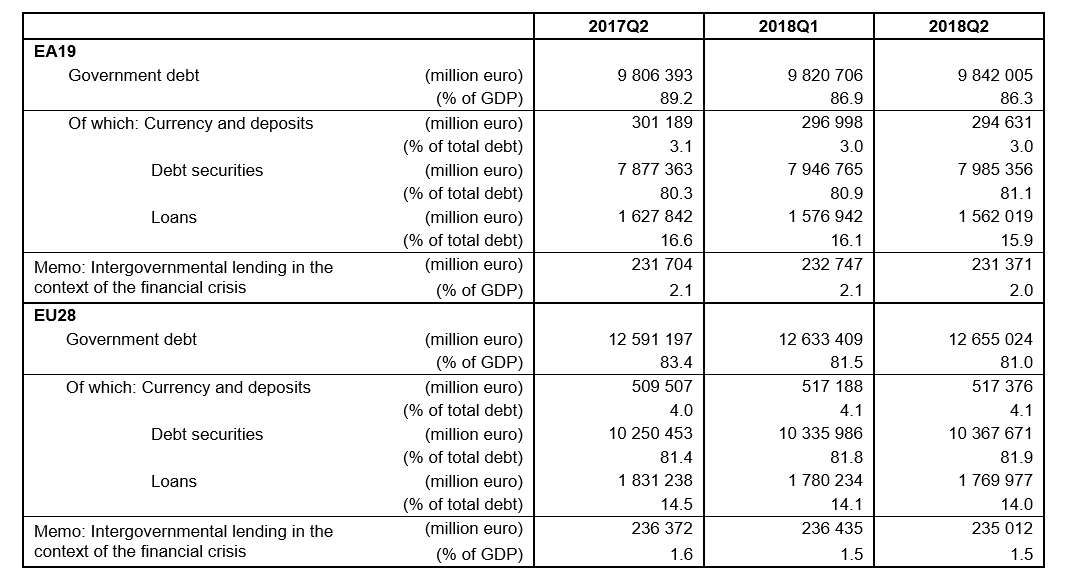

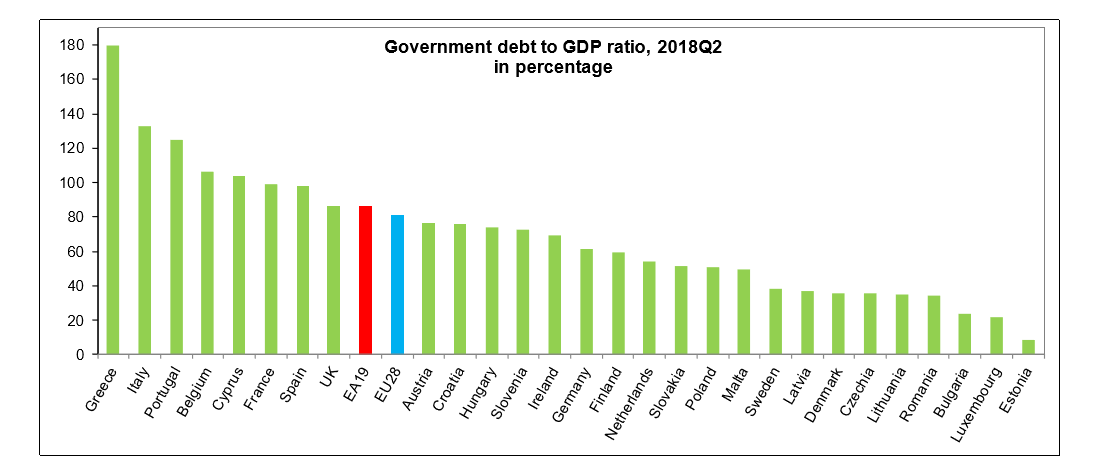

At the end of the second quarter of 2018, the government debt to GDP ratio in the Euro area (EA19) or Eurozone stood at 86.3% and in the European Union (EU28) the ratio stood at 81%.

Government debt at the end of the second quarter 2018 by Member State

The highest ratios of government debt to GDP at the end of the second quarter of 2018 were recorded in Greece (179.7%), Italy (133.1%) and Portugal (124.9%), and the lowest in Estonia (8.3%), Luxembourg (22.0%) and Bulgaria (23.8%).

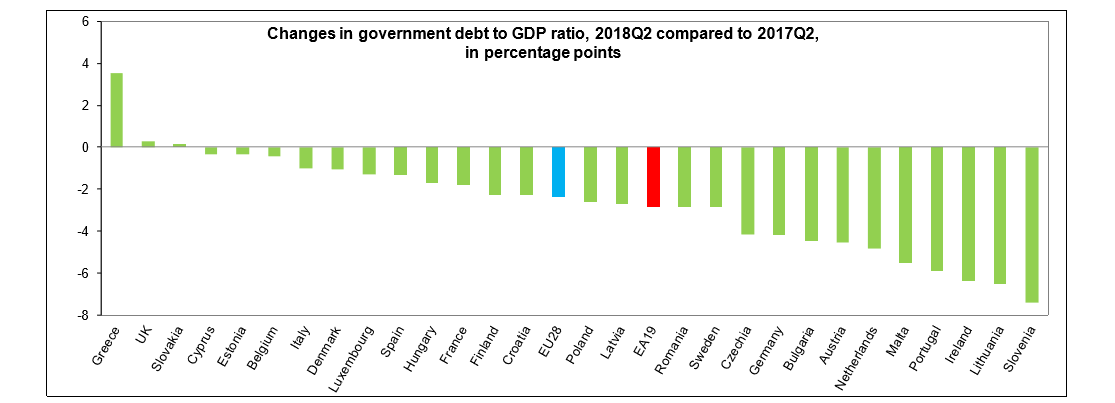

Compared with the second quarter of 2017, three Member States registered an increase in their debt to GDP ratio at the end of the second quarter of 2018, and twenty-five a decrease. An increase in the ratio was recorded in Greece (+3.5%), the United Kingdom (+0.3%) and Slovakia (+0.1%), while the largest decreases were recorded in Slovenia (-7.4%), Lithuania (-6.5%), Ireland (-6.4%), Portugal (-5.9%) and Malta (-5.5%).

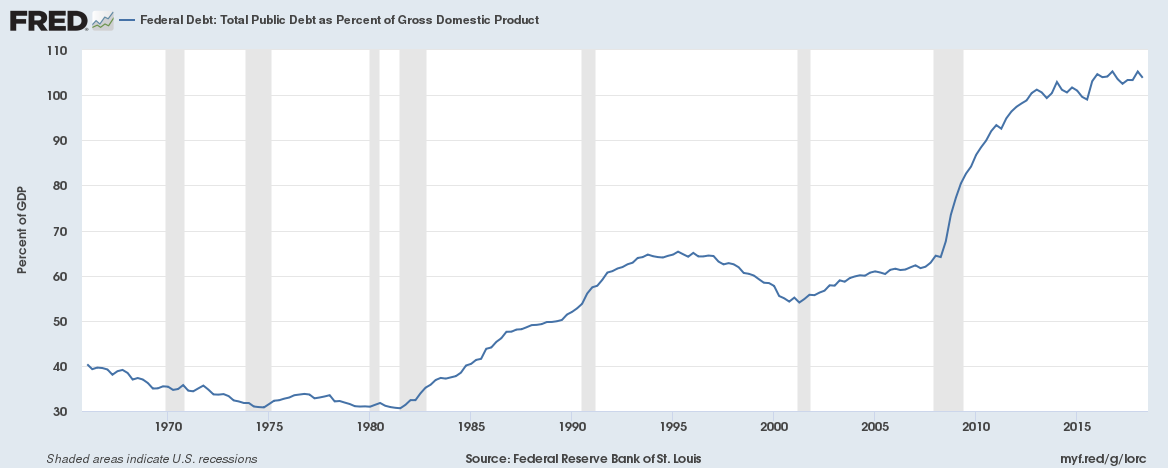

Compare that to Government Debt to GDP of 105% (and growing quickly) for the United States … (Related: Don’t rule out high or hyper inflation in the road ahead)

The Euro Area (EA19) consists of Belgium, Germany, Estonia, Ireland, Greece, Spain, France, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Austria, Portugal, Slovenia, Slovakia and Finland.

The European Union (EU28) currently includes Belgium, Bulgaria, Czechia, Denmark, Germany, Estonia, Ireland, Greece, Spain, France, Croatia, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Hungary, Malta, the Netherlands, Austria, Poland, Portugal, Romania, Slovenia, Slovakia, Finland, Sweden and the United Kingdom.

Related:

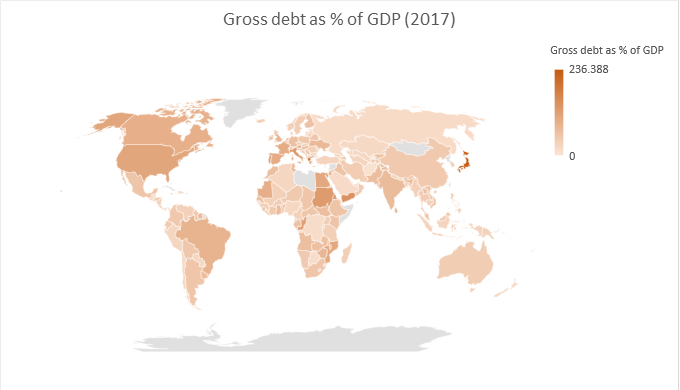

Gross and net debt of every country as percentage of GDP for 2017

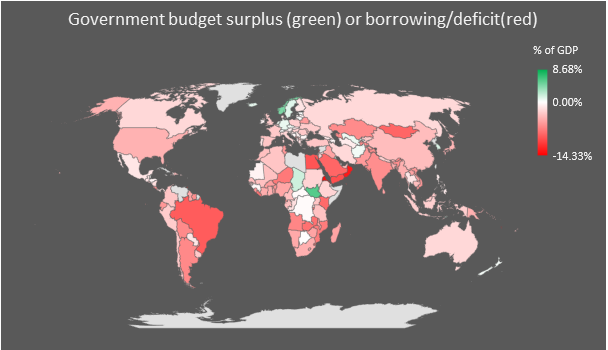

Borrowing or surplus of every country as % of GDP for 2017