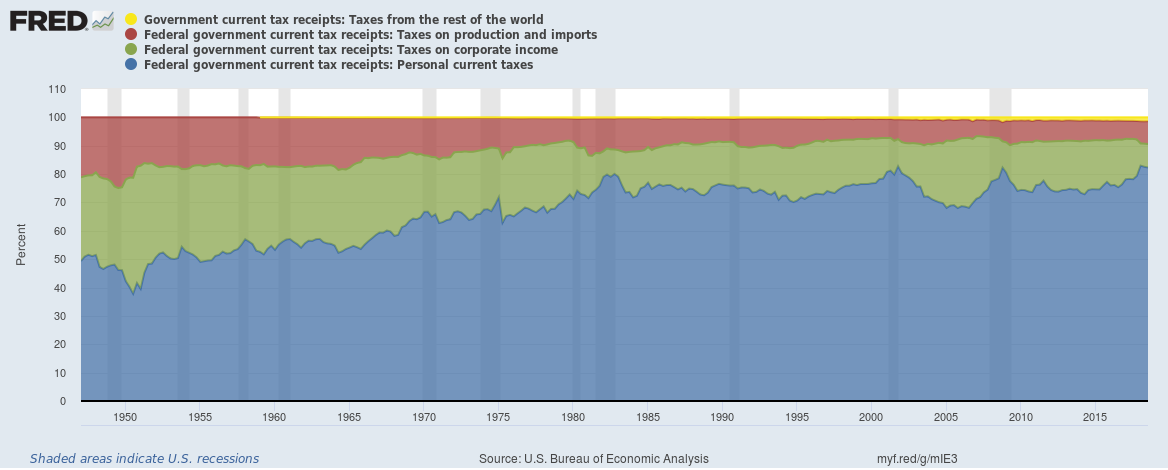

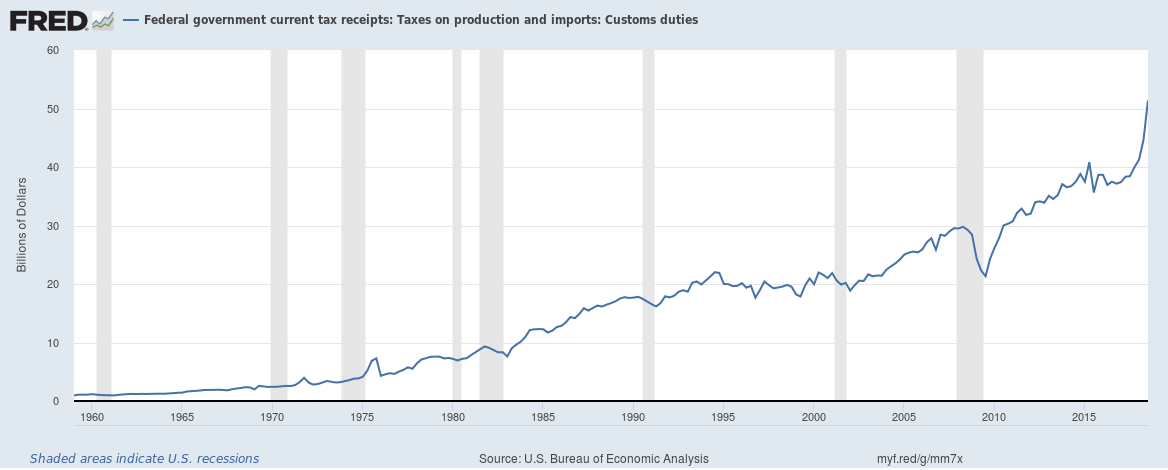

One big impact of the U.S. tax cut for corporations has been that corporate taxes now just contribute 8.3% of all U.S. federal taxes. As import tariffs rise, custom duties have been rising at a staggering rate, and tariffs on imported goods together with taxes levied at production now contribute 8.1% of all U.S. federal taxes. Taxes paid by individuals contribute the vast majority or 82.3% of all U.S. federal taxes.

The smallest source of taxes is the entities abroad category which includes expats filing their income taxes or businesses with some ties to the U.S. that must pay taxes on their activities. Entities abroad contribute just 1.4% of all federal taxes.

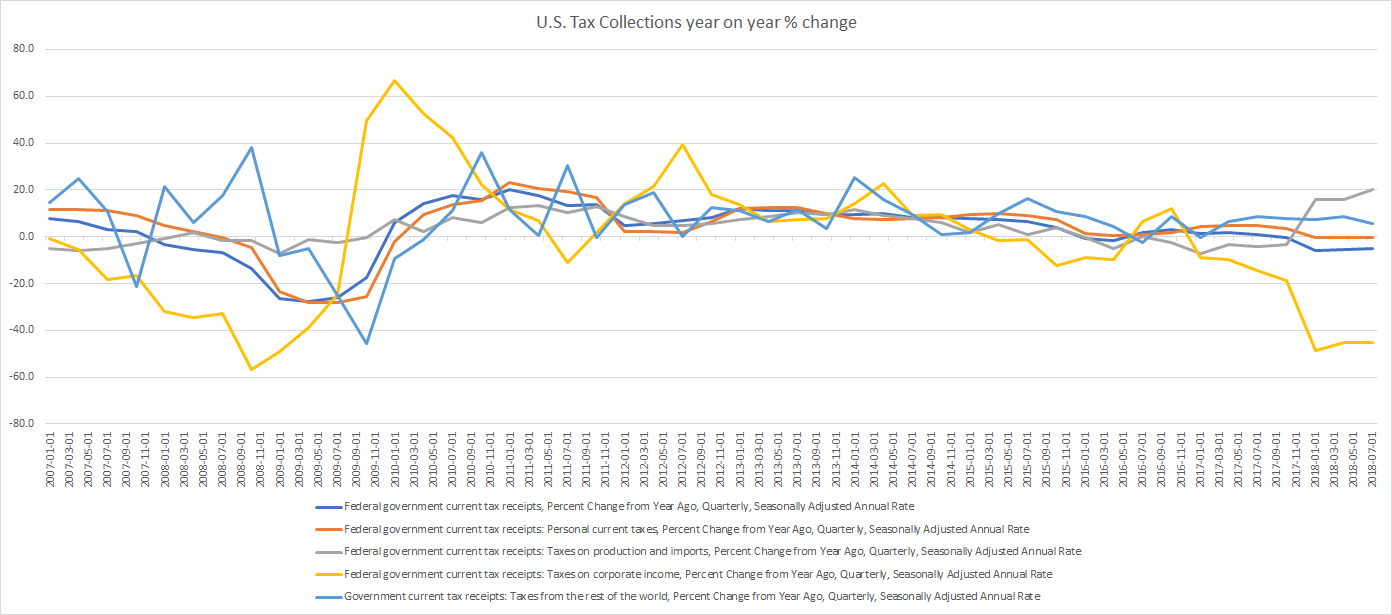

Here is a graph of how different tax collections have changed (year on year) in recent times,

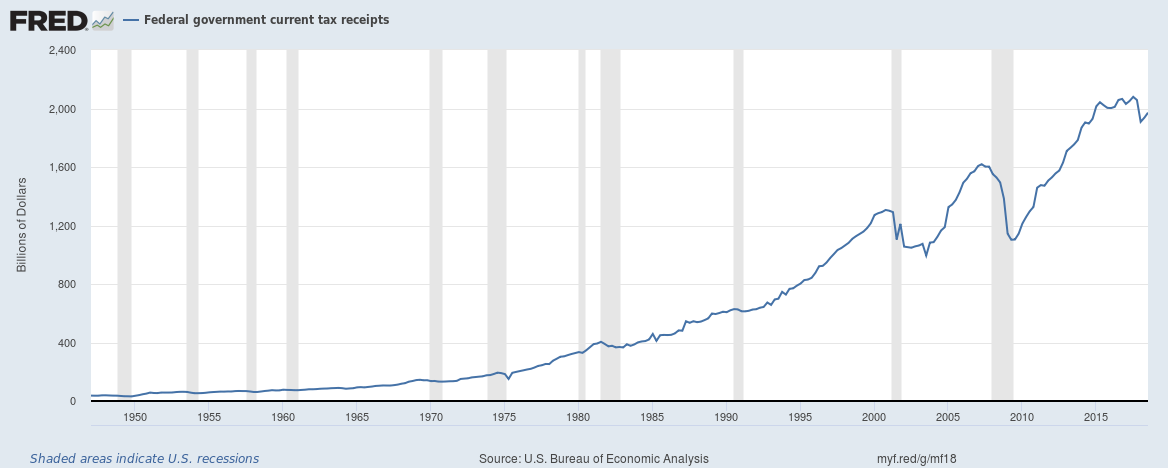

Total federal tax collections have started falling post the tax cuts which isn’t a good thing given that the U.S. Government is now spending $1.24 for every $1 in income and the fiscal deficit has been rising significantly. Here is a graph of total federal tax collections,

And a graph of custom duties,

Related:

The U.S. Government is now spending $1.24 for every $1 in income

The curious case of low U.S. money velocity

Don’t rule out high or hyperinflation in the road ahead

U.S. Corporate profits have been growing well and have hit a record high