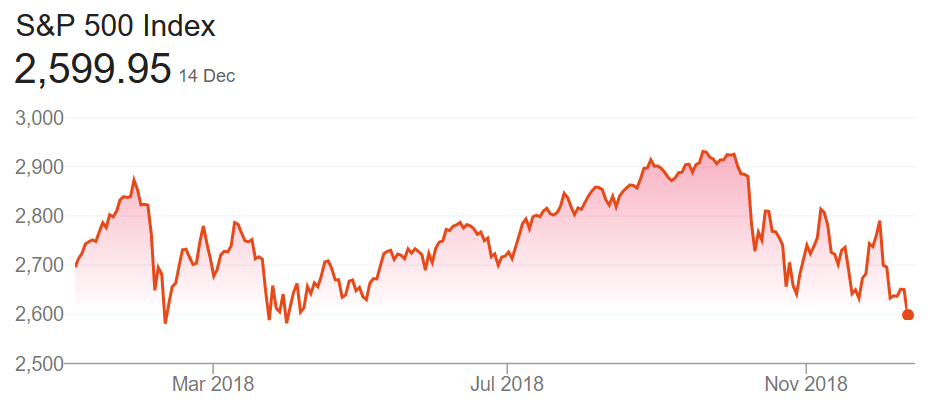

We look back at 2018 year end S&P 500 targets as 2018 draws to a close. The S&P 500 is currently down about 3% year to date and unless something drastic happens almost every major Wall Street strategist will be way off with their target for the S&P 500 for 2018. We also look at 2019 targets which are all bullish again. Will the predictions for 2019 be any better on target than they were for 2018?

Many of the 2018 year end S&P 500 targets were hit in just the first 15 trading days of 2018 and upgrades were made.

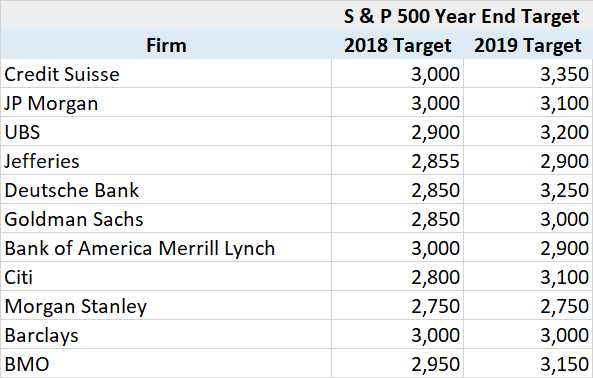

Here’s a summary of Wall Street’s 2018 targets for the S&P 500 (made by January 2018),

Credit Suisse: 3,000

JP Morgan: 3,000

Oppenheimer: 3,000

UBS: 2,900 (they kept increasing the target throughout the year with a peak target of 3,150 at one point of time)

Jefferies: 2,855

Deutsche Bank: 2,850

Goldman Sachs: 2,850

Bank of America Merrill Lynch: 2,800 3,000 – Changed on January 23rd (after the previous target was reached in the first 13 trading days of 2018)

Citi: 2,800

Morgan Stanley: 2,750

Barclays: 3,000

BMO: 2,950

As of close on Friday, December 14th, the S&P 500 closed at 2599.95 which means that every major Wall Street strategist has been way off with their target for the S&P 500 for 2018.

2019 targets

Morgan Stanley is the most conservative with a 2019 S&P 500 target of 2,750. On the other end, the most bullish target stands at 3,350 made by Credit Suisse.

Here are some key takeaways from the forecasts,

Morgan Stanley warns of tightening financial conditions and decelerating growth for 2019.

Jefferies does not expect a recession in 2019.

Bank of America Merrill Lynch warns of volatility.

Economic and earnings growth will revert to the trend in 2019 after the 2018 bump fades, according to Barclays.

Here are 2018 and 2019 targets in a single table,

If history is anything to go by then the 2019 year end targets will be way off again.