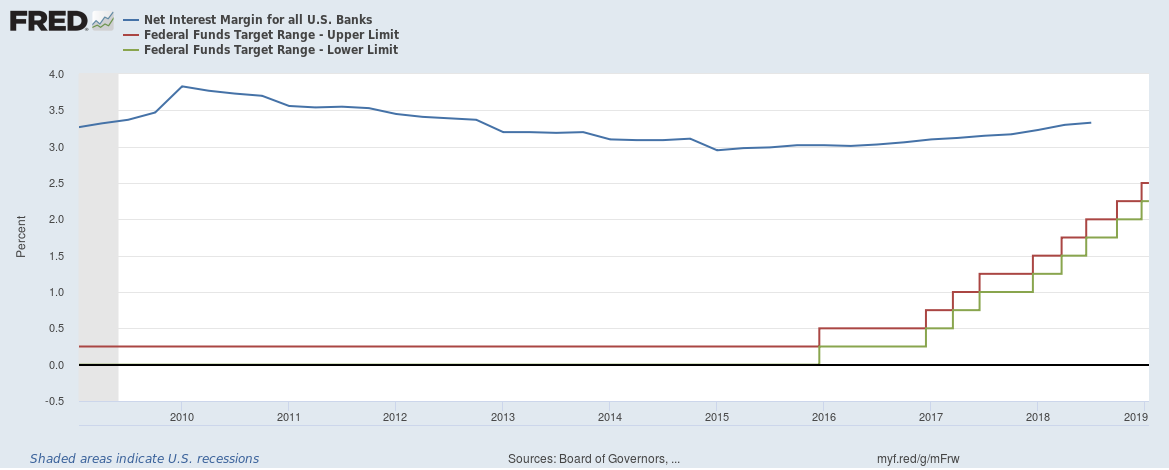

The Federal Reserve increased the target for the bank’s benchmark rate by 0.25% (to a range of 2.25% to 2.5%) at the end of December, the ninth rate rise since 2015. Rising benchmark interest rates are having little impact on mortgage and saving rates or interest margin of banks.

Interest Margin of Banks in the United States stood at 3.33% at the end of Q3 2018, up just 0.03% from Q2 2018 (3.3%) and up just 0.18% from Q3 2017 (3.15%).

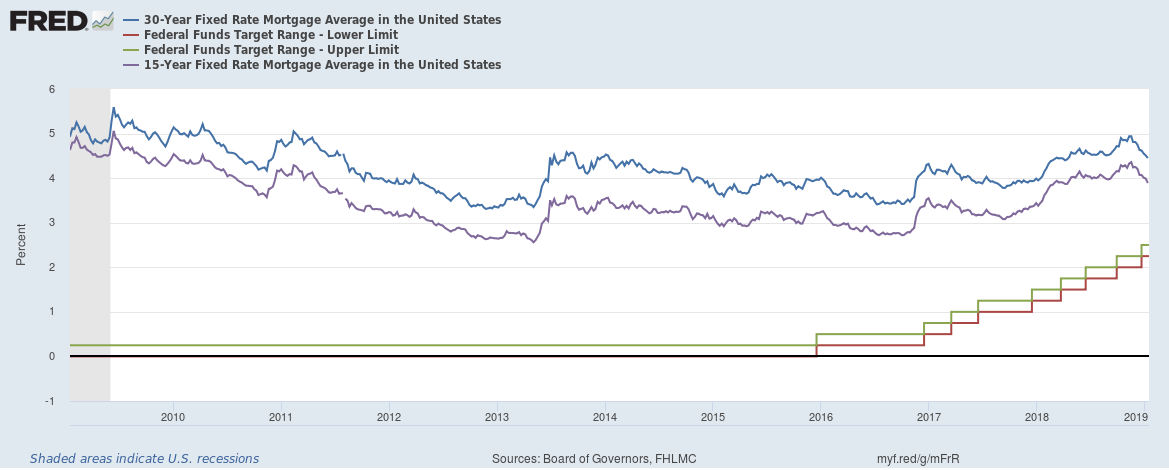

Mortgages rates are little impact from rising benchmark rates,

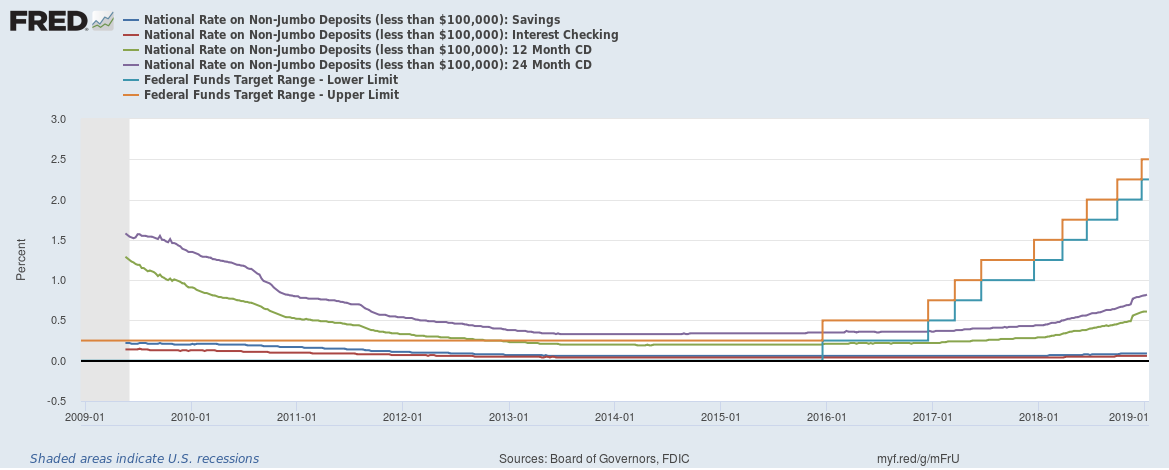

Saving interest rates aren’t rising in line with rising benchmark interest rates either,

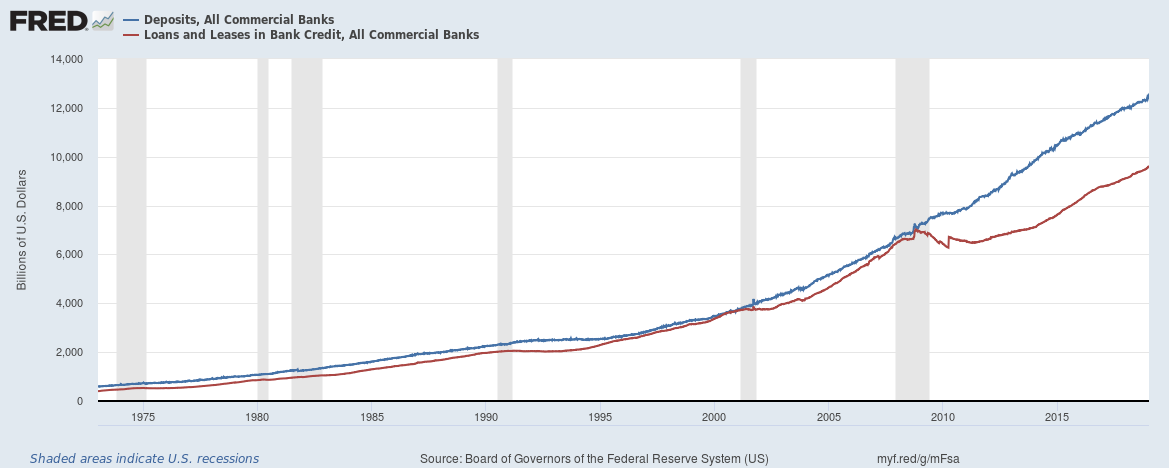

Since the financial crisis of 2008-2009 the difference between bank deposit growth and bank loan growth in the U.S. diverged in a big way, graph below,

Banks don’t need the savings and can’t find enough customers to lend money. Don’t expect better returns on savings, which would only mean the flight of money to riskier assets could continue.

Related:

Are bad loans really increasing for banks in the United States?

Banks in the United States have a problem – they can’t find enough customers to lend money to

The curious case of low U.S. money velocity

Here’s why the Federal Reserve increasing interest rates could be a problem

The yield curve inversion plus why banks and banking stocks are impacted by it

The Federal Reserve is unwinding its balance sheet, here’s why and how it is doing it