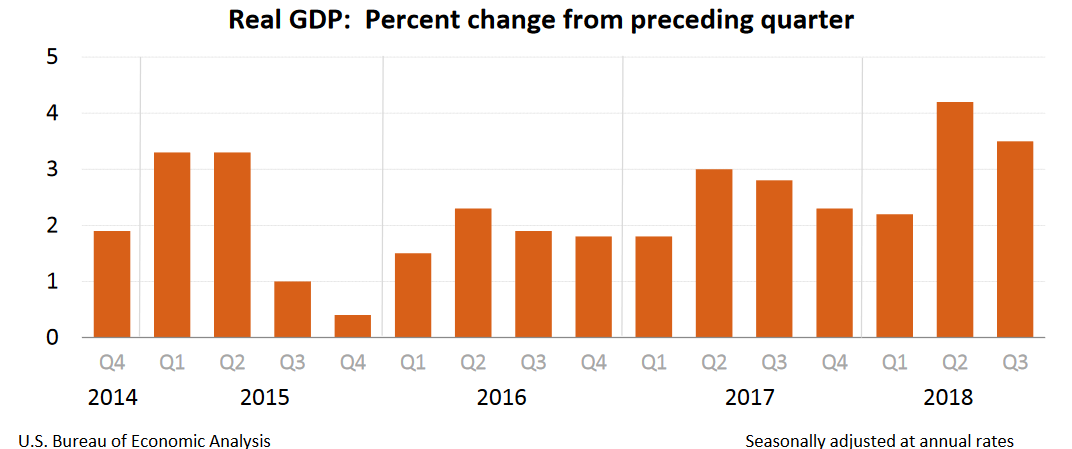

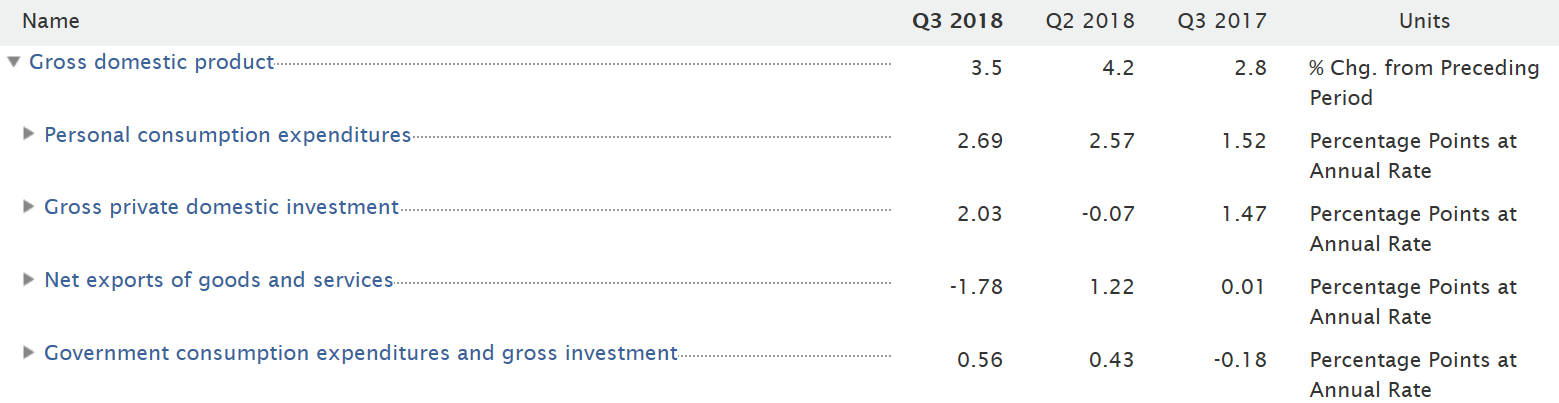

Real gross domestic product (GDP) for the United States increased at an annual rate of 3.5% in the third quarter (Q3) of 2018 according to the advance estimate released by the Bureau of Economic Analysis.

Economic expansion (without a recession) is now in its ninth year and the second longest on record. However, business spending stalled, and residential investment declined for a third straight quarter, perhaps the boost from the $1.5 trillion tax cut was now fading.

An increasing trade deficit had a negative impact of 1.78% on GDP growth in the third quarter, the most since the second quarter of 1985.

Inventories increased at a $76.3 billion rate after declining at a $36.8 billion pace in the second quarter. Business investment increased at an annualised rate of less than 1%, while housing expenditures fell 4%, the third quarter in a row of contraction. The housing market contracted at its steepest pace in more than a year in the third quarter, dimming the economy’s outlook.

Growth in consumer spending (which accounts for about 70% of U.S. GDP), increased at a 4% in the third quarter, the fastest pace since the fourth quarter of 2014.

Disposable personal income increased $155 billion, or 4.1% in the third quarter, compared with an increase of $168.9 billion, or 4.5% in the second quarter. Real disposable personal income increased 2.5%, the same increase as in the second quarter.

Personal saving was $999.6 billion in the third quarter, compared with $1,054.3 billion in the second quarter. The personal saving rate as a percentage of disposable personal income was 6.4% in the third quarter compared with 6.8% in the second quarter.

Related:

U.S. Q2 2018 GDP estimated at 4.1% as personal consumption soars but wage growth collapses