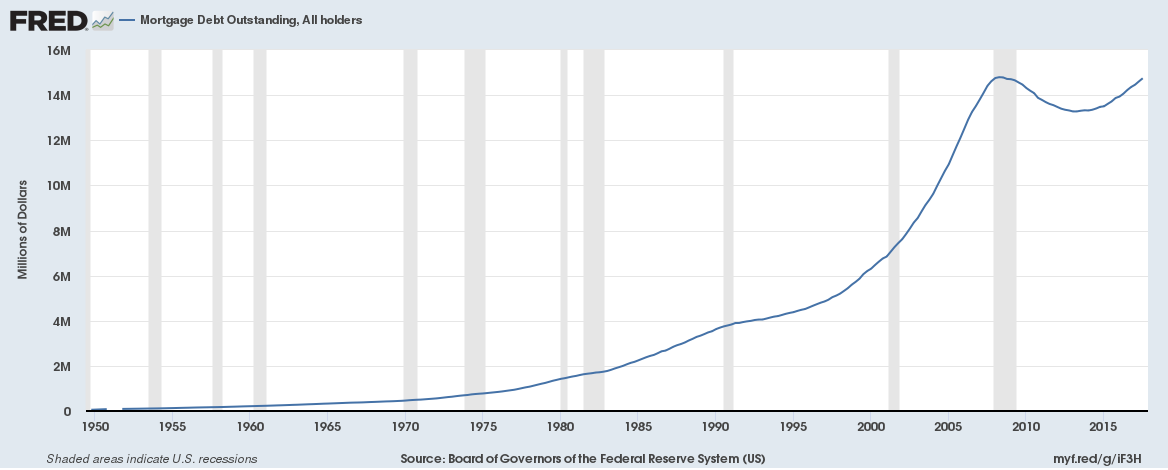

United States of America

US Total Residential Mortgage Debt Outstanding – Individual Holders: $1.32 trillion (down 3% since September 2008), 8% of GDP (2017), Population: 323.1 million (2016)

US Total Residential Mortgage Debt Outstanding – All Holders: $14.76 trillion (down 1% since September 2008), 79% of GDP (2017), Population: 323.1 million (2016)

I love how all the stolen lands except the Uk slab(another story) are in massive debt!! The natives in these jipped lands got paid in beads, booze and sometimes just bullets to the heads for millions of sq miles of priceless lands. Now the offsprings of these thieves are up to their necks in debt!! Is that Karma?? God owns the Universe, for man to sell God’s creation and not pay His 10% slice is a serious crime. Good luck all you Banksters!!