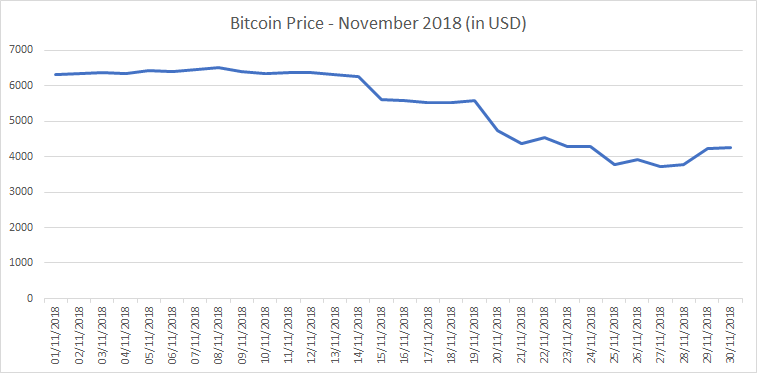

November 2018 saw big falls for Oil with WTI down 22% and Brent down 20.8%. Equities turned largely positive after a disastrous October with the S & P 500 up 2% and NASDAQ 100 up 0.5% during November. Asia was positive too with the Hong Kong HSI Seng Index up 6.2% and the Japanese NIKKEI up 2%. European Stocks performed badly though with the German DAX down 1.7% and the Portuguese PSI down 3.1%. The biggest loser was Bitcoin, down 37% during the month.

Posts in November

Central Bank Balance Sheets Unwind

The Federal Reserve is unwinding its balance sheet, here’s why and how it is doing it

GDP Growth

Both the European Commission and the IMF are forecasting lower GDP growth in Europe

Economics

UK Money Velocity has been trending downwards for years

Nominal wages in the UK grew fastest in a decade but real wages are still lower than a decade ago

Some insights into the current and future economic state of airlines

Markets in November

Just two charts – Oil and the Baltic Dry Index

Winter is coming …