High fuel prices and stretched balance sheets but more people than ever are flying. Here are some insights into the current and future economic state of airlines.

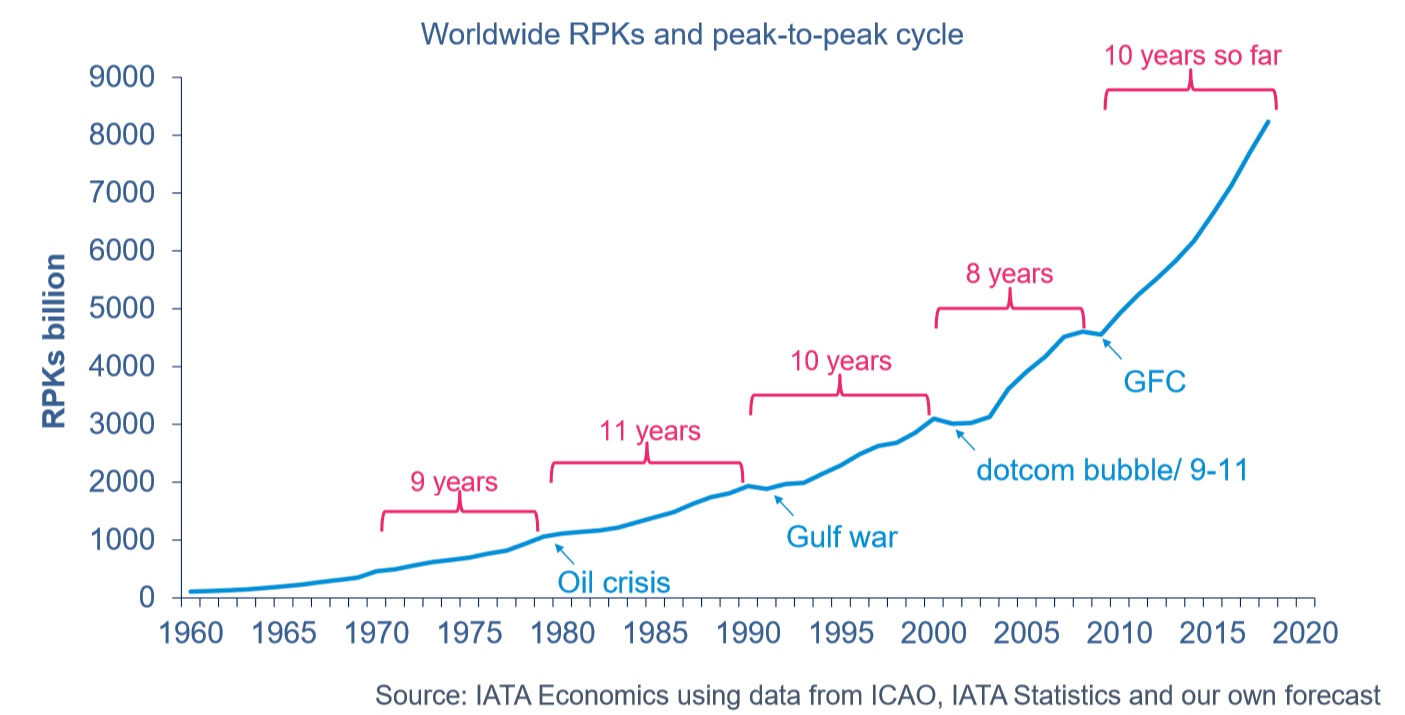

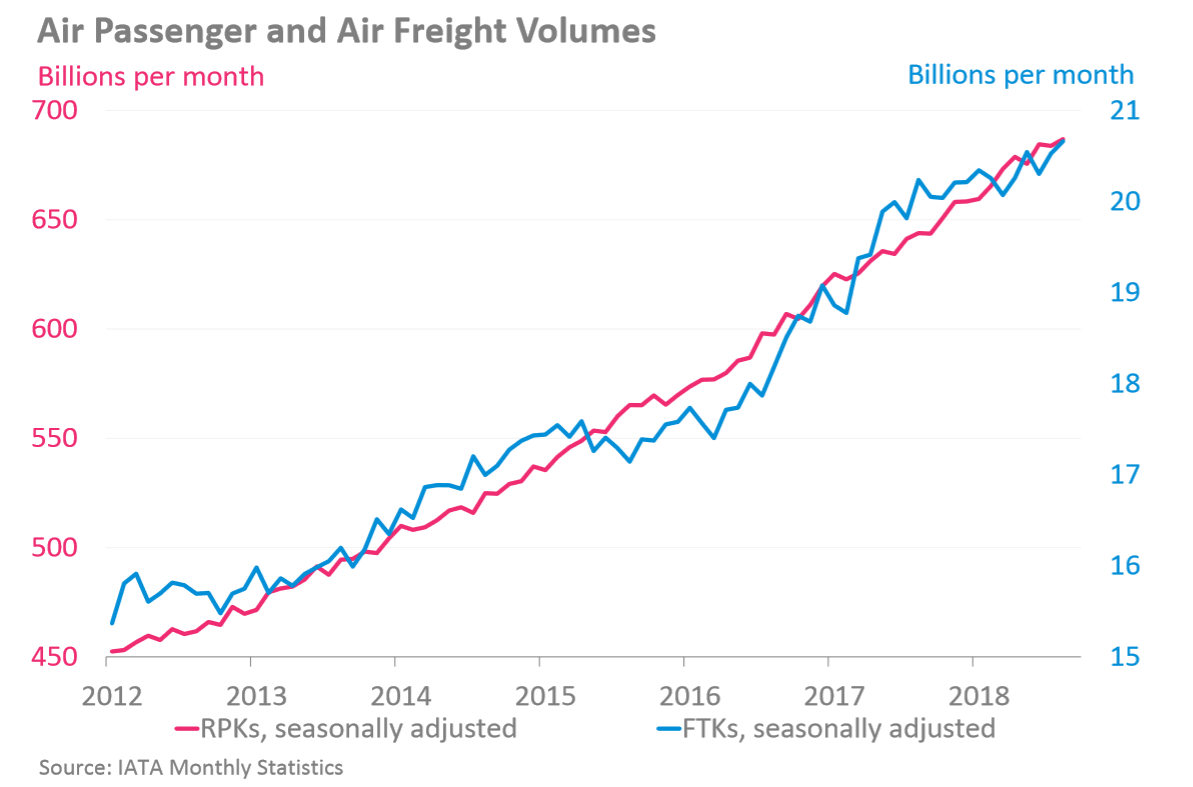

Industry-wide revenue passenger kilometres (RPKs) have more than doubled in the last decade,

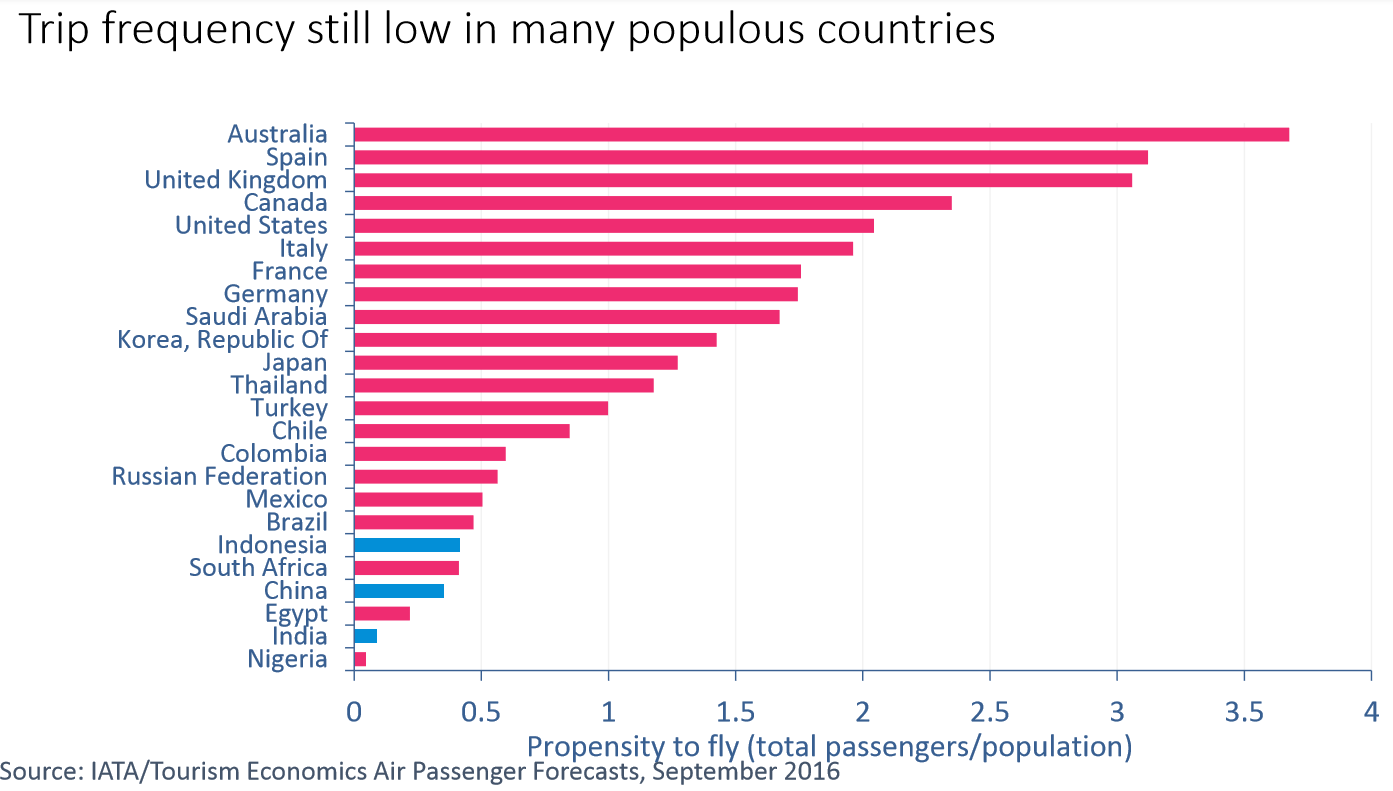

And there is a lot of potential for growth,

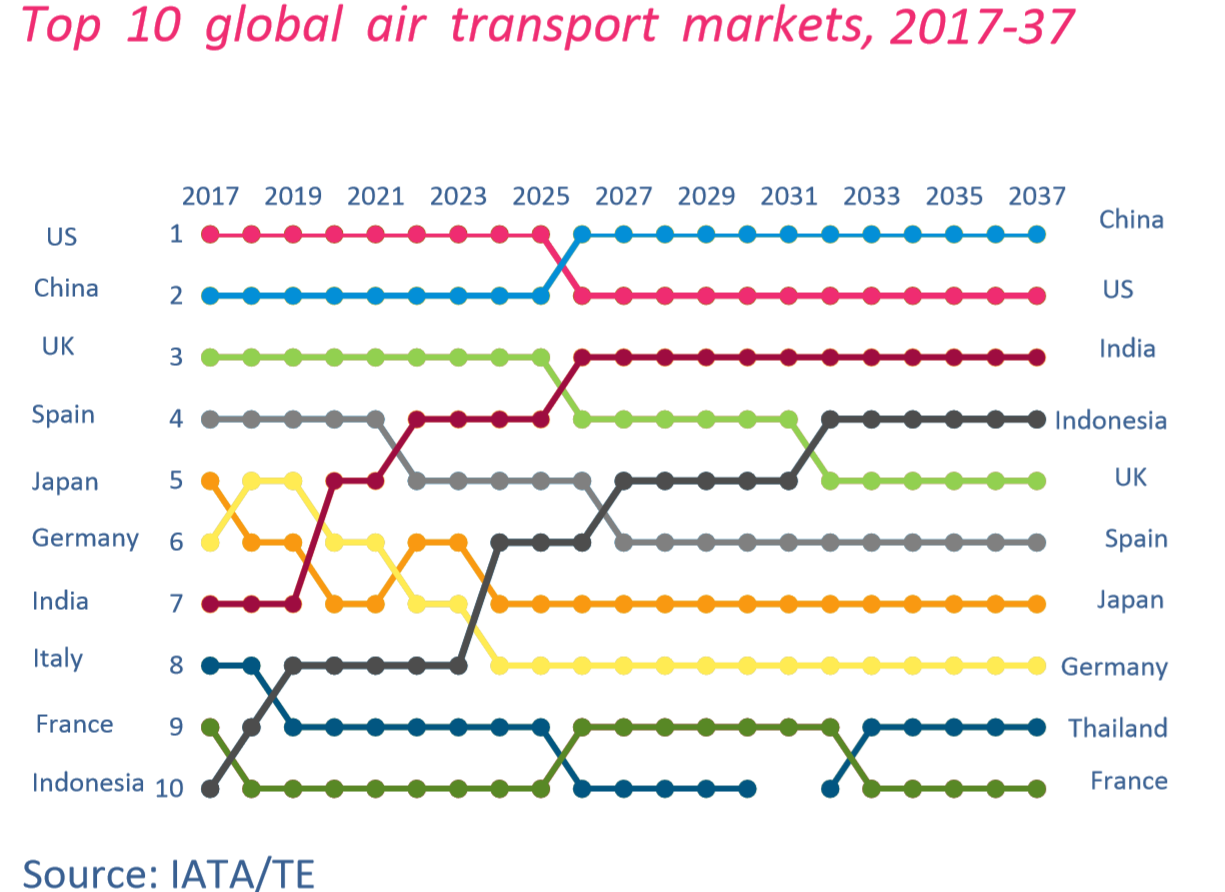

India and Indonesia are set to grow the most for aviation in the next two decades,

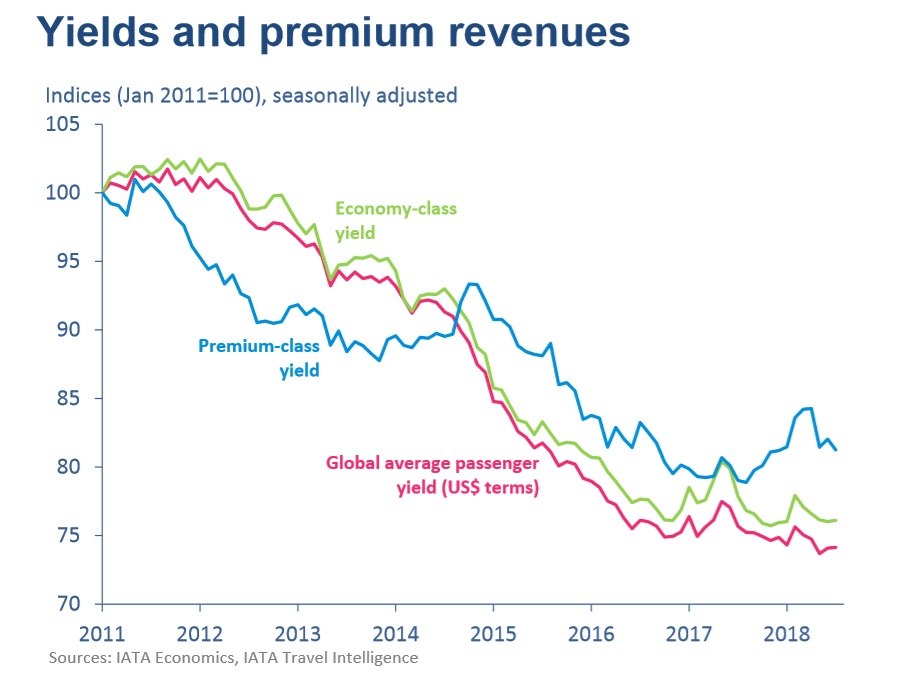

But yields are falling,

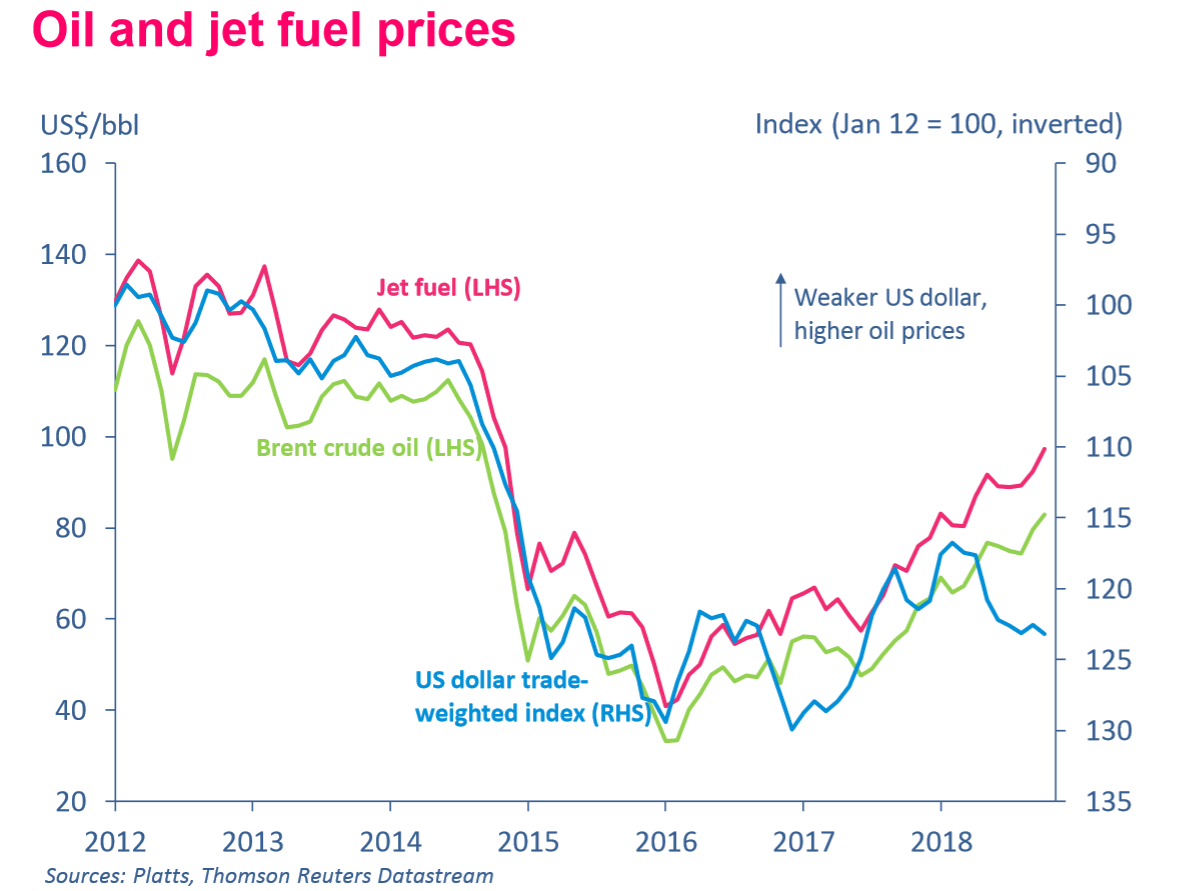

As oil prices rise,

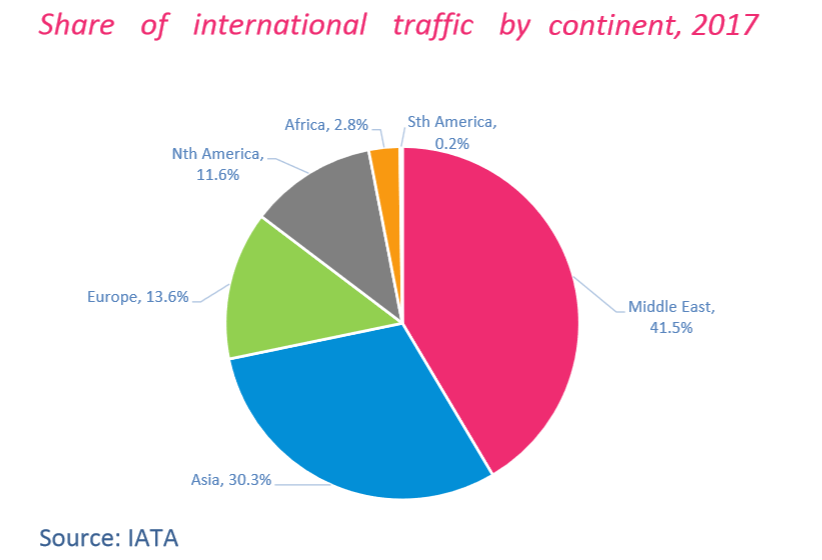

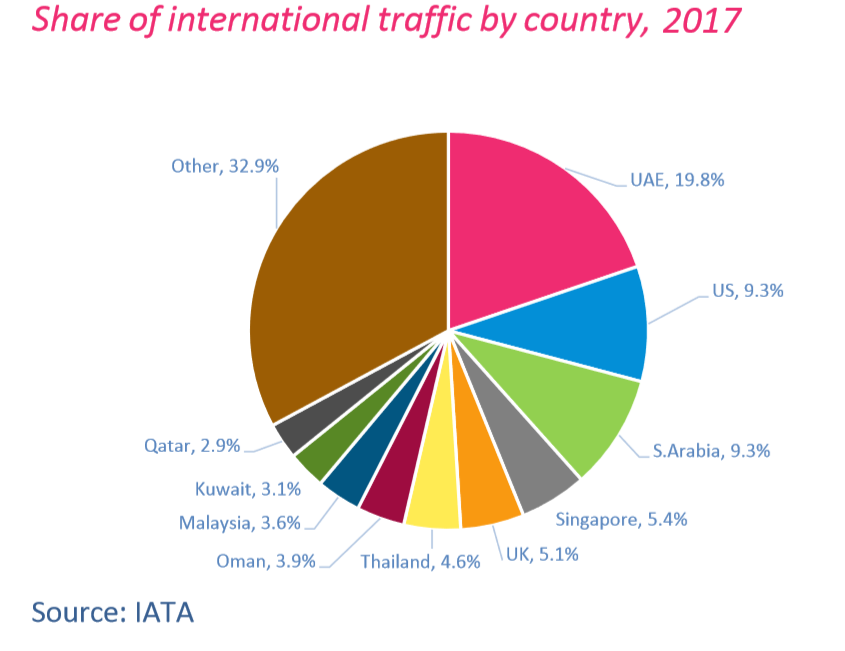

The biggest markets for International air travel by continent and country are not what you think,

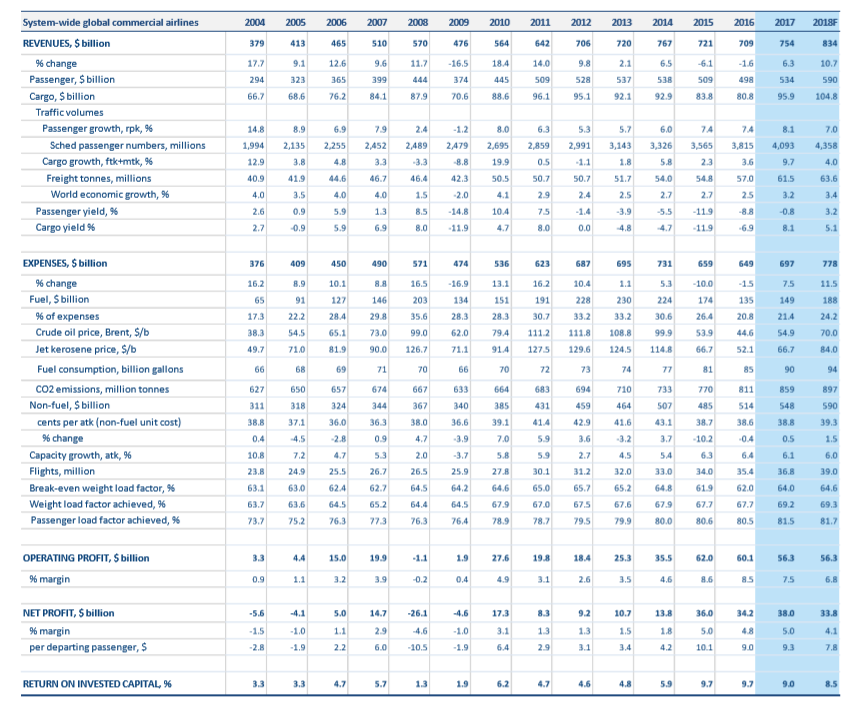

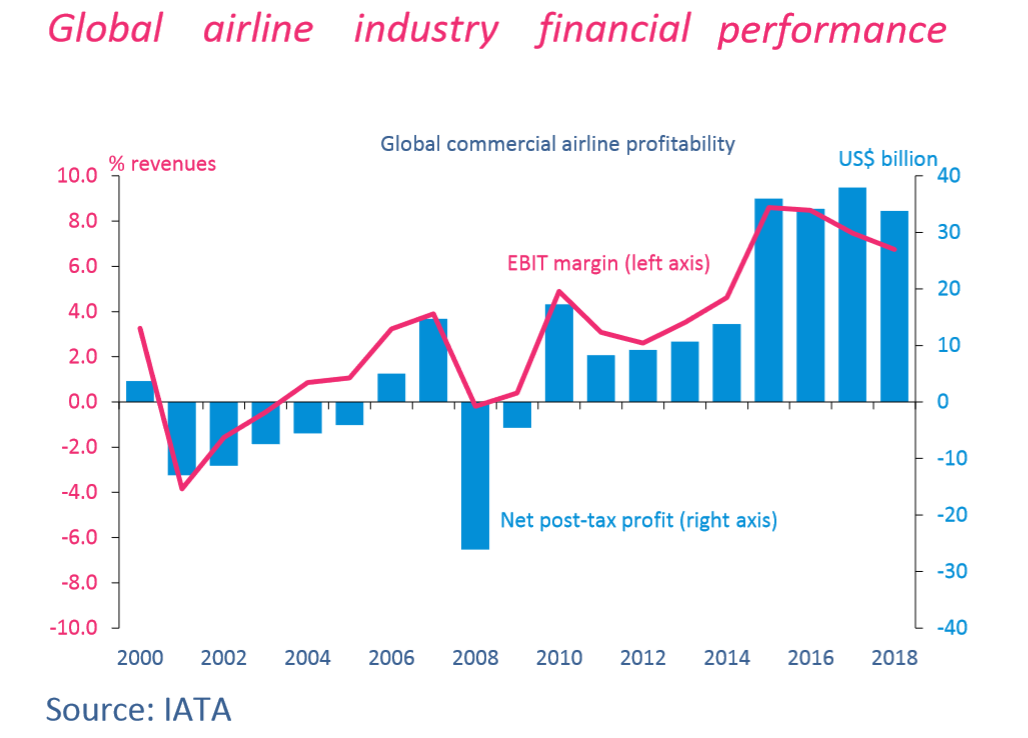

Long term, airlines have only been profitable in the past decade after years of losses,

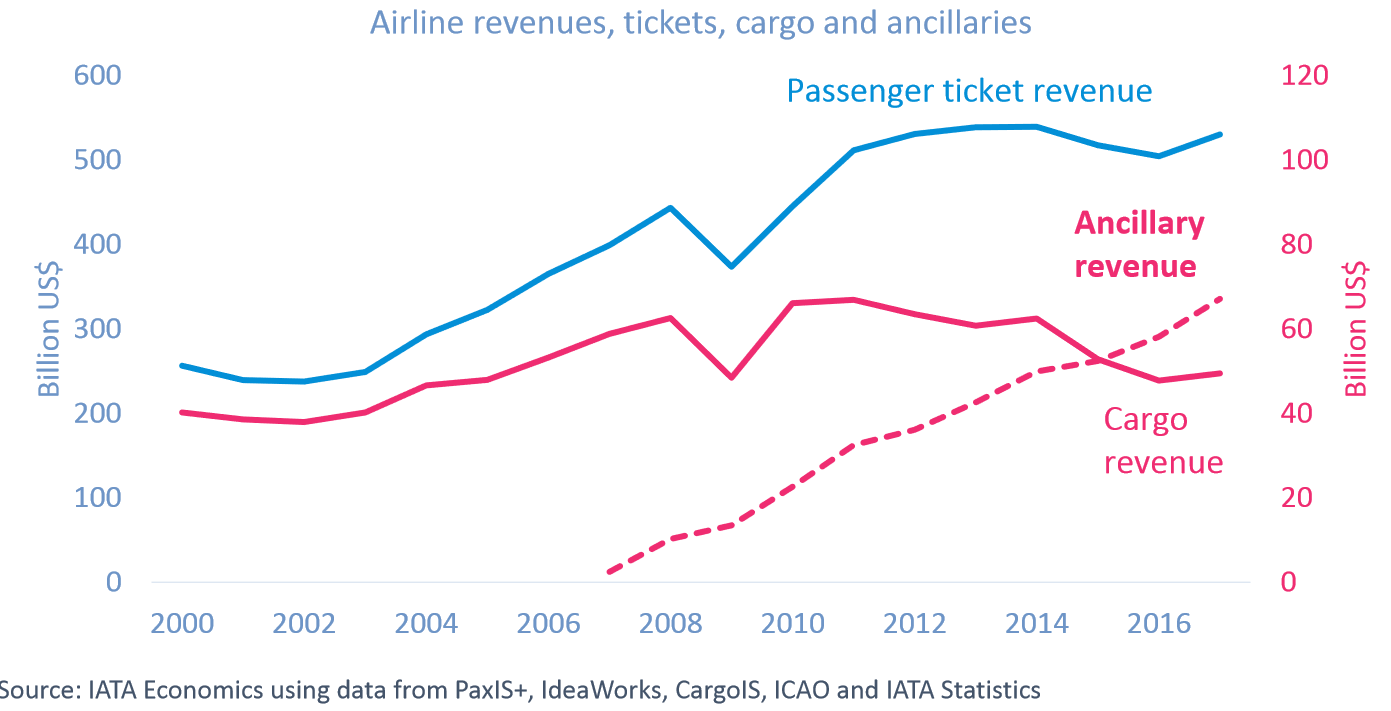

Ancillary revenues for airlines are growing at a rapid pace,

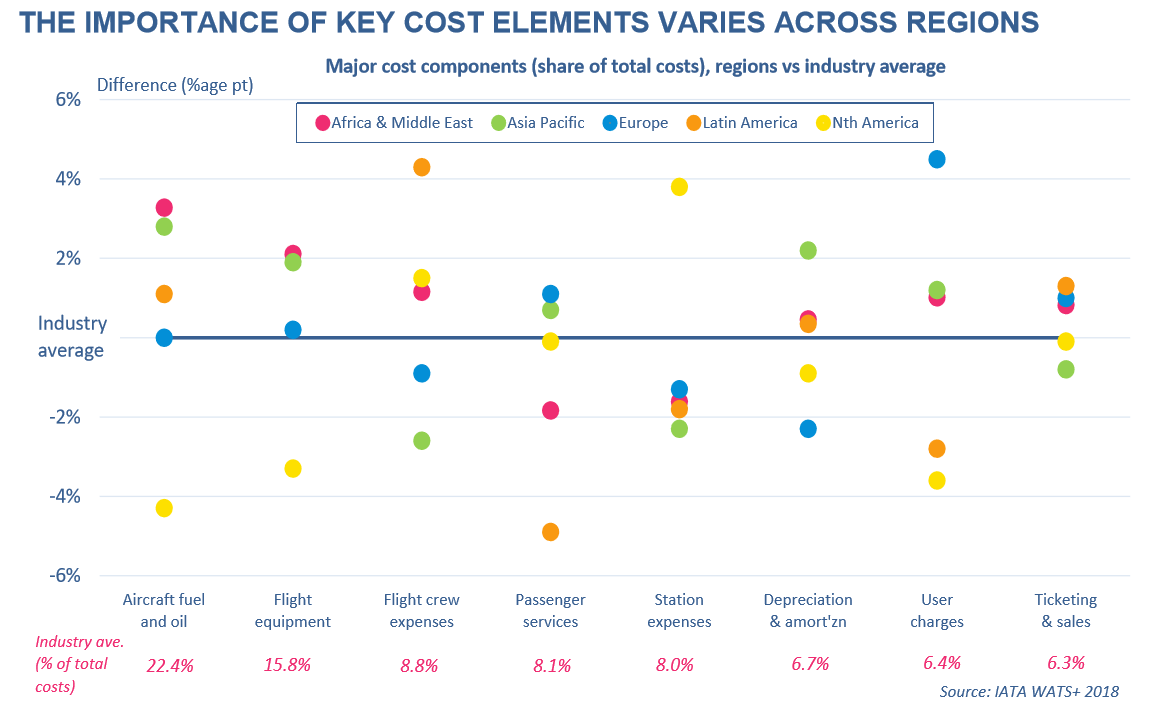

Airline cost varies across different key markets and continents,

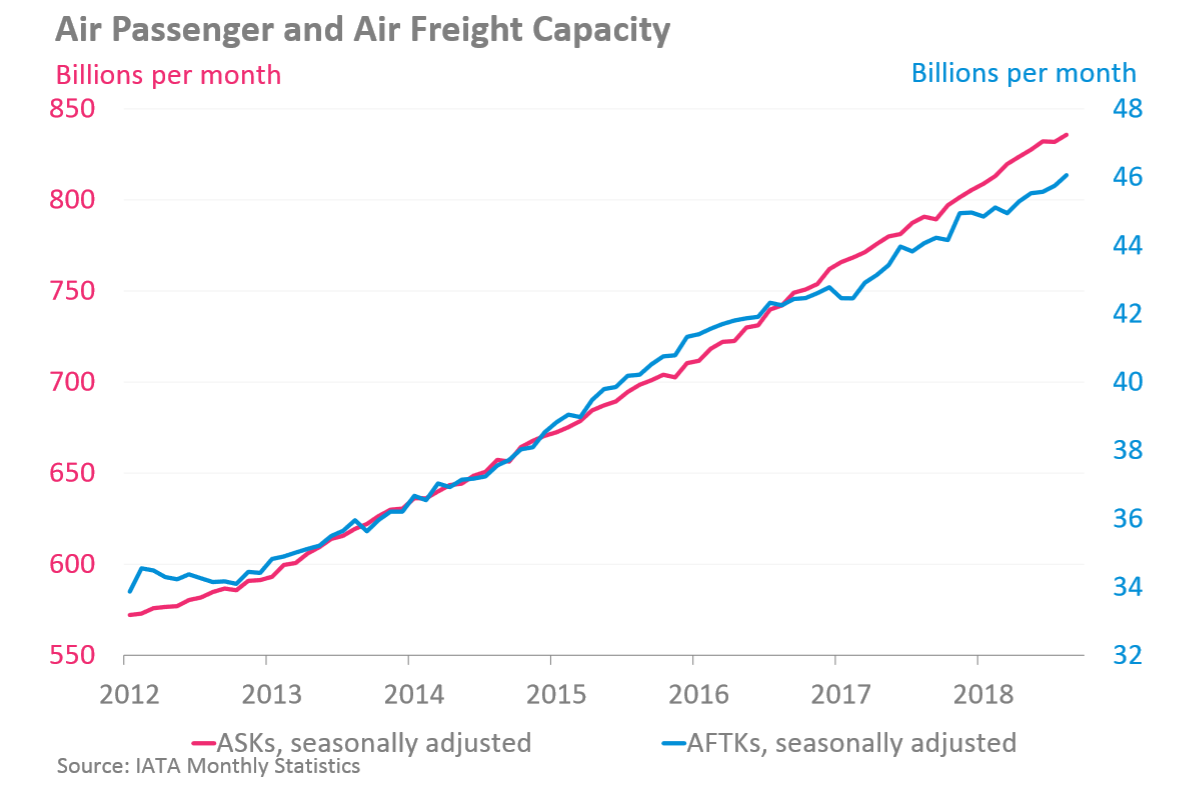

Passenger demand is continuing to trend upwards in seasonally adjusted terms at a slightly faster rate than capacity,

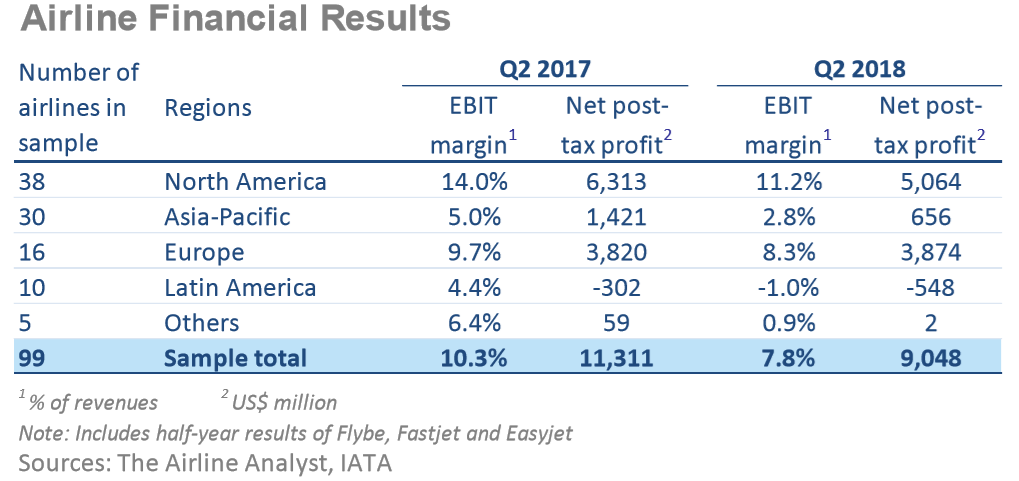

Fuel prices (and slightly excessive short-term capacity) is squeezing airlines currently. The final airline financial data for Q2 2018 confirm the decline in profitability compared with the performance of a year ago. The EBIT margin for our sample of 99 airlines dipped to 7.8% in Q2 2018, from 10.3% a year ago while net post-tax profits are around $2.3bn lower.

The dip in EBIT margin is broad-based, across all regions, as airlines confront ongoing increases in several key input costs. The largest impact on industry-wide profits is coming from North America and the Asia Pacific, although the EBIT margin of airlines in the former region remains robust.

Finally, here are multi-year statistics,