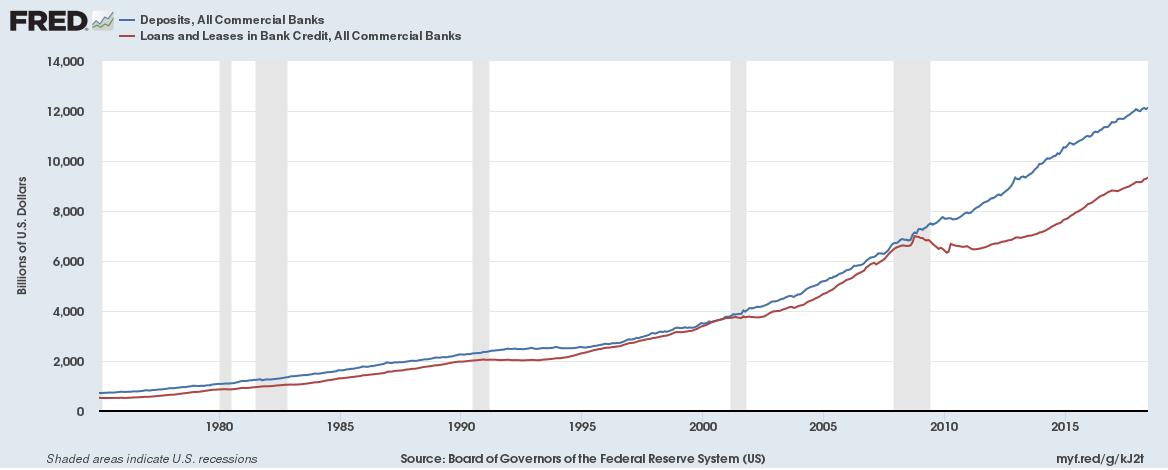

Since the financial crisis of 2008-2009 the difference between bank deposit growth and bank loan growth in the U.S. diverged in a big way, graph below,

Why wouldn’t it be?

Since the financial crisis of 2008-2009 the difference between bank deposit growth and bank loan growth in the U.S. diverged in a big way, graph below,

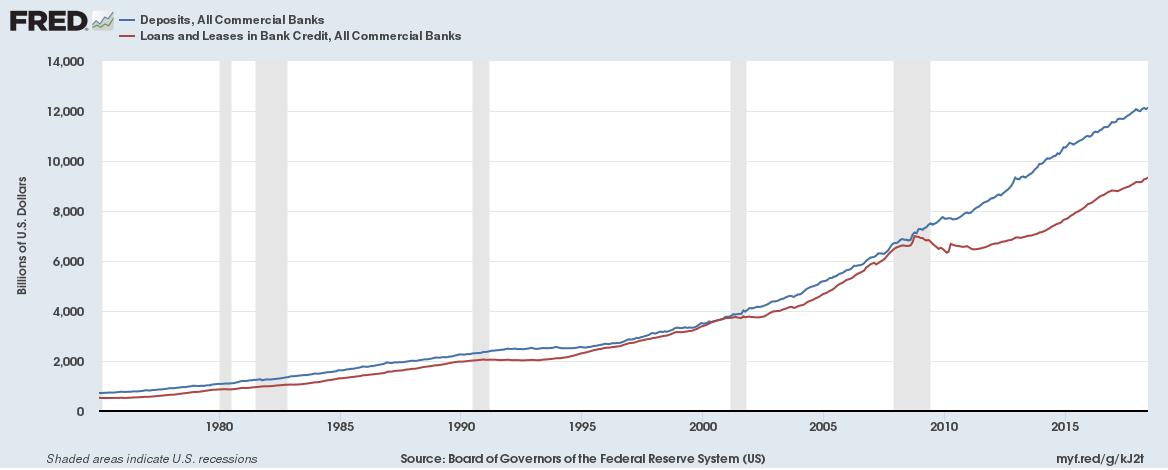

Here are the base interest rates for Central Banks as of June 8, 2018 for each country (in increasing order of interest rate),

Continue reading “Interest Rate for each country (as of June 2018)”

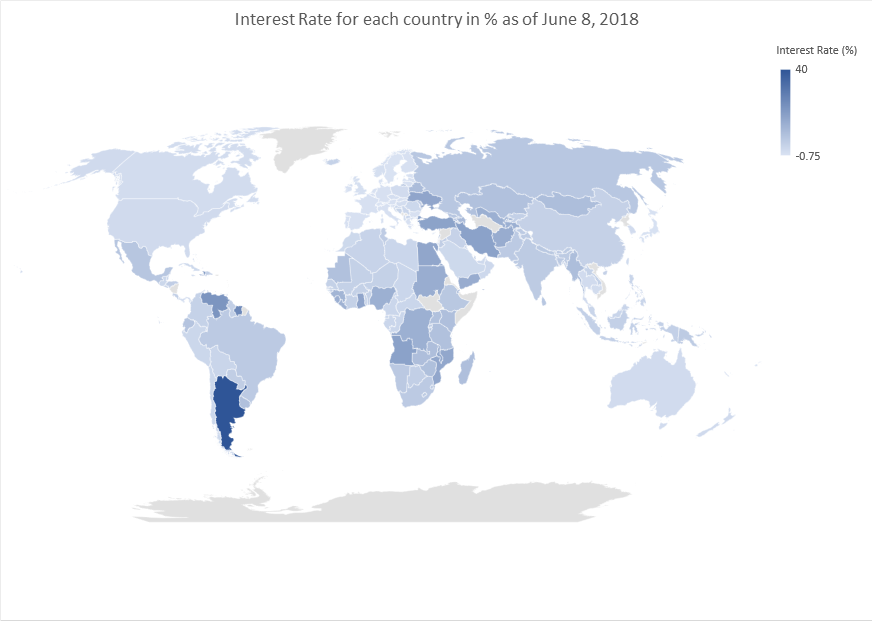

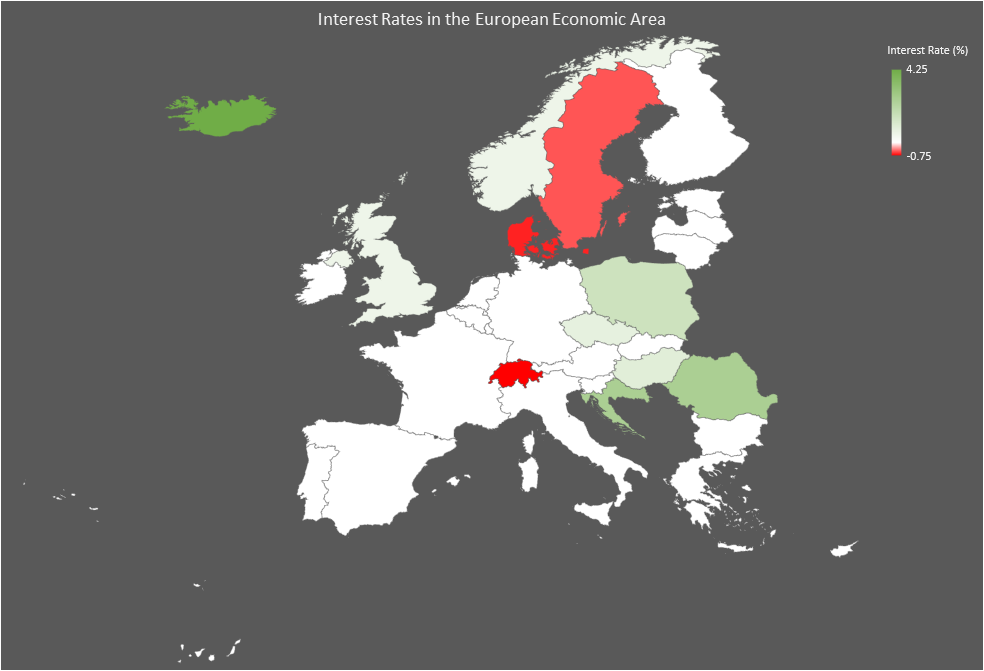

Are interest rates rising or falling globally? Well, if the past three months are anything to go by then the world is moving in different directions with regards to interest rates. So much for synchronized increases or decreases in interest rates …

Here is a map of changes,

Here are the base interest rates for countries in the European Union plus additionally those in the European Economic Area and Switzerland (as of June 5, 2018),

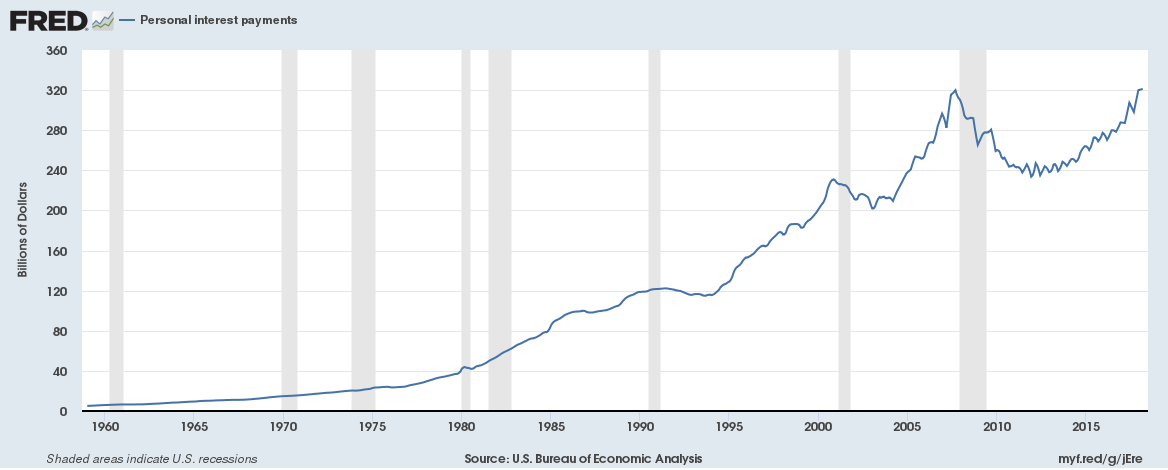

Personal interest payments for households in the United States have hit an all-time high with annualized interest payments now $321 billion, this despite low interest rates currently.

Continue reading “U.S. Personal interest payments hit all time high despite low interest rates”

Investors seek safety

What a difference a week makes, just last week everyone was talking about soaring bond yields. Investors are now seeking safety with developed economies bond yields falling significantly during the week.

Here are some 10-year bond yields, figures in brackets indicate change during the week.

US 2.93% (-15 bps)

UK 1.32% (-21 bps)

Germany 0.41% (-17 bps)

Canada 2.35% (-14 bps)

Switzerland 0.00% (-13 bps)

Netherlands 0.59%% (-15 bps)

Australia 2.79% (-13 bps) Continue reading “Weekly Overview: Investors seek safety as bond yields fall; Crude Oil down 5%; Baltic Dry Index down 15%; Bank of England Governor prepared to cut or freeze interest rates; US E-Commerce Retail sales soaring”

We recently wrote about the impact of rising interest rates for UK households, read more about it here. We also wrote about the impact of higher bond yields for the US government, read more about it here.

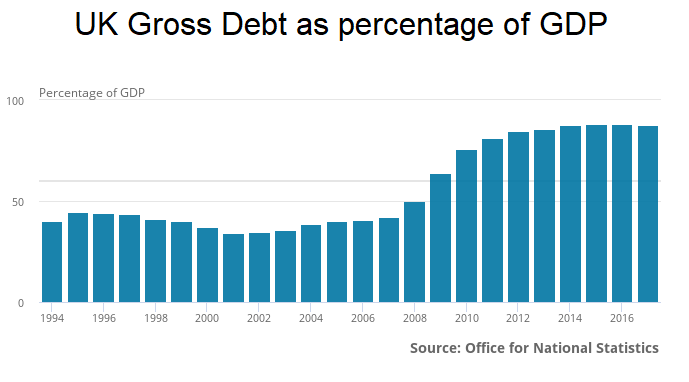

Impact of higher interest rates for the UK Government

The UK government has around £1.72 trillion in debt and pays around £36 billion in interest payments a year (an effective interest rate of 2%).

The UK tax revenues are around £800 billion a year, which would mean 4.5% of all tax revenues are paid as interest. The UK has paid £540 billion in interest since it last ran a surplus in 2001.

Continue reading “Can the UK Government afford higher interest rates or rising bond yields?”

Continue reading “Can the UK Government afford higher interest rates or rising bond yields?”

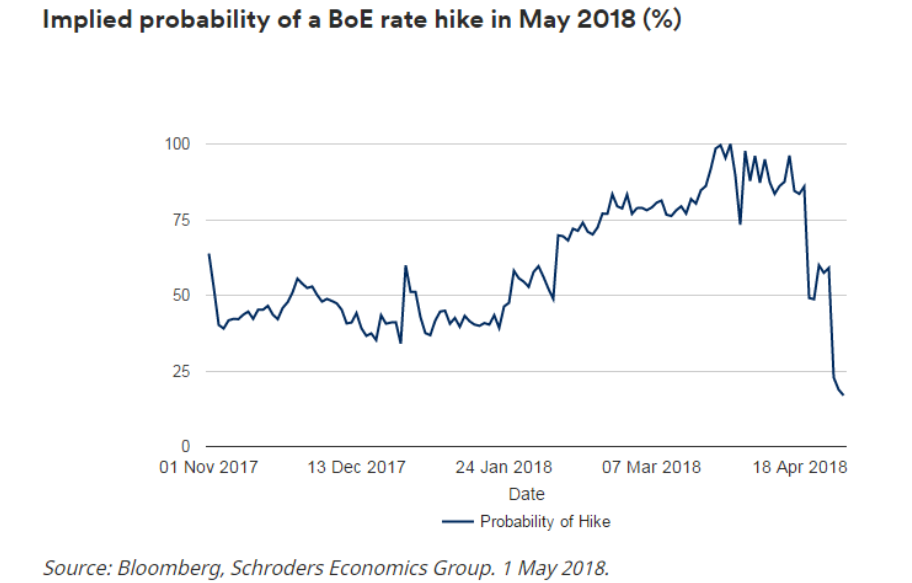

UK interest rate hike expectations

The Monetary Policy Committee of the Bank of England meets on Thursday, May 10 to decide the direction of interest rates.

Following a weak UK Q1 2018 GDP growth of only 0.1%, the slowest since Q4 2012 (read here) and inflation falling from 2.7% in February to 2.5% in March (against a Bank of England target of 2%), the market is now pricing in a 17% of a rate rise in May. The market had factored in a 100% chance of a hike just a few weeks ago.

UK 10-year bond yields fell 5bps during the week. The 10-year bond now yields 1.4% (up 0.32% over the past year)

UK households find themselves in a strange situation ten years on from the financial crisis. Interest rates have never been lower for both borrowers and for savers.

We assess the impact of potentially higher interest rates for households in the UK.

First, here are some household debt statistics, Continue reading “Impact of (potentially) higher interest rates on households in the UK”

The US government has around $20.5 trillion in debt and pays around $558 billion in interest payments a year (an effective interest rate of 2.72%).

Bond yields have been rising recently in the US on the back of a strong economy. The 10-year bond yield topped 3% (up 0.66% over the past year) recently, the highest since January 2014. The 2-year bond yield topped 2.5% (up a massive 1.18% over the past year), the highest since July 2008 (Read more here). Continue reading “Can the US government really cope with rising bond yields?”