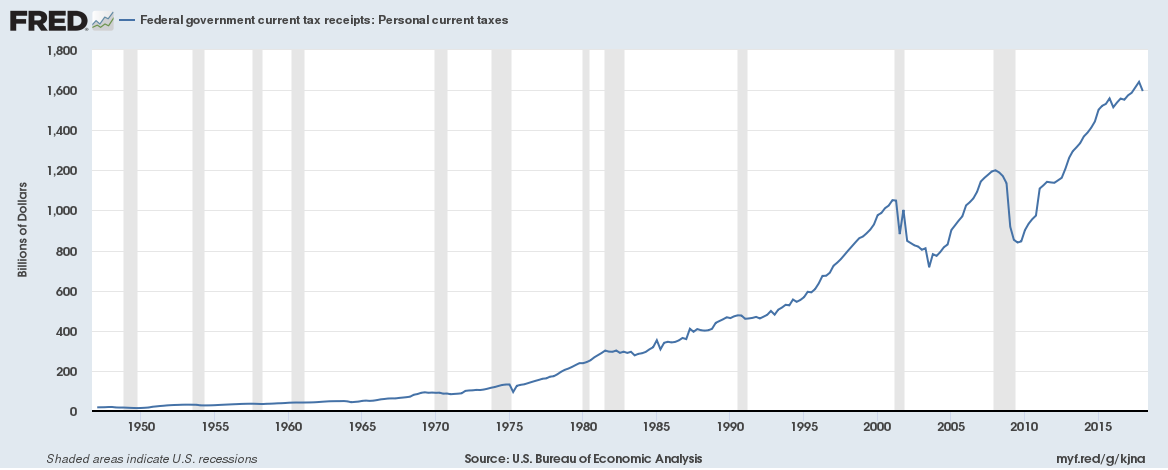

Personal taxes now contribute a multi-year record 45.7% of total Federal government receipts.

This despite personal tax receipts just rising 1.35% year on year (Q1 2018 vs Q1 2017) from $1.57 trillion in Q1 2017 to $1.59 trillion in Q1 2018.

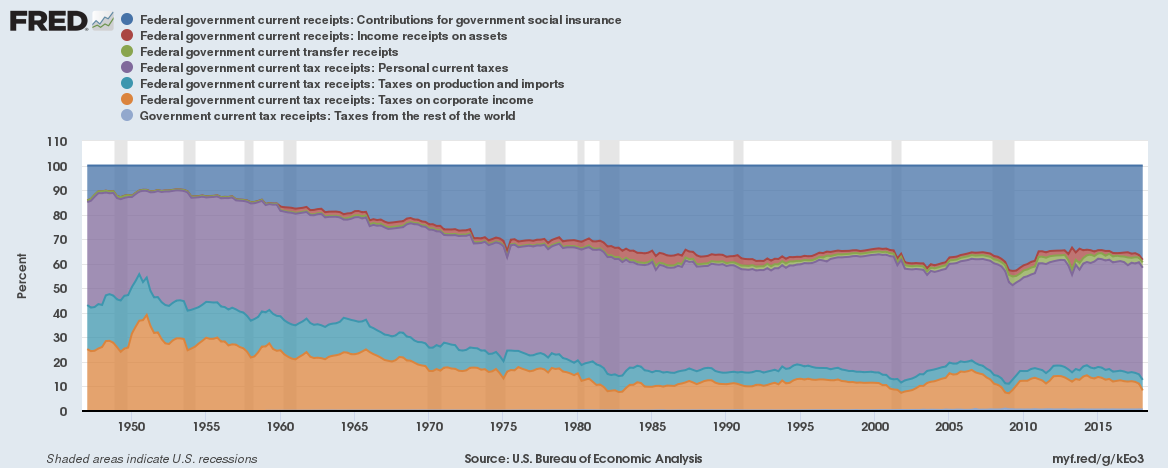

Over time, the total composition of tax receipts has changed:

- Social Security tax has become a bigger part of the composition of total receipts as its tax rate was increased to finance an aging population. (Related: The business of aging – how changing demographics are shaping the economic future in more ways than one)

- After years of remaining stable, personal income tax has started becoming a bigger part of the total composition. (Related: The impact of U.S. tax cuts on Federal finances so far)

- Corporate income tax has a decreasing share of total receipts. Corporate tax receipts are down 34% year on year (Q1 2018 vs Q1 2017). Corporate tax profits are down 34% from $408.85 billion in Q1 2017 to $269.26 billion in Q1 2018. (Related: The impact of U.S. tax cuts on Federal finances so far)

- Taxes on imports have decreased over time as tariffs have been decreasing, that might change though. (Related: 14 things about U.S. trade and trade tariffs)