UK households find themselves in a strange situation ten years on from the financial crisis. Interest rates have never been lower for both borrowers and for savers.

We assess the impact of potentially higher interest rates for households in the UK.

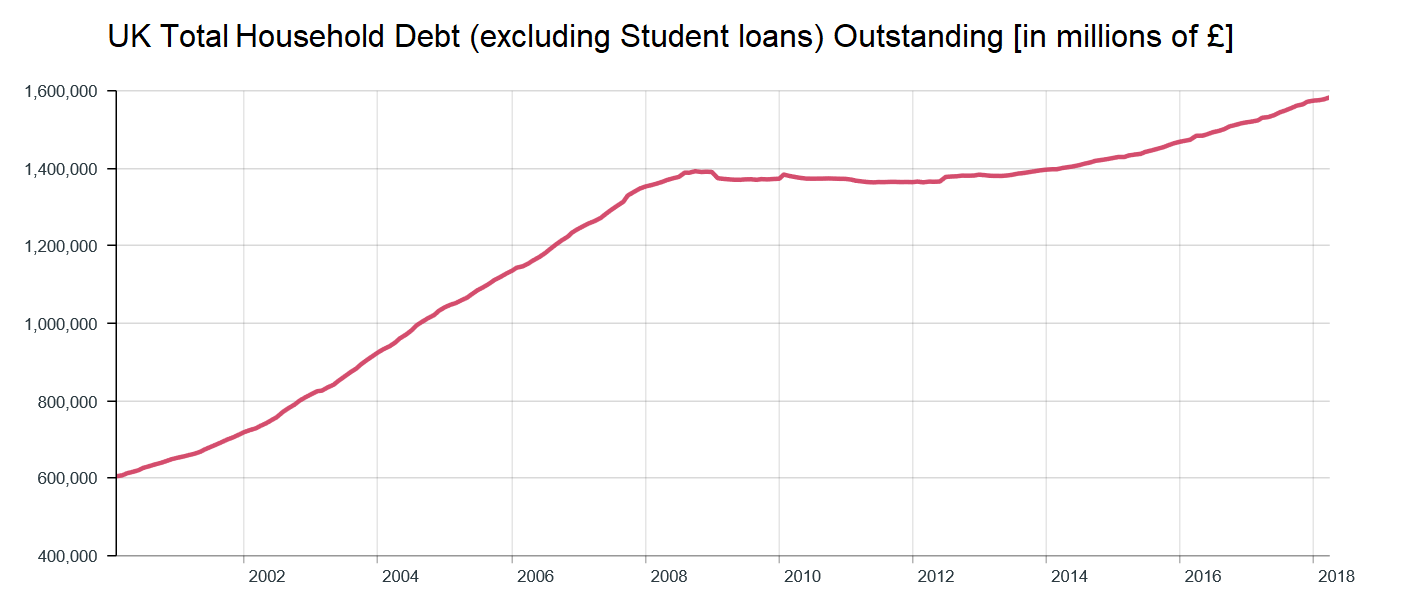

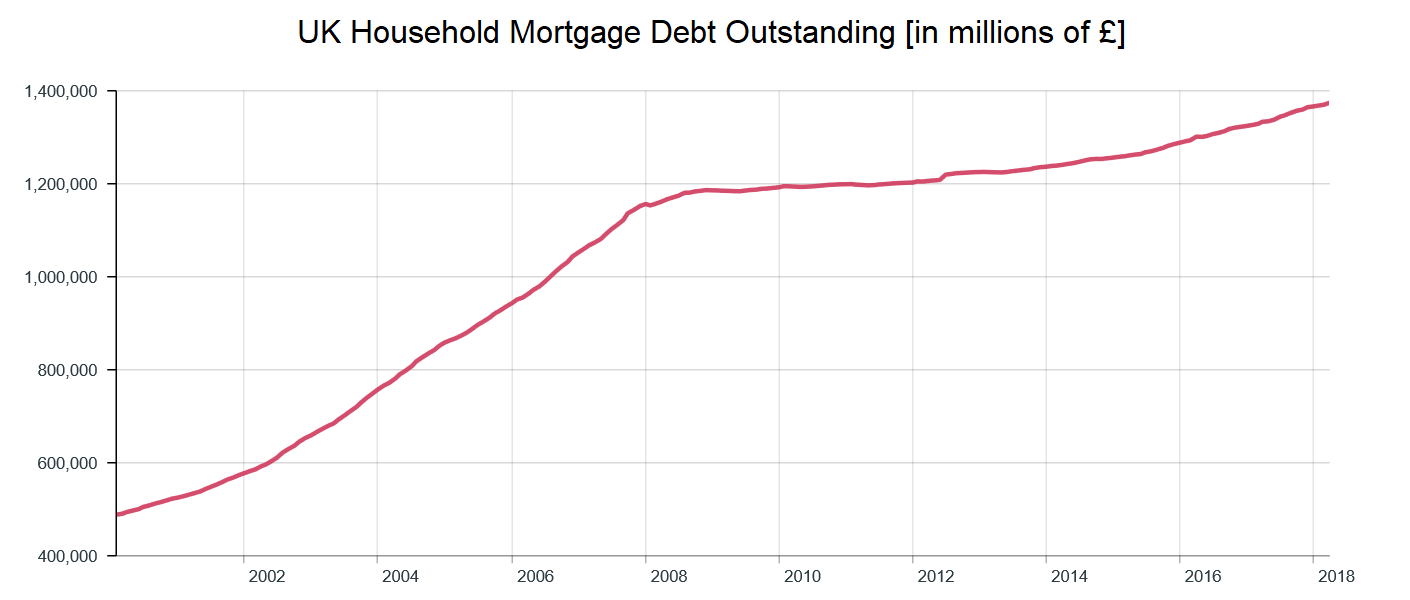

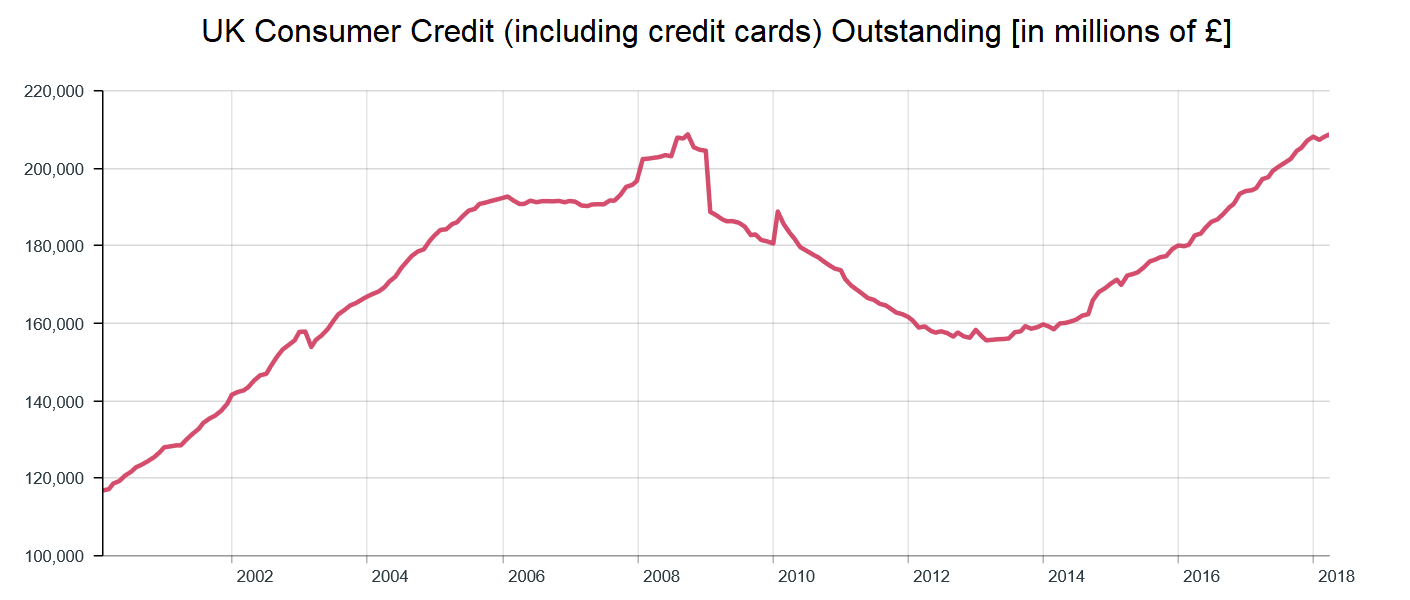

First, here are some household debt statistics,

All numbers as of March 31, 2018. Data source: Bank of England

UK total household debt (excluding student loans) outstanding: £1.59 trillion

includes

Household Mortgage debt outstanding: £1.38 trillion

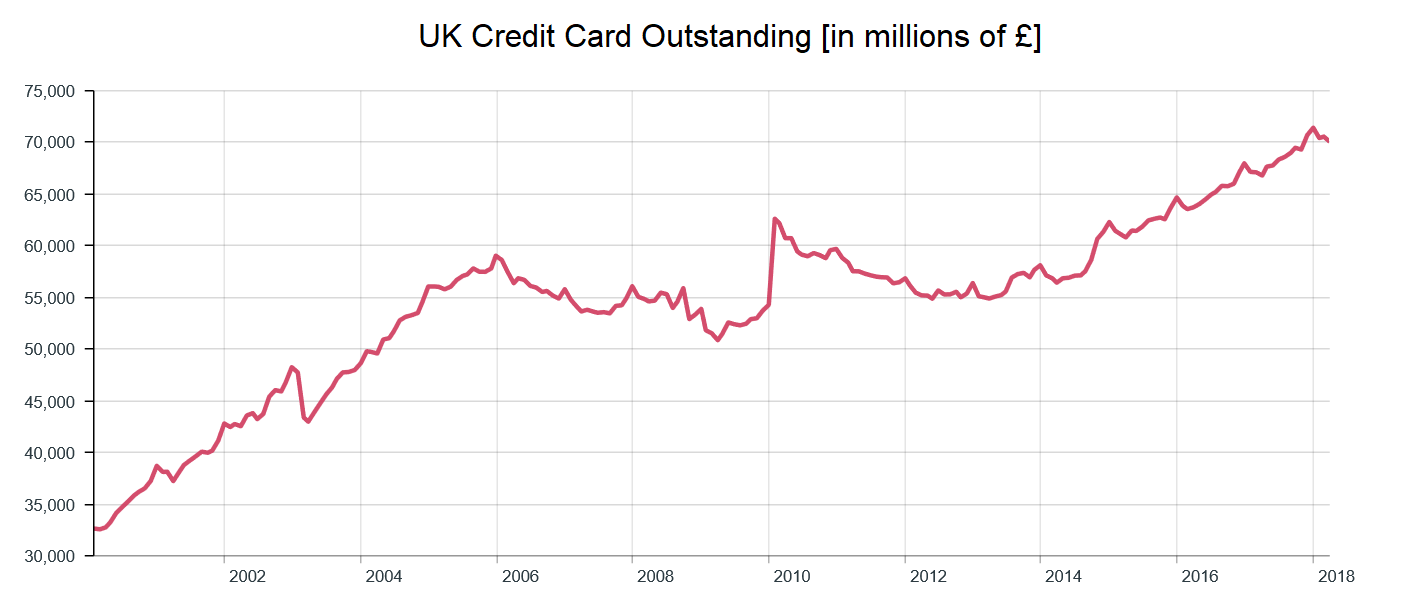

Credit Card debt outstanding: £70.71 billion

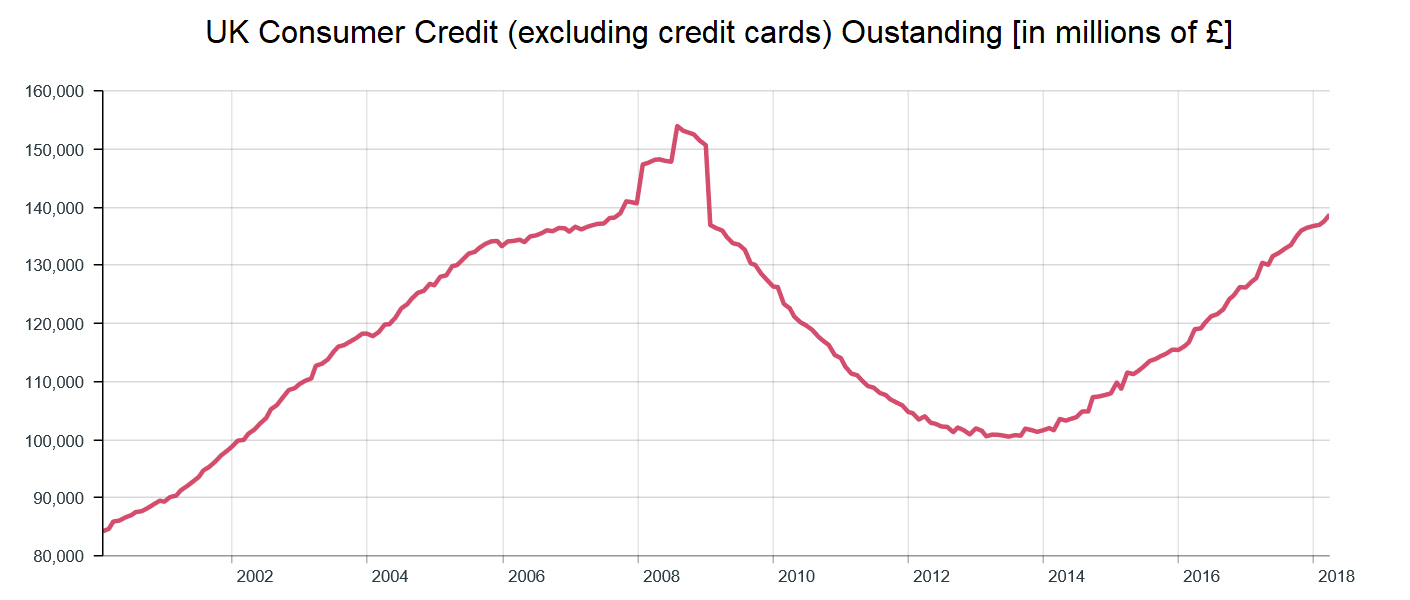

Other consumer debt (overdrafts, loans, others but excluding credit card debt) outstanding: £138.81 billion

Here are charts,

The maximum debt is understandably on mortgages.

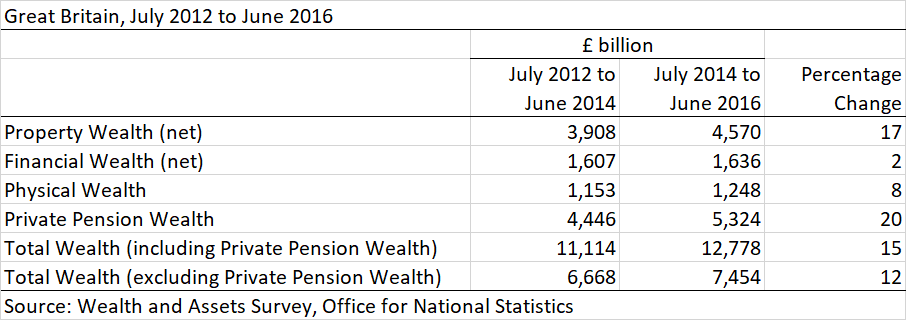

The problem is most of the UK wealth (excluding private pensions) is in property. Below is a table of the wealth distribution by asset type.

Back to the impact of potentially higher interest rates

Of the 8.1 million households with a mortgage, 3.7 million (or 46%) are on either a standard variable rate or a tracker rate. They will see a rise in interest rates in line with the any potential rise with the official bank rate. Variable rates are on an average 3.8% above the base rate. The base rate is currently 0.5% which means the average variable rate is currently 4.3%.

The other 4.4 million or 54% will either get on a new fix at the end of the current term or might have to switch to a variable rate or tracker. The key thing here is “might have to switch”. New mortgage affordability checks have been put in place which might cause people to be in a situation where they are unable to switch to a fixed rate product if they can’t afford new payments based on their own economic conditions or if market conditions change.

29% of all fixed rate mortgage product tenures end every year which is around 15% (i.e. 29% of the 54%) of all mortgages plus those on a variable rate or tracker (46%) are susceptible to rate increases. This means 61% of all mortgages would be impacted with an interest rate hike. How much is the impact? A 0.25% (25 bps) of £1.38 trillion would mean an extra £2.1 billion in interest payments (0.25% * 61% * £1.38 trillion) a year. UK Households spend £1.1 trillion on goods and services (including financial payments) annually so an extra £2.1 billion a year wouldn’t be much but this takes into account only a 25 bps hike.

The danger for household debt is bigger interest rate hikes or property prices falling considerably. We are going to write about the impact of property prices falling in the UK over the next week.

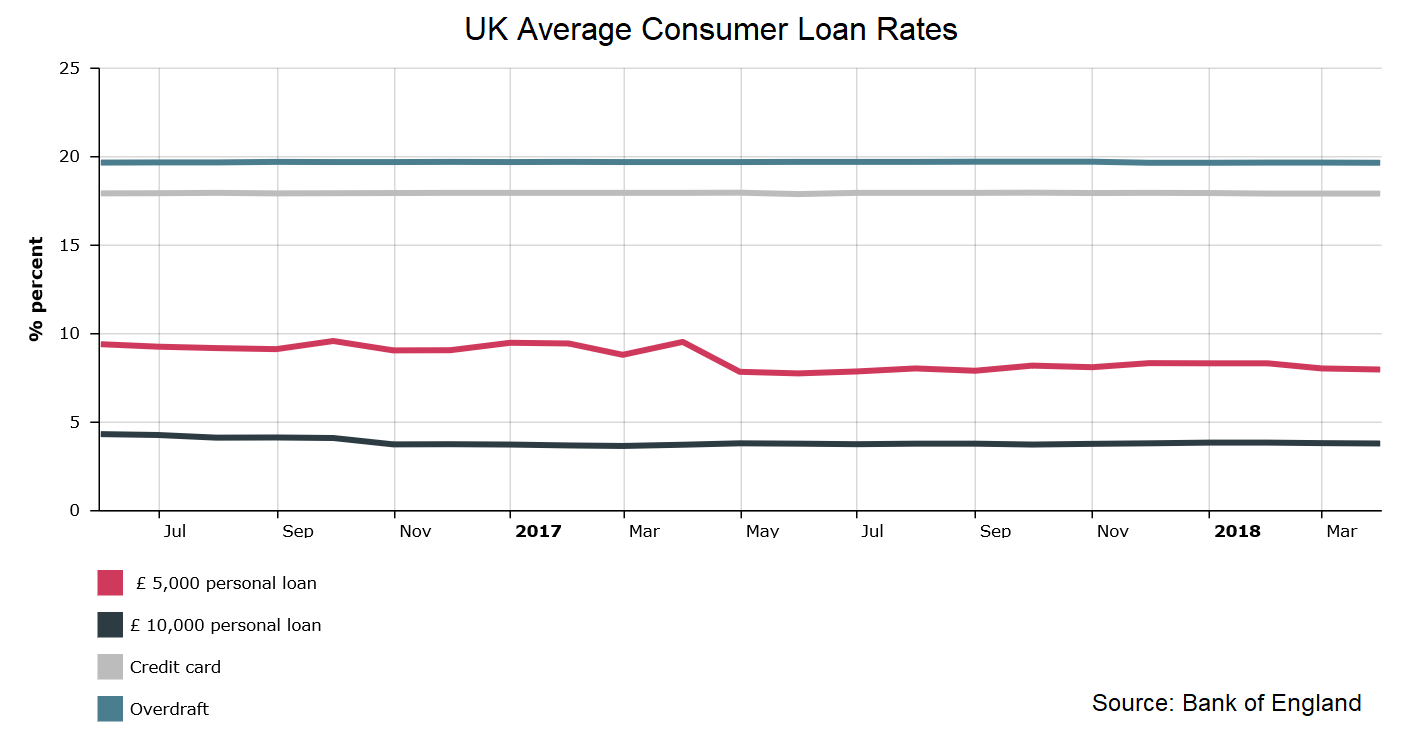

What about other credit products?

Well, most personal loans have a fixed interest rate for the entire term so there wouldn’t be much of an impact.

There would be an impact on overdrafts and credit card debt but then those are already on high rates (credit cards at around 19% and overdrafts at 10%) so a small rise wouldn’t make much of an impact.

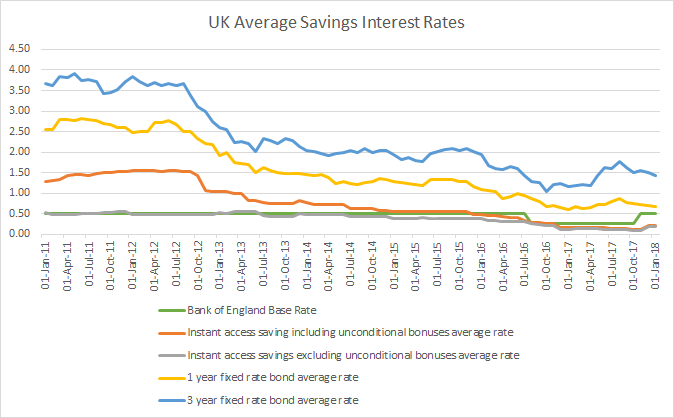

Will things improve for savers?

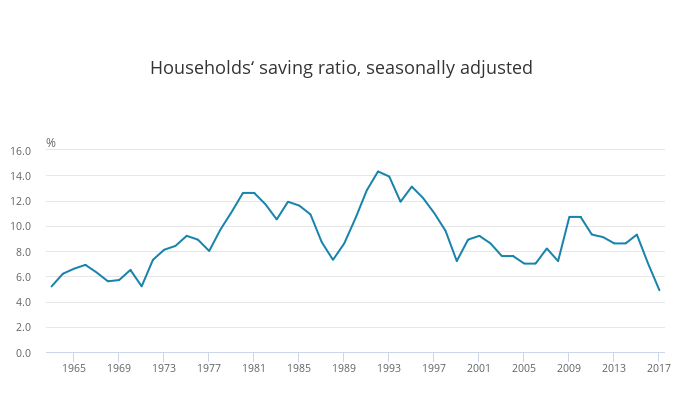

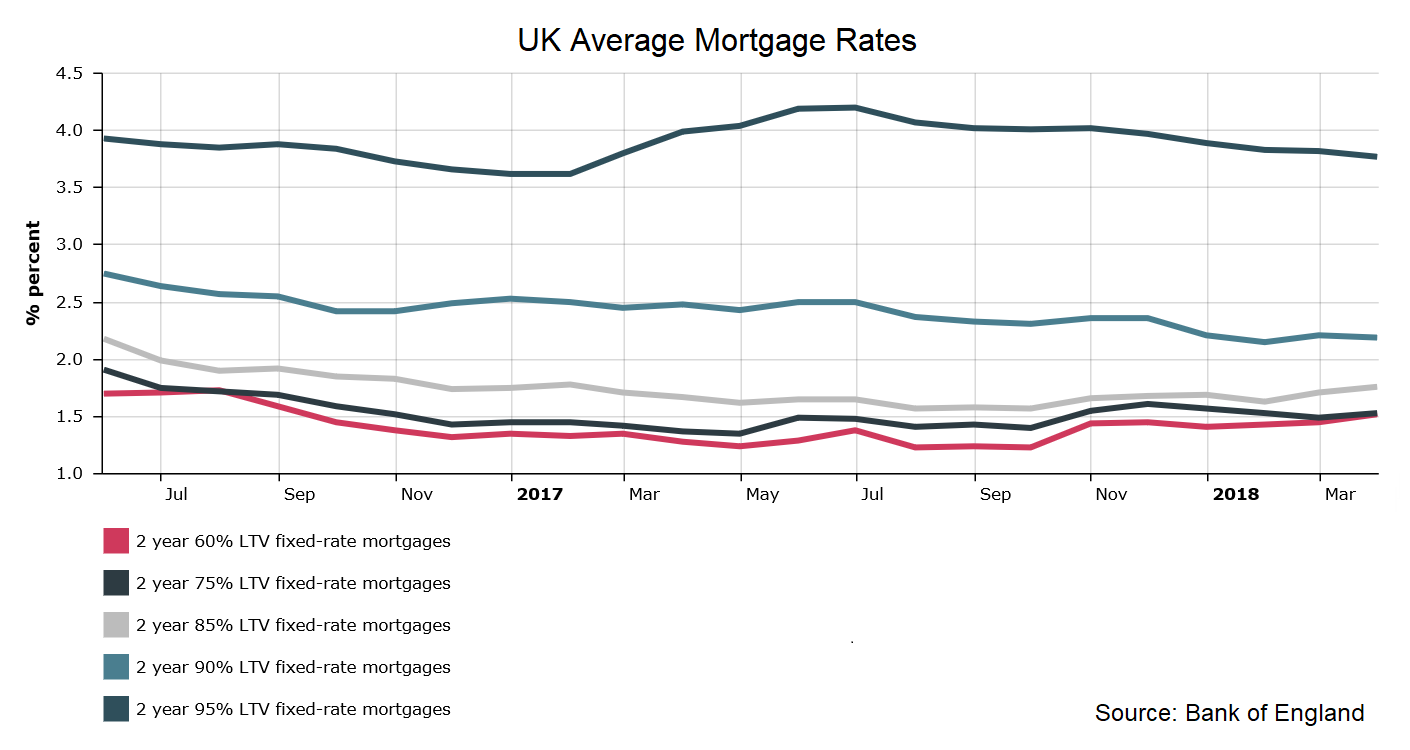

Look at the chart below,

Interest rates won’t go up for savers unless quantitative easing (QE) ends. In the meanwhile, inflation continues to run above the savings interest rate. Little wonder that the household savings rate in the UK is currently at a record low.