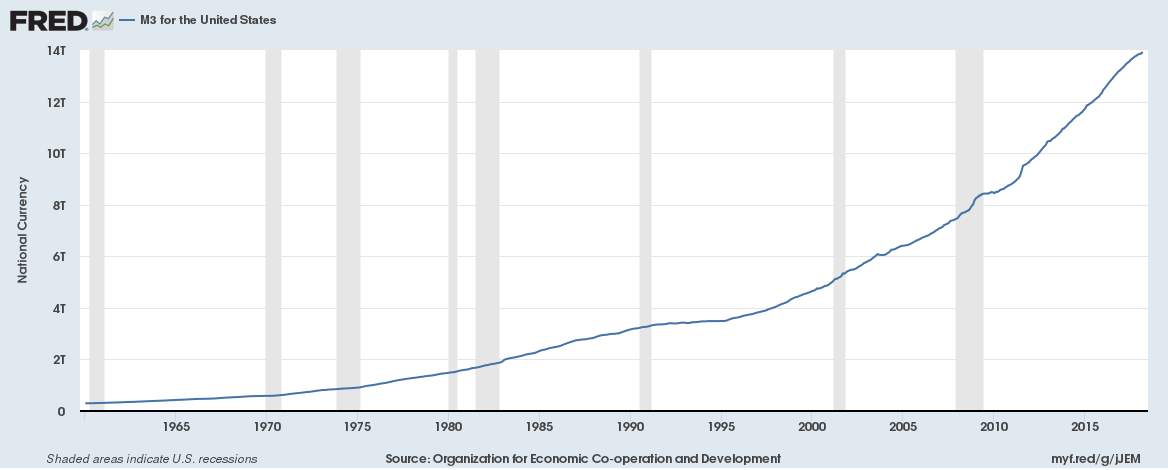

From the Federal Reserve’s definition of Money Velocity and Money Supply,

Money Velocity

The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy. Continue reading “The curious case of low U.S. money velocity”