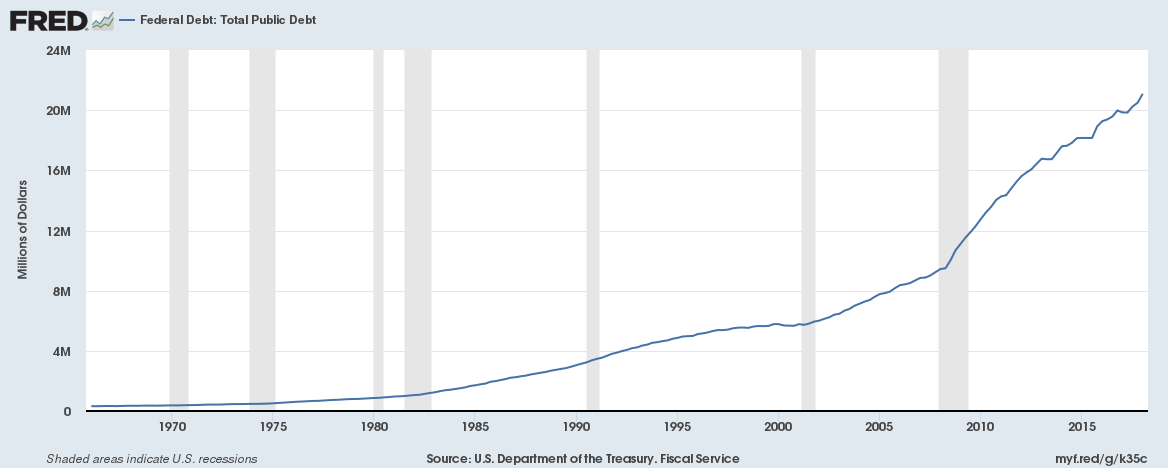

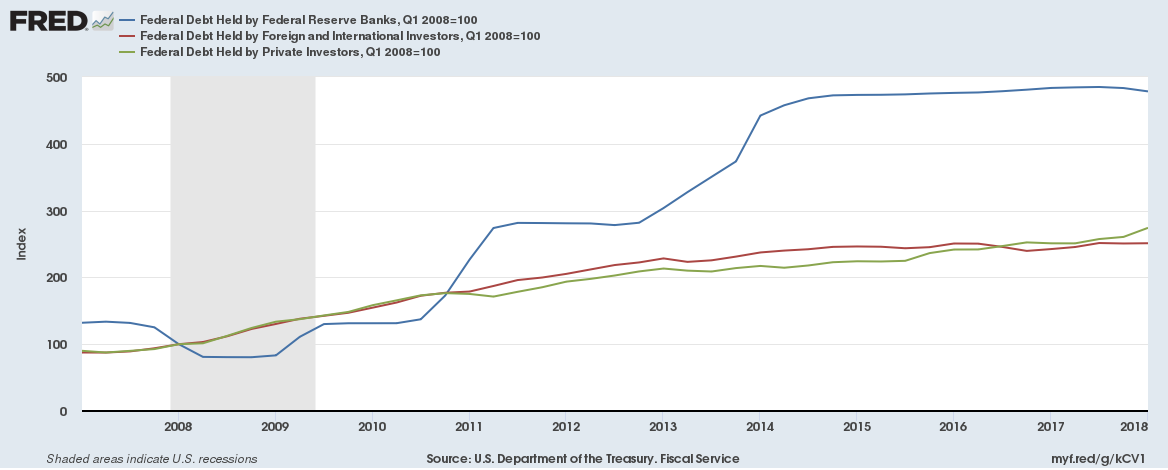

The United States government is likely to run a record fiscal deficit this year due to lower tax receipts. And given deficits since 2001, Federal debt is soaring (chart below). In the immediate aftermath of the last recession, the Federal Reserve was a major buyer of U.S. Treasury bonds.

Since 2014 though, the Fed isn’t really a buyer of Treasury bonds. The question is who is buying federal government debt?

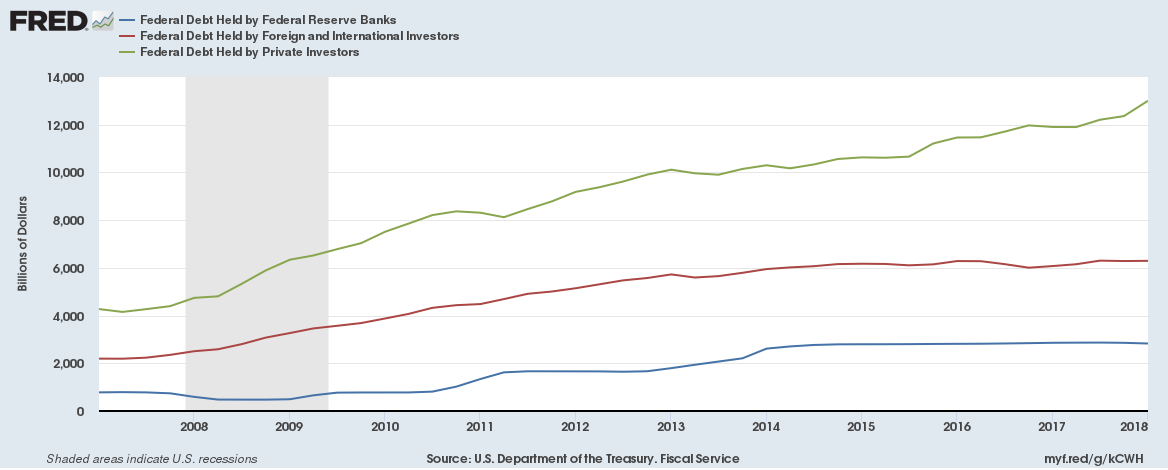

The three main categories of buyers are 1) Federal Reserve Banks 2) Foreign buyers 3) Domestic Private investors

At the end of Q1 2018,

$2.83 trillion is held by Federal Reserve Banks (up from $591 billion at the end of Q1 2008)

$6.29 trillion is held by Foreign buyers (up from $2.51 trillion at the end of Q1 2008)

$13 trillion is held by Domestic Private investors (up from $4.72 trillion at the end of Q1 2008)

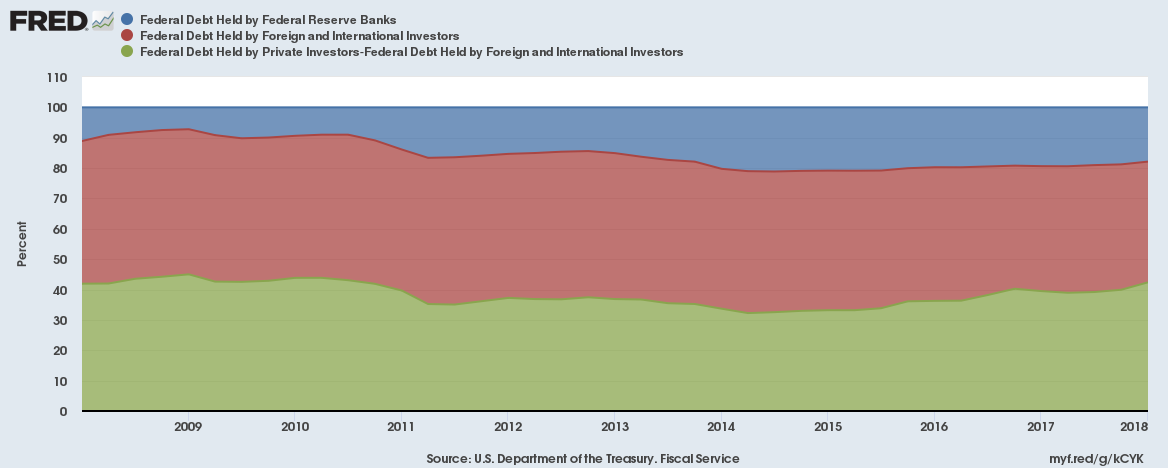

The ownership of federal debt has been shifting away from foreign investors toward domestic investors.

Soaring debt being bought domestically. Sounds a lot like Japan since early 1990s.

Related:

The impact of tax cuts in the U.S. on Federal finances so far

Can the US government really cope with rising bond yields?