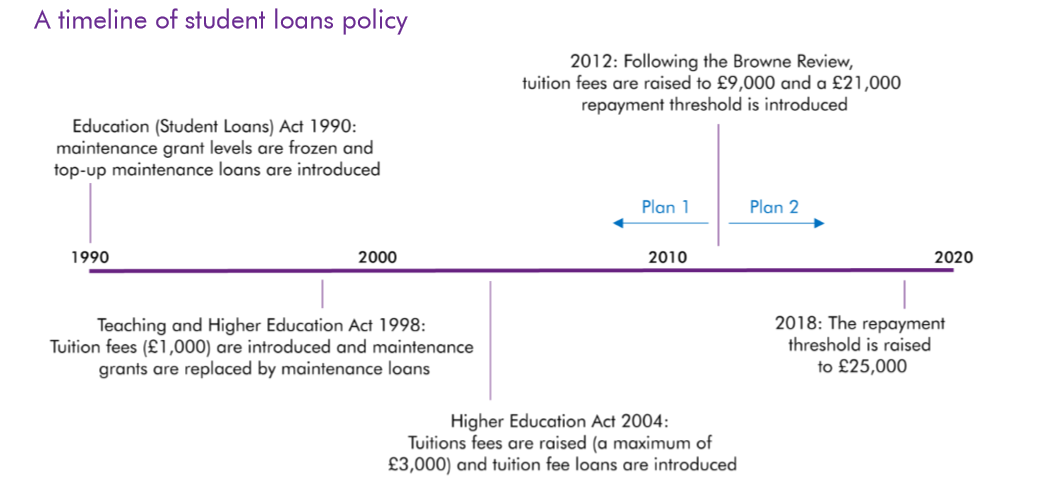

The UK’s higher education funding system is unique in many ways and a change today is quite significant in terms of fiscal accounting. Firstly, here’s a timeline of the student loan system in the UK.

The UK’s student loan system is based on the government giving loans to most students for their tuition fees and maintenance. Students then repay these loans from their pay packets once they have graduated.

Higher education is devolved in the UK and student loans are operated differently in Scotland, Wales and Northern Ireland:

• In Scotland, borrowers must be ordinarily resident in Scotland before the first day of the first academic year of their course. Tuition fees are paid for by the Scottish Government and there are means-tested maintenance loans of up to £5,750 a year, with some bursaries and grants. Repayments are 9 per cent on earnings above £18,330 for 2018-19. The interest rate is currently set at 1.5 per cent.

• In Wales recipients must normally live in Wales on the first day of the first academic year of their course. Tuition fee loans are available up to £9,000 a year and means tested maintenance loans are available up to £10,250 a year, alongside maintenance grants and allowances. There is a minimum £1,000 a year grant available for all students regardless of household income. Repayments are treated on the same basis as English Plan 2 loans.

• In Northern Ireland borrowers must have been living in Northern Ireland for at least three years before the start date of their course. Tuition fee loans are available up to £4,160 a year, as well as means-tested maintenance loans up to £6,780 a year, alongside grants. Repayments are treated on the same basis as English Plan 1 loans.

Currently, these loans are treated as government lending. But, just 37% of these loans are currently repaid (and that number is likely to decrease going forward). A change in accounting announced today means that student loans should be treated as government spending rather than government lending.

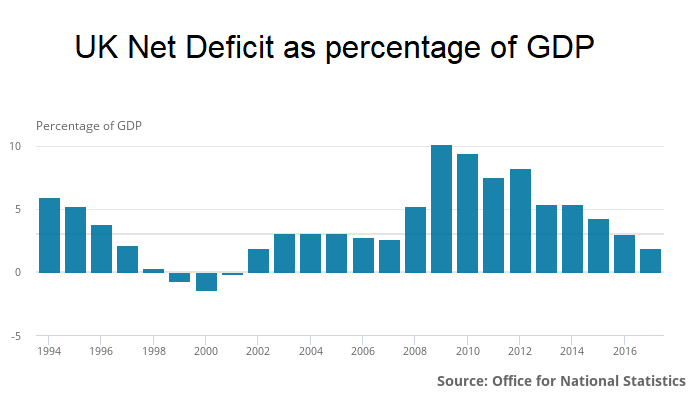

This change has no impact on the overall level of government debt. This is because debt is a cash measure so is unaffected by whether the money being paid out is classified as a loan or spending. However, this change will increase the government’s budget deficit, to ensure it properly reflects the true picture of government spending because student loan debt write-offs that would have taken place.

The Office for Budget Responsibility (OBR) has published some initial estimates for the impact on government deficit. According to these estimates, the new approach will lead to the deficit being increased by approximately 0.6% of GDP a year, which equates to around £12 billion in the current year.

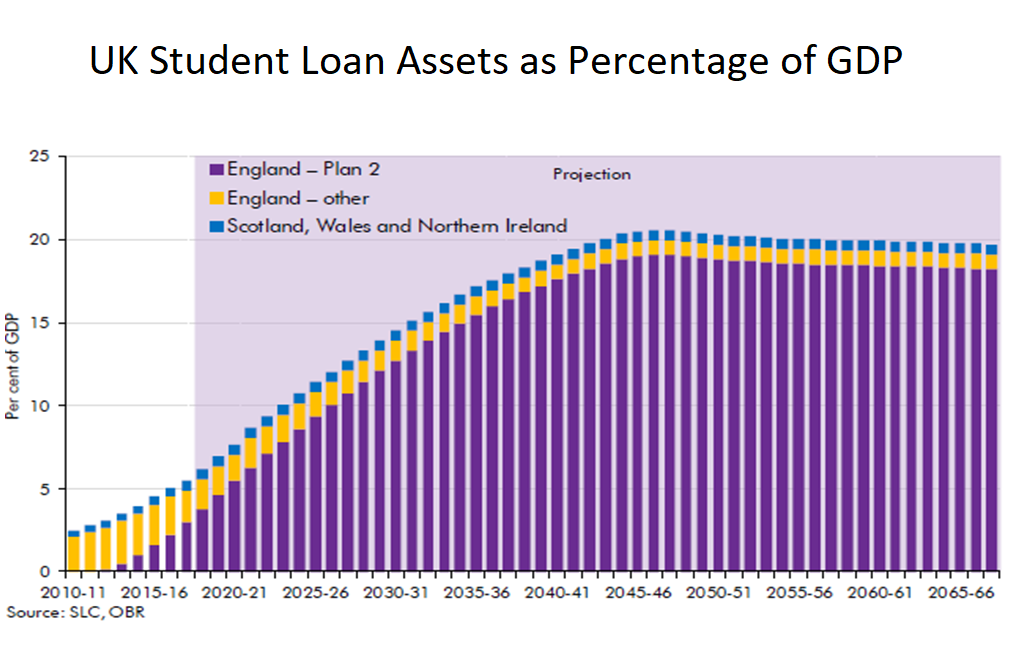

UK student loans outstanding currently stand at around £100 billion in 2017-18 (4.9% of GDP) but the total outstanding is expected to reach around 20% GDP from the 2040s onwards. At this pace the UK will not have a fiscal surplus until 2040 at the earliest. The last time the UK ran a budgetary surplus was 2001.

Related: