Q1 2018 GDP

The US, the UK, France and Spain all reported GDP numbers over the last week.

US real GDP increased at an annual rate of 2.3% in the first quarter of 2018 as per an advance estimate released by the Bureau of Economic Analysis. Read more about it here.

Personal consumption collapsed, with vehicle sale falling significantly. Business inventories were up significantly too. Total employee compensation (which includes wages and benefits) rose 2.7% over past 12 months, up from 2.4% a year ago and the highest since Q3 2008, while the household savings rate fell to a multi-year low of 3.1%.

Q1 2018 GDP for the UK only increased by 0.1%. Read more about it here, UK GDP growth was the slowest since Q4 2012, with construction being the largest downward pull on GDP, falling by 3.3%.

France’s Q1 2018 GDP was a weak 0.3%. Private consumption was a mere 0.2%, remaining low for the last 2 years now. Exports were weak on a strong euro.

Spain’s Q1 2018 GDP was 2.9% annualised, its slowest in 3 years. And it is projecting slower growth over the next 3 years.

ECB on QE

From the ECB press release this week,

“At today’s meeting the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively.The Governing Council expects the key ECB interest rates to remain at their present levels for an extended period of time, and well past the horizon of the net asset purchases.

Regarding non-standard monetary policy measures, the Governing Council confirms that the net asset purchases, at the current monthly pace of €30 billion, are intended to run until the end of September 2018, or beyond, if necessary, and in any case until the Governing Council sees a sustained adjustment in the path of inflation consistent with its inflation aim.”

So, QE might not end in September then? We wrote here that the ECB balance sheet is now over 4.5 trillion Euros, some 45% of Eurozone GDP. And the European Central Bank (ECB) is by far the biggest holder of European bonds and the biggest (possibly the only) buyer of the weaker Eurozone (Italy, Spain, Portugal and Greece) countries debt.

We can’t see how the Eurozone (and European) credit markets could do with the ECB ending its QE program.

US bond yields

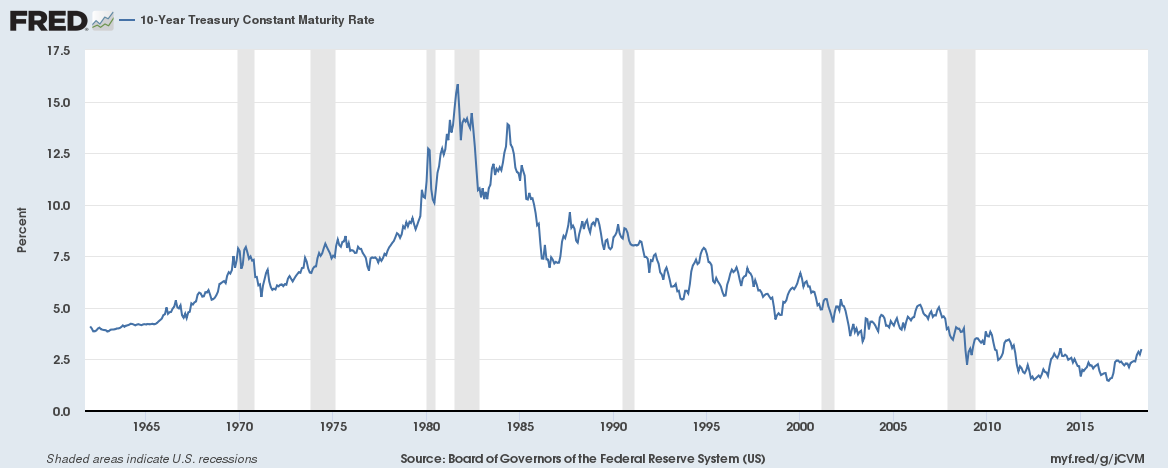

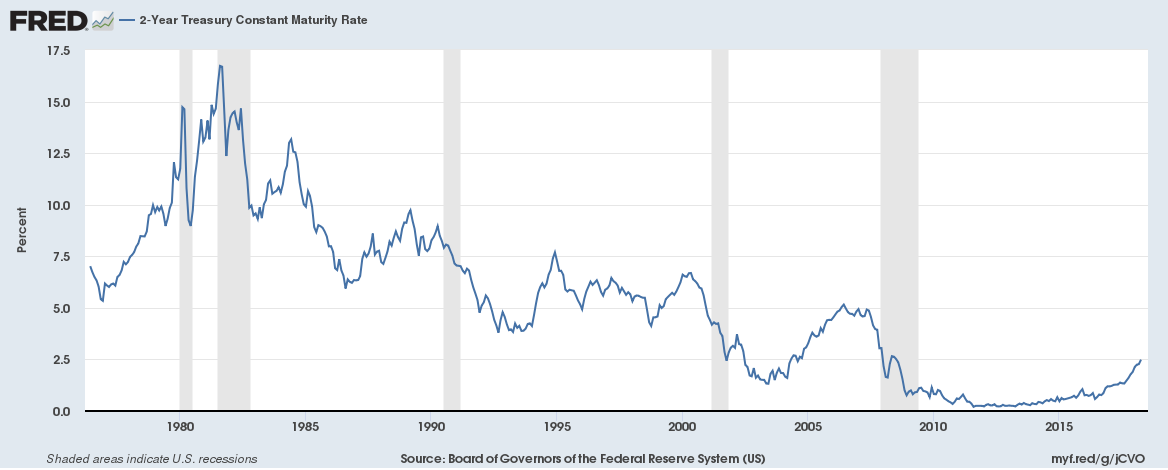

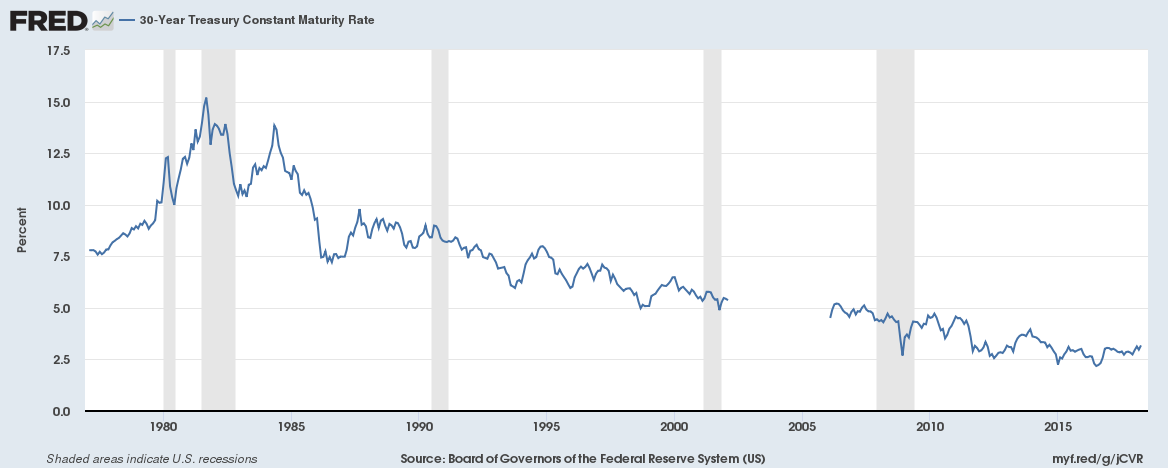

The 10-year bond yield topped 3% (up 0.66% over the past year) during the week, the highest since January 2014. The 2-year bond yield topped 2.5% (up a massive 1.18% over the past year), the highest since July 2008.

We wrote here on whether the US government can cope with higher bond yields. Bond yields are still historically low though (see charts below).

Other things

Lloyds Bank, UK’s largest bank reported an asset quality ratio (bad loans) of 0.23% for Q1 2018, although that is low, it is almost double of 0.12% reported last year. Additionally, the net interest margin was 2.93% (up 0.13% on a year ago) despite low interest rates. And the loan to deposit ratio was 108% (which means it is borrowing from other banks – including the central bank to lend).

Deutsche Bank will scale back areas where it believes it no longer has a competitive advantage in the changed market environment. The Investment Bank is the main target with the US and the equities business the first target.

Argentina’s central bank sharply raised its benchmark interest rate from 27.25% to 30.25% on Friday (300 bps), aimed at propping up its ailing currency from sliding further against the US dollar. The currency has lost over 10 % against the US dollar in the past four months alone with inflation running at 25%.

Amid worker shortages some companies in the US are offering sign up bonuses of up to $25,000 to get employees on board. BNSF Railway and Union Pacific Corporation are offering the bonuses to railway recruits as they are finding it difficult to recruit in a tight job market.

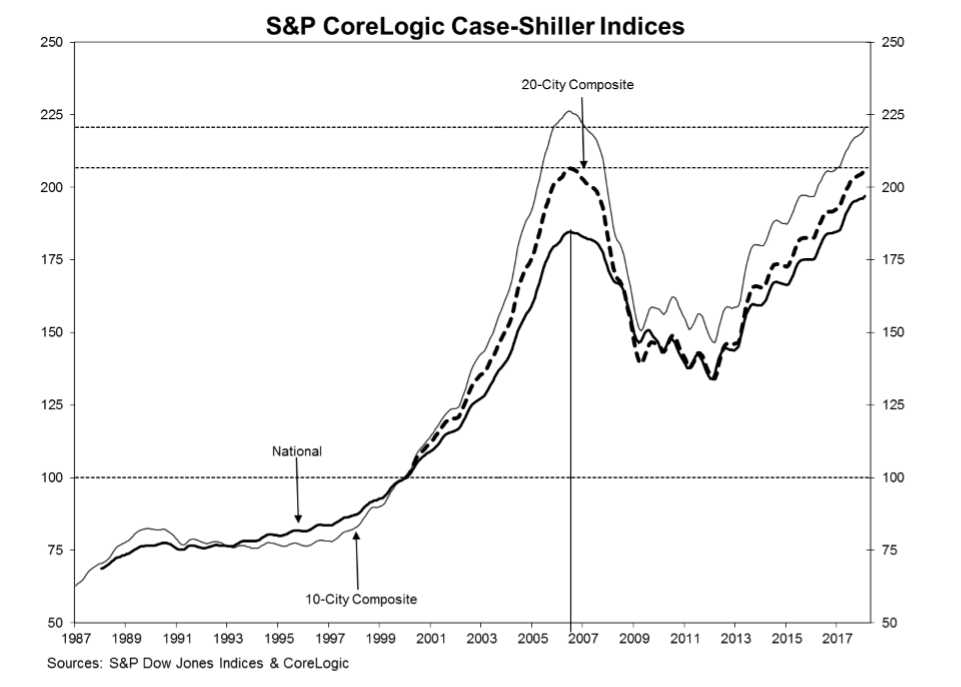

US house prices: The S&P CoreLogic Case-Shiller Home Price Index jumped 6.3% in February compared to a year ago. The 10-City and 20-City Composites are back to their winter 2007 levels.