The first estimate of Euro area or Eurozone (EA19) and European Union (EU28) trade statistics by Eurostat for 2018 reveals several interesting insights.

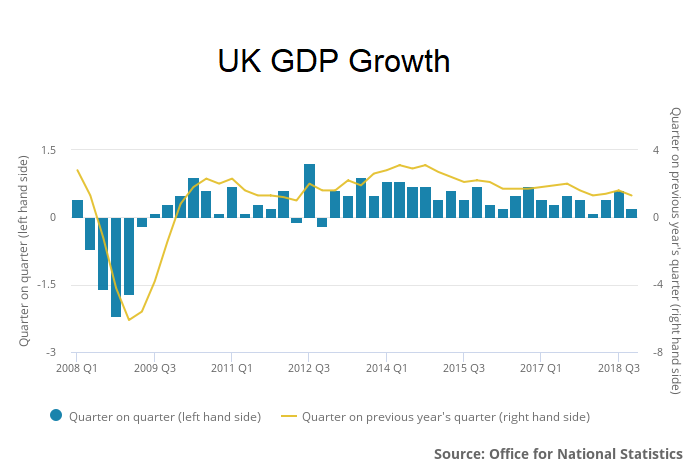

UK Q4 2018 GDP growth estimated at 0.2% and 2018 GDP growth estimated at 1.4%; Business Investment continues to fall

European Commission (again) cuts GDP growth forecast for the European Union; Bank of England cuts UK GDP growth forecast; Germany forecast to grow slower than the UK despite Brexit

The European Commission slashed their GDP growth forecast for the European Union (excluding the United Kingdom) and the Eurozone for 2019 and 2020 citing slowing growth in China and weakening global trade.

The growth forecast for 2019 for the European Union (excluding the United Kingdom) was cut to 1.5% for 2019 (was previously forecast 2%) and for the Eurozone was cut to 1.3% (was previously forecast 1.9%).

Germany, Italy and the Netherlands all saw big downgrades for their growth outlook.

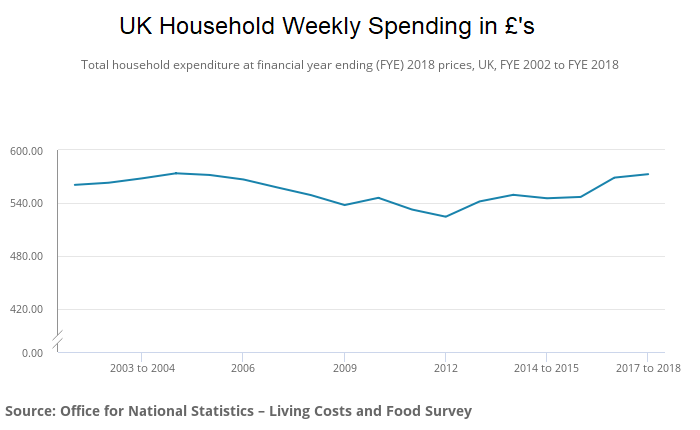

Here are UK household spending insights

Here are insights into the spending habits of UK households by region and type of spending based on living costs and food survey of the Office for National Statistics.

Average weekly household expenditure in the UK was £572.60 in the financial year ending 2018; the highest weekly spend since the financial year ending 2005, after adjusting for inflation.

UK household credit growth remains robust despite Brexit as outstanding household debt hits 80% of GDP

Household credit growth has been slowing around most of the world including the United States, Canada and Australia but remains robust in the United Kingdom despite economic concerns around Brexit. Household debt excluding student loans has hit 80% of GDP and including student loans has hit 90% of GDP.

2019, a year that will be different

At the outset, we wish you a Happy New Year!

Today, the 3rd of January has been a record day every year (for at least the last 15 years) for several things. For starters you have online returns (in the U.S. and the U.K.), gym memberships and dating website(s) signups peaking on the day. But this year is different so expect the unexpected. We can’t write about everything today but cover four topics (Retail, Technology, Interest Rates and Debt).

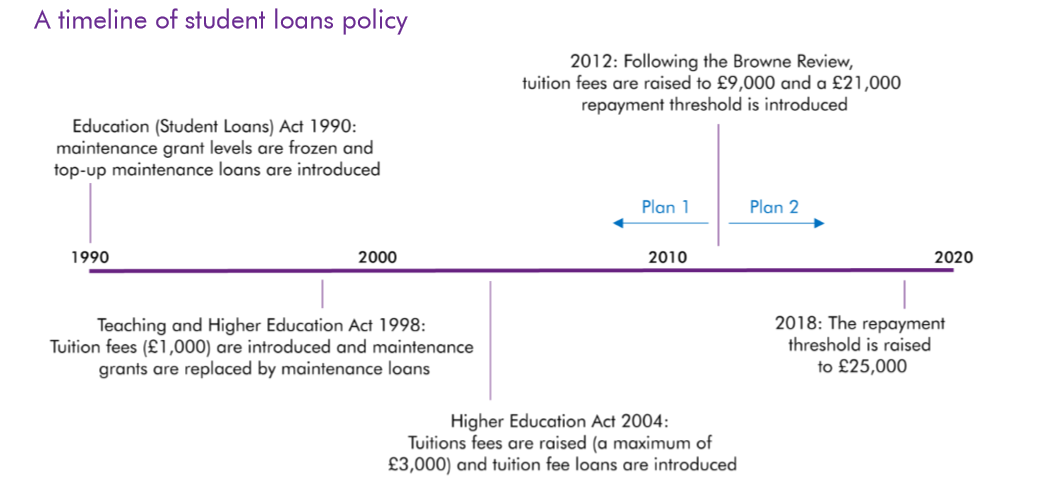

The UK just changed the way they account for student loans which means the UK will likely have a fiscal deficit at least until the 2040s

The UK’s higher education funding system is unique in many ways and a change today is quite significant in terms of fiscal accounting. Firstly, here’s a timeline of the student loan system in the UK.

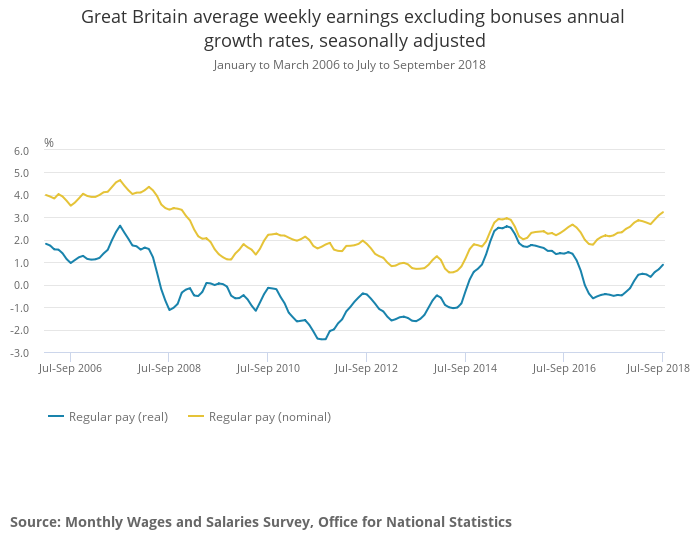

Nominal wages in the UK grew fastest in a decade but real wages are still lower than a decade ago

As widely expected, wages are rising in the UK, at least partially due to labour shortages down to Brexit. Nominal wage growth was fastest in a decade, but real (adjusted for inflation) wages are still lower than a decade ago. We recently also wrote about why wages weren’t rising despite record employment and labour shortages.

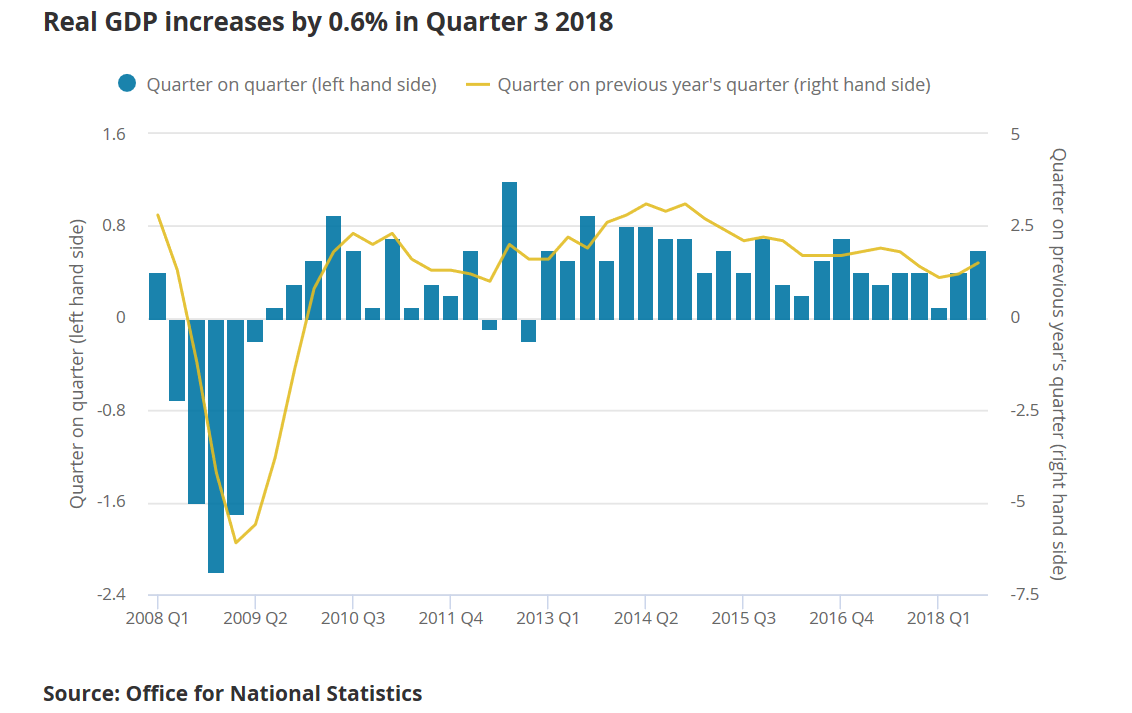

UK Q3 2018 GDP increased by 0.6% (growing 3 times quicker than the Eurozone and at the fastest pace since 2016) but business investment fell

UK gross domestic product (GDP) in volume terms was estimated to have increased by 0.6% between Quarter 2 (Apr to June) 2018 and Quarter 3 (July to Sept) 2018.

In comparison with the same quarter in the previous year, the UK economy has grown by 1.5%, continuing its relatively subdued performance over the last year.

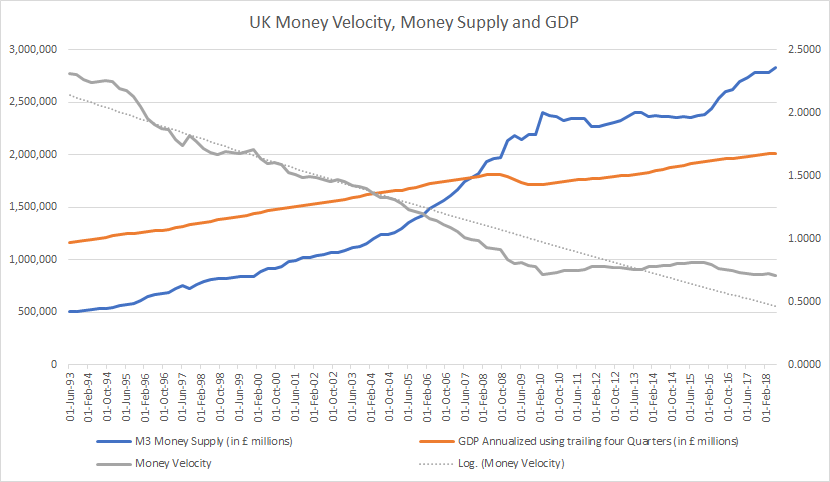

UK Money Velocity has been trending downwards for years

Continue reading “UK Money Velocity has been trending downwards for years”