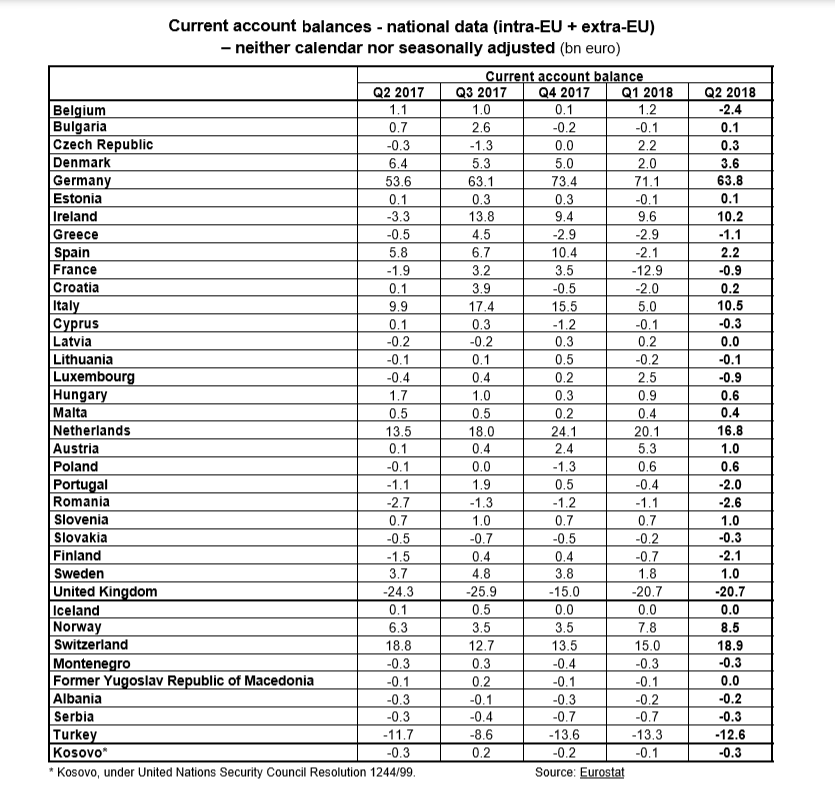

Sixteen members of the European Union recorded current account surpluses, eleven current account deficits and one was in current account balance in the second quarter of 2018 for the total (intra-EU plus extra-EU) current account balances of the European Union (EU28) Member States.

The highest surpluses were observed in Germany (+€63.8 bn), the Netherlands (+€16.8 bn), Italy (+€10.5 bn), Ireland (+€10.2 bn) and Denmark (+€3.6), and the largest deficits in the United Kingdom (-€20.7 bn), Romania (-€2.6 bn) and Belgium (-€2.4 bn).

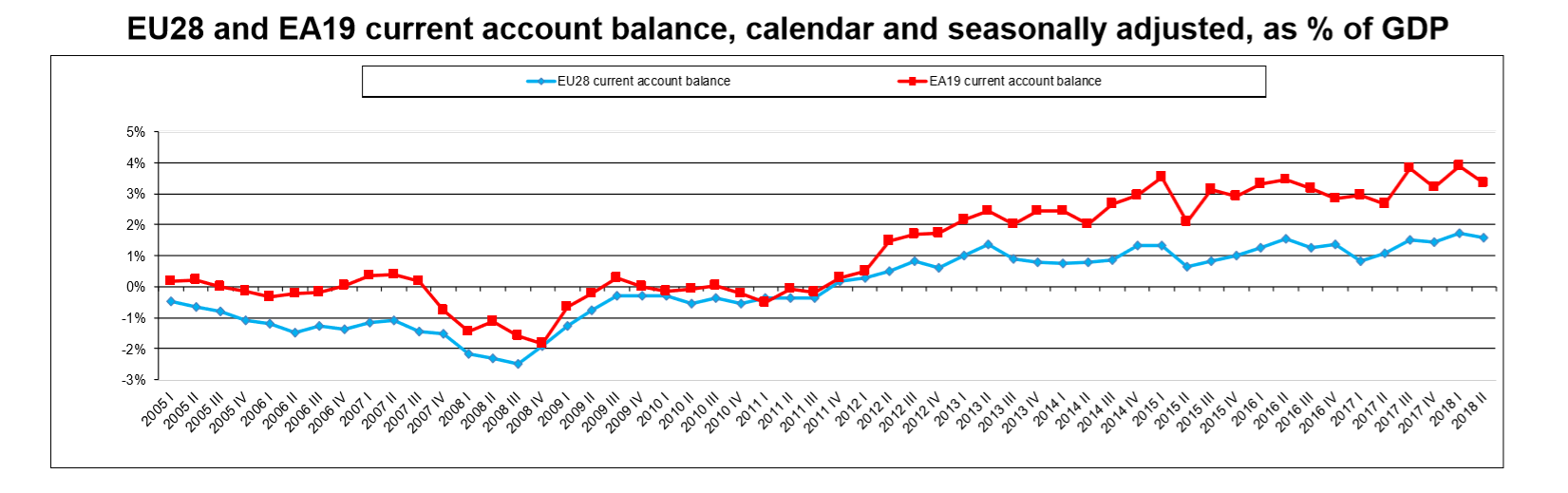

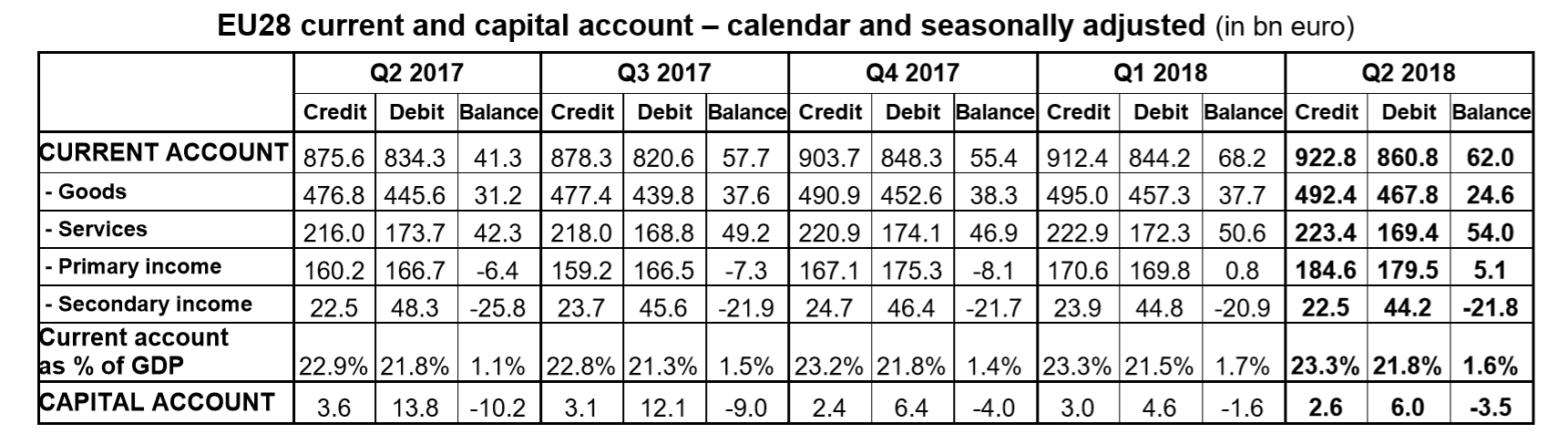

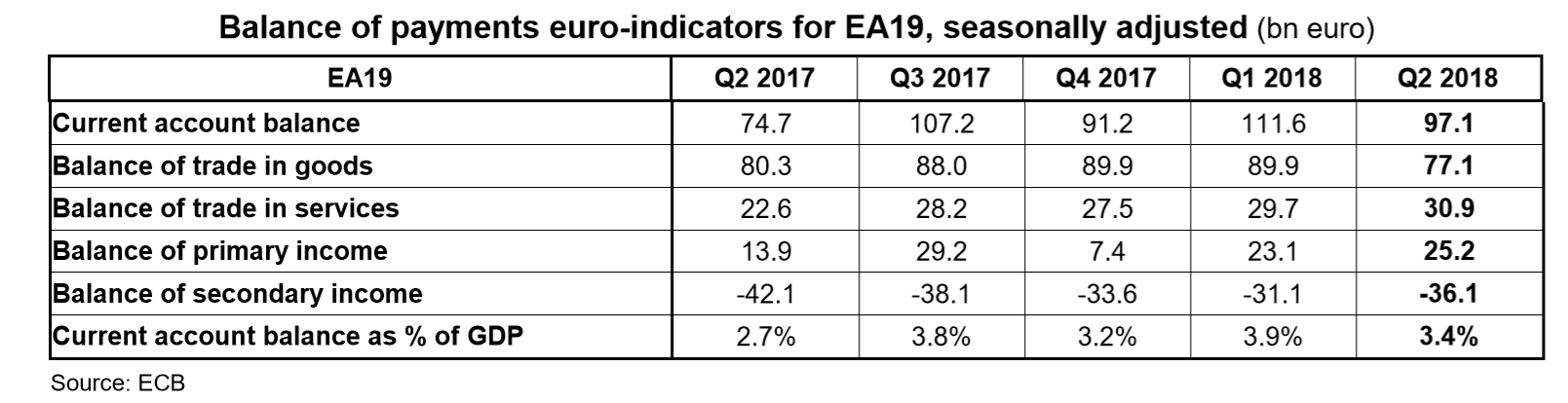

The EU28 seasonally adjusted current account of the balance of payments recorded a surplus of €62.0 billion (1.6% of GDP) in the second quarter of 2018, down from a surplus of €68.2 billion (1.7% of GDP) in the first quarter of 2018 and up from a surplus of €41.3 billion (1.1% of GDP) in the second quarter of 2017, according to estimates released by Eurostat, the statistical office of the European Union.

In the second quarter of 2018 compared with the first quarter of 2018, based on seasonally adjusted data, the surplus of the goods account decreased (+€24.6 bn compared to +€37.7 bn). The surplus of the services account grew (+€54.0 bn compared to +€50.6 bn), as did the surplus in the primary income account (+€5.1 bn compared to +€0.8 bn). The deficit of the secondary income account increased (-€21.8 bn compared to -€20.9 bn), as did the deficit of the capital account (-€3.5 bn compared to -€1.6 bn).

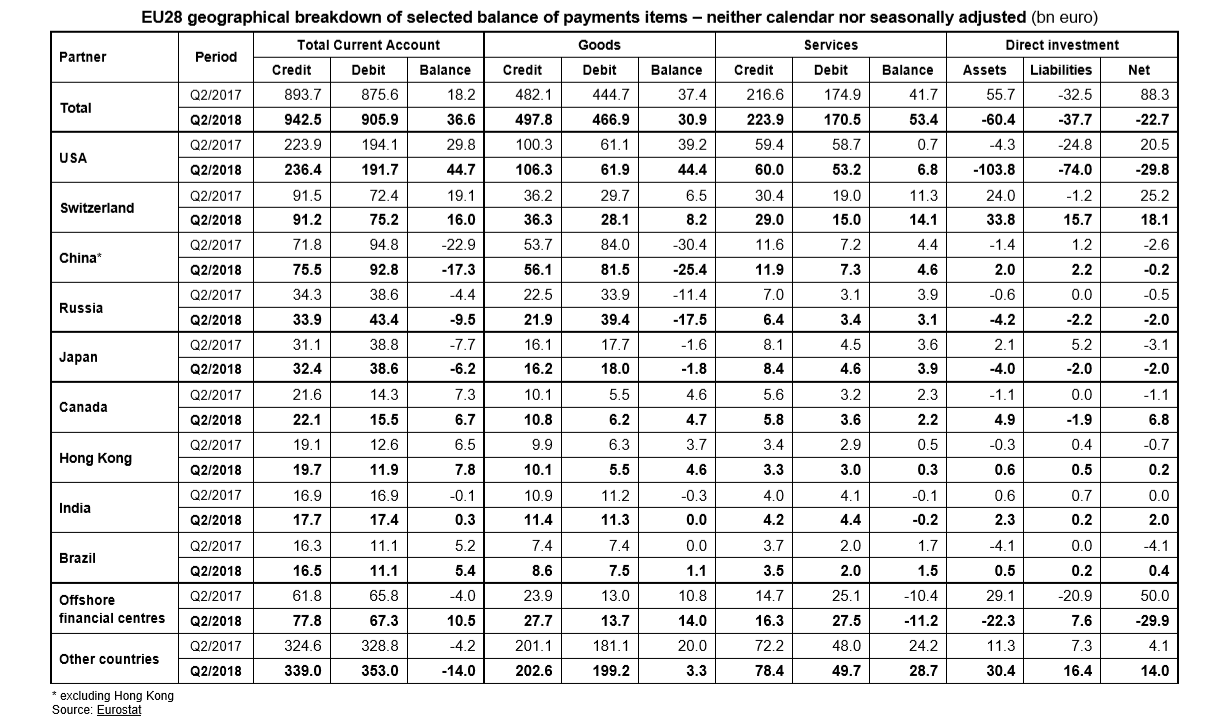

In the second quarter of 2018, based on non-seasonally adjusted data, the EU28 recorded external current account surpluses with the USA (+€44.7 bn), Switzerland (+€16.0 bn), offshore financial centres (+€10.5 bn), Hong Kong (+€7.8 bn), Canada (+€6.7 bn), Brazil (+€5.4 bn) and India (+€0.3 bn). Deficits were registered with China (-€17.3 bn), Russia (-€9.5 bn) and Japan (-€6.2 bn).

The European Union (EU28) currently includes Belgium, Bulgaria, the Czech Republic, Denmark, Germany, Estonia, Ireland, Greece, Spain, France, Croatia, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Hungary, Malta, the Netherlands, Austria, Poland, Portugal, Romania, Slovenia, Slovakia, Finland, Sweden and the United Kingdom.

The euro area (EA19) currently includes Belgium, Germany, Estonia, Ireland, Greece, Spain, France, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Austria, Portugal, Slovenia, Slovakia and Finland.

Offshore Financial Centres (OFC) is an aggregate which includes 40 countries. As examples, the aggregate contains financial centres such as Liechtenstein, Guernsey, Jersey, the Isle of Man, Andorra, Gibraltar, Panama, Bermuda, the Bahamas, the Cayman Islands, British Virgin Islands, Bahrain, Hong Kong, Singapore and the Philippines.

Related:

Do nations with balance of payments or trade surpluses really outperform those with deficits?

All you wanted to know about US trade in 2017 and why China matters so much