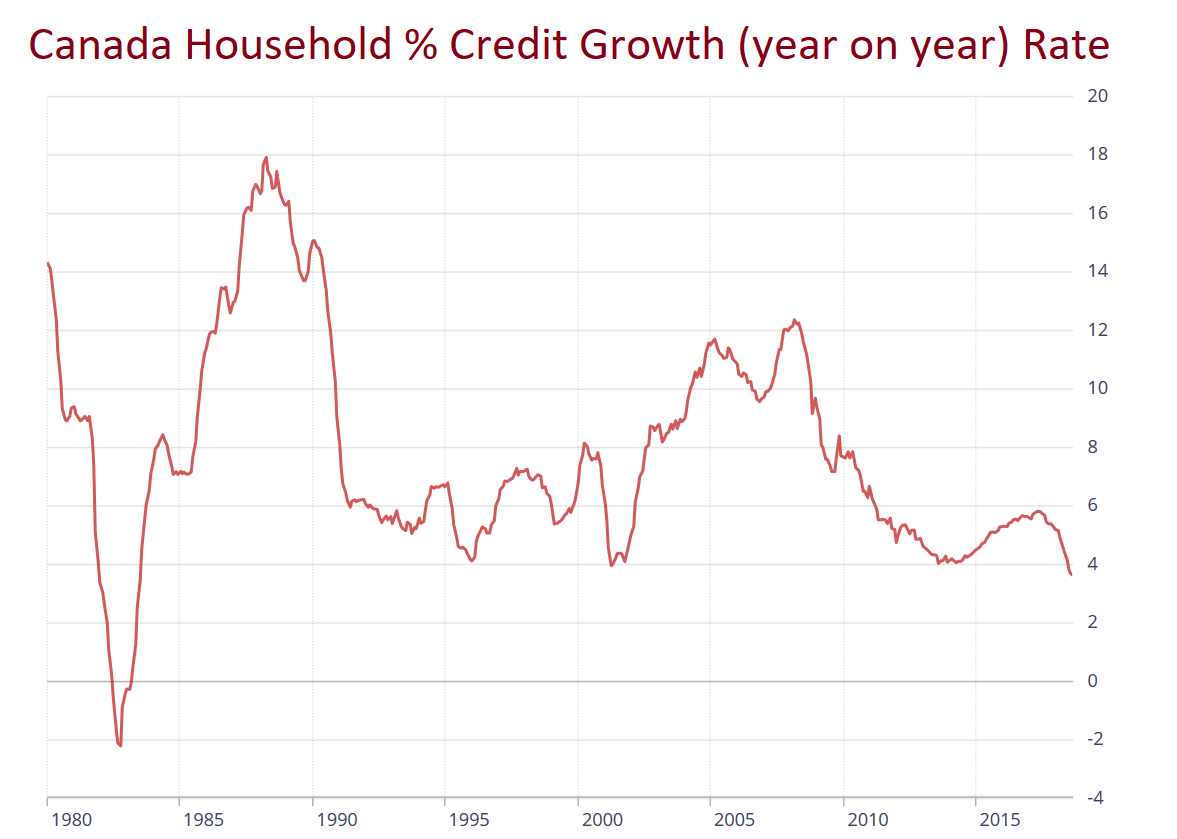

Households in Canada are accumulating debt at the slowest pace in 35 years as interest rates continue to rise. Household credit growth has slowed to 3.5%, the slowest since 1983.

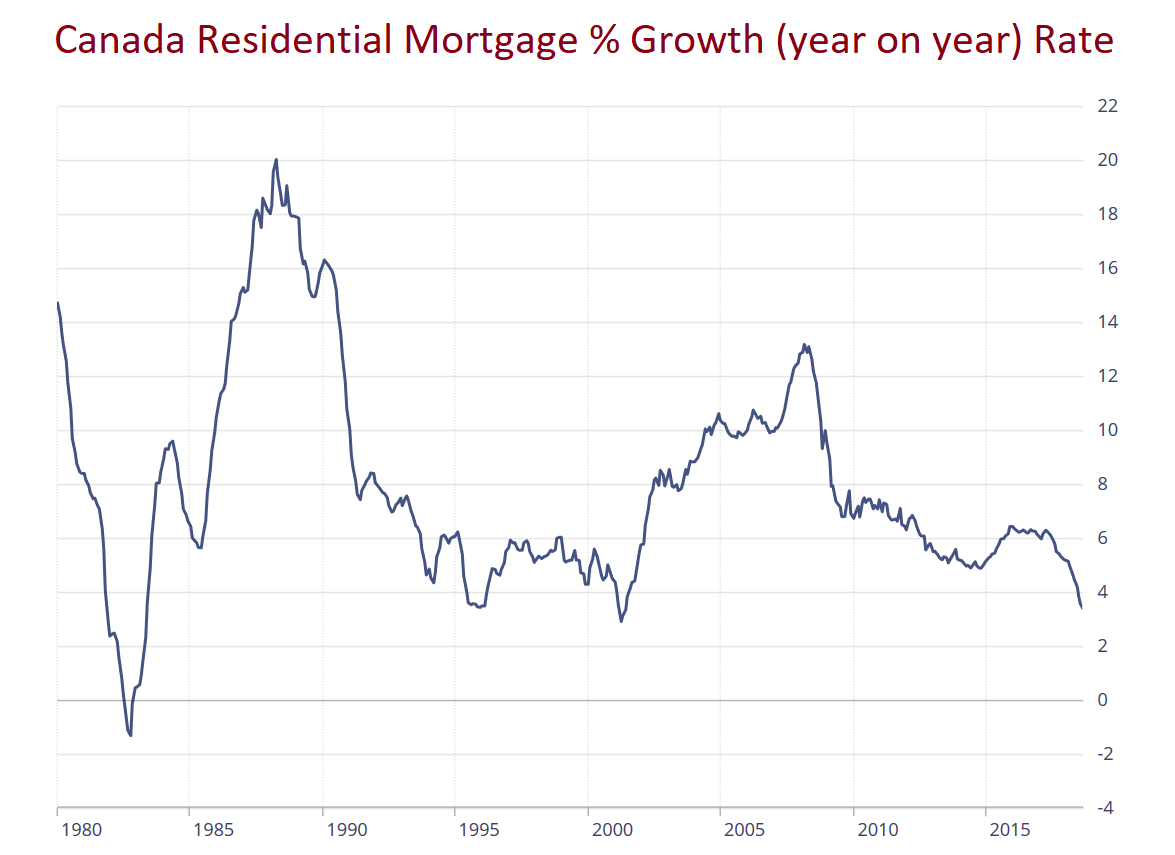

Residential mortgage growth has slowed to 3.3% too, the lowest growth rate since 2001.

Growing Debt

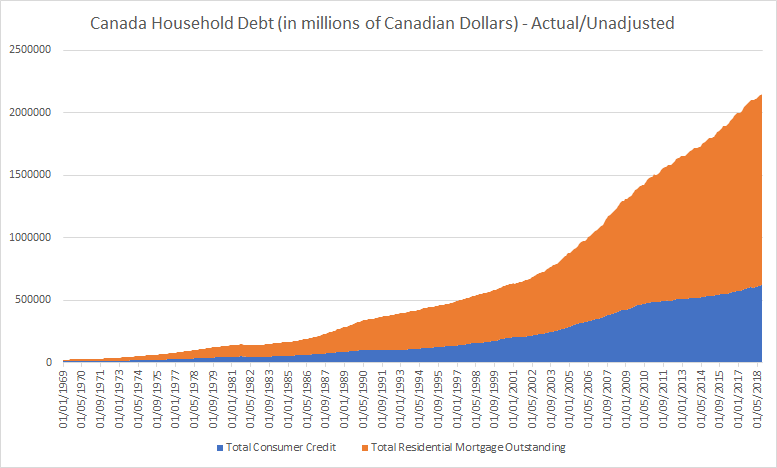

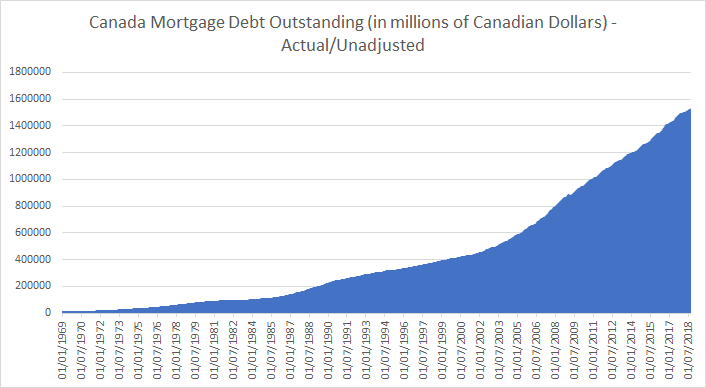

But total household debt stands at C$2.15 trillion (US$1.62 trillion) with total consumer debt (other than mortgages) at C$622.37 billion (US$468.62 billion) and mortgage debt outstanding at C$1.53 trillion (US$1.15 trillion). This means that household debt stands at 125% of GDP.

Rising Interest Rates

The Bank of Canada raised its overnight benchmark rate by a quarter point to 1.75% at the end of October, the third hike this year and fifth since it began tightening in 2017. It also acknowledged for the first time in more than a decade it expects to completely remove monetary stimulus from the economy and said it had to bring rates to levels that are neutral or in other words no longer expansionary.

Household Indebtedness

The average Canadian owes about $1.75 for every dollar of income he or she earns per year (after taxes). As per the Bank of Canada about 8% of households in Canada are “highly indebted” and owe 350% or more of their gross income, representing a bit more than 20% of total household debt. These are the people who would be most affected by an increase in interest rates. That 8% is the highest number ever (again as per the Bank of Canada’s own research).

Recent changes to mortgage regulations include requiring people to show that they can service their debt at higher interest rates, which is good, but is it too little too late?