It is said that an Englishman’s home is his castle. Is that the reason the British are so obsessed about house buying?

The UK has always been a nation where property ownership has been encouraged by society. Having your own home is considered as a sign of stability, of security and a way of telling the world you have a place of your own. For a new couple or partners in a relationship it is a way of showing commitment and that of a life together and shared responsibility. If your family and friends have a place of their own then it only adds to the social pressure.

Buying your own place rather than renting is also said to make you feel closer to the community. It brings a sense of belonging. Having your own place also gives you control, you have the freedom of improving or changing your property and adding your style and name to it.

Europe is a continent where more people rent than own their own home. Why is Britain different? Well, renting in the UK doesn’t really support long term contracts and rents are high (and therefore returns are good for landlords). Plus, if property prices are constantly rising then rents must go up to keep rental yields constant.

In other places in Europe, the rental market is different. For instance, in Paris, rent caps peg rents to the median income and in Zurich majority of property is owned by the City council (a municipality) or by co-operatives which rent out to tenants at affordable rates.

There is another angle of buying property in the UK and that is financial. It is the idea that property is one of the best long term investments which is indeed true for the UK. Property has only risen in value in the UK in the past 8 decades. There have been three major crashes in those 8 decades, but prices have recovered in each instance. People are more likely to buy knowing prices are going to rise.

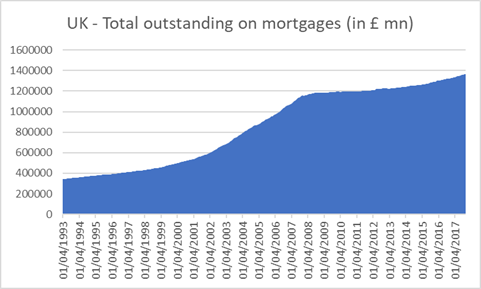

UK homeowners today have £1.367 trillion ($1.93 trillion) in outstanding mortgage debt (as of December 31, 2017 – based on the latest release from The Bank of England). Residential property in the UK is estimated to be worth some £7 trillion ($9.91 trillion) and as such property by far is the biggest investment for people in the UK.

Many people want to pass on their property to the next generation wishing to ensure that the asset yields a positive return in their lifetime.

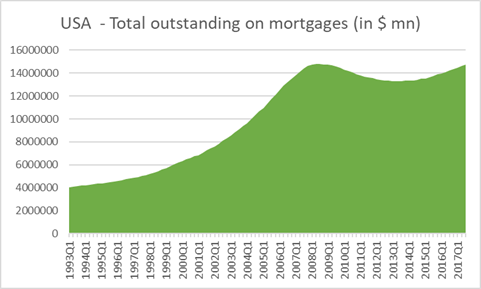

The UK is an outlier in the case of mortgage outstanding. Here are graphs of mortgage outstanding for both the UK (source: The Bank of England) and the US (source: The Federal Reserve). The US graph is close to what happened globally in most countries. As you would observe, in the UK the mortgage outstanding has only increased even after the financial crisis of 2008.

The two major property websites in the UK are Rightmove (www.rightmove.co.uk) and Zoopla (www.zoopla.co.uk). They currently are the 37th and 104th most popular websites in the UK as per Alexa rankings (www.alexa.com). Rightmove beats most shopping websites, all banks and all utility companies in popularity. It is said that 2 in 3 adults in the UK visit the website at least once a month. Why? Well, if your main investment is property you do want to keep track of how it is doing! And the best way to assess your property’s worth is to have a look around on how other properties on the market are doing.

The home ownership rate in the UK is around 65% which is more than others in Europe, but it is just around the average for the G20.

Are the British obsessed about house buying? No. Are the British obsessed about house prices? Yes.

“Home isn’t where you’re from, it’s where you find light when all grows dark.” – Pierce Brown