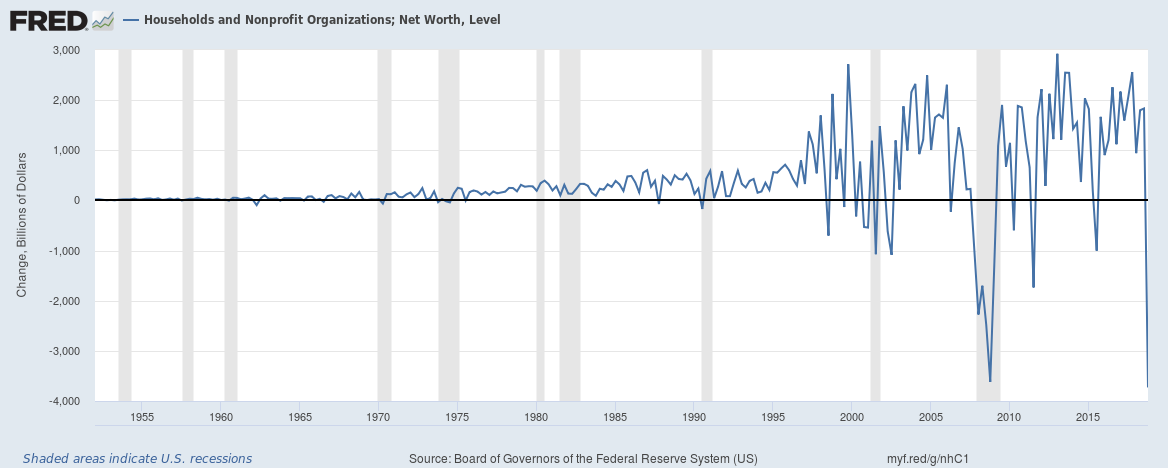

Household wealth (or household net worth) in the United States fell by a record $3.72 trillion in the fourth quarter of 2018. The fall in the stock markets would have probably been the largest contributor to the overall fall.

Why wouldn’t it be?

Household wealth (or household net worth) in the United States fell by a record $3.72 trillion in the fourth quarter of 2018. The fall in the stock markets would have probably been the largest contributor to the overall fall.

Are more houses being constructed? And what about the average and median prices of houses being sold?

Real gross domestic product (GDP) for the United States increased at an annual rate of 2.6% in Q4 2018, according to the initial estimate released by the Bureau of Economic Analysis (BEA).

Continue reading “U.S. Q4 2018 GDP growth estimated at 2.6%; 2018 GDP growth at 2.9%”

We wrote recently that delinquency and charge-off rates across banks in the United States remain low and that bad loans aren’t really increasing for banks in the United States despite some claiming that they are. We had also written about banks in the United States having a problem – they couldn’t find enough customers to lend money to. We wrote that last year and it appears a few things are changing; bank lending in the U.S. is now finally on the up.

Continue reading “Have banks in the U.S. started lending more money recently?”

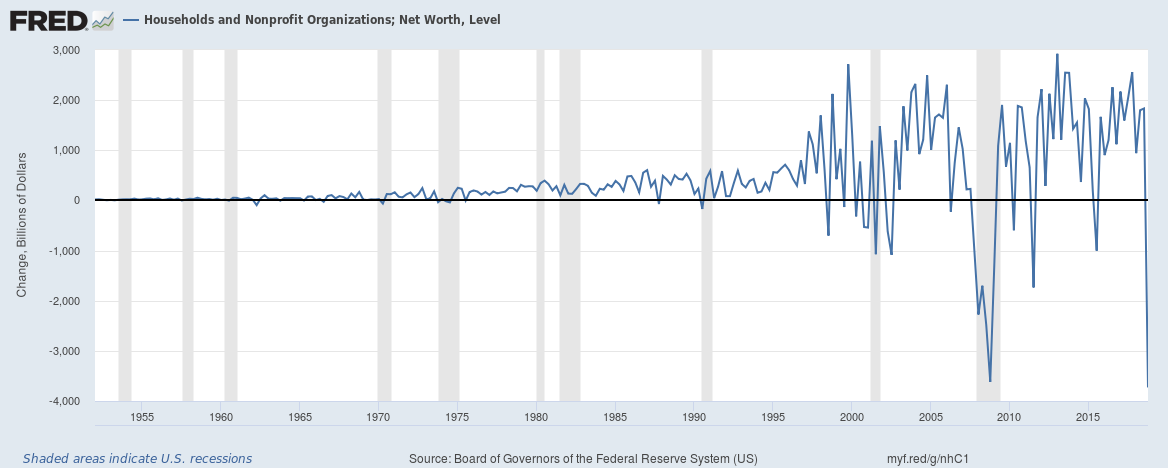

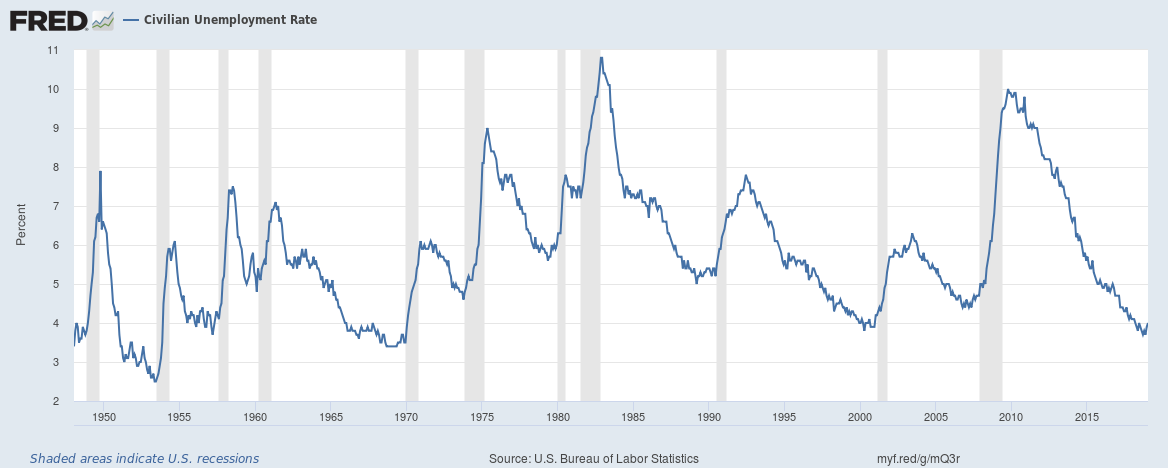

This is an interesting one, one of our three U.S. recession indicators is the U.S. unemployment rate.

The U.S. Bureau of Labor Statistics data reveals that the U.S. unemployment rate has hit a new multi-year low four to eight months before the start of every recession since the 1940s. In other words, the economy hits full employment four to eight months before the start of a recession.

The unemployment rate goes up at least 1% and then doesn’t go back down without a recession occurring.

There are various ways to look at Household Debt (total debt outstanding including mortgages, loans, credit cards and other debt) in the United States, we look at two today.

The first is debt servicing costs to disposable income which effectively is how much it costs to service household debt as a fraction of disposable (after tax) income. The second is household debt outstanding to disposable income which effectively is how much debt there is with respect to the same disposable (after tax) income measure.

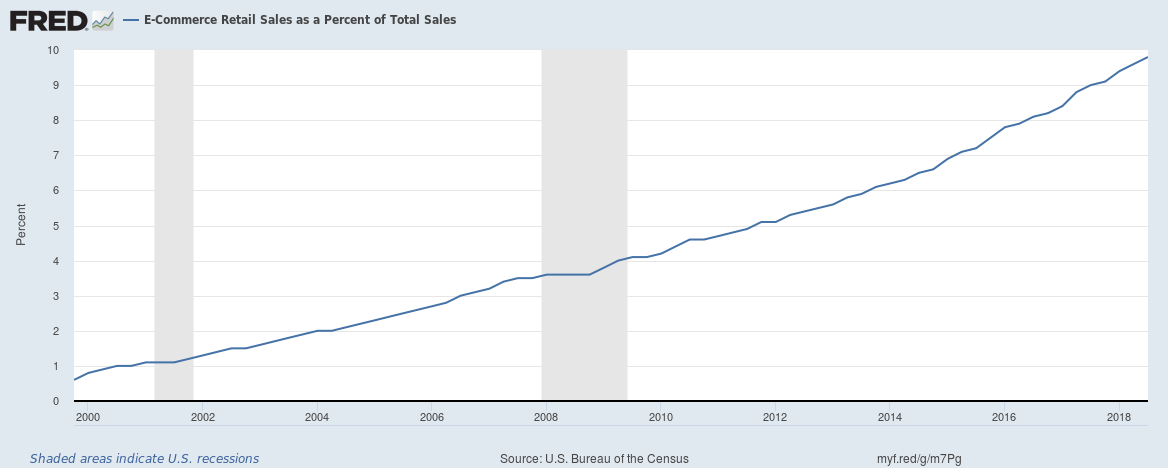

Chart 1: E-Commerce Retail Sales as a Percent of Total Sales

E-Commerce retail sales are now 9.8% of total retail sales (at the end of Q3 2018). Amazon is estimated to be 50% of all E-Commerce sales in the U.S. which would mean Amazon accounts for around 5% (or $1 in every $20 spent) of all retail sales in the U.S.

Continue reading “The growth of E-Commerce in the United States in three charts”

We answered the question whether bad loans were really increasing for banks in the United States at the end of December. We look at Delinquency and Charge-off rates across banks for United States across different products in this post.

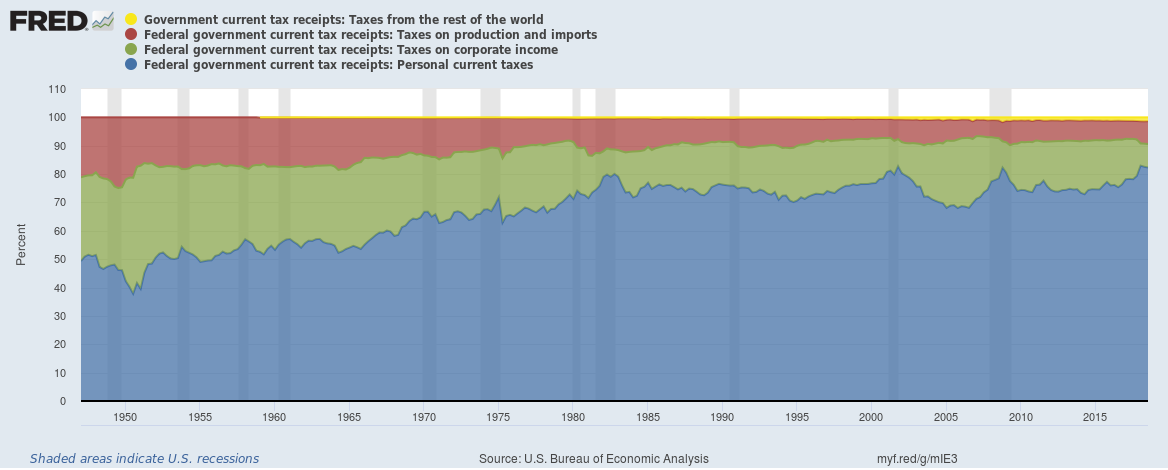

One big impact of the U.S. tax cut for corporations has been that corporate taxes now just contribute 8.3% of all U.S. federal taxes. As import tariffs rise, custom duties have been rising at a staggering rate, and tariffs on imported goods together with taxes levied at production now contribute 8.1% of all U.S. federal taxes. Taxes paid by individuals contribute the vast majority or 82.3% of all U.S. federal taxes.

Continue reading “Individuals now consistently contribute over 80% of all U.S. federal taxes”

In September last year we wrote why wages weren’t rising despite record employment and labour shortages and earlier this month we wrote that U.S. Corporate profits have been growing well and have hit a record high. We explore another angle, total wages (wages including bonuses and overtime – all before taxes) to the corporate profits (before taxes) ratio.