There are various ways to look at Household Debt (total debt outstanding including mortgages, loans, credit cards and other debt) in the United States, we look at two today.

The first is debt servicing costs to disposable income which effectively is how much it costs to service household debt as a fraction of disposable (after tax) income. The second is household debt outstanding to disposable income which effectively is how much debt there is with respect to the same disposable (after tax) income measure.

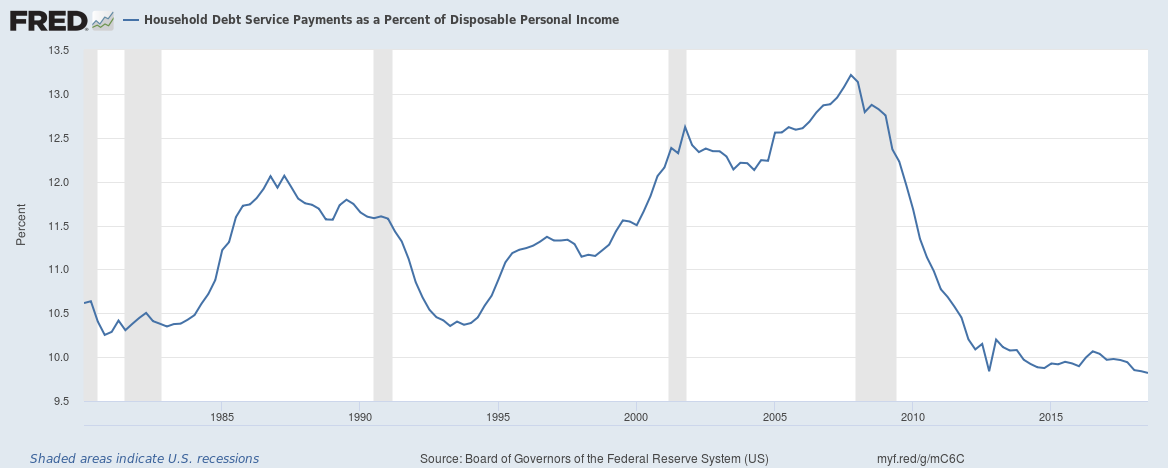

Household debt servicing costs to disposable income

Under 10% of disposable income is used to service household debt. This is lower than the 13% before the financial crisis. By this measure, household debt is far more manageable than before the crisis.

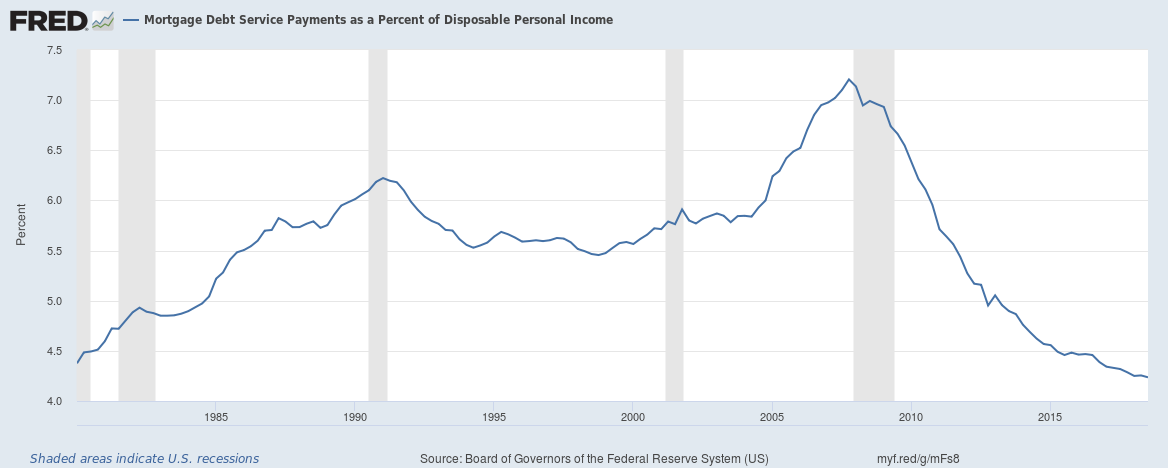

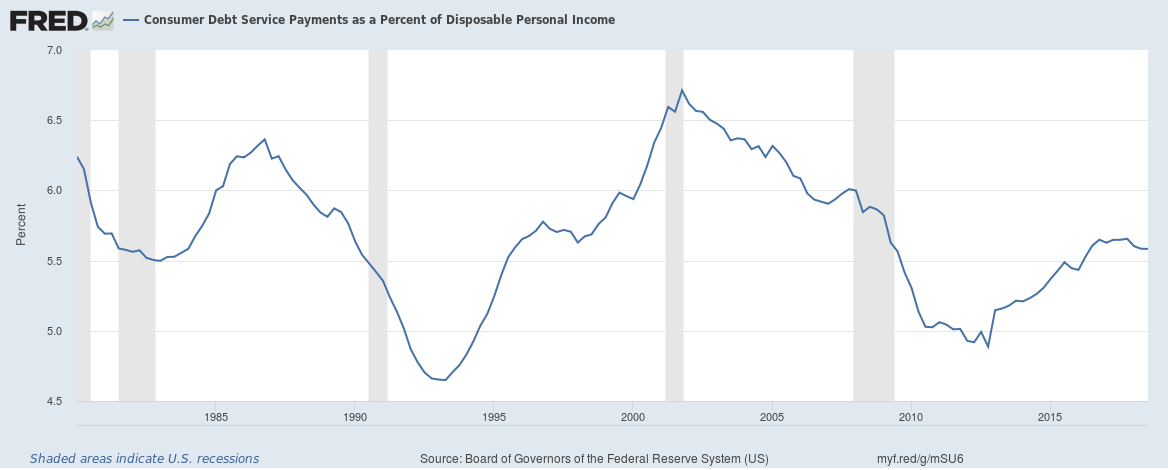

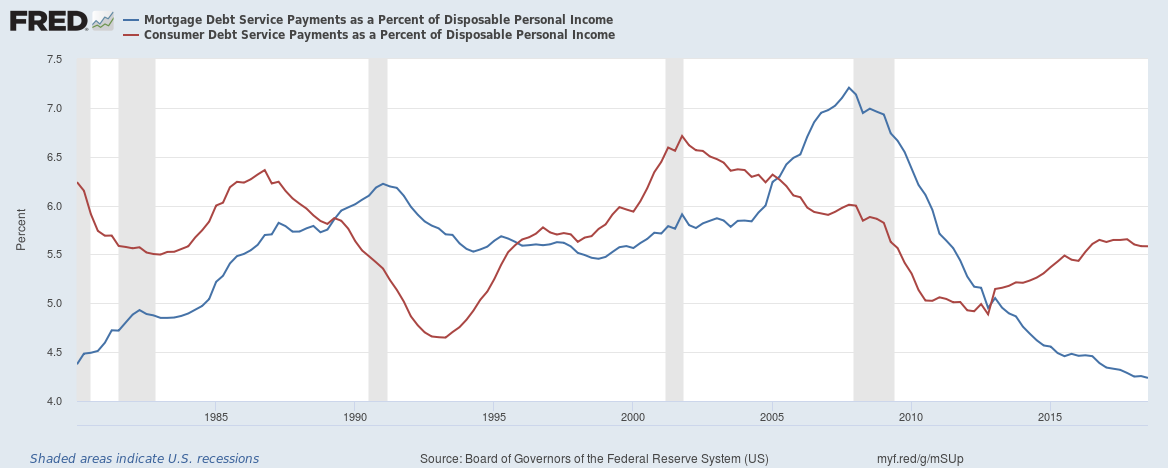

The primary reason is lower costs for servicing mortgages. Consumer debt (non-mortgage loans) servicing costs are lower than before the crisis but not as much as mortgage servicing costs. The main reason for lower debt servicing costs is lower interest rates. Rising interest rates could have an impact on debt servicing costs.

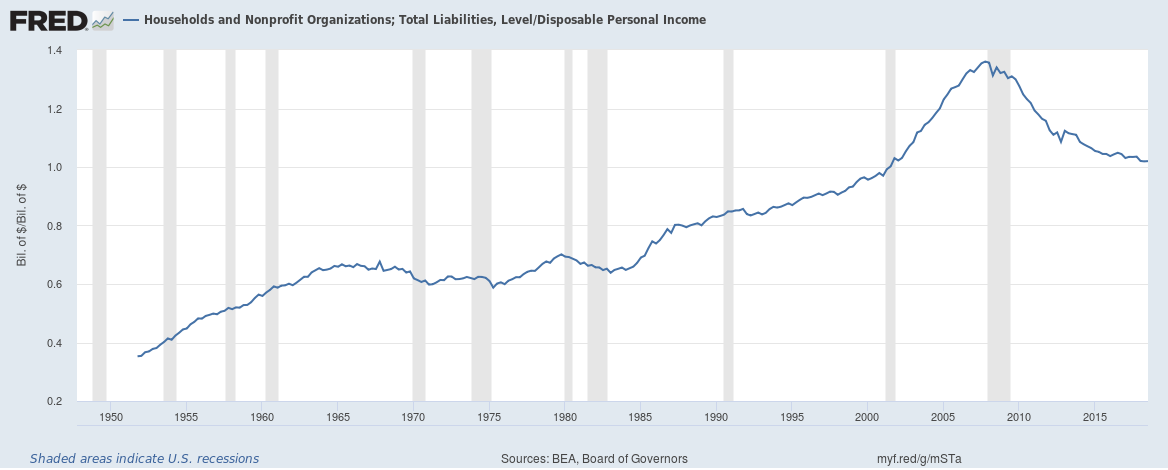

Household debt outstanding to disposable income

This ratio is down from 1.35 from before the crisis to about 1 now. Household debt outstanding is growing far slower than disposable income which is good as it makes household debt more manageable.

Conclusion

By both measures, household debt in the United States is far more manageable than before the crisis.

Related:

Are bad loans really increasing for banks in the United States?

Delinquency and Charge-off rates across banks in the United States remain low

Banks in the United States have a problem – they can’t find enough customers to lend money to

The curious case of low U.S. money velocity

Here’s why the Federal Reserve increasing interest rates could be a problem

The yield curve inversion plus why banks and banking stocks are impacted by it