Household credit growth has been slowing around most of the world including the United States, Canada and Australia but remains robust in the United Kingdom despite economic concerns around Brexit. Household debt excluding student loans has hit 80% of GDP and including student loans has hit 90% of GDP.

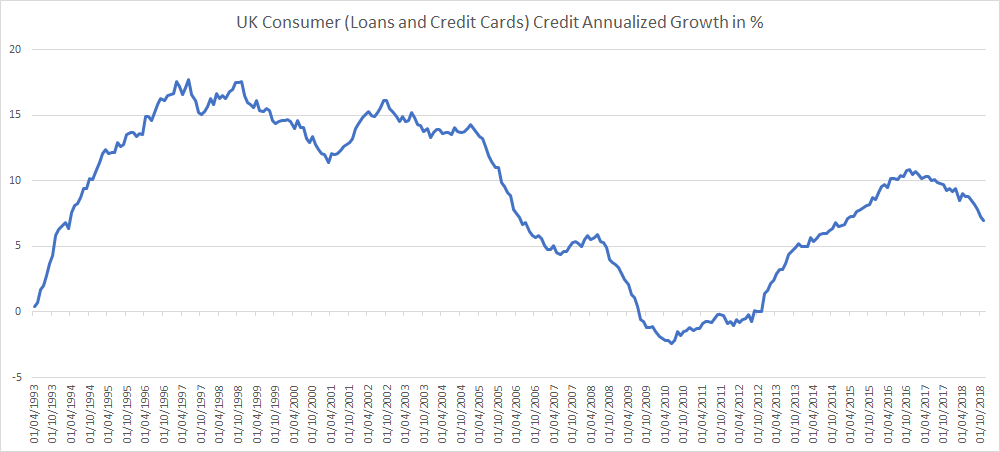

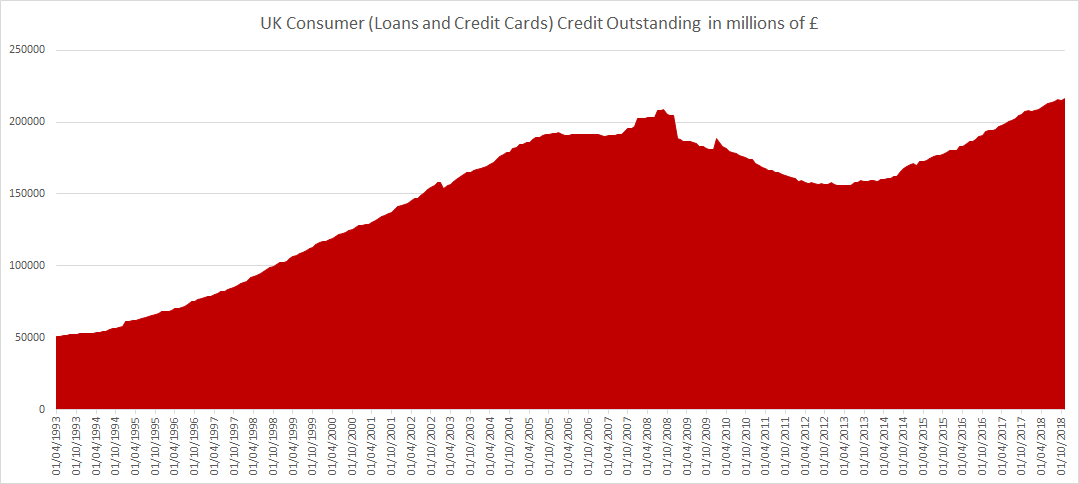

Consumer Credit (loans and credit cards)

Consumer Credit (loans and credit cards) is growing at an annualized 7%. That is down from the 11% growth rate as recently as 2016 but way above the 5-6% in 2008 before the financial crisis hit.

Consumer Credit (loans and credit cards) debt outstanding has hit £216 billion.

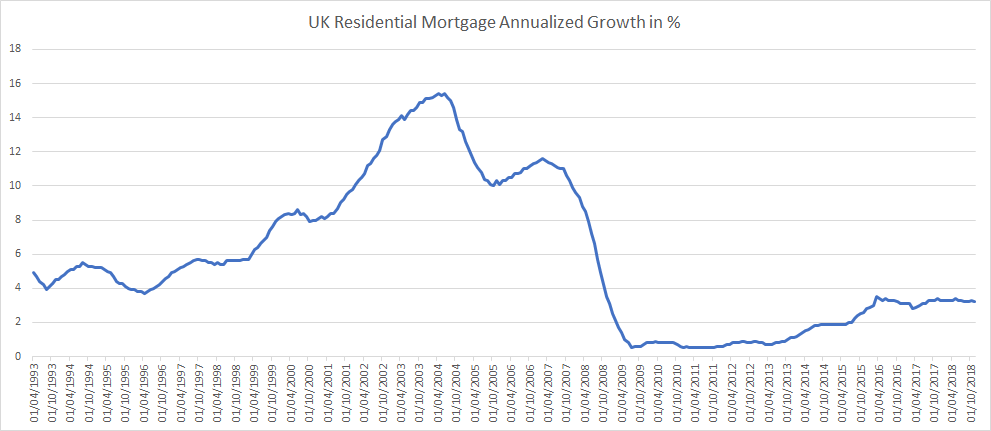

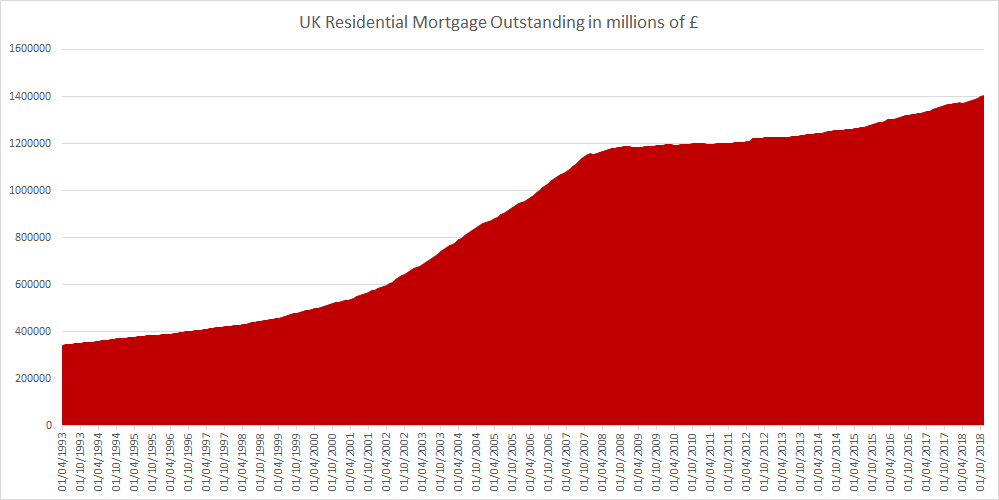

Residential Mortgages

Residential Mortgages growth stands at an annualized 3.2%. Most of UK wealth is in real estate or property and despite economic concerns surrounding Brexit property sales haven’t really slowed. Mortgage growth had fallen to under 1% between 2010 and 2012 but was as high as 11% in 2007.

Residential Mortgage debt outstanding stands at £1.4 trillion (which is 70% of GDP).

Total Household Debt

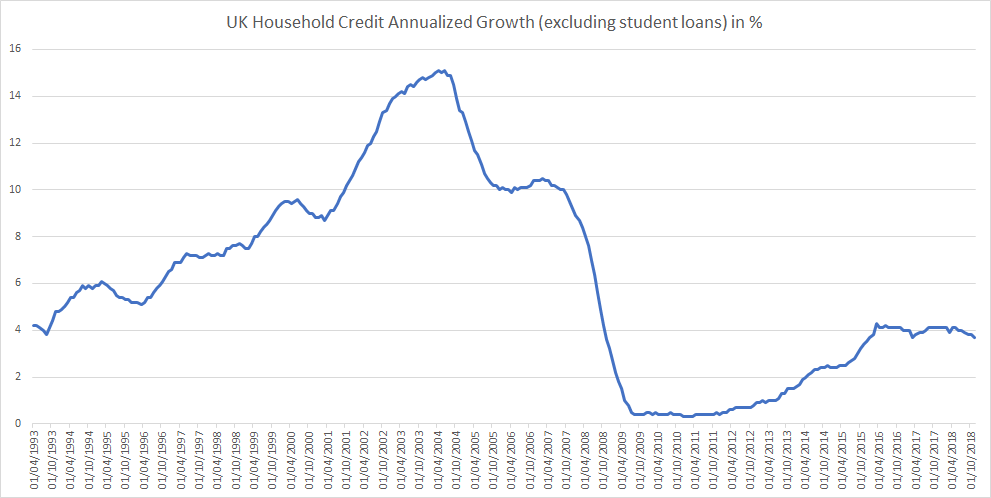

Total household debt (loans, credit cards, mortgages but excluding student loans) are growing at 3.7%, down from 10% in 2007.

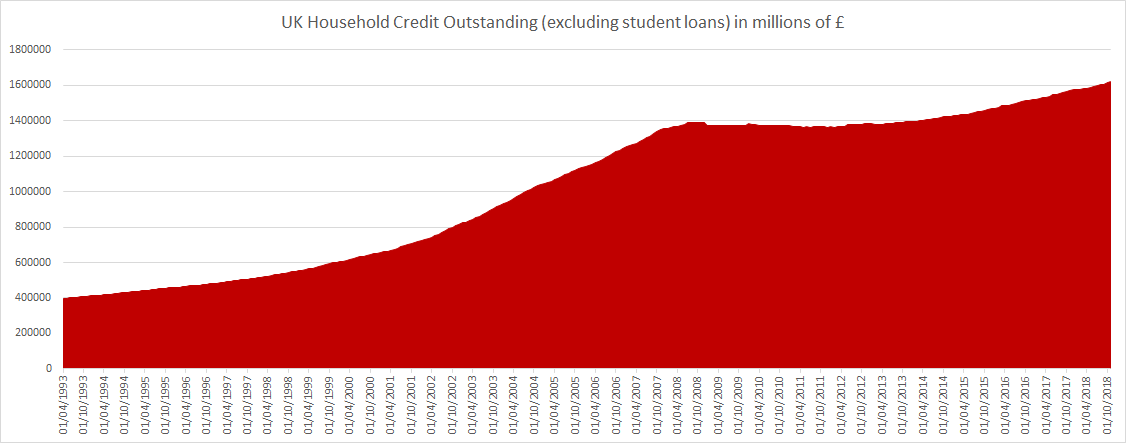

Total household debt (loans, credit cards, mortgages but excluding student loans) stands at £1.61 trillion (or 80% of GDP). Student loans are an additional £200 billion.

Related:

The UK’s net worth is now estimated at £10.2 trillion, an average of £155000 per person

This is how wealthy UK households are

The UK economy a decade on from the 2008 recession

Nominal wages in the UK grew fastest in a decade but real wages are still lower than a decade ago

UK households have seen their outgoings surpass their income for the first time in nearly 30 years