The Greek stock market has been one of the best performing markets in the world over the past year. The Athens Stock Exchange General Index has returned 19% over the last year. But it has lost 85% (5334.5 to today’s close at 781.14) in value since October 2007. Continue reading “The Athens Stock Exchange General Index has returned 19% over the last year (but lost 85% since 2007); Australian interest rates are lower than that of the US for the first time in 18 years”

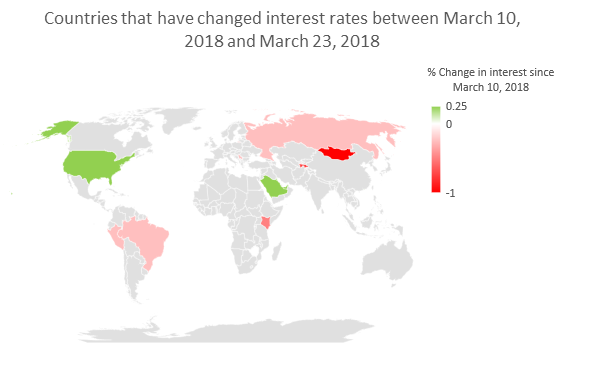

7 countries hiked interest rates and 7 lowered interest rates in the past 2 weeks

The US was not alone in hiking interest rates. The 6 other countries that hiked interest rates by 0.25% in line with the US were United Arab Emirates, Bahrain, Kuwait, Saudi Arabia, Hong Kong and Macau – all of which peg their interest rates in line with the one in the US.

Meanwhile Russia, Brazil, Mongolia, Tajikistan, Kenya, Serbia and Peru all lowered their interest rate.

Continue reading “7 countries hiked interest rates and 7 lowered interest rates in the past 2 weeks”

As LIBOR moves upwards, Central Banks remain so predictable

The Federal Reserve under new chairman Jerome Powell approved a 0.25% hike that puts the new benchmark funds rate at a target of 1.5% to 1.75%.

There was once a time when no one knew what to expect when Central Bankers met. Times have entirely changed, they are so predictable. Continue reading “As LIBOR moves upwards, Central Banks remain so predictable”

Markets should ignore cyclical factors and focus at the structural factors instead

How often do analysts get the markets wrong? How often to fund managers get stock picks wrong? They get things wrong far more often then they get it right.

2017 was probably the worst year for hedge funds. And the start of 2018 isn’t turning out to be any better.

The problem probably lies with everyone focussing on the business cycle rather than the structural factors driving the markets. Continue reading “Markets should ignore cyclical factors and focus at the structural factors instead”

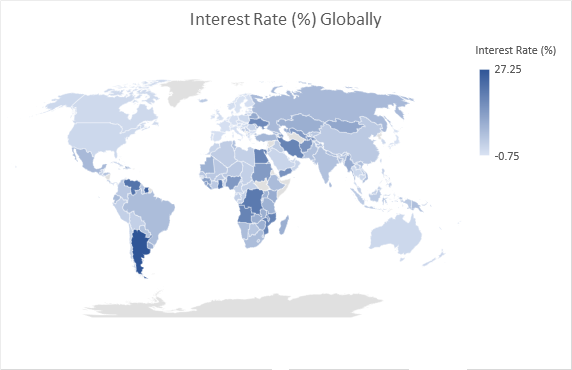

Interest Rates around the World

Here are the base interest rates for Central Banks around the world (in increasing order),

High (or hyper) inflation or long term zero (or negative) interest rates – how might the world pay its debt?

The divergence of interest rates, bond yields, inflation, currency strength, budget deficit and total debt of countries around the world has never been bigger. We look at how the US, the UK, the Eurozone, Japan, Switzerland and India are doing in addressing paying off their debt. Continue reading “High (or hyper) inflation or long term zero (or negative) interest rates – how might the world pay its debt?”

Will saving/deposit interest rates in the UK really improve if the base rate goes up? One chart might answer the question

Here is a chart of the average quoted interest rate on savings/deposits in the UK (Source: Bank of England) since 2011, Continue reading “Will saving/deposit interest rates in the UK really improve if the base rate goes up? One chart might answer the question”

US 10-year bond yield hits a 4-year high, is the US now an exception?

Greece (Moody’s Credit Rating: Caa2) is now paying 83 bps lower interest on 2-year bonds than the US (Moody’s Credit Rating: Aaa). Is the US now truly the exception? Continue reading “US 10-year bond yield hits a 4-year high, is the US now an exception?”

How do Central Banks with zero or negative interest rates spend their money?

At the outset, here are the countries whose Central Banks have zero or negative interest rates, Continue reading “How do Central Banks with zero or negative interest rates spend their money?”

One chart that will make you wonder how a generation managed with high interest rates

Here is a chart of the Bank of England base rate from 1975 till date, Continue reading “One chart that will make you wonder how a generation managed with high interest rates”