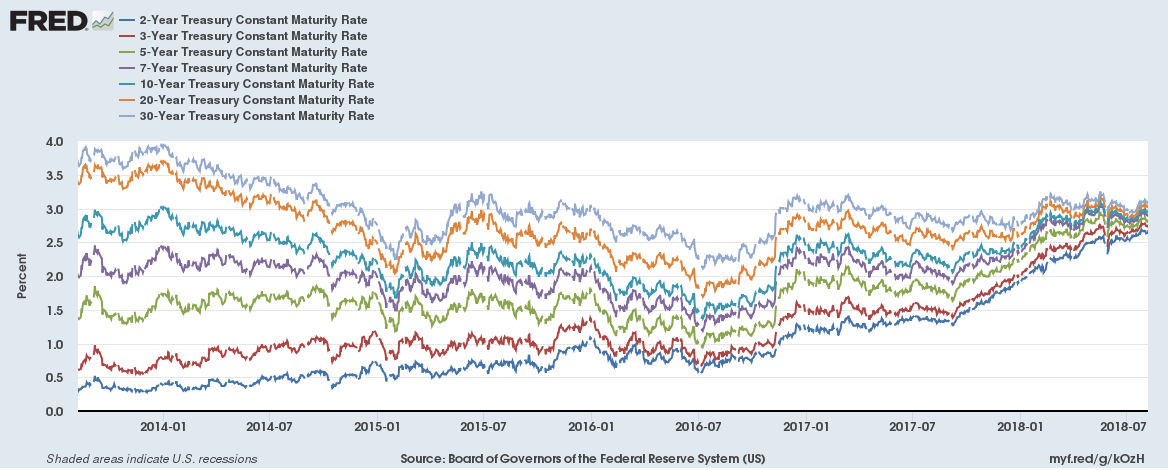

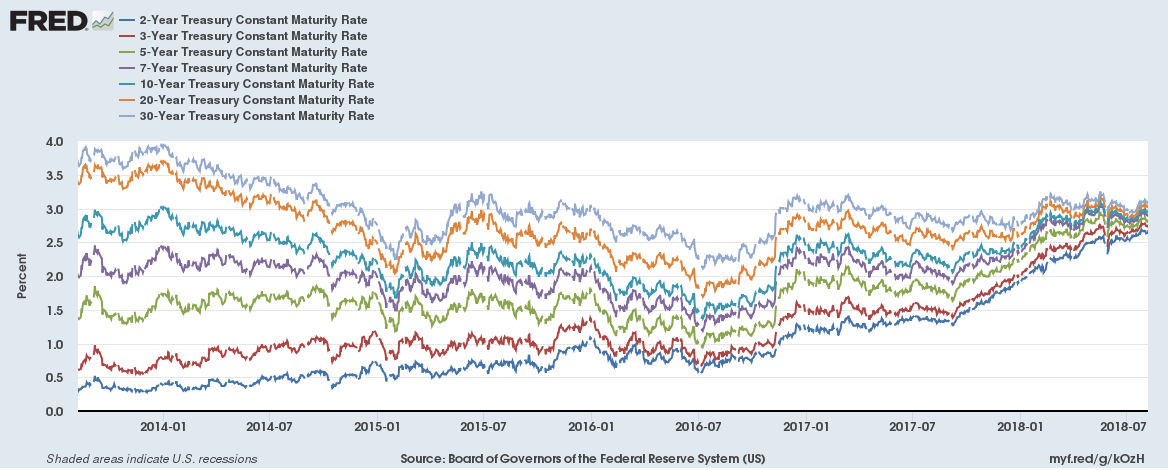

U.S. 2-year, 3-year, 5-year, 7-year, 10-year, 20-year and 30-year yields are all converging. Looks like a beautiful chart, just one thing …

Continue reading “The great U.S. Government bond yield convergence chart”

Why wouldn’t it be?

U.S. 2-year, 3-year, 5-year, 7-year, 10-year, 20-year and 30-year yields are all converging. Looks like a beautiful chart, just one thing …

Continue reading “The great U.S. Government bond yield convergence chart”

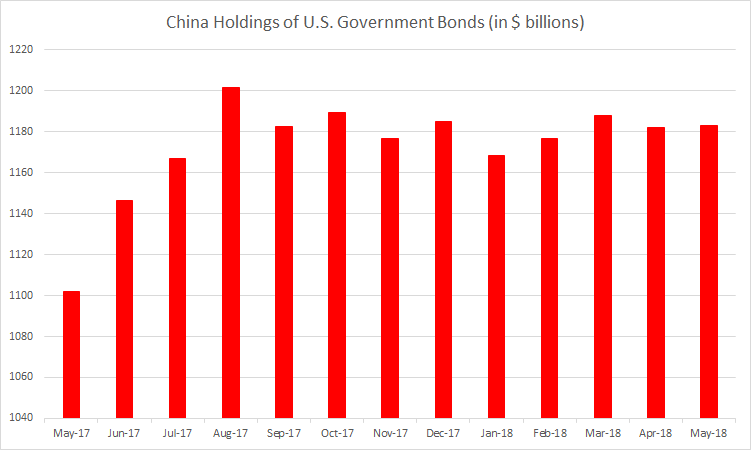

Is China selling U.S Government Bonds (Treasury Bills, T-Bonds and Notes) given the trade war tensions between China and the United States? The simple answer to that is no. Actually, no major foreign country holder of bonds is really selling.

But you might wonder what is going on if you make a chart look like this,

Continue reading “China hasn’t been selling U.S. Government Bonds despite trade tensions”

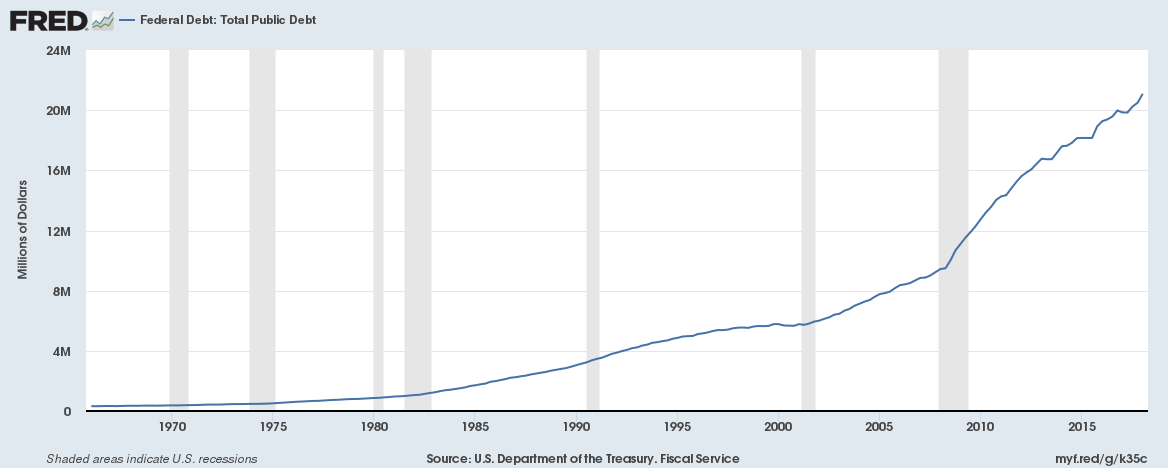

The United States government is likely to run a record fiscal deficit this year due to lower tax receipts. And given deficits since 2001, Federal debt is soaring (chart below). In the immediate aftermath of the last recession, the Federal Reserve was a major buyer of U.S. Treasury bonds.

Since 2014 though, the Fed isn’t really a buyer of Treasury bonds. The question is who is buying federal government debt?

We haven’t written about bond yields for some time. Government bond yields have largely been falling despite Central Banks announcing reductions or end to their bond buying programmes.

The only notable countries where yields are still up over the past year are the United States, Canada, Italy and Emerging Markets.

It wouldn’t appear that the market is anticipating interest rate rises in the short term. We will write about that in a few days but in the meanwhile here are 10-year government bond yields as of 14th July 2018 (figure in brackets indicate absolute 1-year change),

Everyone seems to be focussing on the equity markets recently, but equity markets haven’t really moved much over the past one month. Over the past month, major equity markets have lost between 1.5% to 4%.

The real action is in bonds and commodities. And trade seems to be flourishing too.

10-year government bond yields of major economies are lower by 5% to 40% (in relative terms not absolute terms) in just the past month. 10-year German bonds are down 12 bps over the past month. That wouldn’t sound much but they are down 28% from 42 bps to 30 bps. U.K. yields are down 8%, U.S. yields down 5%, Japanese yields down 40%. Even Greek yields are down 20% over just the past month. Does the market anticipate a pause in interest rate rises? It would appear so.

Continue reading “Something strange is happening in the global economy right now”

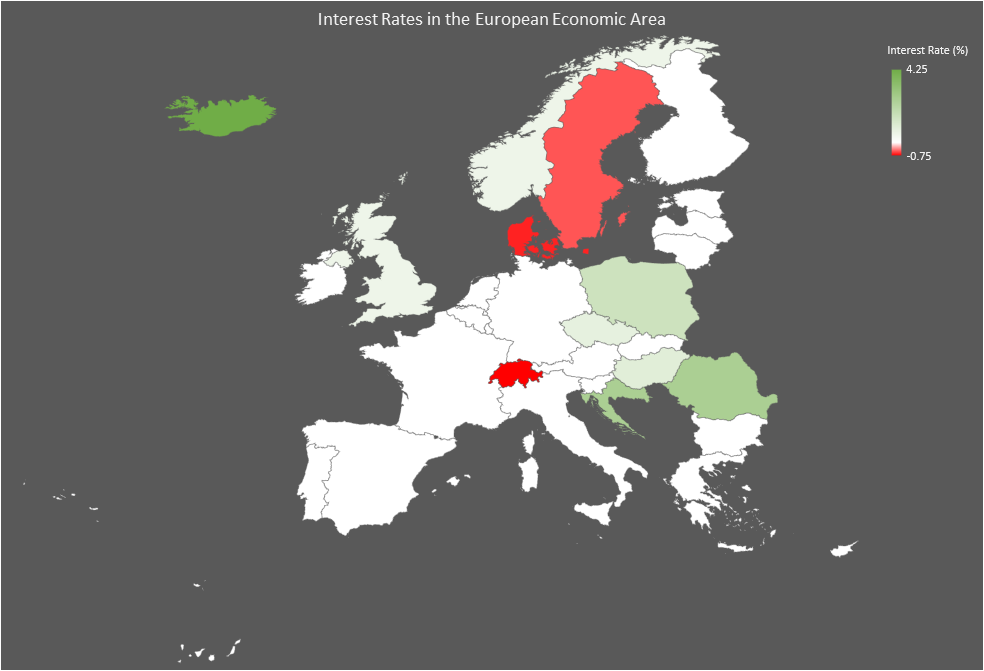

Interest Rates

What a difference a year makes. The Federal Reserve has hiked interest rates thrice (in December, March and June) with a target rate range of 1.75% to 2% now. The Eurozone meanwhile maintains its zero-interest rate policy.

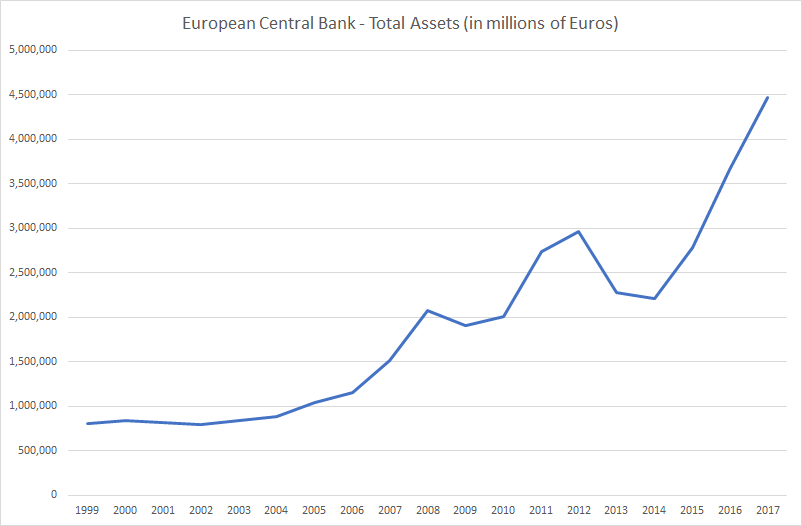

The European Central Bank (ECB) announced on Wednesday that it will halve its bond buys to 15 billion Euros (from the current 30 billion Euros) a month from October then shut the programme at the end of the year.

ECB’s balance sheet has increased by 2 trillion Euros since 2015 when it announced its bond buying programme. 2-year yields for most of the Eurozone countries are currently negative and 10-year yields in most cases are lower than that of the United States. The European Central Bank (ECB) is by far the biggest holder of European bonds and the biggest (almost 90%) buyer of the weaker Eurozone (Italy, Spain, Portugal and Greece) countries debt since 2015. The ECB balance sheet is now over 4.5 trillion Euros, some 45% of Eurozone GDP.

Continue reading “This is what is likely to happen when the European Central Bank ends bond buying”

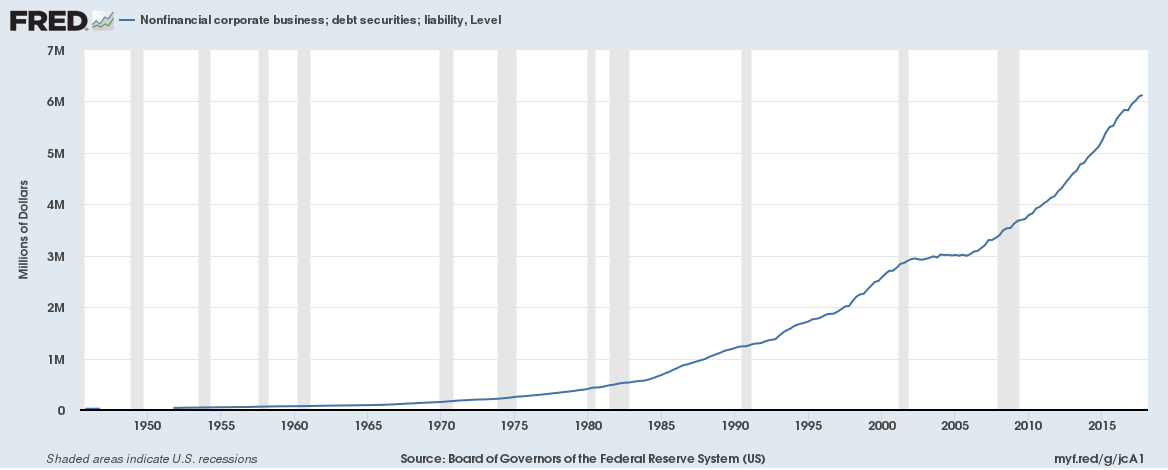

Corporations (non-financial) in the United States have $6.2 trillion in debt and debt has doubled in the past decade,

Continue reading “Corporate debt is soaring in the U.S. even as corporate bond yields are rising”

Continue reading “Corporate debt is soaring in the U.S. even as corporate bond yields are rising”

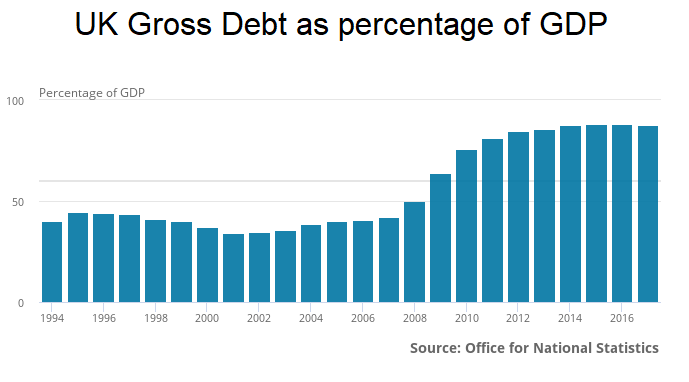

We recently wrote about the impact of rising interest rates for UK households, read more about it here. We also wrote about the impact of higher bond yields for the US government, read more about it here.

Impact of higher interest rates for the UK Government

The UK government has around £1.72 trillion in debt and pays around £36 billion in interest payments a year (an effective interest rate of 2%).

The UK tax revenues are around £800 billion a year, which would mean 4.5% of all tax revenues are paid as interest. The UK has paid £540 billion in interest since it last ran a surplus in 2001.

Continue reading “Can the UK Government afford higher interest rates or rising bond yields?”

Continue reading “Can the UK Government afford higher interest rates or rising bond yields?”

US and emerging market bond yields

The US 10-year bond yield soared to 3.09% today (up 75 bps over the past year and 25 bps over the past month), the highest since 2011. The 2-year yield hit 2.59%, the highest since August 2008 (read more here on the financial impact of rising yields for the US Government).

The bigger story is of emerging markets though. Brazilian and Indian 10-year yields have soared 33 bps in just a week. The Brazilian 10-year bond yield topped 10.12% while the Indian 10-year bond yield topped 7.91%. The US dollar has gained 7% against the Brazilian Real and 4% against the Indian Rupee over the past month.

Canadian bond yields are soaring the most amongst developed nations with the 10-year yield hitting 2.51%, up 94 bps over the past year and 24 bps over the past month. Continue reading “US and emerging market bond yields soar; UK retail; US Student debt; German GDP”