We wrote recently that delinquency and charge-off rates across banks in the United States remain low and that bad loans aren’t really increasing for banks in the United States despite some claiming that they are. We had also written about banks in the United States having a problem – they couldn’t find enough customers to lend money to. We wrote that last year and it appears a few things are changing; bank lending in the U.S. is now finally on the up.

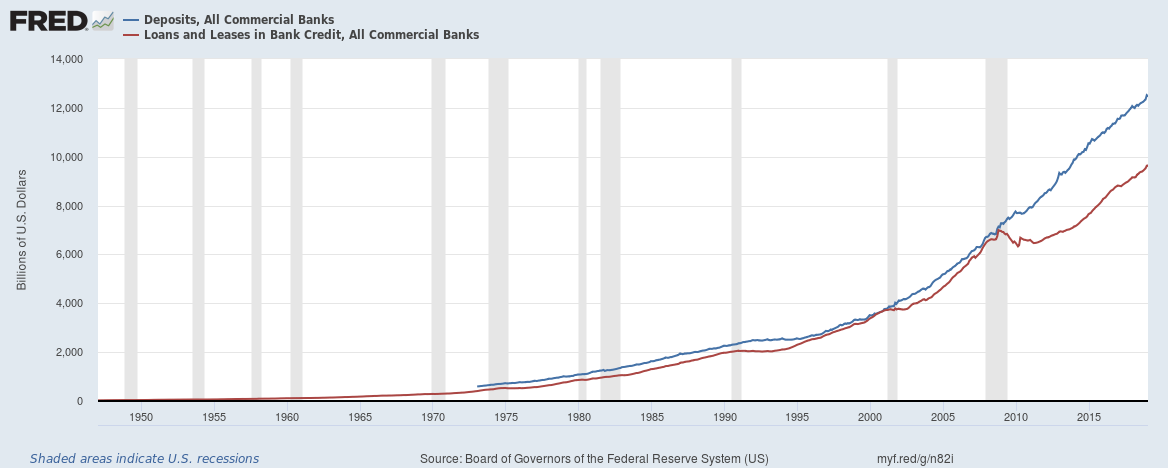

Firstly, here is a graph of bank loans and deposits. Since the financial crisis of 2008-2009 the difference between bank deposit growth and bank loan growth in the U.S. diverged in a big way.

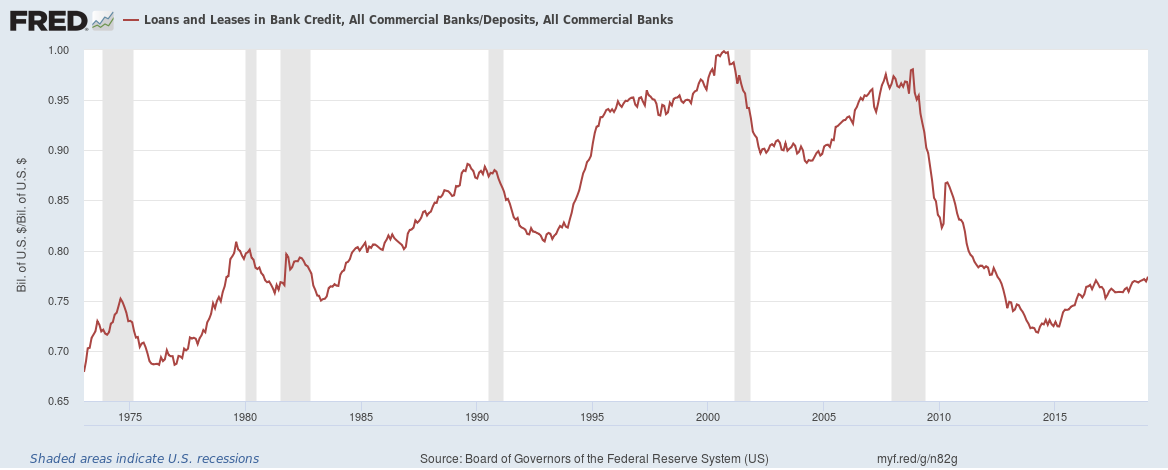

The loans to deposit had been falling since the financial crisis but it is finally on the up. The current levels are still quite low as compared to before to the financial crisis.

What has changed?

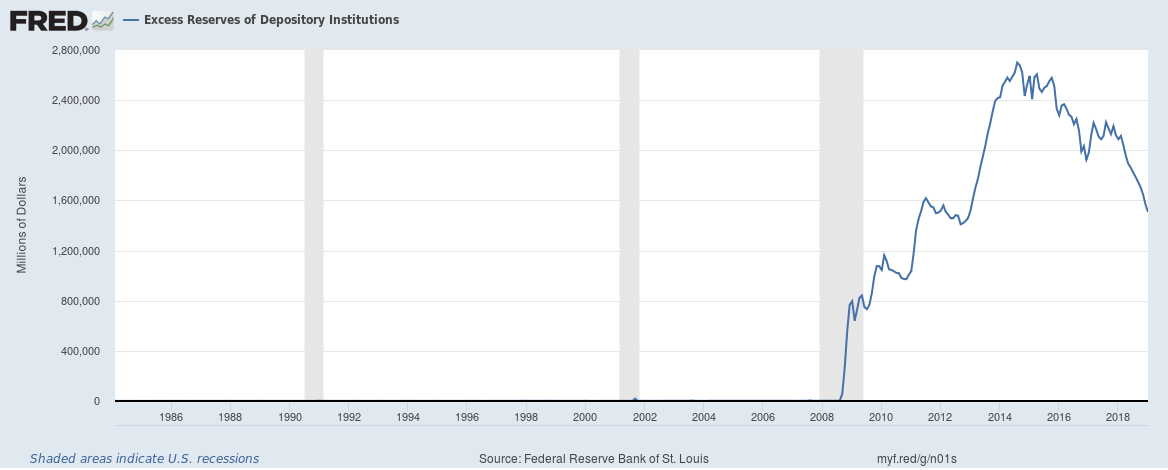

Firstly, banks are keeping less in excess reserves with the Federal Reserve. In 2008, as part of the Emergency Economic Stabilization Act of 2008 it was mandated that interest would be paid on reserve balances held with the Federal Reserve. Banks have estimated to have earned some $25 billion by keeping money as excess reserves with the Federal Reserve in 2018. The money earned was essentially risk-free return.

Excess reserves cash funds held by banks over and above the required reserves have grown significantly since the financial crisis. During the crisis banks borrowed money from the Federal Reserve but that has reversed. Banks currently hold over $1.5 trillion in excess reserves with the Federal Reserve. The number has been falling though from the $2.7 trillion peak in August 2015. The Federal Reserve has been unwinding its balance sheet and doesn’t need or want the money. Banks must find somewhere to deploy this money.

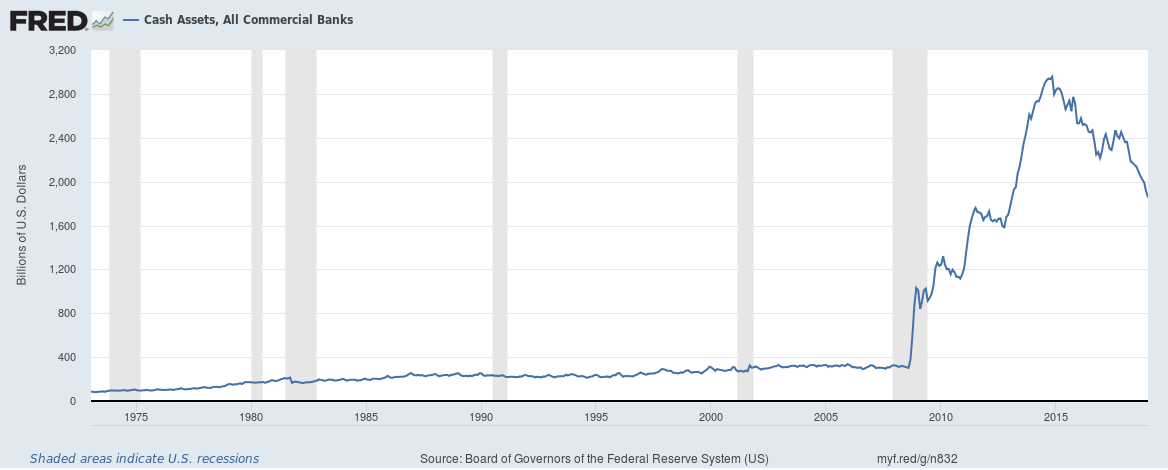

Banks are also reducing the money they hold in cash assets. After peaking at $3 trillion in 2015, the number is down to $1.86 trillion currently.

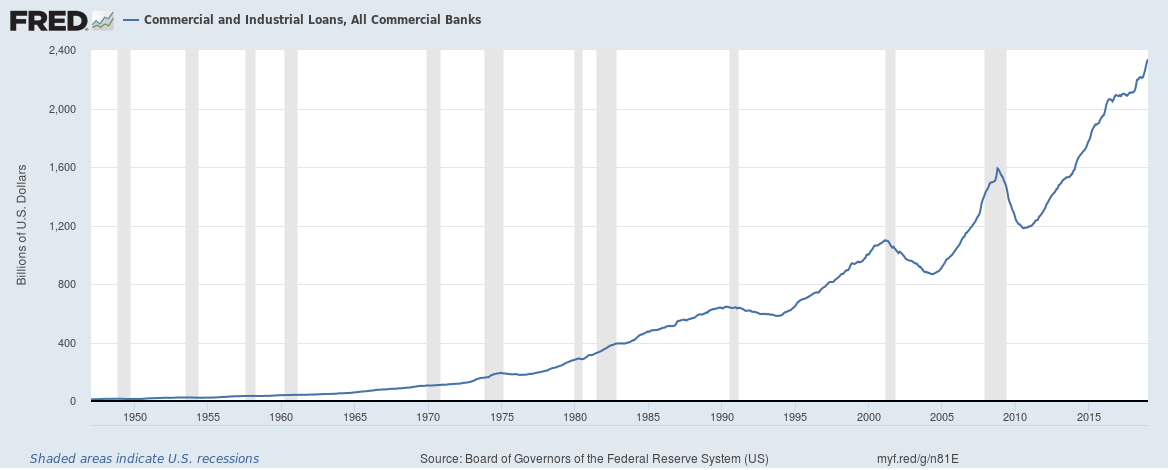

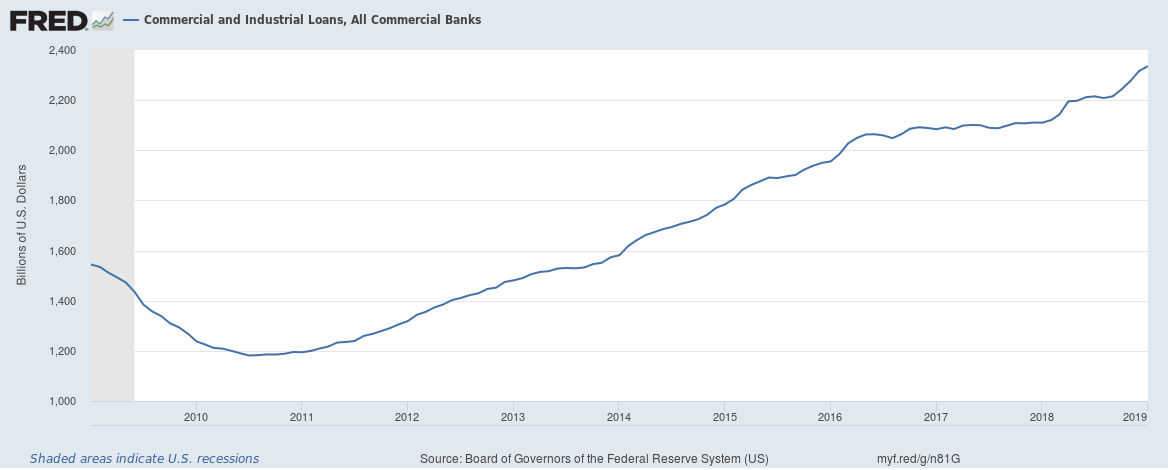

Whom are banks lending additional money to? Mainly to commercial or corporate customers. Lending to commercial customers has topped $2.34 trillion. Increased commercial lending is generally a sign of a strong economy. Consumer lending is growing but not much which is a sign that households are borrowing more cautiously.

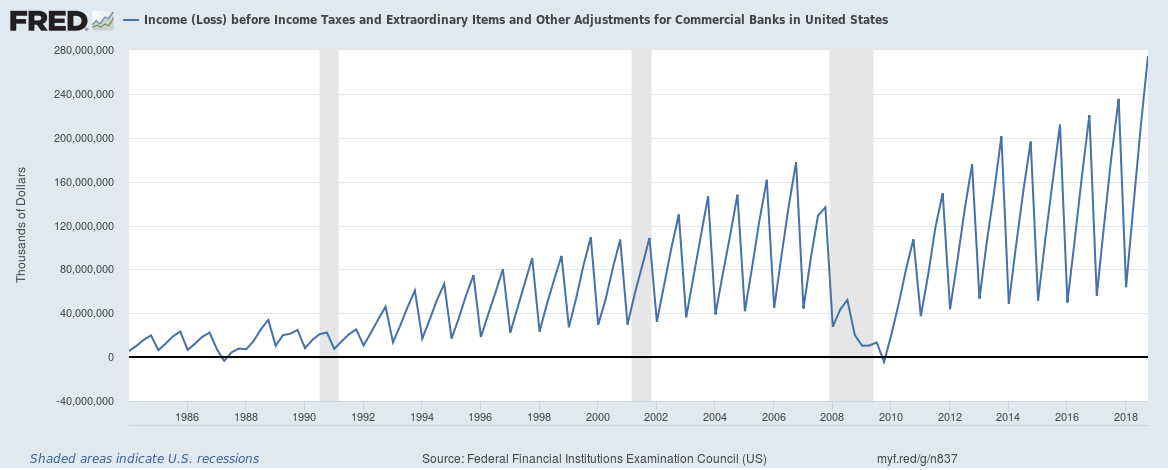

Finally, banking income hit its highest level ever in Q4 2018, which is another sign of a strong economy.

Related:

Are bad loans really increasing for banks in the United States?

Delinquency and Charge-off rates across banks in the United States remain low

Banks in the United States have a problem – they can’t find enough customers to lend money to

The curious case of low U.S. money velocity

Here’s why the Federal Reserve increasing interest rates could be a problem

The yield curve inversion plus why banks and banking stocks are impacted by it

The Federal Reserve is unwinding its balance sheet, here’s why and how it is doing it