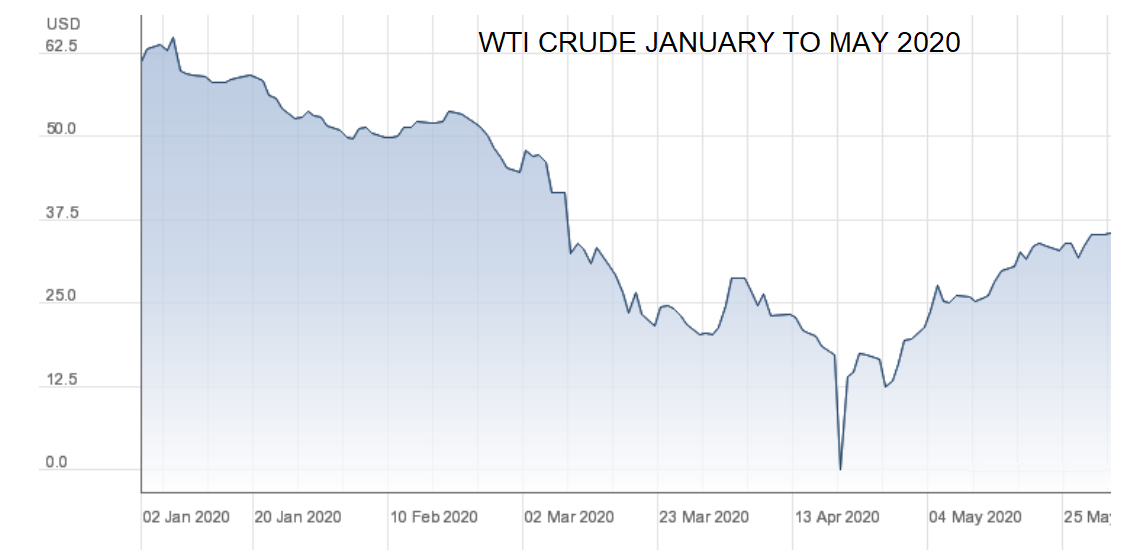

Oil has best month ever

In April, oil prices briefly went negative. May was a different story with WTI Crude, the U.S. oil benchmark, registering its best month ever after gaining 88.38%. Record supply cuts and an uptick in demand pushed prices higher.

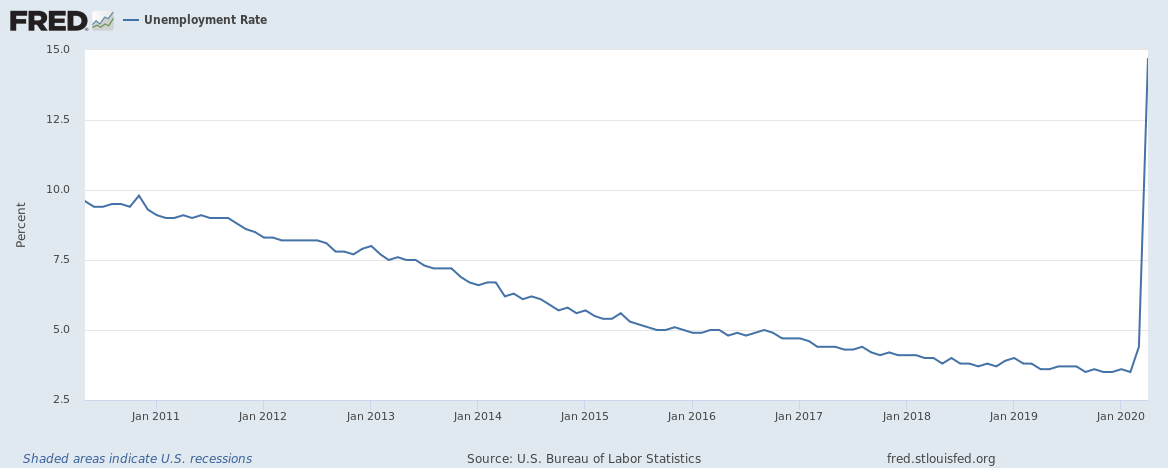

COVID-19 impact on employment

As the impact of lockdowns on back of COVID-19 became apparent, U.S. unemployment soared from 4.4% in March to 14.7% in April (numbers were only reported in May).

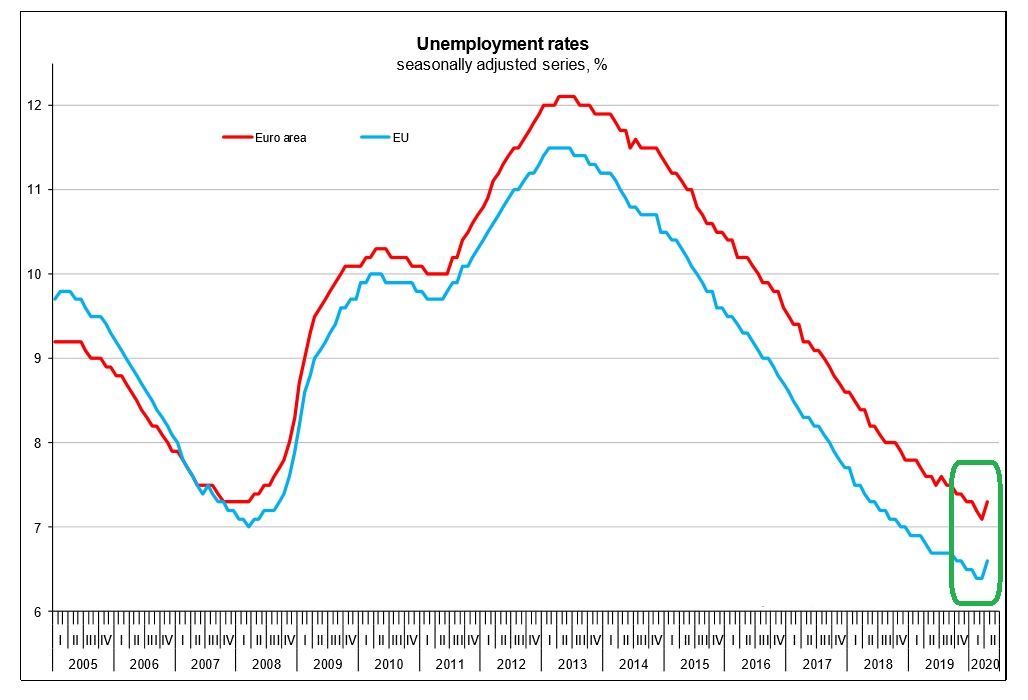

Meanwhile, the impact was much lesser in the European Union (EU). The unemployment rate in the EU was only up marginally to 6.6% in April (up from 6.4% in March). In the Eurozone, the unemployment rate was up to 7.3% in March (up from 7.1% in March).

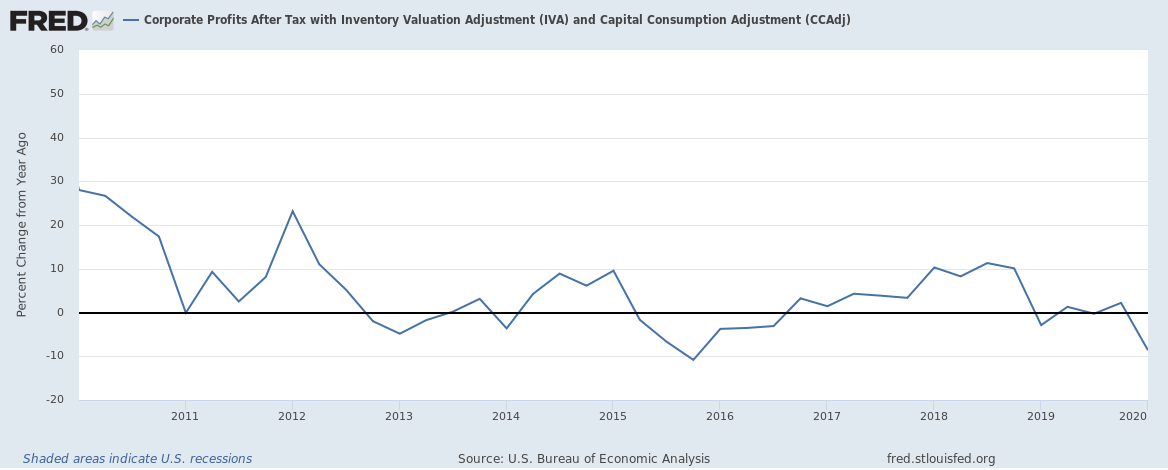

U.S. Corporate Earnings

U.S. Corporate earnings reported in May for Q1 2020 were down 8.8%. Not too bad given the impact of the COVID-19, Q2 will likely be much worse though …

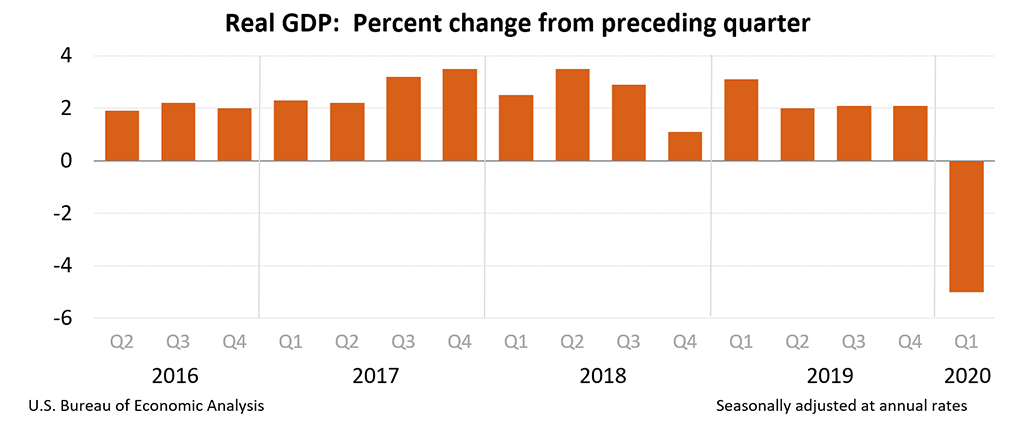

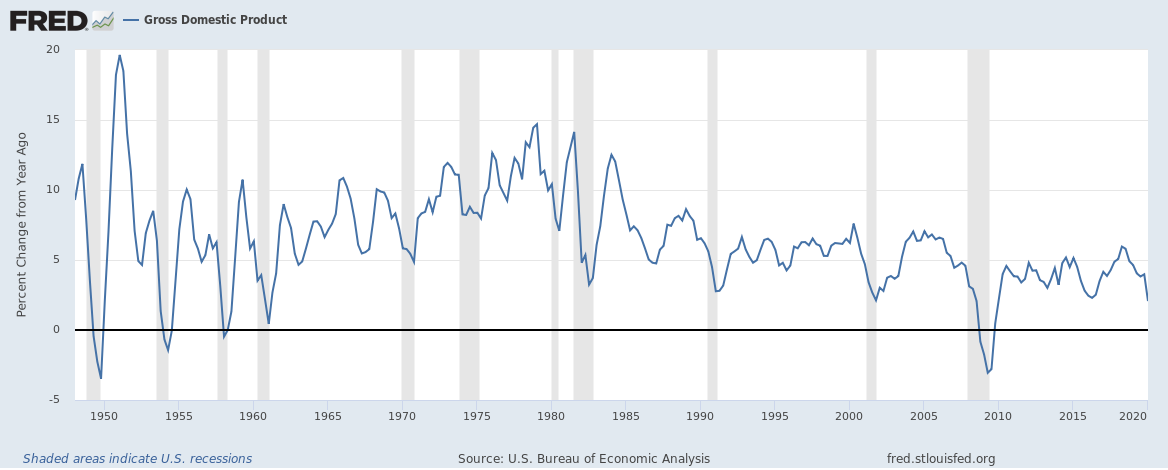

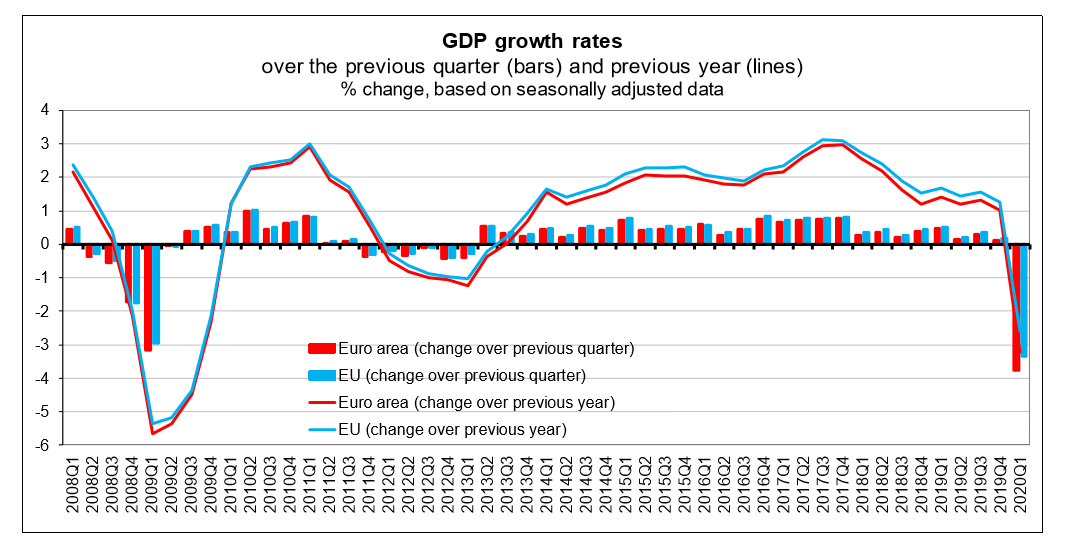

Q1 2020 GDP readings

Q1 GDP readings were reported during the month. U.S. Q1 2020 contracted 5% QoQ (vs Q4 2019) but grew YoY (vs Q1 2019).

The European Union Q1 2020 GDP contracted 3.3% (QoQ) and 2.6% (YoY). France (-5.8% QoQ), Spain (-5.2% QoQ) and Italy (-4.7% QoQ) were the most impacted economies in EU. Sweden output fell QoQ (-0.3%) but grew YoY (+0.5%) despite not locking down the economy like other European Union member states. Germany, the largest European economy contracted 2.2% QoQ.

UK Q1 2020 GDP contracted 2% (QoQ) and 1.6% (YoY).

Read More: U.S. Q1 2020 GDP contracts 5% (QoQ) but grows 2.1% (YoY) as COVID-19 hits economic activity

Stocks continue rebound

Stocks continued their upward trajectory. Japan led the way with the TOPIX up 6.8% during the month. U.S. indices are set to record all-time highs (despite the pandemic). The S&P 500 was up 4.6% during the month (just 10% off its all-time high set in February and up 39% from its March low). The Dow was up 4.2% during the month and the Nasdaq gained 6.7% during May (just 2% away from its all-time high). Europe ex UK was up 4.4%, UK was up 3.4% and Emerging Markets were about flat. Stock markets seem to be immune to pandemics …