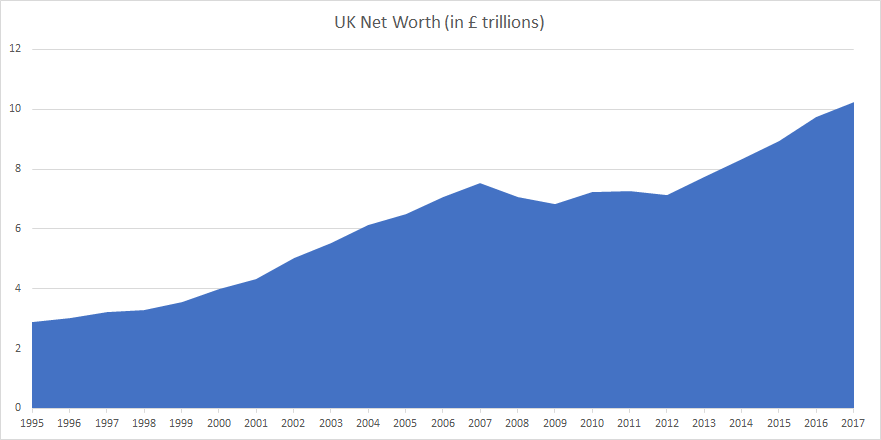

The United Kingdom’s net worth was estimated at £10.2 trillion in 2017 or an average of £155,000 per person as per the Office for National Statistics. UK net worth more than trebled between 1995 and 2017, and much of this was from growth in the value of land. Land accounts for 51% of the UK’s net worth. The UK’s net worth rose by £492 billion from 2016 to £10.2 trillion in 2017.

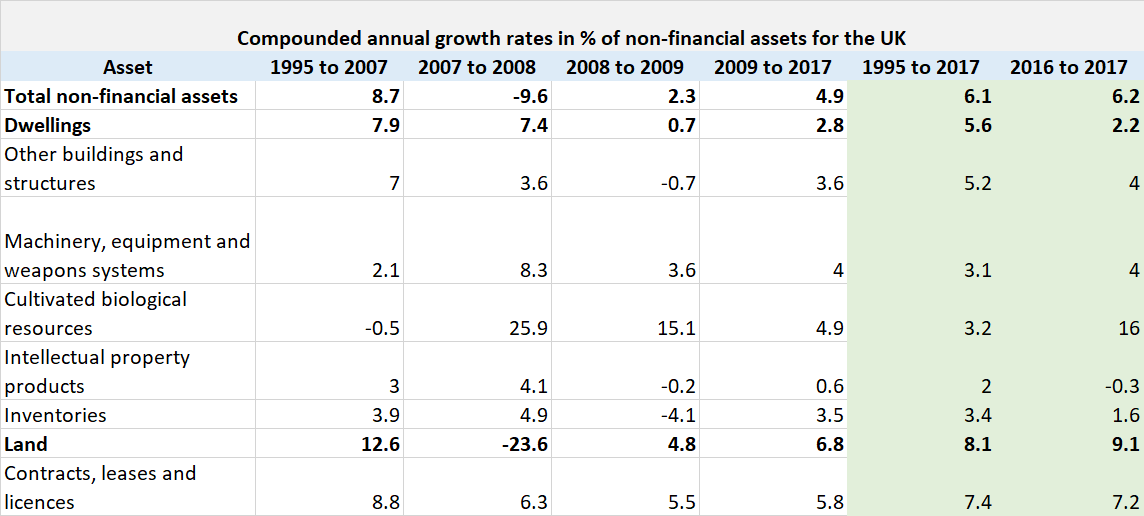

The growth between 2016 and 2017, at 5.1%, was in line with the average growth between 2009 and 2017 of 5.2%. The rise in UK net worth in 2017 was mainly due to a £610 billion increase in the value of non-financial assets. Financial assets and liabilities had a negative effect on net worth, decreasing in value by £117 billion. Land was by far the largest contributor to the increase in net value, rising by £450 billion since 2016.

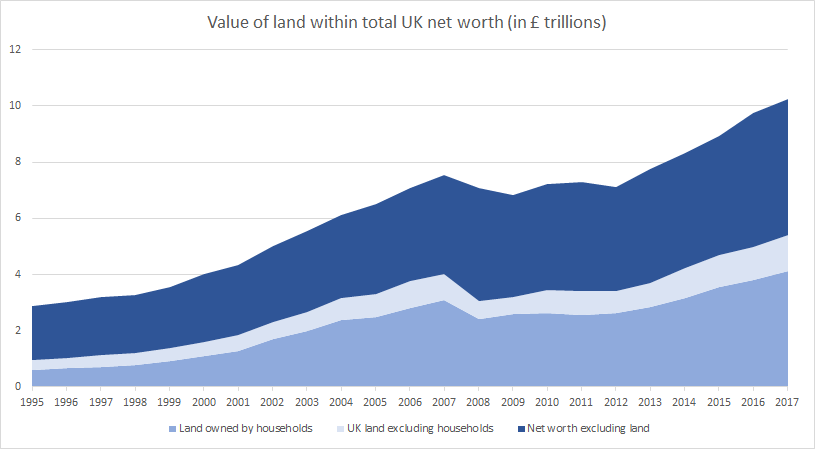

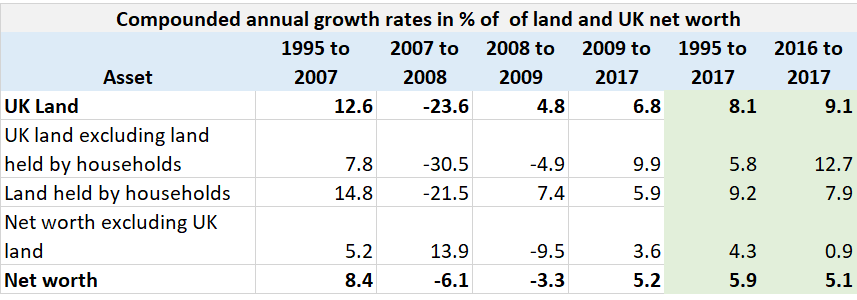

Growth in the worth of household land accounts for much of the growth in UK net worth. In 2017, land in the household sector was worth £4.1 trillion, increasing by £302 billion from 2016 and representing 76% of the total value of UK land. This contrasts with the household sector being worth just 61% of the total value in 1995, showing that the growth of household land has outpaced all other sector.

The value of household land has grown from 21% of UK net worth in 1995, to a peak of 41% in 2007, then down to 40% in 2017.

The growth of land values has had a significant effect on growth in UK net worth since 1995. Before the economic downturn there was a rapid increase in the value of land, principally in the household sector between 1999 and 2007. This meant that annually, UK net worth rose by 8.4%, though when land is not included, UK net worth grew annually by 5.2%.

A similar growth in land can be seen between 2012 and 2017, resulting in annual net worth growth increasing to 5.2%. When land is not included it increased by 3.6% between 2009 to 2017. Between 2016 and 2017, the UK net worth rose by 5.1% but if the growth of land is excluded then this goes down to just 0.9%.

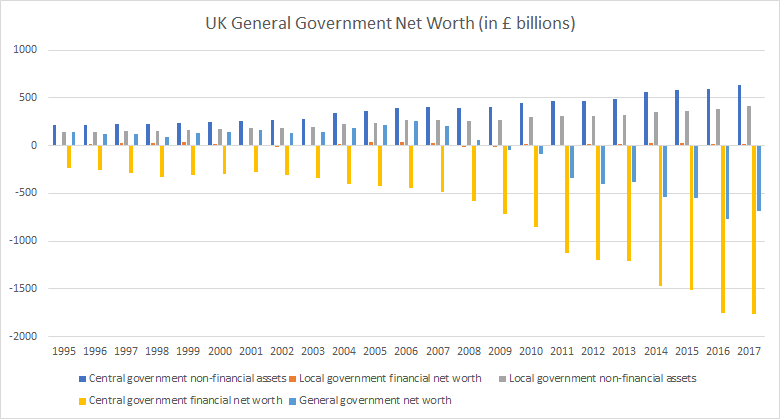

The UK government saw its largest rise in net worth on record in 2017. General government in the UK was valued at negative £689 billion in 2017, an increase of £74 billion from 2016. This is the largest increase in general government’s net worth since 1995 and one of only two years since the economic downturn where net worth rose, the other being 2013.

Central government’s financial net worth dropped by £6 billion in 2017, compared with a drop of £240 billion in 2016. The large drop in 2016 was due to liabilities in debt securities, which decreased in 2017. The source of this was long-term central government securities, which indicates that a large amount of government-issued bonds were redeemed in 2017.

Overall, local government’s assets had the effect of increasing the worth of government, with a net worth of £435 billion in 2017. This is an increase of £36 billion since 2016, as growth in the value of non-financial assets outpaced the decline in financial net worth. The main cause of this rise was the increase in value of buildings other than dwellings and land, which when combined, rose by £32 billion since 2016.

Related:

This is how wealthy UK households are (as per the Office for National Statistics)

London house prices have fallen most since 2009 but it is not what it seems

UK house sales and house price growth are slowing but is this time any different?

Are the British obsessed about house buying and house prices?