Amazon declared its Q3 results on Thursday, Net sales increased 29% to $56.6 billion in the third quarter, compared with $43.7 billion in the third quarter of 2017. Excluding the unfavourable impact of foreign exchange rates throughout the quarter, net sales increased 30% compared with third quarter 2017.

Operating income increased to $3.7 billion in the third quarter, compared with operating income of $347 million in the third quarter of 2017.

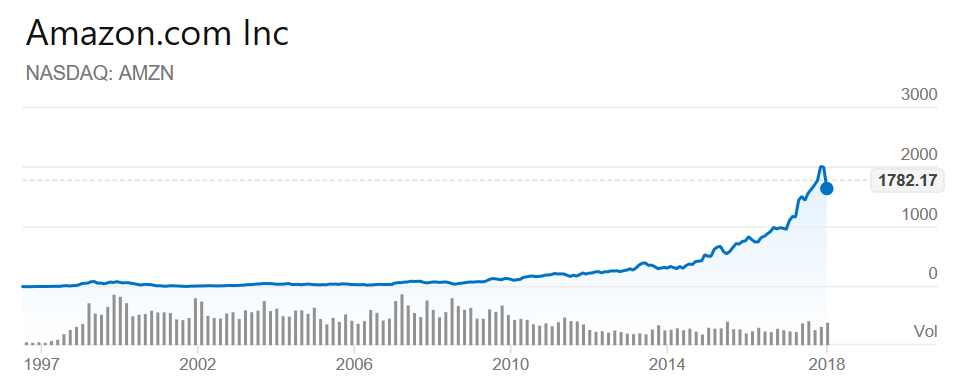

Amazon’s share price has soared 500% in the past four years despite the recent 20% fall in the share price.

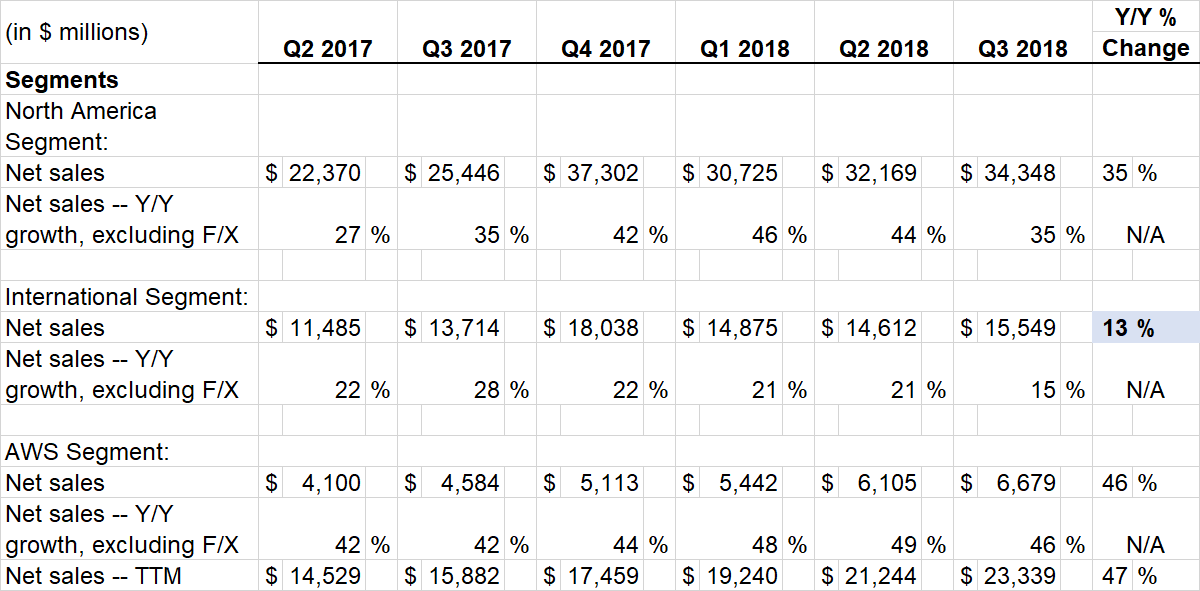

Everything looks good but there are two issues, firstly international sales are barely growing despite Amazon expanding to new markets like Australia and Turkey and rapidly expanding operations in India. International sales have grown just 13% year on year.

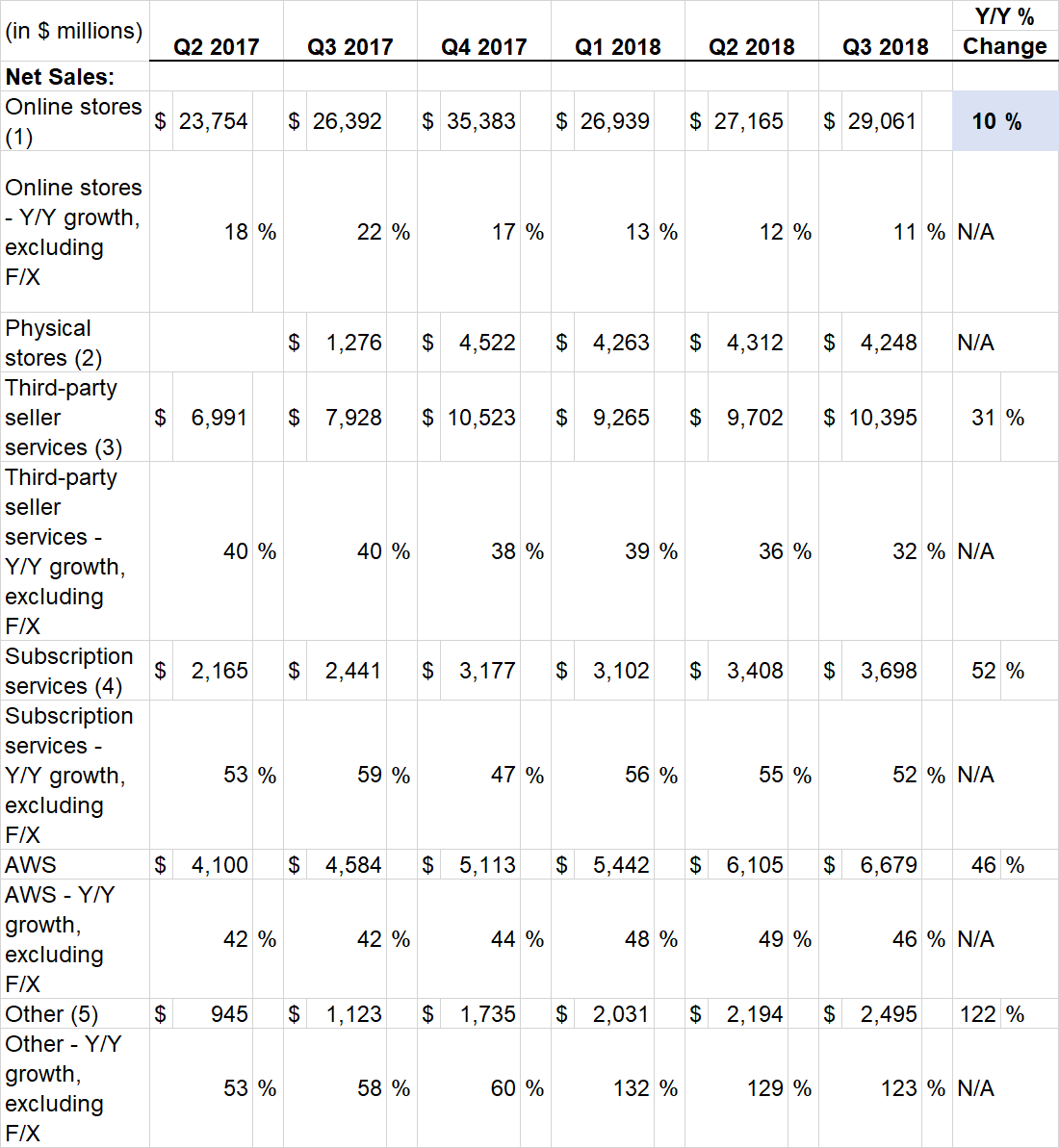

Secondly, core first party sales are growing at just 10% year on year. Core sales includes sales of goods sold by Amazon (not sold by others and simply fulfilled by Amazon). Third party sales (Marketplace, similar to eBay) grew 31% year on year and were over $10 billion during Q3. eBay recently sued Amazon alleging it was illegally poaching sellers from its platform.

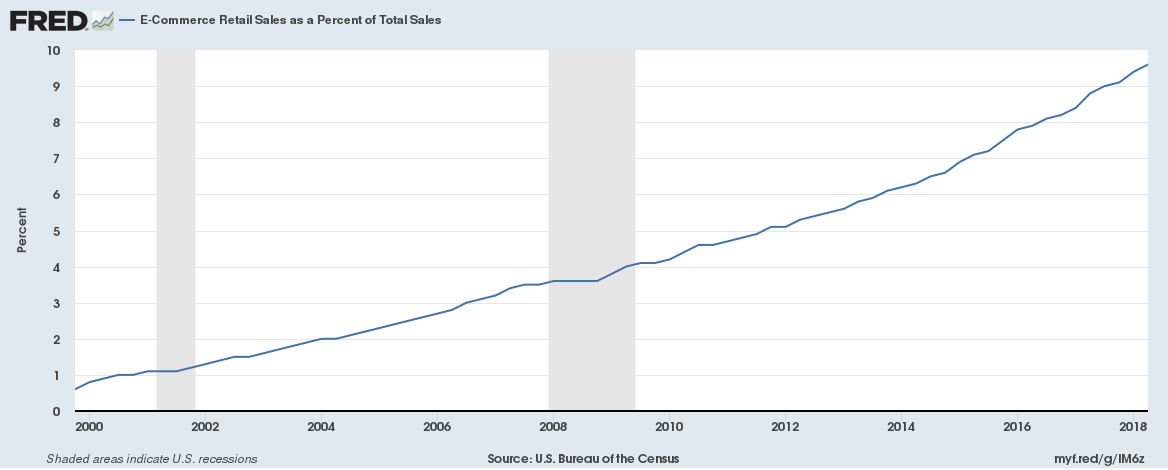

Amazon accounts for 50% of U.S. online sales, online sales itself are about 9.4% of all retail sales in the U.S. which means Amazon online sales are about 4.7% of U.S. retail sales.

Is Amazon finally slowing? At least core online sales are. Marketplace, AWS (Amazon Web Services) and other services (including Prime subscriptions) are still doing well.

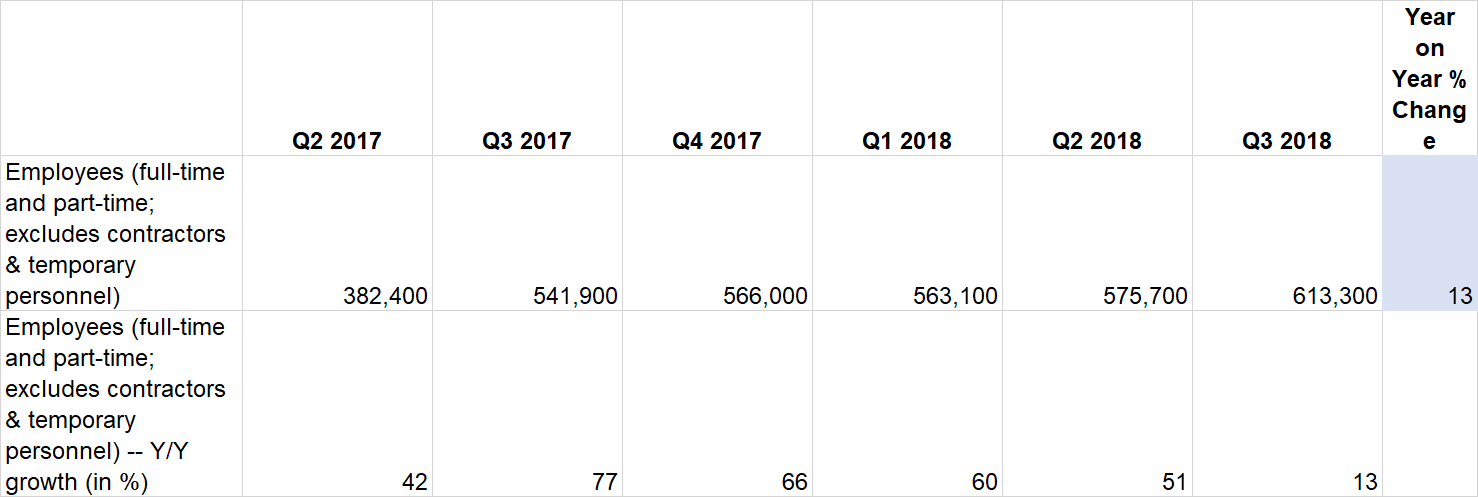

Headcount growth has slowed to just 13% year on year compared to an average of 50% over the past eight quarters.

Related:

Amazon’s spending on lobbying increased 600% since 2009

Technology Companies granted an astonishing amount of Restricted Stock Units by value in 2017