A U.S. recession is always preceded by falling corporate profits so growing corporate profitability is a good (leading) indicator that a U.S. recession is not here (yet) …

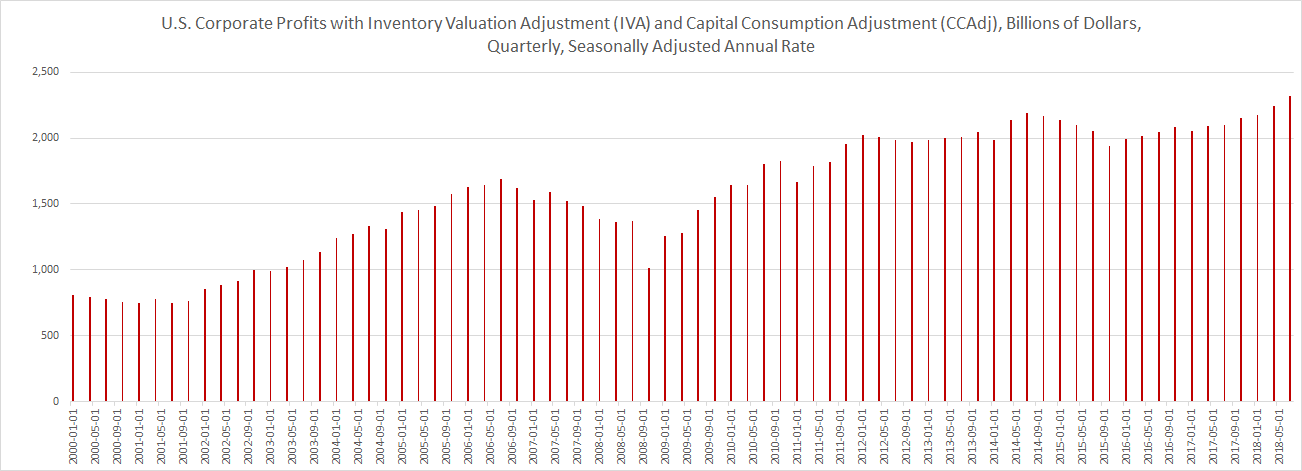

Corporations in the United States are set to make an annualized profit of $2.32 trillion (based on the latest Q3 2018 numbers), a record high. These are for all corporations in the United States and not just listed ones and are before taxes. Will listed companies deliver on earnings? If yes, the equity markets could go much higher.

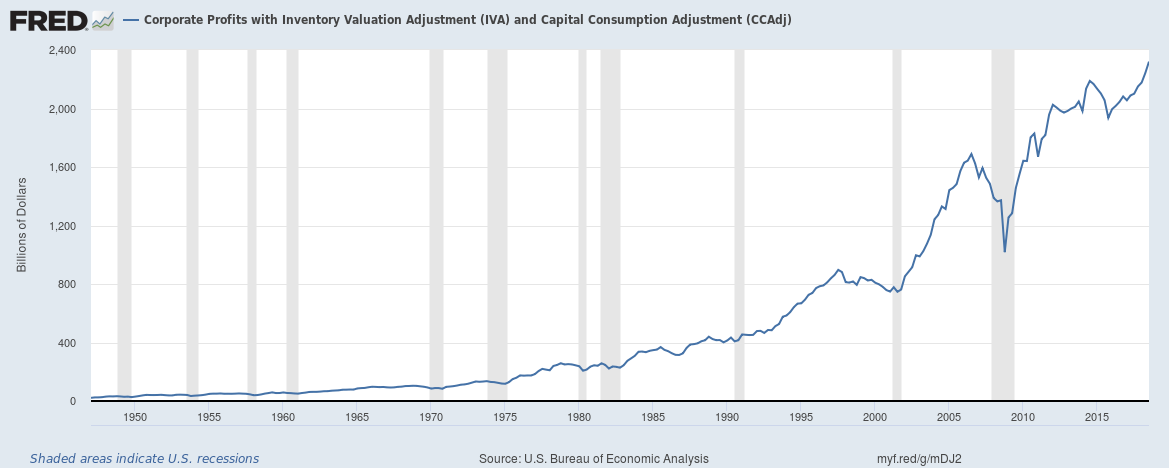

Here are two graphs (we created one to give a better perspective),

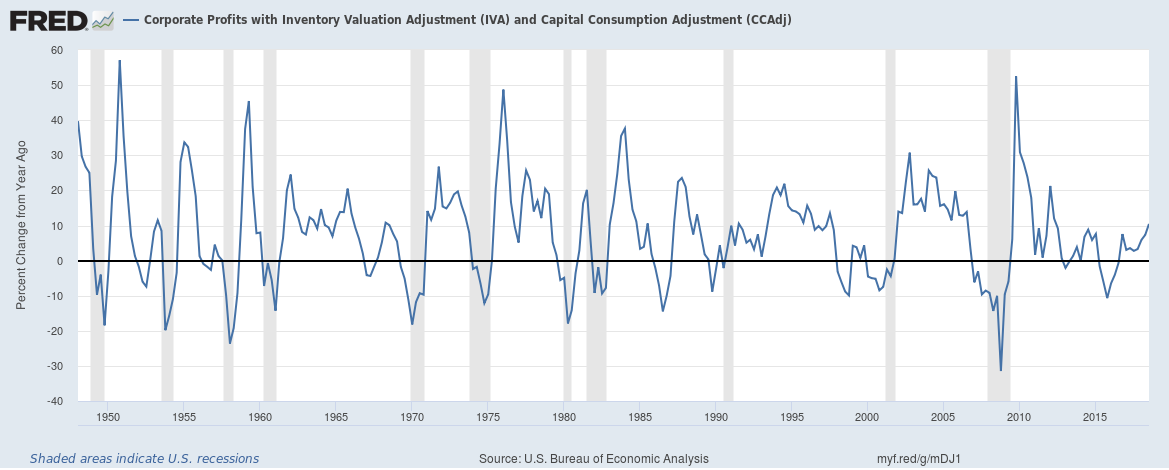

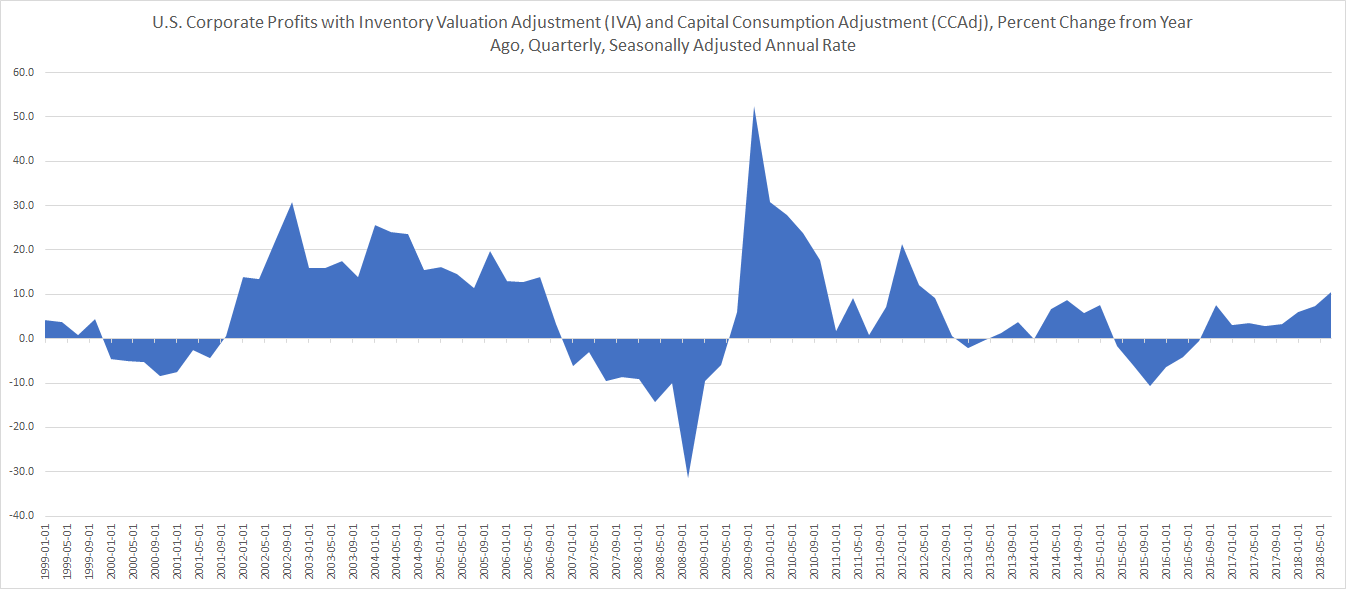

Profitability (before taxes) is growing at a good pace of 10.4%. The numbers look even better post tax given the tax cuts on corporate profits. Falling Corporate profits are a leading indicator for a U.S. recession. Given the growing trend, it doesn’t look like a U.S. recession is near.

Again, here are two graphs,

Related:

The U.S. Government is now spending $1.24 for every $1 in income

Healthcare has displaced Retail as the largest employer in the United States

Are bad loans really increasing for banks in the United States?