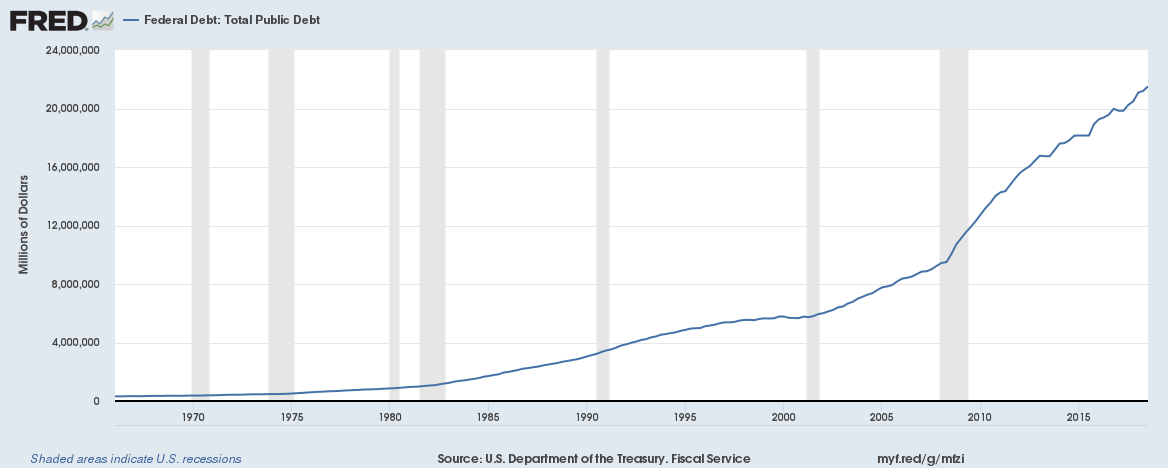

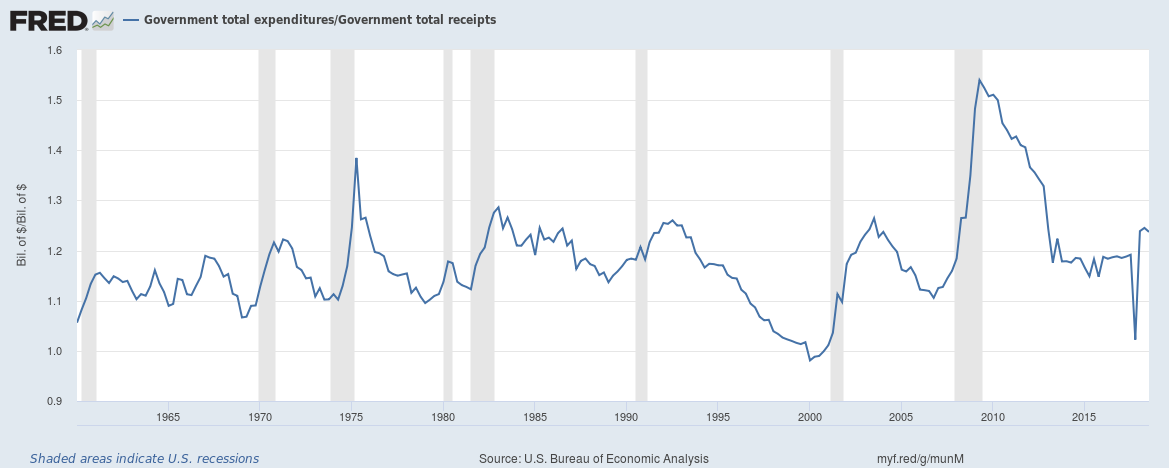

The fiscal situation in the United States is worsening as government debt piles up. The U.S. government (Federal, state and local combined) now spends $1.24 for every $1 in income.

Continue reading “The U.S. Government is now spending $1.24 for every $1 in income”