Deutsche Bank

Apparently, the new CEO of Deutsche Bank is “sick and tired of bad news”. Here are some recent events,

April 8: Christian Sewing is appointed new CEO of Deutsche Bank.

April 15: The European Central Bank (ECB) asks Deutsche Bank to estimate the cost of winding down its investment bank.

Thursday, May 31: The Financial Times reported that Deutsche Bank’s US subsidiary was added to the Federal Deposit Insurance Corporation’s list of “problem banks,” or those with weaknesses that threaten their financial survival.

Thursday, May 31: Deutsche Bank shares hit an all-time low.

Friday, June 1: Standard & Poor’s cut Deutsche Bank’s credit rating from A- to BBB+. The ratings agency also questioned whether Deutsche Bank’s new CEO Christian Sewing would be able to return the bank to profit.

Friday, June 1: Deutsche Bank is going to face new cartel and criminal charges in Australia.

Friday, June 1: Deutsche Bank shares hit new all-time low.

That is quite a lot for a new CEO. How bad are things are Deutsche Bank?

Their CEO claims that “At group level, our financial strength is beyond doubt”. That is at least partially true.

Deutsche Bank (DB) has Tier 1 capital of €53 billion and a Tier 1 capital ratio of over 13.4% as of March 31, 2018. Yet the bank is only worth €18 billion. Its share price closed at €9.3 on Friday despite a tangible book value per share of €25.70. The thing is anyone can run a business at a loss, doesn’t take an expert to do that.

For the March quarter, DB had a cost/income ratio of 92.6%, and all divisions (not just the investment bank) had a high cost/income ratio. The Corporate & Investment Bank at 94.7%, the Private & Commercial Bank at 84.4% and the Asset Management Unit at 86.6%.

The bank has made a loss for the past 3 years and made a small profit of just €120 million in the March 2018 quarter. And then there are derivatives, DB has a portfolio of €48.5 trillion ($60 trillion) notional derivatives as of December 31, 2017. The net derivative position is about €21 billion.

And the investment bank is losing market share, Fixed Income and Currencies (FIC) revenues were down 16% and Equity Sales & Trading revenues declined 21% in the March quarter year on year. The investment bank has lost scale and continues to lose scale as DB retrenches from certain segments and markets.

Some might argue it is Germany’s largest bank and is very safe. Yes, it is the largest German bank but over half of its revenues come from the Investment Bank and that is not German centric. The thing is once sentiment or confidence turns negative then it is very difficult as counterparties desert your business. DB is not the next Lehman, Germany would never let it go down. But it does have to scale down its investment bank quickly which is far from easy.

Italy

The anti-establishment (and occasionally labelled left-wing) Five Star Movement and right-wing League have gone into coalition to form a government led by law professor Giuseppe Conte.

On the agenda are tax cuts, a guaranteed basic income for the poor, deportations of 500,000 migrants, rejection of EU austerity and potential renegotiation of Italy’s debt.

During the week there were talks of fresh elections when the President rejected the choice of a new Eurosceptic economy minister.

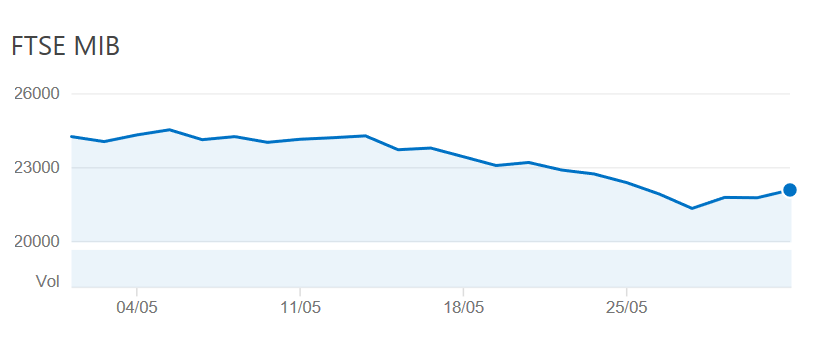

The stock market didn’t do too badly during the week, but bond yields soared.

10-year bond yields ended the week at 2.69% (up 24 bps during the week and 91 bps during the past month)

30-year bond yields ended the week at 3.38% (up 1 bp during the week and 50 bps during the past month)

2-year bond yields ended the week at 1.03% (up 76 bps during the week and 121 bps during the past month)

Since 2015, 89% of Italian government bonds have been bought by a single buyer – the European Central Bank. Little wonder yields are lower than the United States. The big question is – will Italy ditch the Euro?

Who holds the largest amount of Italian government debt? The European Central Bank followed by French Banks especially BNP Paribas. At least Deutsche Bank is ok there. There you go Deutsche Bank – some good news for you.

US Unemployment

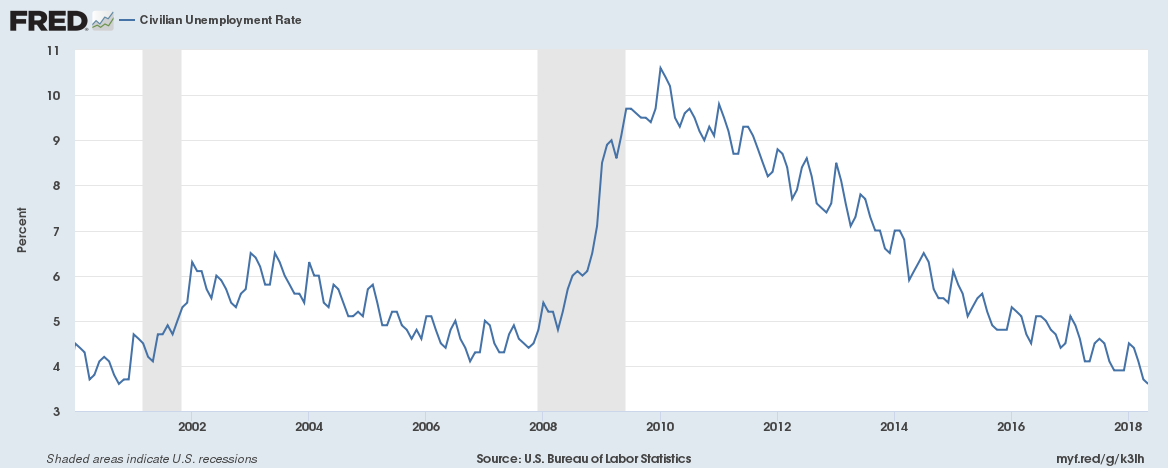

US employers added 223,000 jobs in May and the unemployment rate fell further to 3.8%.

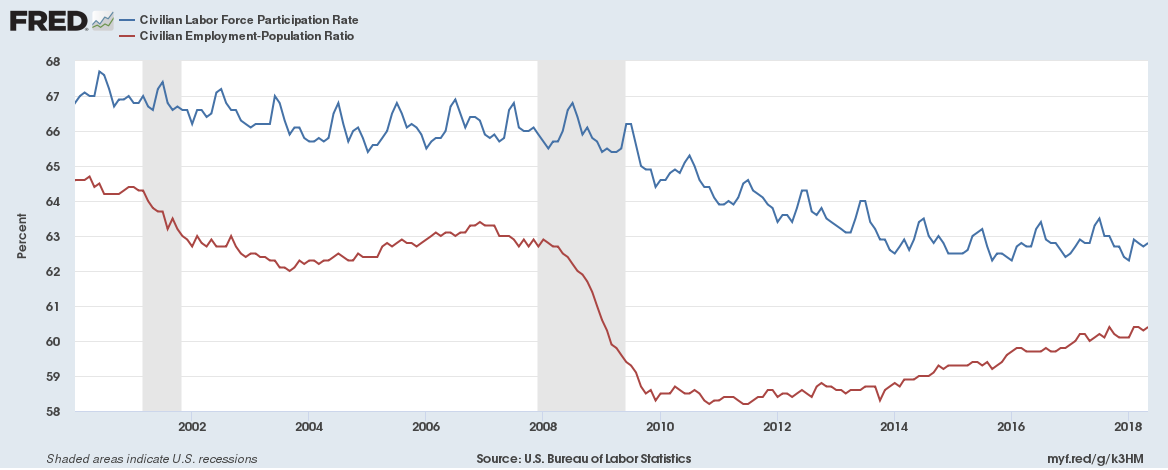

Let’s not forget the US unemployment rate is at an 18-year low but only because the labour force participation rate is close to a 40-year low. And this is what has happened to the unemployment rate in the US four to eight months before every recession since the 1940s.