Has Gold, U.S. Equities or U.S. Property performed the best? We compare the performance of each and the results are surprising.

Are foreign companies really acquiring UK companies at a record pace due to a weak pound?

Have inward mergers and acquisitions (foreign companies acquiring UK companies) really soared in the United Kingdom due to a weak pound? The answer is no. The Office for National Statistics (ONS) publishes numbers for inward, outward and domestic mergers and acquisitions and it doesn’t appear either have really changed pace despite a weaker pound.

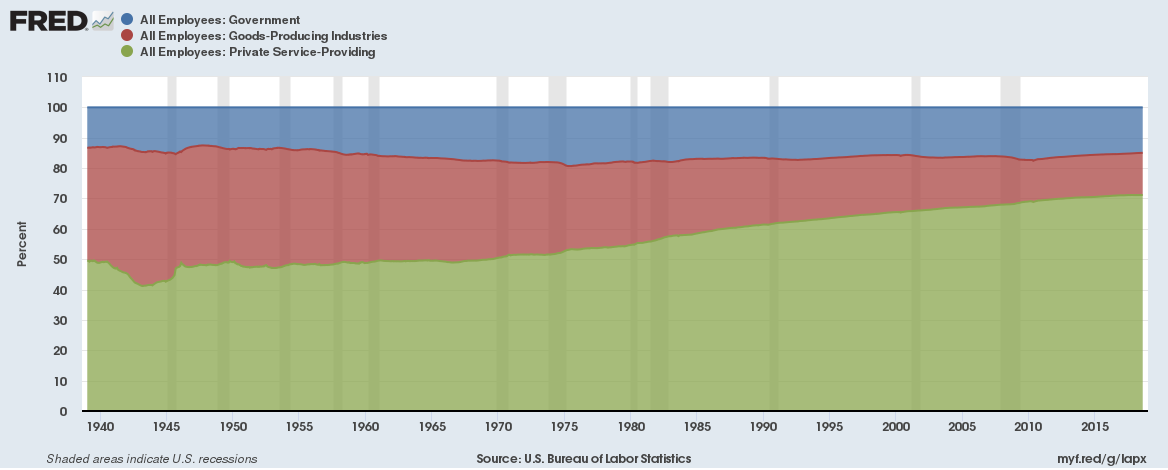

The Service sector increasingly dominates the U.S. labour market

The private service sector in the United States now accounts for over 71% of all jobs given the growth in entertainment, tourism, healthcare and educational services. The exponential growth of the internet and people buying more experiences (like travelling or eating out) rather than buying goods means the goods-producing industries (like construction, manufacturing and mining) have seen a decline in jobs and now contribute less than 14% of all jobs. Government jobs have contributed around 15% consistently to the overall labour market over the past 50 years.

Continue reading “The Service sector increasingly dominates the U.S. labour market”

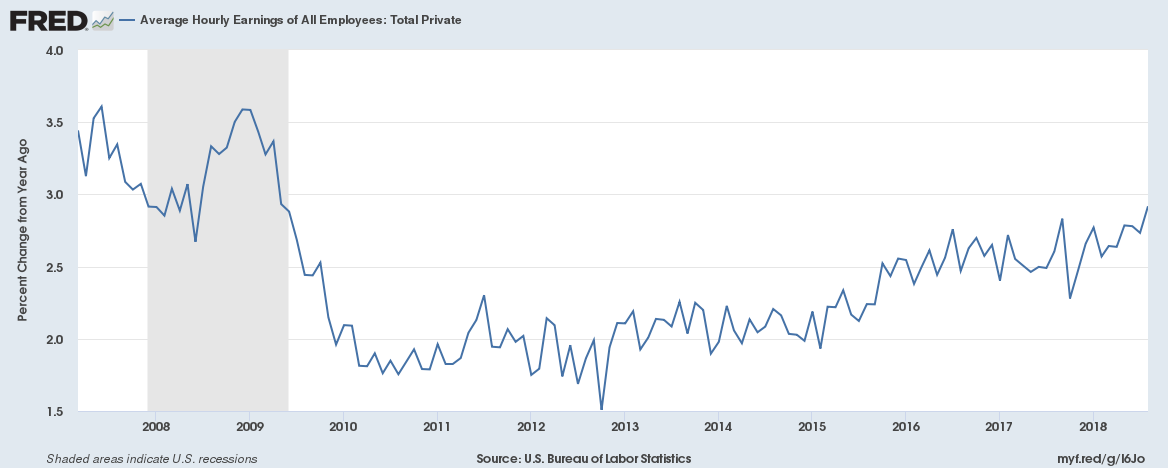

Here’s why wages aren’t rising despite record employment and labour shortages

Both the United Kingdom and the United States currently have record multi-year high levels of employment, yet wages haven’t kept up with inflation for the vast majority of people causing a real income squeeze. Although the U.S. recently reported the highest wage growth since the last recession most people don’t feel their wages are keeping up with rising prices. What is going on?

Continue reading “Here’s why wages aren’t rising despite record employment and labour shortages”

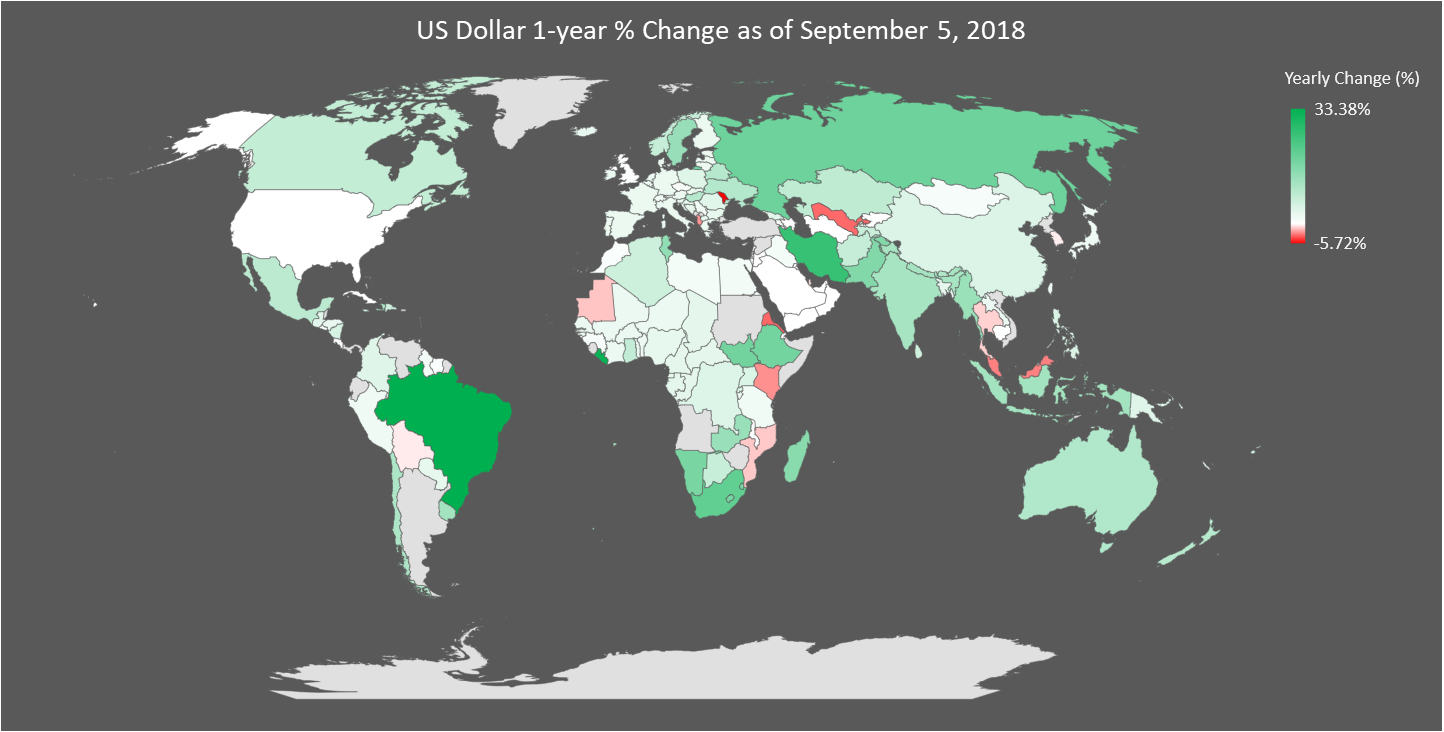

Currency carnage everywhere, here’s how every currency in the world has performed against the US dollar over the past year

What a difference six months makes, here’s the performance of the US dollar against each currency as of the 5th of September 2018,

Notes: 1. We have excluded the performance of Angola, Sudan, Argentina, Turkey and Venezuela on the map because they are major outliers. They are included in the data set below. 2. Currency price data updated 05-September-2018

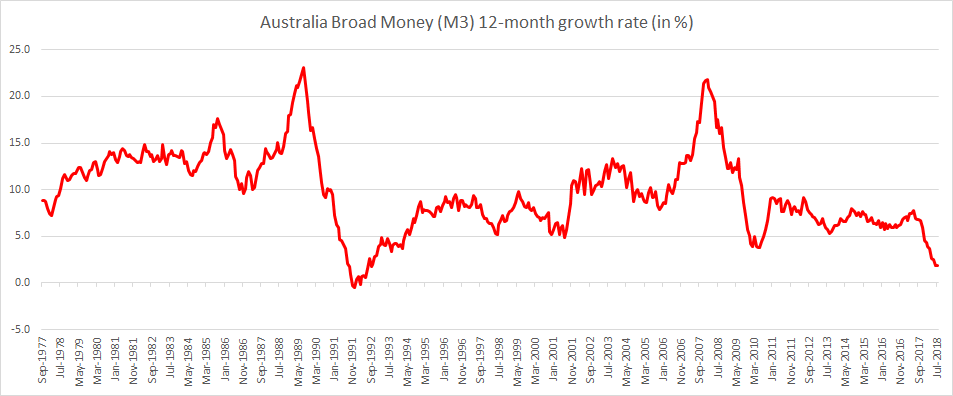

Australian credit growth is slowing with Investor housing credit growth slowest ever, Broad Money Supply growth slowest since the last recession 26 years ago

Australian credit growth is slowing but outstanding debt remains at historically high levels. Housing credit growth, personal credit growth, investor housing credit growth and business credit growth are all slowing. But the rather surprising thing is broad money (M3) supply growing at a 12-month rate of just 1.9%, the slowest since 1992 when Australia faced eight consecutive quarters of declining economic growth.

Do nations with balance of payments or trade surpluses really outperform those with deficits?

Does a balance of payment (or trade) surplus equate higher growth? Not necessarily, Australia which has had deficits for over forty years has grown faster than Germany which has had over forty years of surpluses. Does a current account surplus (i.e. exports greater than imports) mean a nation is doing better than other nations with current account deficits? The answer is no, what really matters is why the deficits exist.

Highlights from August 2018

Here are highlights from August 2018,

Our three most read posts in August 2018

Do economic fundamentals matter anymore? (Most read for a second month running)

London house prices have fallen most since 2009 but it is not what it seems

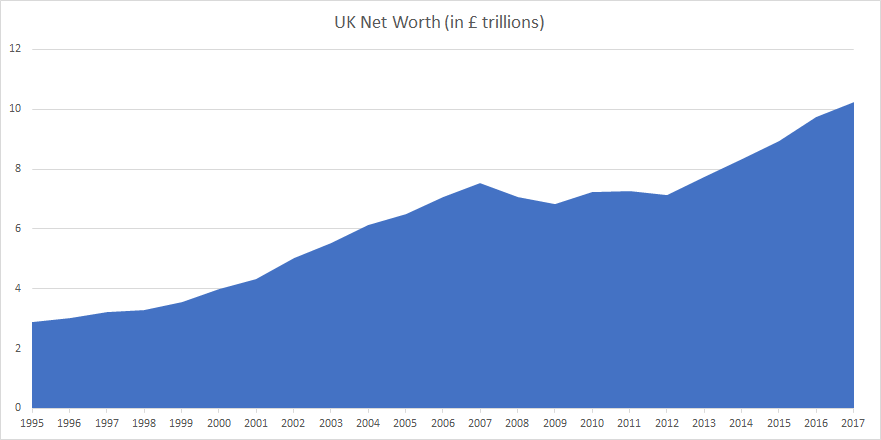

The UK’s net worth is now estimated at £10.2 trillion, an average of £155000 per person

The United Kingdom’s net worth was estimated at £10.2 trillion in 2017 or an average of £155,000 per person as per the Office for National Statistics. UK net worth more than trebled between 1995 and 2017, and much of this was from growth in the value of land. Land accounts for 51% of the UK’s net worth. The UK’s net worth rose by £492 billion from 2016 to £10.2 trillion in 2017.

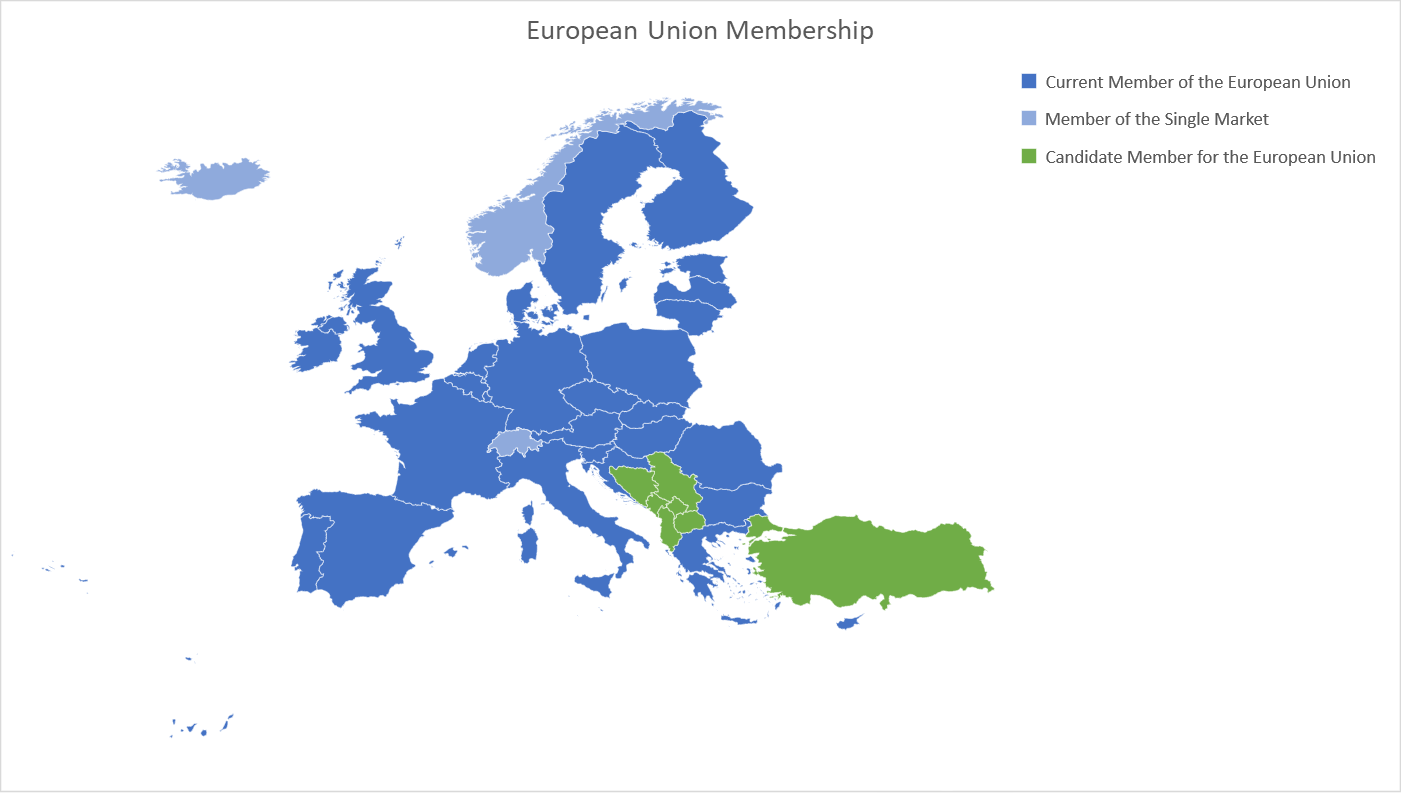

Here’s how the demographic and economic statistics look for candidate members of the European Union

We will be publishing a number of statistics for the United Kingdom (and the European Union) over the next few days in the run up to a major piece we will be publishing on the real economics of Brexit.

Montenegro, the former Yugoslav Republic of Macedonia, Albania, Serbia, Turkey, Bosnia and Herzegovina and Kosovo are countries on the road to join the European Union.