Restricted Stock Units (RSU) are company stock (or shares by another name) granted to employees as a form of compensation. Employers save some tax, and it generally aligns the long-term interest of employees (and shareholders) as it normally carries a vesting period. 2017 was great for technology company share prices and technology companies granted an eye-watering amount of Restricted Stock Units by value leaving banks way behind …

Are Restricted Stock Units a bad thing? No, not at all. They are a great way to keep staff motivated (as long as the share price doesn’t fall). Amazon recently announced an increase in the hourly wage for its warehouse employees but has said that it will eliminate grants of Restricted Stock Units in most cases.

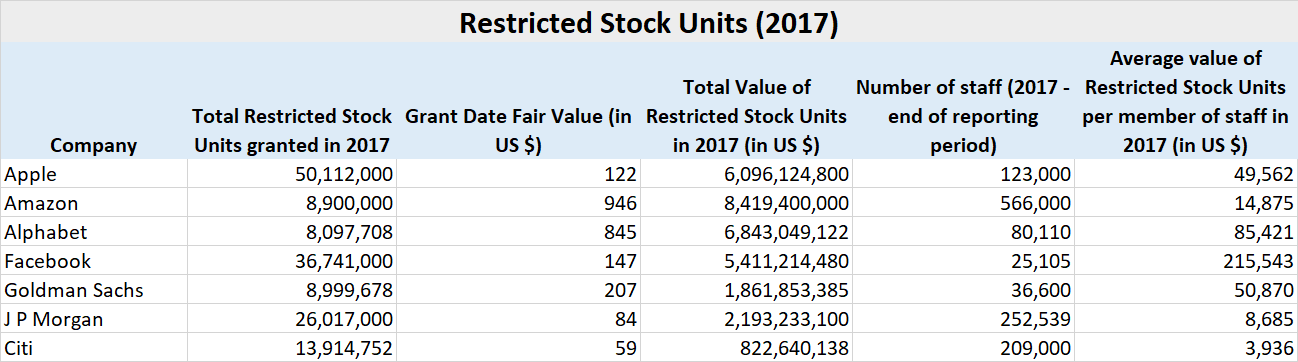

Facebook granted each employee an average of $215,543 worth of stock in 2017. And that is just the stock component of compensation. Granted this is an average and not the median but it is still a big number. Alphabet (the parent company of Google) was way behind Facebook with an average of $85,421 worth of RSUs per employee. Apple followed at $49,562 and Amazon at $14,875. Compare that with $50,870 for Goldman Sachs, $8,685 for J P Morgan and $3,936 for Citi. Here is the entire dataset,

Related:

Alphabet (the parent company of Google) spent the most as a company on lobbying in 2017