US and emerging market bond yields

The US 10-year bond yield soared to 3.09% today (up 75 bps over the past year and 25 bps over the past month), the highest since 2011. The 2-year yield hit 2.59%, the highest since August 2008 (read more here on the financial impact of rising yields for the US Government).

The bigger story is of emerging markets though. Brazilian and Indian 10-year yields have soared 33 bps in just a week. The Brazilian 10-year bond yield topped 10.12% while the Indian 10-year bond yield topped 7.91%. The US dollar has gained 7% against the Brazilian Real and 4% against the Indian Rupee over the past month.

Canadian bond yields are soaring the most amongst developed nations with the 10-year yield hitting 2.51%, up 94 bps over the past year and 24 bps over the past month.

UK retail

The British Retail Consortium reported an unprecedented 4.8% drop in footfall in March and April, even more than the 3.8% drop that was reported during the recession in 2009. Poor weather in April was at least to partially blame for the drop.

Meanwhile, Visa via its Visa spending report has estimated an overall fall in consumer spending of 2% with high street spending down 5.4%. This following a January fall in total spending of 1.2%, February and March both with a fall of 2%.

Poor weather, Brexit uncertainty or low consumer confidence? Probably a bit of all of it.

Read more here on the Retail and restaurant apocalypse in the UK.

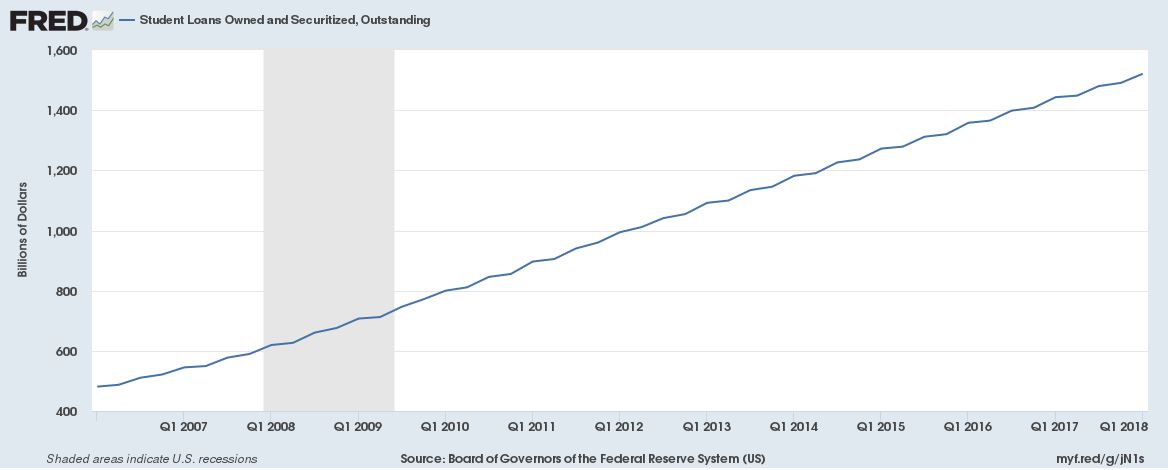

US Student Debt

US Student debt has crossed $1.5 trillion. That is more than the GDP of 185 individual countries and more than individual mortgage debt in the US.

Well, at least keeping more people in education keeps them out of the job market and keeps unemployment low.

German GDP

The German Federal Statistics Office reported Q1 GDP numbers today. Q1 2018 GDP grew by just 0.3%, the slowest rate since Q3 2016 on back of weak exports and low government spending. This follows weak Q1 2018 GDP numbers from the US, the UK and France.