We wrote recently about three slightly different U.S. recession indicators that have been predictive of the past few recessions. How near or far are those from being invoked?

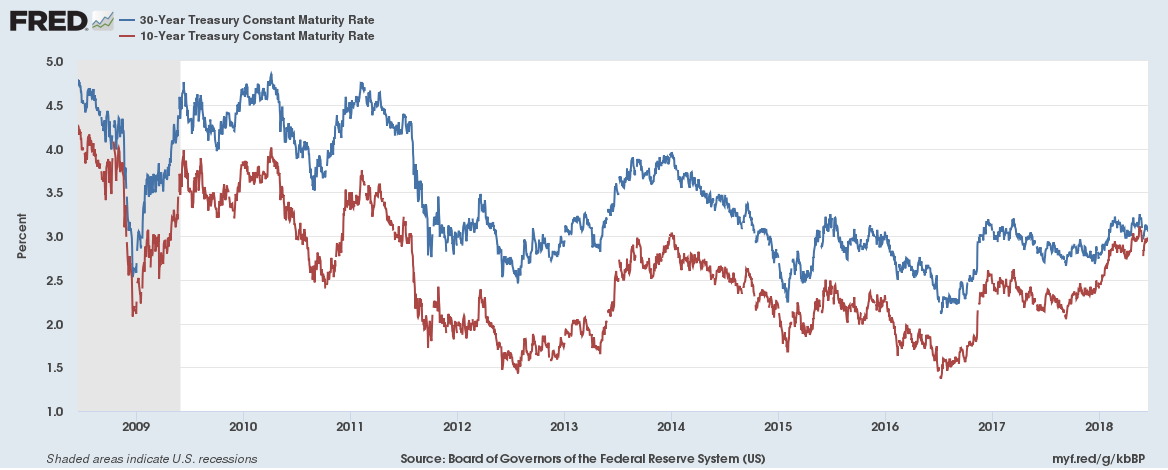

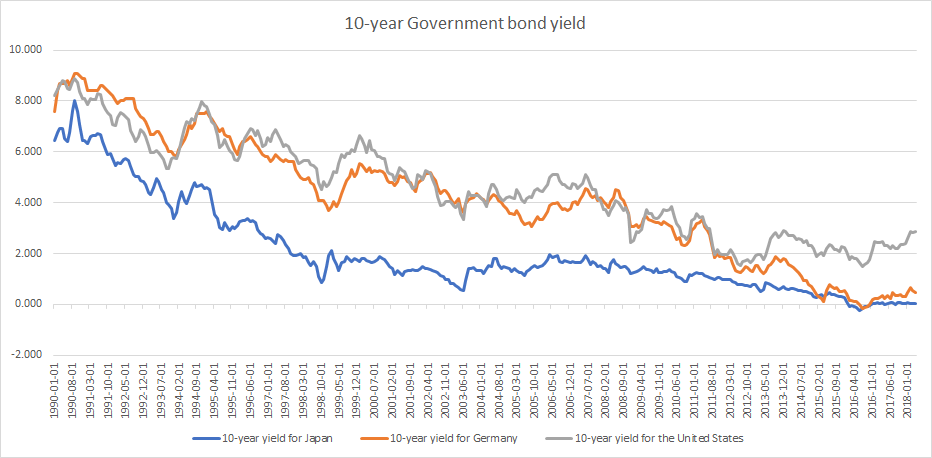

30-year and 10-year Treasury yield

The 10-year Treasury yield has been greater than the 30-year Treasury yield three to six months before each of the past four. Currently the difference is just 19 bps.

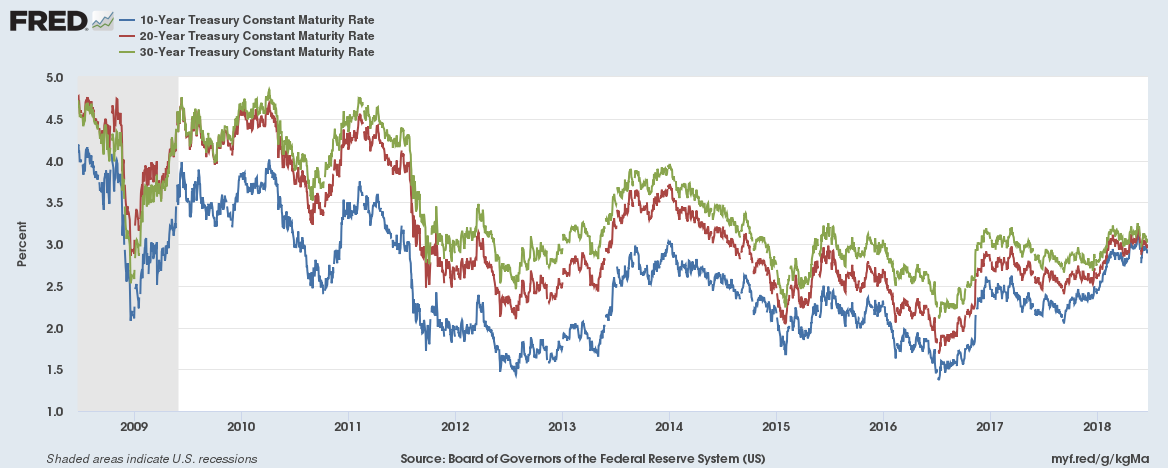

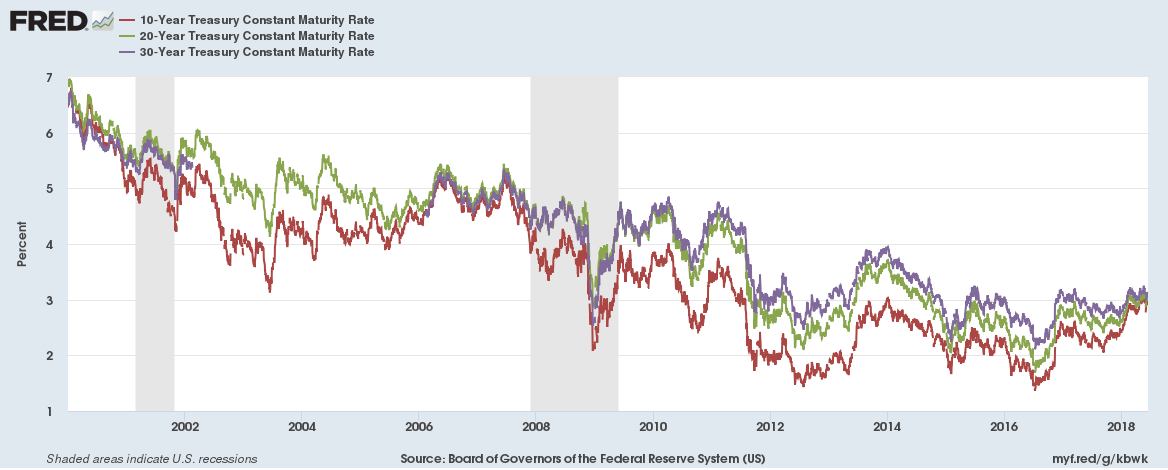

And the 30-year, 20-year and 10-year Treasury yields have almost converged three to six months before each of the past five recessions as well. The 20-year yield already 3 bps higher than the 30-year yield, they have been converging for the past two weeks.