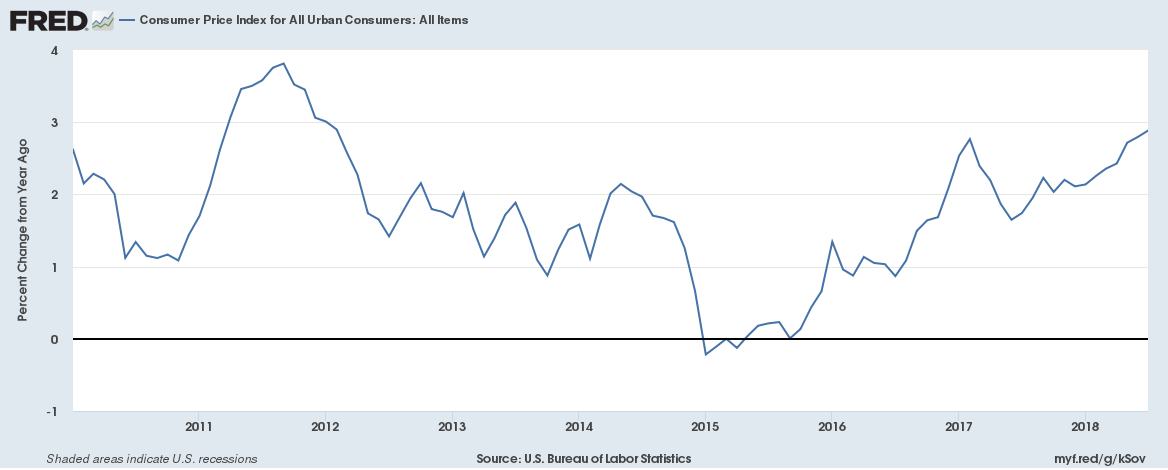

U.S. Consumer Inflation at 2.9% is the highest since February 2012. And it isn’t just energy prices causing inflation to soar. Core inflation (which is Consumer inflation excluding volatile energy and food prices) at 2.4% has risen at the fastest pace in a decade. Here is a chart for CPI inflation growth,

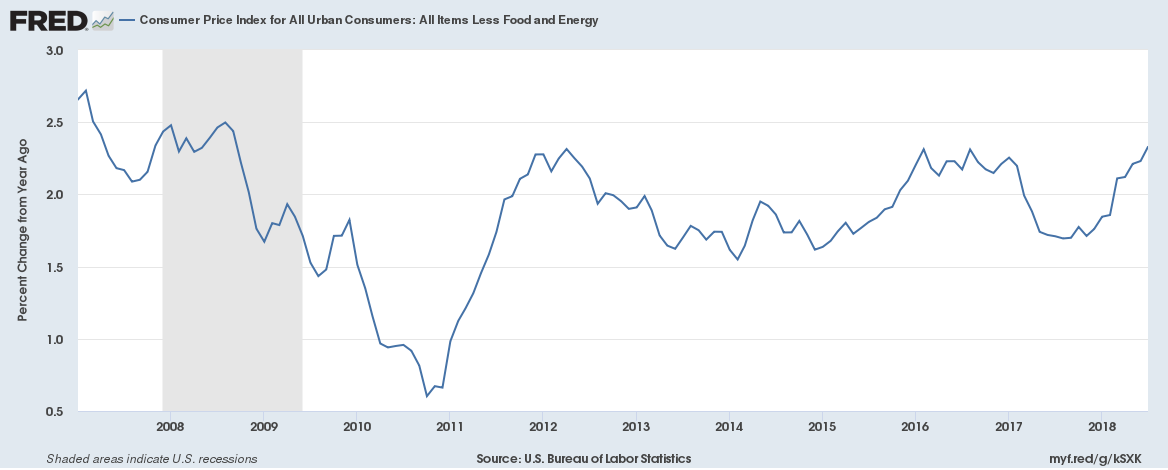

And core inflation (Consumer inflation excluding energy and food prices),

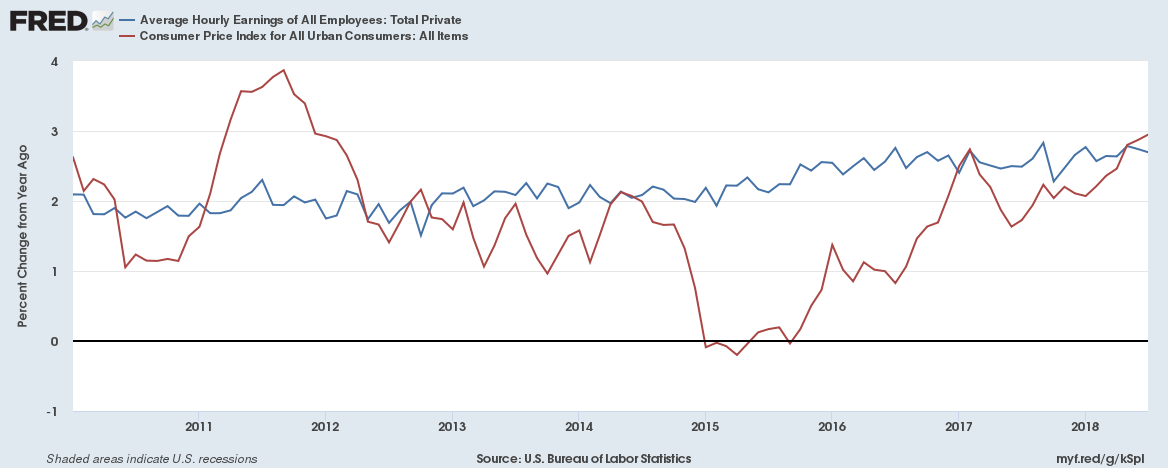

Wage growth isn’t keeping up with inflation for the first time since 2012 with wage growth at 2.7% lagging inflation for the first time since October 2012,

Is this the perfect Goldilocks economy with Inflation and wage growth (almost) tracking each other? The Federal Reserve has the “perfect” conditions to continue raising interest rates. The dollar index (DXY) is at a one year high, GDP growth at annual rate of 4.1% based on the second quarter number and unemployment at an 18-year low and now inflation is rising. That leaves absolutely no reason for the Fed not to raise interest rates unless something major happens in the global economy.