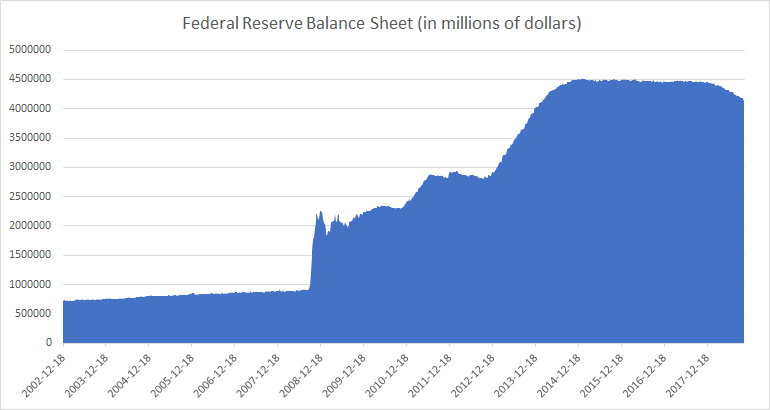

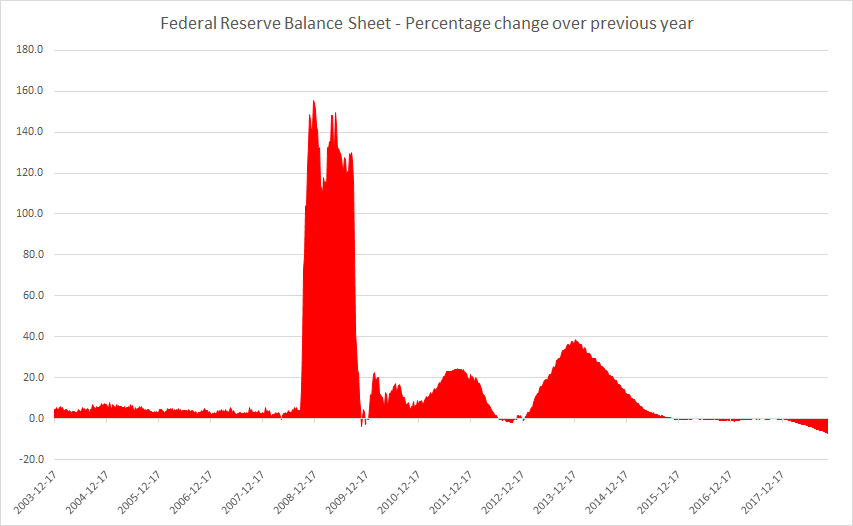

The Federal Reserve has been unwinding or reducing its balance sheet. The Federal Reserve’s balance sheet swelled from $900 billion at the start of 2008 to a peak of $4.5 trillion in 2017.

The Federal Reserve’s balance sheet consists of assets and liabilities. Its principal assets are the securities that it holds in its portfolio, which consist primarily of U.S. Treasury and mortgage-backed securities. Its principal liabilities include U.S. currency and the reserve deposits that banks and other depository institutions hold with it.

The Federal Reserve’s balance sheet became much more complicated during and after the financial crisis as the it acted to provide liquidity to the financial system during the crisis, and to encourage recovery from the recession that followed. To achieve this the Federal Reserve purchased large amounts of U.S. Treasury and mortgage-backed securities. It paid for those purchases by adding funds to reserve deposits.

Why is the Federal Reserve Unwinding its balance sheet?

Well, the economy has recovered, and it is time to normalize things. The monetary policy steps that the Federal Reserve took amid and following the financial crisis are no longer needed for today’s economy.

The Federal Reserve’s balance sheet expansion was one strategy to assist economic recovery.

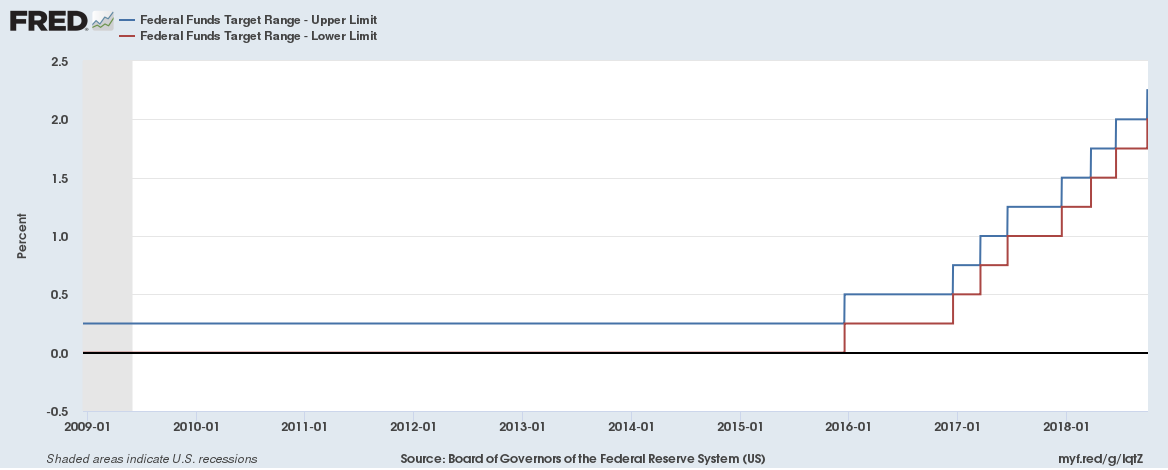

Another was keeping interest rates at or near zero for almost a decade. Interest rates are being gradually increased to “normalize” them.

How will the Federal Reserve unwind or reduce its balance sheet?

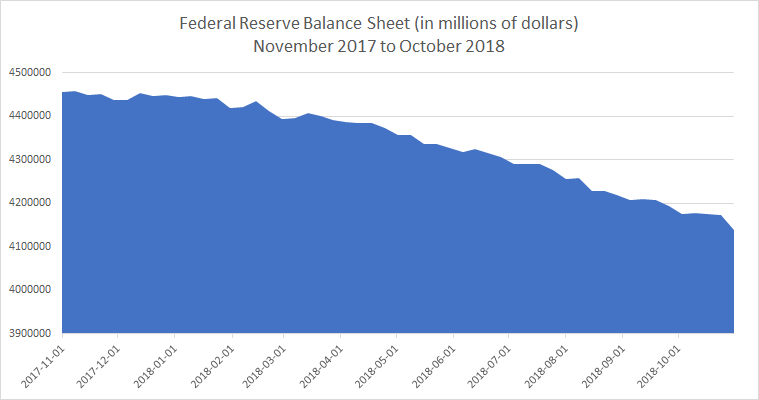

When Treasury securities reach their maturity date, they are paid off by the government. Mortgage-backed securities are paid off by Fannie Mae and Freddie Mac. The Federal Reserve had been going out in the market and replacing those securities with purchases of other securities so as to keep the balance sheet constant. Unwinding the balance sheet is simply stopping the replacement of securities that mature. The process of unwinding is slow and gradual.

The Federal Reserve is taking a capped and controlled approach to unwinding its balance sheet by letting Treasury securities “run off” at about $6 billion a month and letting mortgage-backed securities run off at about $4 billion a month. That number is going to increase every three months until there’s a maximum of $30 billion a month in Treasuries running off, and $20 billion a month in mortgage-backed securities running off. All this simply means increasing the supply on the market of U.S. Treasuries letting the private sector buy more of them.

Related:

The curious case of low U.S. money velocity

The Bank of England Balance sheet has been expanding rather quickly recently

Here’s how much money supply has grown for major economies in the past decade (2008 to 2018)

Japan is ahead of us by 20 years. due to older population. The Balance sheet of the BOJ total is now more than 1 year of Japan’s GDP. Why the US could not follow the same path in the next few years, trying to revive the economy ? I don’t see any reason….