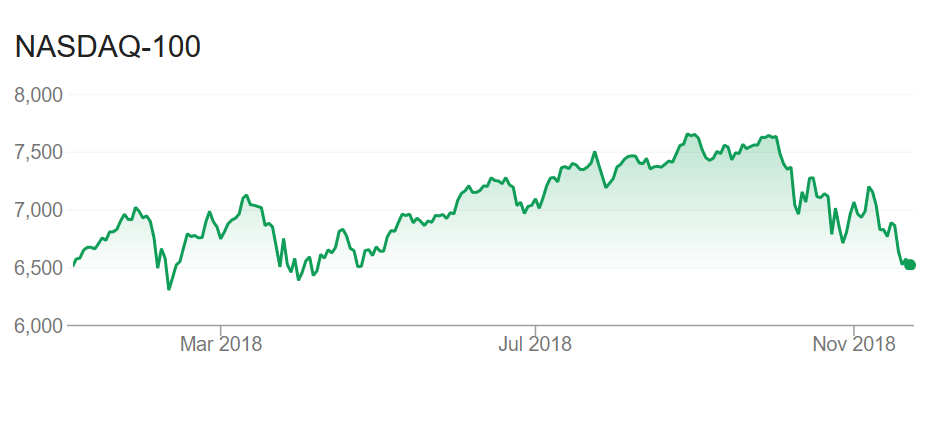

The S & P 500 and the NASDAQ 100 hit all time highs in early October and since then they have fallen about 10% each. The S & P 500 has turned negative for the year and the NASDAQ 100 has barely moved. FAANG (Facebook, Amazon, Apple, Netflix and Google/Alphabet) stocks accounted for almost all the 2018 gains until October. And their fall has caused the market meltdown but there is more to the story …

The important questions

Are technology companies affected much by the business cycle? That is an interesting question. But the more interesting question is that if FAANG led most of the stock market gains (and then the subsequent fall) this year then are other companies (outside of technology) really doing well in this supposedly strong economy? Or are technology companies now proxy for the consumer economy? Were or are technology companies massively overvalued?

The melt down

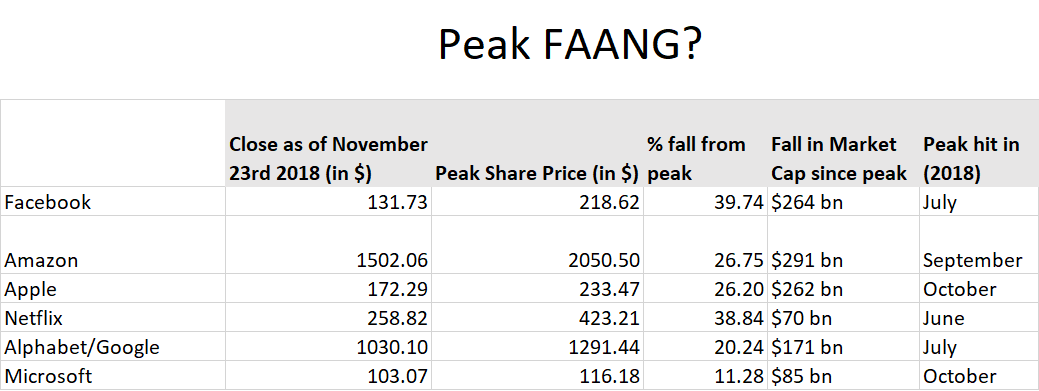

FAANG stocks have lost over $1.1 trillion in market cap since the early October U.S. stock market peak. To put that into perspective, $1.1 trillion is equivalent to 1.6% of the global stock market cap. Here is their performance,

What went wrong?

A different case for each company, here is what has gone wrong for each of the FAANG stocks.

Facebook (down 40% from its peak stock price)

Cambridge Analytica privacy issues caused the first bump but ever since everyone seems to be questioning whether we have reached Facebook? Facebook owned Instagram and WhatsApp are doing well but youngsters (and generally everyone else) seems to be deserting Facebook. Peak Facebook? Perhaps but the bigger question is whether Facebook advertising is worthwhile? Some recent metrics are shocking …

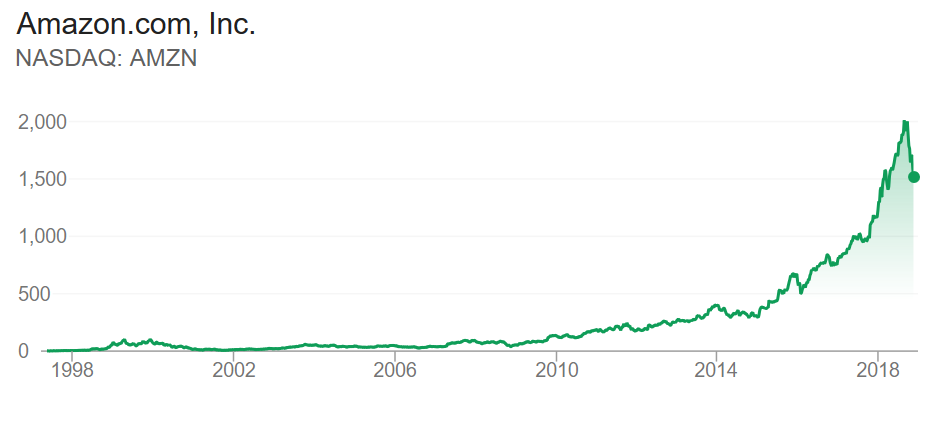

Amazon (down 27% from its peak stock price)

We wrote about Amazon a couple of days ago and mentioned that core Amazon first party sales growth was the slowest ever and the quarterly employee addition was slowest in over 40 quarters. Peak Amazon? No, but growth is slowing. And as the company gets bigger inefficiency will grow. At the moment, Amazon is reinvesting money in the business rather than growing profits. It could easily be far more profitable if it wanted to.

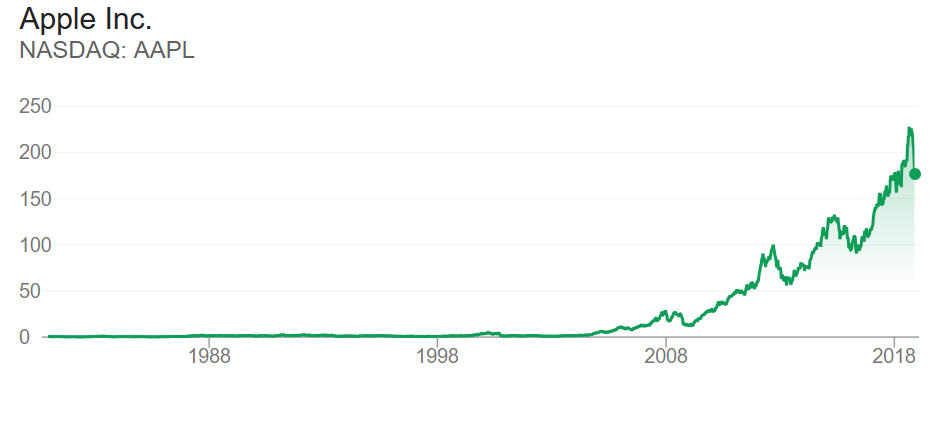

Apple (down 26% from its peak stock price)

On November 1st, Apple announced that it would stop reporting its hardware revenue by product (namely iPhone’s, iPad’s and MAC’s). Revenue per unit sold is growing as iPhone price inflation is about 5 times normal inflation (Apple has great pricing power amongst its fan user base). Have we reached peak Apple? Services account for almost a quarter of the revenues of the company now and they are growing as the installed base grows. The company has some $280 billion in offshore tax havens the bank, so it is not going away anywhere. That money will be spent eventually …

Netflix (down 39% from its peak stock price)

Netflix trades at a price to earnings ratio of 85 (or 10 times annual revenues). The company expects free cash flow of minus $3 billion to minus $4 billion in 2018 (yes, that is negative cash flow). It has some 120 million subscribers but how much more can it grow? Will Rupert Murdoch buy Netflix with the sale proceeds of 21st Century Fox to Disney?

Alphabet (down 20% from its peak stock price)

Alphabet (the parent company of Google) is doing well but is almost entirely dependent on advertising. And although online advertising is still growing well there is a risk of it being too dependent on the business cycle. Alphabet isn’t saying how much areas such as Google cloud are growing which adds to investor worries.

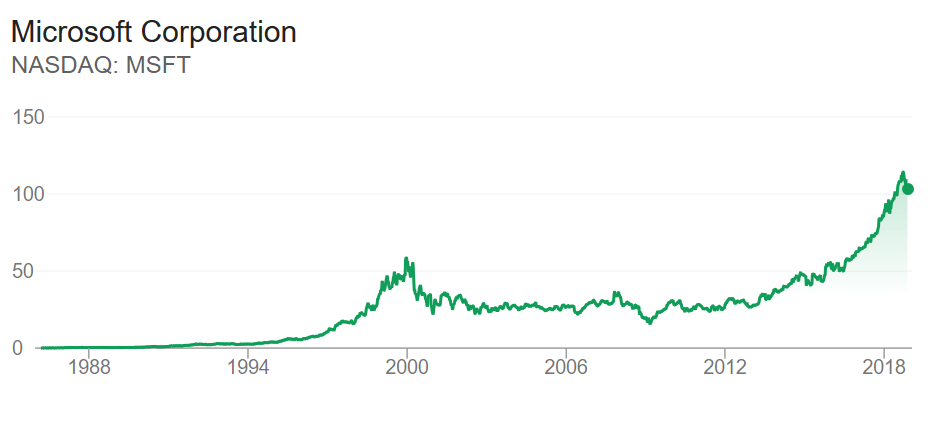

And Microsoft – the market saviour (down just 11% from its peak stock price)

Microsoft could soon regain its status as the world’s most valuable company and is the only reason the markets haven’t fallen more. What’s different between FAANG’s and Microsoft? Microsoft has a more stable business model and its stock hadn’t gone up as much as the FAANG’s. Talk about gravity …

Related:

Technology Companies granted an astonishing amount of Restricted Stock Units by value in 2017

Core Amazon Online sales growth is slowing at an unprecedented pace despite stellar overall results

Alphabet (the parent company of Google) spent the most as a company on lobbying in 2017