Will the United Kingdom exit the European Union on the scheduled date of the 29th of March? Highly unlikely irrespective of how Parliament votes on the deal on the table.

Even if the House of Commons votes the deal through, there isn’t enough time to pass legislation in its entirety, so an extension of 3 months is likely. If the deal isn’t voted through, then a longer extension of possibly 21 months is likely.

Irrespective of what happens next the UK faces three immediate economic challenges

The Payment Protection Insurance (PPI) Compensation deadline is looming and its end means an immediate fall in GDP growth

Payment Protection Insurance or PPI was designed to cover loan or credit card repayments for a year (in most cases) in the event of an accident, long term sickness or unemployment. By design it was a good product but a number of cases of mis-selling were highlighted. For instance, self-employed couldn’t claim on it (in most cases) but were still sold the policy.

Additionally, it was also reported that the terms and conditions in some instances were widely restrictive.

In 2011, the High Court rejected a judicial review brought by the British Bankers’ Association or BBA against the Financial Services Authority (FSA). It meant banks would need to look at mis-selling of PPI products and compensate customers where there was evidence of mis-selling.

The FSA subsequently became two separate regulatory authorities, the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA).

Then in 2014, another High Court ruling held that one customer Susan Plevin was treated unfairly because she wasn’t told about the large amount of commission (around 72%) taken from her PPI payment – and ruled that this can be used as a new reason to claim for compensation. It meant that if over 50% of a PPI policy cost went as commission to a bank or a lender and wasn’t clearly explained or evidenced then policy holders were due compensation.

Banks have paid out around £47 billion ($62 billion) so far and have set aside £51 billion ($67 billion). Some 14 million pay outs have been made so far.

The current regulator, the Financial Conduct Authority (FCA) has put in place a deadline for making a claim which is 29 August 2019. It is being widely advertised through different channels.

On an average, some £7 billion has been the direct (financial compensation) contribution to the GDP a year and indirectly that number is £32 billion (financial compensation, claim processing and the compensation being spent several times) a year which is 2% of the annual GDP. That indeed is a big number and that is about to end in August.

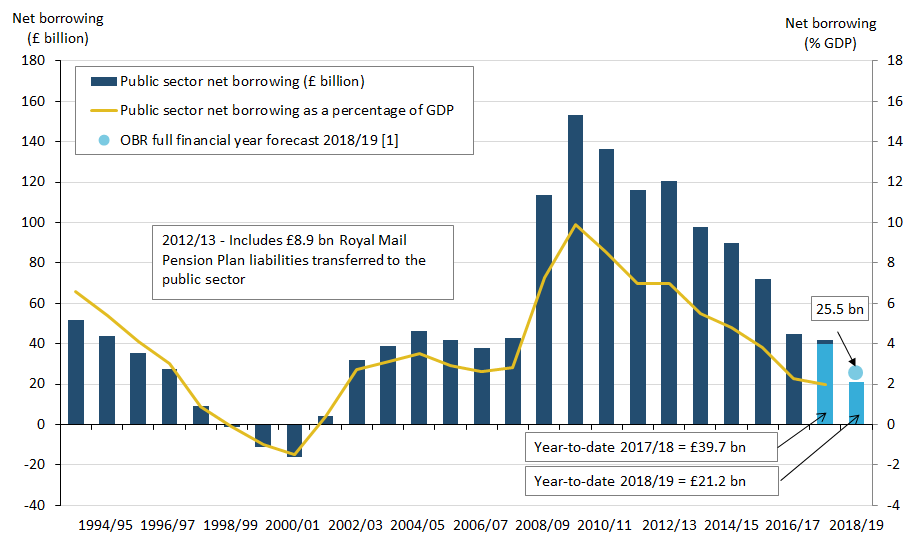

The UK fiscal deficit is falling but a change in the way student loans are accounted will likely mean the UK will have a deficit until at least the 2040s

Currently, student loans are treated as government lending. But, just 37% of these loans are currently repaid (and that number is likely to decrease going forward). A change in accounting (or rather accounting the right way) means that student loans will be treated as government spending rather than government lending.

This change has no impact on the overall level of government debt. This is because debt is a cash measure so is unaffected by whether the money being paid out is classified as a loan or spending. However, this change will increase the government’s budget deficit, to ensure it properly reflects the true picture of government spending because student loan debt write-offs that would have taken place. At least 40 years of a fiscal deficit (the last surplus was in 2001) …

The Japan – EU trade deal means Japanese manufactures will leave the UK (and the EU)

The Japan – EU (somewhat free) trade deal means there is little incentive for Japanese companies (particularly automobile) to manufacture anything in Europe. Nissan has confirmed that the new X-Trail originally planned for its Sunderland plant will instead be made in Japan. Honda is set to close its Swindon car plant in 2022, with the loss of about 3,500 jobs.

The EU is fighting against Diesel vehicles, impacting the entire sector but the bigger issue is that the EU and Japan currently have balanced trade (which means neither has a big surplus) but the new trade deal would tilt things heavily in favour of Japanese automobile manufacturers (most of whom are based in the UK) making vehicles in Japan and French Cheese manufacturers. Irrespective of Brexit, the EU – Japan trade deal is a bad deal for the UK.

UK Related:

Here are UK household spending insights

The UK’s net worth is now estimated at £10.2 trillion, an average of £155000 per person

This is how wealthy UK households are

UK households have seen their outgoings surpass their income for the first time in nearly 30 years

The UK economy a decade on from the 2008 recession

Nominal wages in the UK grew fastest in a decade but real wages are still lower than a decade ago

UK 2018 GDP growth estimated at 1.4%